Nvidia News

-

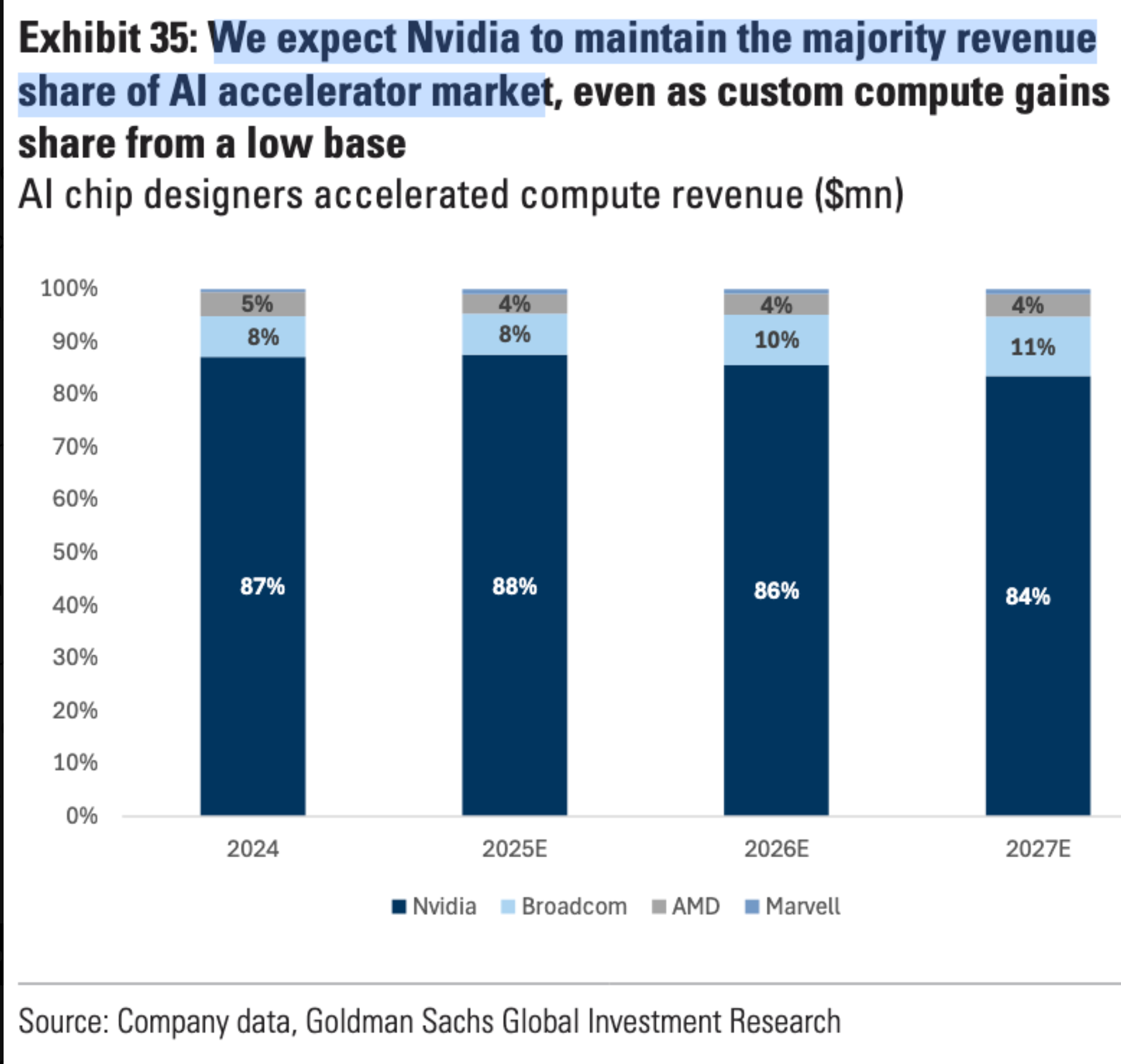

Grom GS today-nothing we don't already know. Obviously the TAM is growing at a large rate. In fact they are speculating on beyond 2025 but I can live with 84% market share

-

Nvidia CEO Jensen Huang will hold a media briefing in Beijing on July 16, Reuters reports, raising hopes a new China-focused chip may be unveiled that meets US export controls.

Looks like the B30 GPU, designed specifically to meet export controls, will be announced-availability set for September with several large customers in China having already placed preliminary orders worth billions. I would think around 2M chips per year @ $8k per chip is the size of the market-call it $4B/Q.

The export controls, limit two critical chip features. Bandwidth and Speed(operations/s). Bandwidth is nerfed vis DDR memory as opposed to HBM.

