Nvidia News

-

All time high on Nvidia today $187 as several analysts up their target to between $240-$250. Late to the realisation, again.

-

WiWynn, a major AI server original design manufacturer (ODM) partnered with NVIDIA, say they are grappling with an extraordinary surge in demand, with order visibility now stretching through 2027.

Despite operating facilities in Taiwan and a new U.S. plant set to nearly double production capacity by the end of this year, the company is still struggling to keep up. WiWynn is actively scouting new factory locations, with power supply capacity being a pivotal consideration. Key clients, including NVIDIA, OpenAI, Oracle, Google, and Meta, are aggressively scaling up investments in AI infrastructure, signalling that the AI arms race is intensifying. This robust demand underscores a vibrant and rapidly expanding AI server market.

So, they invest heavily a year ago to 2X output and now this is no where enough. Visibility through 2027 is impressive. BTW analysts currently have 2027 as flat for NVDA-sure it is

We said if before, POWER is the new constraint. Not just in the DC but also the factory that makes the servers-why, because these systems must be tested so hooking up a 'system' of X racks needs substantial juice

-

Wowsa

BREAKING: Nvidia, $NVDA, now represents 5.04% of the MSCI All Country World Index.

The MSCI ACWI Index captures ~85% of global equity markets, including large and mid-cap stocks.

Nvidia's weight now significantly surpasses Japan's 4.78% share, the world’s 3rd-largest stock market.

By comparison, China, the UK, and Canada account for 3.33%, 3.23%, and 2.92%, respectively.

Nvidia’s contribution to the index is now larger than France and Germany combined.https://x.com/KobeissiLetter/status/1975391629906485511#

A bit frothy, perhaps?

-

Someone on X making a statement (27k tweets(busy busy)) and calling it 'breaking news'. as though they are Reuters or similar.Someone who bashes 'equity' 24/7 but likes Gold. It's a very insightful observation ;). It's just envy they missed out. Remember, we paid $25.

It's about as useful as Pistonheads Mr Whippy 'Nvidia? They make gaming GPU, right' and another gem ' Nvidia at $40-LOL this will end well'. He was right-it did.

If Nvidia is the most profitable company in the world(fact) then why should it not also have the highest valuation? A valuation that is relatively, lower than KO, Starbucks, Unilever, CL and 1/10th the value of Palantir?

In other breaking news Nvidia now exceeds the combined GDP of all the world’s coffee shops.

-

United States Approves Billions in Nvidia AI Chip Exports to UAE

The United States has authorised billions of dollars’ worth of Nvidia AI chip exports to the United Arab Emirates (UAE), marking a major milestone in the implementation of a high-profile bilateral artificial intelligence agreement, according to a Bloomberg report.

In return, the UAE has pledged to match chip imports with an equivalent level of investment in the United States, as part of a broader plan to invest $1.4 trillion over the next decade. The Commerce Department’s Bureau of Industry and Security recently issued the export licences under a deal reached in May, which could become a template for future U.S. AI diplomacy.

Although specific investment projects have yet to be disclosed, these are the first approved Nvidia AI chip exports to the Gulf nation since former President Donald Trump took office, signalling progress on a deal that has been controversial in Washington.

The agreement centres on a five-gigawatt data centre in Abu Dhabi, where OpenAI is a key partner. The broader arrangement allows for up to 500,000 advanced AI chips each year, with 20% earmarked for G42, an Abu Dhabi-based AI firm working closely with OpenAI. However, the initial batch of export licences excludes G42, and future approvals will depend on the pace and substance of Emirati investments in the U.S.

Some U.S. officials have expressed unease about building critical infrastructure abroad—particularly in a nation maintaining strong business ties with China. The UAE, which has made artificial intelligence a national priority, had been pushing for swift approval amid mounting frustration over regulatory delays.While the Biden administration had previously imposed strict controls on AI chip exports to countries like the UAE due to national security concerns, the Trump administration appears to be relaxing those restrictions. Officials say the goal is to counter China’s technological influence by ensuring that American companies dominate key AI infrastructure across the Middle East.

This development is a significant win for Nvidia. After months of export uncertainty and tightening U.S. chip restrictions, the approval opens a valuable market in the Gulf region, potentially worth billions in new sales.