Useful insight. Why, if the B30 is significantly less powerful than local competing alternatives, namely the Ascend range from Huawei, proving to be in high demand? CUDA! The backbone of their moat now and for the next decade at least.

-

Almost certainly Nvidia based-Huang met Trump at the WH last Friday for one on one talks. Slowing down?

-

This is big.

Nvidia’s getting the green light to restart H20 chip sales to China after U.S. assurances on export licences, a big win after a $5.5 billion hit from unsold stock and potentially $15 billion in lost sales. This reverses a Trump-era ban , boosting Nvidia’s shares(almost certainly) and lifting tech stocks, a $17 billion market for Nvidia, can now access H20 chips for AI development, fuelling firms like Baidu, Tencent, Alibaba. Nvidia’s also launching the RTX Pro GPU, a cheaper, export-compliant chip for smart factories. It’s a massive deal for Nvidia’s bottom line and keeps them in China’s AI race.

-

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

-

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

@Adam-Kay said in Nvidia News:

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

Sorry to be fick but I thought that NVidia was selling every scrap of whatever they could make, and had a backfilled order book for 18 months or more? If that's the case then how can they have $5bn of inventory sitting around?

I expect I've missed something somewhere.

-

During the Biden tenure the US banned the Hopper-H100 if you recall. Enter the H20 which was a restricted version, produced to meet two core prescriptive limits (for china), bandwidth and operations per seconds. Approx 4 months ago Trump restricted the H20 leaving Nvidia holding $5B of unsold inventory and pretty much ejected them from the China market. Nvidia said at the time 'we are taking a $5.5B charge to our earnings' and would have guided $52B for Q1 if not for the restriction. Instead they guided $43B and made the decision not to include any china revenue in their guide-obviously there were and still are China sales however, immaterial to the mass market which was H20.

Today's news is fantastic. Whether this is a one off, clear the inventory or something else, we don't know.

Nvidia also has the further restricted B30 on deck.

I personally think it is the right thing to do, purely on the basis, China would have found a way to acquire the technology, it's good for relations and US business. It's narrow minded to hurt US business, less tax dollars, less dollars for R&D and force China to innovate faster. Let's remember the US has Blackwell which is 30X more powerful than H20. They ought to lead with this technology, right.

-

During the Biden tenure the US banned the Hopper-H100 if you recall. Enter the H20 which was a restricted version, produced to meet two core prescriptive limits (for china), bandwidth and operations per seconds. Approx 4 months ago Trump restricted the H20 leaving Nvidia holding $5B of unsold inventory and pretty much ejected them from the China market. Nvidia said at the time 'we are taking a $5.5B charge to our earnings' and would have guided $52B for Q1 if not for the restriction. Instead they guided $43B and made the decision not to include any china revenue in their guide-obviously there were and still are China sales however, immaterial to the mass market which was H20.

Today's news is fantastic. Whether this is a one off, clear the inventory or something else, we don't know.

Nvidia also has the further restricted B30 on deck.

I personally think it is the right thing to do, purely on the basis, China would have found a way to acquire the technology, it's good for relations and US business. It's narrow minded to hurt US business, less tax dollars, less dollars for R&D and force China to innovate faster. Let's remember the US has Blackwell which is 30X more powerful than H20. They ought to lead with this technology, right.

@Adam-Kay said in Nvidia News:

Helpful Explanation

Thanks Adam - that was a very helpful explanation. I didn't realise that the excess stock you referred to was of stuff that they were prohibited from selling but the trading of which is no longer verboten.

This move from Trump therefore looks like good news indeed.

Thanks again for the explanation. (If you can persuade Nik to reply to my eMail of this morning then I'll be even more pleased!)

-

My take on the approval of the H20. The export controls have not been relaxed/rewritten. This is very much looking like a one time 'clear the inventory'. I believe Nvidia are holding $8B in chip stocks(H20). Going fwd the company has two approved chips:

B30: Employs GDDR7 to comply with export limits (capped at ~1.4–TB/s per U.S. regulations).

RTX Pro 6000D: Also uses GDDR7, with bandwidth estimates ranging from 1.1 TB/s (per some sources)

Chinese customers are fully aware and have ordered at least 2 million 6000D and around 1.5 million B30. This is good news

-

If you recall when the H20 'ban' came in, on these very boards we discussed the real possibility of it being:

Used as a bargaining 'chip' re Trump/China trade negotiations. That the $5.5b provision (hit to earnings) would likely be reversed. That sale of compliant GPUs would continue in China.

Going fwd the H20 will not reenter production. It is definitely a clear the inventory one time solution. Export limits are unchanged and Nvidia has two compliant chips to sell, having already secured material pre-orders from Chinese customers. The chips are known externally as:

B30

B40 (RTX pro 6kD)Whilst the internet was panicking we applied sound reason/logic to an untenable situation that would be resolved in time. And here we are. It's nice having a CEO who has a seat at the highest table. It bodes well for the years ahead. The President recognises Nvidia's importance to the US economy and future and will do whatever he can to help them succeed. And just as importantly, Jensen Huang is the consummate diplomat-he is well equipped to manage the relationship imo! ;)(to avoid any doubt I mean 'stay friends')

-

Is the news with the link with REE trades with Vhina

-

I had to think about that for a mo

Rare Earth Metals and China-have I got that right

-

Likely. It was always going to be quid pro quo

It went like this....maybe. Or it could just be satirical

Folks, listen up, nobody makes deals like me, nobody! These H20 GPUs, tremendous, beautiful chips, the best for AI, everyone’s talking about ‘em, fantastic! I told NVIDIA, “You wanna sell to China? I’m the guy who makes it happen!” China-China, they’re desperate, throwing top dollar, big bucks, like it’s a fire sale! I said, “Go ahead, sell ‘em, but make sure they pay through the nose!” And they did, folks, because I’m the master negotiator. Those rare earth metals? Oh, we got plenty, like a glittering Trump Tower of shiny stuff. China’s begging, but I made sure they paid a premium, the best prices, because nobody plays the game better than me. It’s a huge win, absolutely huge, believe me! And Jensen Huang, a very good friend, very smart, but not as smart as me.

-

@Adam-Kay said in Nvidia News:

I had to think about that for a mo

Rare Earth Metals and China-have I got that right

-

Good news. It's safe to assume little to no chips snuck into the Q2 period ending July. However with 'earnings'(and balance sheet ftm) post balance date events must be taken into account and specifically, Nvidia incurred a large $5B(ish) reserve in their Q1 results. At least some of that will certainly reverse(popping margin). Their Q3 guide will now include these sales plus forecast (China) business. We will recap on estimates closer to their earnings date, schedule for the last week of August (27th?).

Funny Fact- first year auditing an IT company(back in the day). Thinking what are these revenue numbers (for NZ), then what we called a shoe box audit because the client had 3 staff, no offices, all sales guys with laptops and a company car but 10s of millions in sales and huge growth. Shoe box because all the financial records for the year could fit in a small box. Never heard of the company. what is this company 'Cisco'. After that I went to Intel and that too blew my mind. This was Intels golden period, when TSM was just a twinkle in Morris Changs' eye.

(it was less than 10 years old).

(it was less than 10 years old).Now that I recall, Ciscso back then was so small in NZ, our firm used to perform their accounting functions and pay their staff.

sliding doors and serendipity!

-

I don't pay much attention to analysts as they usually have an agenda or are plain wrong. Predicting $3B over their guide isn't anything unexpected nor is it all that relevant because they are still constrained. The guide is always more interesting (and margin). I think the Q3 could get close to $60B!-well the actually number they report. Conservatively id be surprised if they didn't commit to $55B (guide) and beat it

Wells Fargo raised the price target for Nvidia's shares to $220 from $185 in anticipation of the company’s quarterly earnings later this month.

The firm retained its Overweight rating on Nvidia, cited robust intra-quarter demand data and reports of approved licences to restart H20 chip sales in China, prompting them to revise their estimates (above market expectations) before Nvidia’s earnings report on 27 August.The analysts highlighted that strong intra-quarter data led them to adjust their fiscal second-quarter estimates above Nvidia’s $45.0B +/-2% guidance, now forecasting $48.2B/$1.06 (previously $45.8B/$1.00). They noted this reflects higher Data Center revenue estimates, now at $43.1B (previously $40.7B; market estimate is $41.1B).

-

NVIDIA Spectrum-XGS: Extending AI Networking at Scale

NVIDIA has introduced its latest development in AI networking, the Spectrum-XGS Ethernet platform. This system is designed to extend the benefits of Spectrum-X beyond a single data hall, enabling efficient scaling of massive AI clusters across multiple buildings and even entire data centres.

What sets Spectrum-XGS apart is its fully integrated design: NVIDIA controls the switches, the SuperNICs, and the supporting software stack. This approach delivers superior coordination of congestion management and tail-latency, areas where traditional Ethernet fabrics often struggle. NVIDIA reports performance improvements of up to 1.9× compared with generic Ethernet, translating directly into faster training times and higher GPU utilisation.