The UAE’s commitment to match chip imports with U.S. investment also strengthens Nvidia’s strategic positioning within American foreign policy objectives—effectively tying commercial opportunity to diplomatic influence.

If the UAE follows through with its pledged investments and infrastructure rollout, capital should begin to flow relatively soon. The export licences have already been granted, meaning Nvidia can start fulfilling orders and recognising revenue once shipments commence.

In short, this is a big deal both politically and commercially. It signals a renewed U.S. willingness to project AI leadership through private-sector partnerships, while giving Nvidia a powerful foothold in one of the world’s fastest-growing technology regions. -

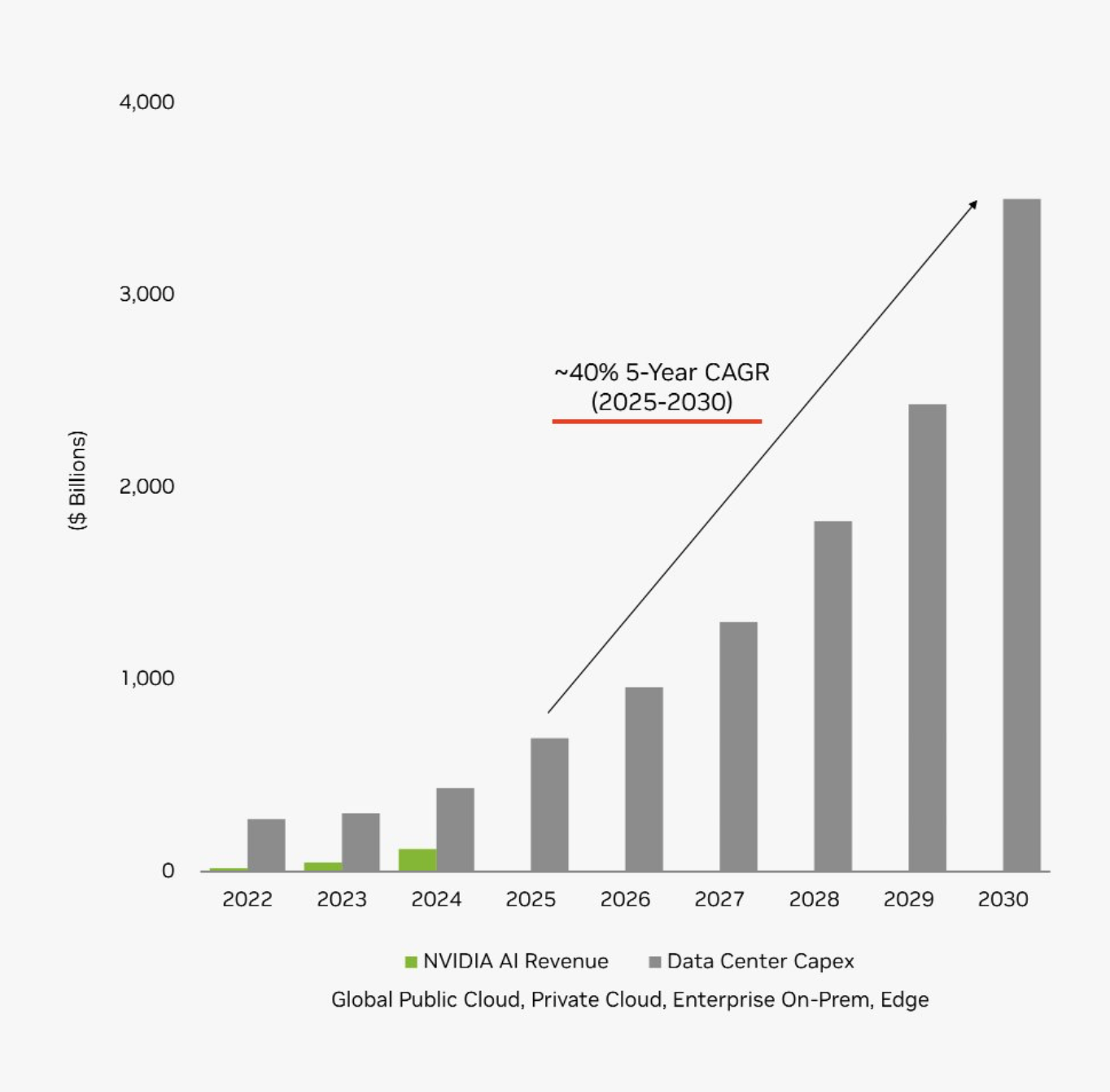

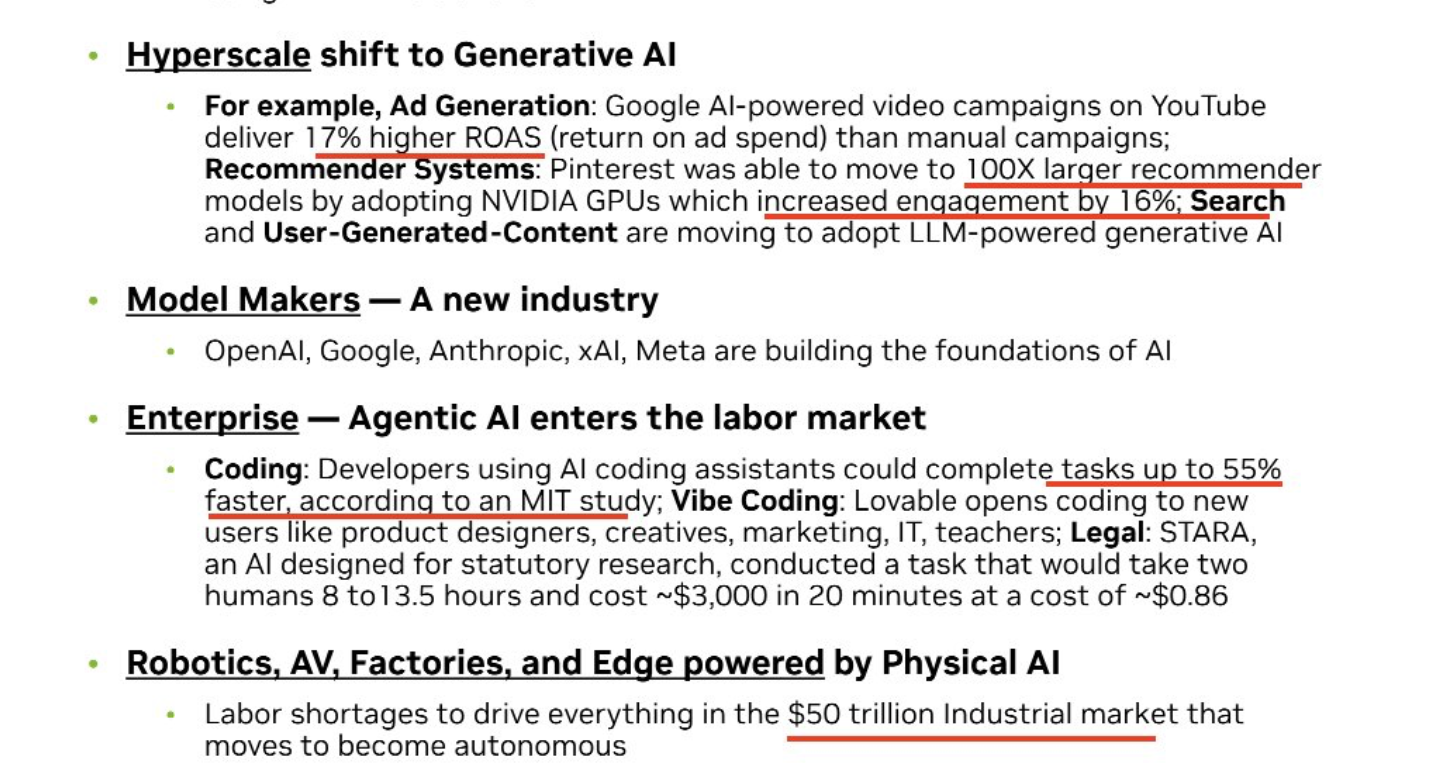

Internal(NVDA) slide on Capex....and driven by

A $50 Trillion industry. Interesting, given where we are now!

-

-internally generated I should say.

-

Talking up their own book?

One could read it and dismiss it out of hand-many companies spin this sort of stuff, right.A few factors to consider.