The platform is positioned to work best in hyperscale environments, where organisations are training and serving generative AI models across hundreds of thousands to potentially over a million GPUs. In these scenarios, the ability to maintain high throughput and predictable completion times across wide, multi-building fabrics is critical — and Spectrum-XGS is being promoted as the first Ethernet system specifically built to meet this demand.

Spectrum-XGS represents a clear step ahead of competing Ethernet solutions from Broadcom and Cisco, offering a purpose-built path for scaling AI infrastructure to unprecedented sizes. -

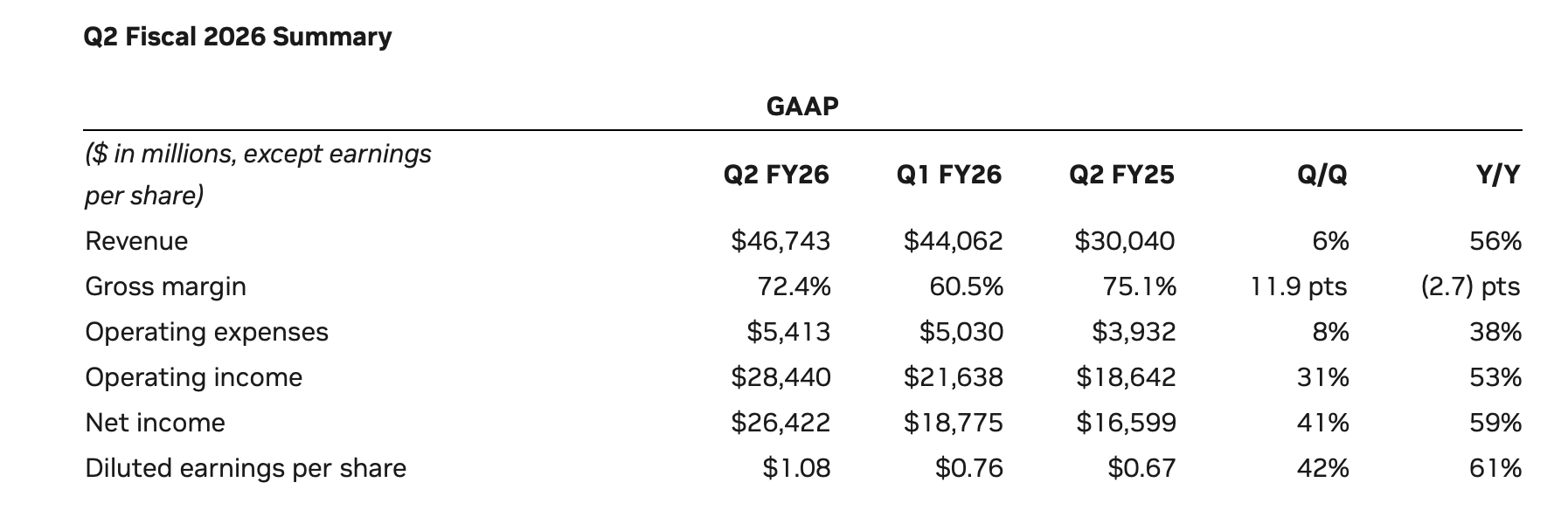

Some highlights taken from the conference call. If you look at our previous posts, we predicted a $60B print for Q3 and that is exactly what has been set up. The +8B QoQ cadence due to Blackwell Ultra has materialised. We called it when no one else did. The result is very impressive. After hours fade of $5 is nothing but option gamblers selling their hedges, nothing more. The company has delivered(and some) all the ingredients to see its stock ascension continue and imo it will. Their margins are just incredible (well over 70% and guided to rise to mid 70's). For every $10 in revenue they banked $5.65 after tax.

Here is a company trading at a fwd PE of 25 or less and continued geometric average growth in the 50% range over the next 5 years. For comparison, Palantir has a PE nearer3-400-yet 'they say Nvidia is expensive'. It is not.

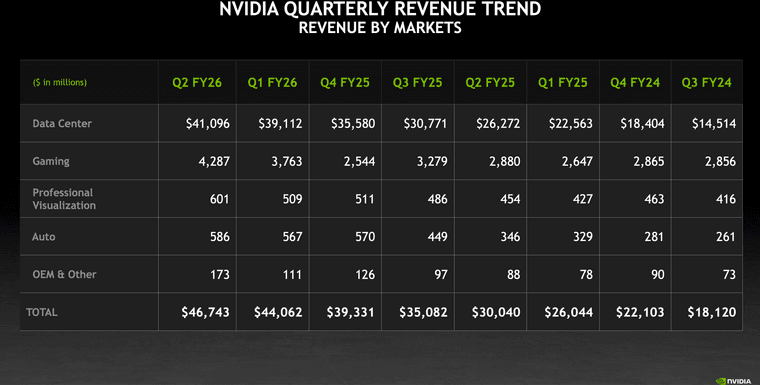

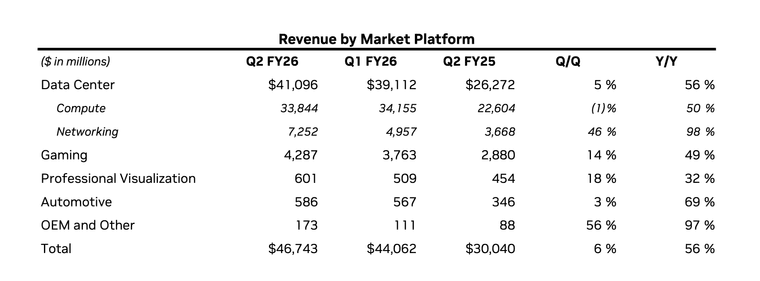

Financial Performance:NVIDIA reported record Q2 revenue of $46.7 billion, surpassing expectations, with sequential growth across all platforms. Data centre revenue rose 56% year-over-year, despite a $4 billion drop in H20 (China-specific) revenue. The Blackwell platform grew 17% sequentially, with GB300 production starting.

Non-GAAP gross margin was 72.7%, including a $180 million H20 inventory benefit(a non china customer purchased some H20). Excluding this, margins were 72.3%. Q3 revenue is projected at $54 billion (±2%), with non-GAAP gross margins at 73.5%, and full-year margins expected in the mid-70s.

NVIDIA returned $10 billion to shareholders via repurchases and dividends, with a new $60 billion share repurchase authorisation.Key Business Highlights:

Data Centre and AI Infrastructure: NVIDIA anticipates a $3–4 trillion AI infrastructure market by 2030, (super charged growth) driven by reasoning agentic AI, which demands 100x–1,000x more compute than traditional models. Blackwell’s NVLink 72 rack-scale systems deliver significant performance and energy efficiency gains, enabling a 50x increase in token-per-watt efficiency compared to Hopper. Major adopters include OpenAI, Meta, and Mistral.

China Market: Excluded from Q3 outlook due to U.S. licensing reviews, Colette Kress noted potential H20 revenue of $2–5 billion in Q3 if approvals are granted, with supply ready and more possible if demand rises. Jensen Huang estimated China’s AI market at $50 billion this year, with a 50% CAGR, driven by 50% of global AI researchers residing there. Approval for Blackwell in China is being advocated to support U.S. tech leadership.

Networking: Record $7.3 billion revenue, up 46% sequentially, with Spectrum-X Ethernet exceeding $10 billion annually. Spectrum-XGS, for giga-scale data centre interconnects, doubles GPU communication speed, enhancing AI factory efficiency.

Other Segments: Gaming revenue hit $4.3 billion (up 49% year-over-year), professional visualisation $601 million (up 32%), and automotive $586 million (up 69%), driven by Thor SoC(system on chip) for autonomous vehicles. Sovereign AI revenue is expected to exceed $20 billion in 2025, doubling from last year.Rubin Platform: Set for 2026 volume production, Rubin will continue NVIDIA’s annual cadence, introducing innovations to boost performance-per-watt, critical for power-limited data centres. Rubin is on time (contrary to rumours)

Q3 Outlook:Revenue expected at $54 billion, with Blackwell driving most of the $7 billion sequential growth. Hopper (H100, H200) remains in demand but secondary to Blackwell. Operating expenses will rise in the high 30s year-over-year to support growth.

Significance of Results:

NVIDIA’s record-breaking Q2 underscores its dominance in the AI infrastructure market, with Blackwell setting a new standard for AI inference and training. The exclusion of China from the Q3 outlook highlights geopolitical challenges, yet the potential $2–5 billion H20 revenue signals significant upside if approvals are secured, as Kress indicated is likely. This, combined with a projected 50% CAGR for the AI market, positions NVIDIA to capture a substantial share of the $3–4 trillion opportunity by 2030. The company’s full-stack approach—spanning compute, networking, and software—mitigates competitive threats from ASICs, ensuring long-term relevance across clouds, enterprises, and robotics. The focus on energy efficiency and performance-per-watt addresses critical data centre constraints, driving customer revenue and margins, and reinforcing NVIDIA’s leadership in the AI-driven industrial revolution.