-

We don't have to realise this sort of scale. 25% works, such is the position today. The near term numbers are solid, the longer dated, clearly some speculation.

-

Jensen Huang is a businessman but he is also very credible, has high integrity and he has an excellent track record. Remember, he was planning this 10 years ago.

-

Many other highly credible people/organisations agree. C. C Wei (TSM), he's building the factories to support it. And the customers are buying/building it at unprecedented scale/pace.

-

As we have said before, the decision has been made to aim high (AGI/ASI) and in the words of Masa San, this will require 200M GPU and $7T. And the big players are racing to get their first. Zuckerberg himself stated, his fear is not scaling quickly enough.

-

From where we sit, the numbers today more than stack up (Nvidia revenue and earnings). Imo valuation is not stretched and I would challenge anyone to put forward a credible argument against this. We have several more years of rapid build out before a determination is widely accepted, success, great success or, they hit a brick wall. In the mean time we are watching very closely and very much enjoying, not just the financials evolve but the technology.

I also wanted to add. Picking a good investment isn't just about quantitative research. Anyone can do that. The interpretation of those numbers/metrics are very important. Two people will draw different conclusions.

Often overlooked is the qualitative factors. Management quality, credibility, track record.

The common denominator-experience. I've been doing this for a very long time, I've seen a lot and you really only understand a business if you have followed them for years(through thick and thin) and have the tools to actually understand what the numbers mean. Experience is knowing a stock correction is structural or a market whim (buy the dip or bail) with much higher confidence (no one is right all the time). Staying calm vs panic. And I would argue many of these attributes can not be learned, not in the short term at least.

-

-

breaking news-

On 15 October 2025, BlackRock's Global Infrastructure Partners (GIP)-led AI Infrastructure Partnership (AIP)—including NVIDIA, Microsoft, xAI, and MGX—announced a $40 billion acquisition of Aligned Data Centers, a U.S. hyperscale operator with 15+ facilities. This landmark deal, one of the largest in AI infrastructure, encompasses debt and targets expansion to $100 billion via equity and financing, focusing on acquiring existing sites and building new renewable-powered data centres (DCs) optimised for AI workloads.

-

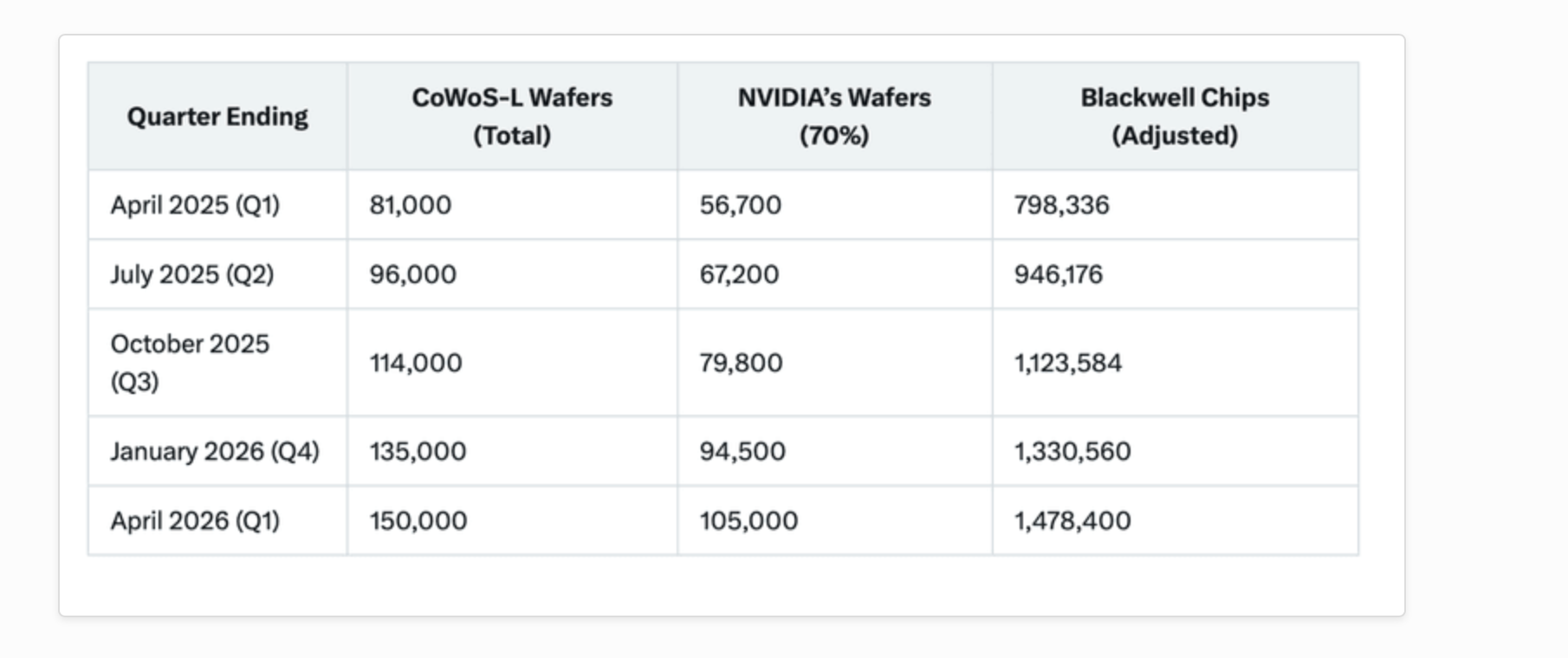

HSBC Research today issued a report on Cowos capacity, stating, they see evidence of Nvidia wafer allocation at 800k units through 2027. This is the first sign of wafer accelerated growth since June 2025. A recap

Here is my May 25 estimate based on TSM public comments-this proved accurate QoQ. The important column being Nvidia wafers, circa 105k by year end. I would think e are ahead of this. Remember, there is a direct correlation between wafers and revenue. And HSBC makes this very point.

If we extrapolated these numbers using the existing expansion cadence we would arrive at circa 570k wafer through 2027. HSNC claims the number is now up to 800K and have modelled GPU(DC) segment revenues of up to $400B. Accordingly they have modelled just under $10 EPS! Accordingly they have issued a new price target of $320.

Exciting times ahead

-

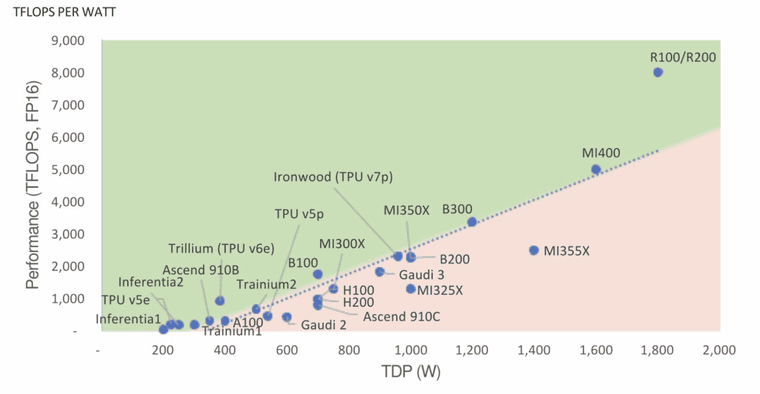

One GPU to rule them all. R100/R200 Rubin

-

News just in. Somethings cooking-quick catch up with Jensen before Trump meets Xi. We have speculated about an easing of export restrictions. It's likely imo.

U.S. President Donald Trump said he will meet Nvidia's CEO Jensen Huang on Wednesday.

Trump is on a visit to Japan and South Korea, where he will meet global leaders and industry chiefs at the Asia-Pacific Economic Cooperation, or APEC, events in Gyeongju, South Korea. Trump and Chinese President Xi Jinping are also expected to meet.

Trump made the remark about meeting Huang in an address to business leaders in Tokyo on Tuesday before traveling to South Korea.

-

If they get the green light it can only move upwards imo.

-

Jensen at a keynote 30 mins ago just said this:

"We now have $500 billion in committed business locked in over the next six quarters—that's take-or-pay contracts from our partners, with every slot in our production pipeline filled through 2027. This isn't speculation; it's the foundation of the AI revolution, powered by Blackwell and Rubin architectures, ensuring the United States leads the world in sovereign AI and energy-efficient computing."

Stock is now at $198, an ATH