Nvidia News

-

Worth a watch to see what all the fuss is about...

-

Curiously, looking at todays slide deck:

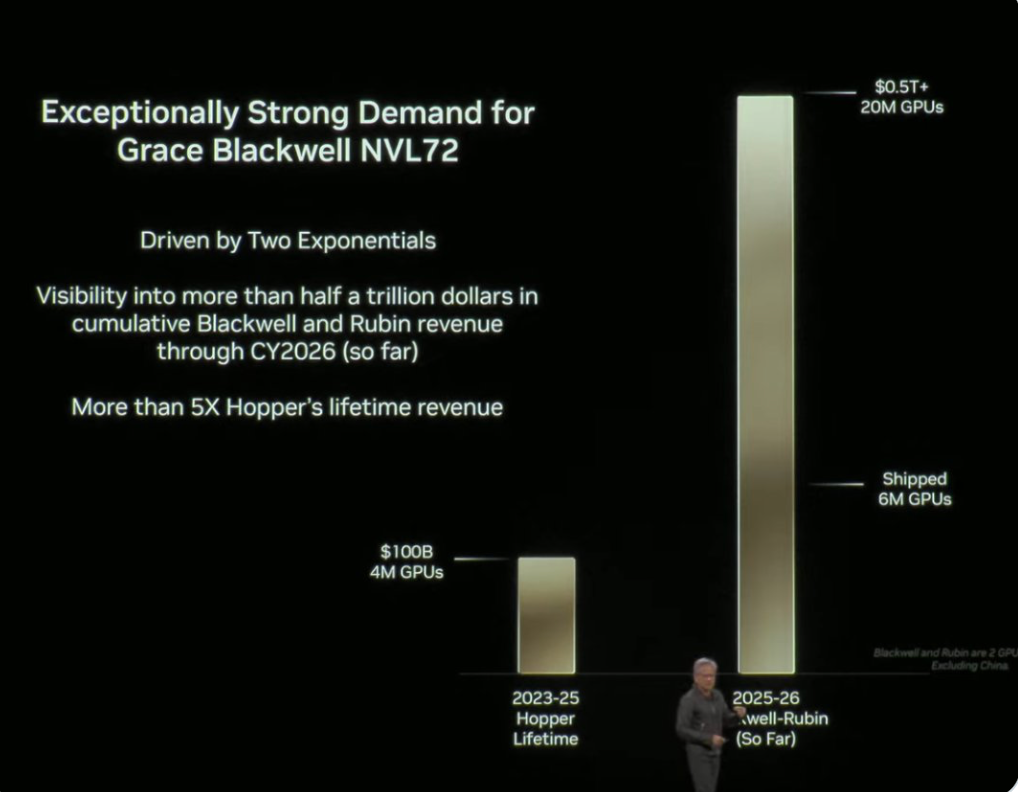

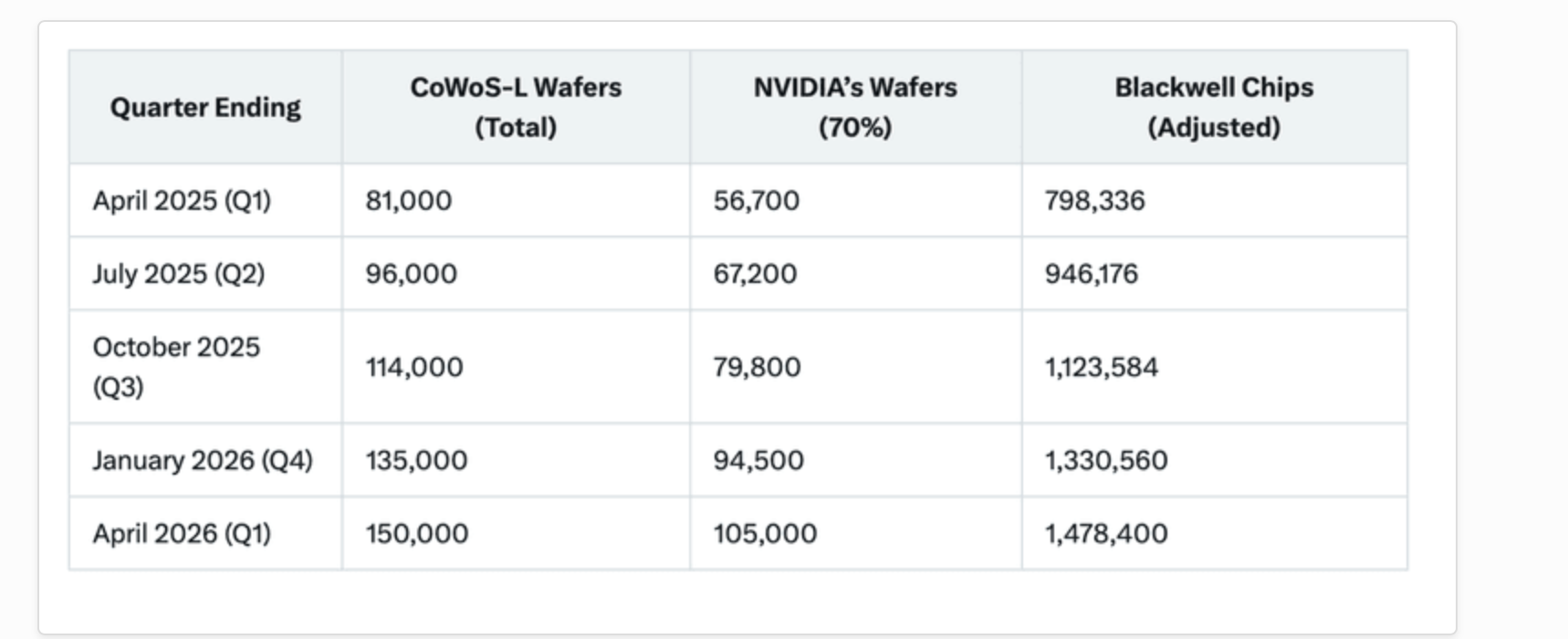

compare it to the forecast made earlier in the year-and I can conform up to a quarter or so ago, was very accurate:

. 5.7M Blackwell predicted for 1 year starting and regardless if it's fiscal or calendar, Jensen is suggesting 6M 'today'. Interesting. It suggests they shipped 2M this quarter which is +$5B over their guide excluding gaming, visualisation, autonomous systems and omniverse which is approx 5-6B more. They could report $60B this Q. NB: here he is counting the GPU stand alone $. But it's GPU+DPU+CPU+NV Link+Switch+DGX basecommand+cloud access.

. 5.7M Blackwell predicted for 1 year starting and regardless if it's fiscal or calendar, Jensen is suggesting 6M 'today'. Interesting. It suggests they shipped 2M this quarter which is +$5B over their guide excluding gaming, visualisation, autonomous systems and omniverse which is approx 5-6B more. They could report $60B this Q. NB: here he is counting the GPU stand alone $. But it's GPU+DPU+CPU+NV Link+Switch+DGX basecommand+cloud access. -

Trump late last night commented on Nvidia's advanced Blackwell AI chips (specifically the GB200 Grace Blackwell Superchip) during a media scrum on October 28, 2025, ahead of his planned high-stakes meeting with Chinese President Xi Jinping on October 30, 2025. When asked about potential agenda items for the talks, which also include issues like fentanyl imports and U.S. agriculture, Trump highlighted the chips as a point of discussion, praising U.S. technological superiority.Key Quotes from Trump:"We'll be speaking about Blackwell, it's the super duper chip."

"That's our country. We're about 10 years ahead of anybody else in chips—in the highly sophisticated chips. I think we may be talking about that with President Xi."

A real sample was shown for the first time.

180KW and $8M give or take.

Just the HBM4 memory is > $2M. Go Micron! -

I like this:

-

No concerns-and on Tuesday week I expect a beat and raise. Earnings above $30B imo

NVIDIA CEO Jensen Huang made his fourth trip to Taiwan this year, flying in privately on Friday afternoon. His itinerary:First stop: Tainan, to tour TSMC's Fab 18 (the world's most advanced 3nm production facility).

Saturday: Attended TSMC's annual company-wide Sports Day in Hsinchu, where he spoke on stage alongside TSMC CEO C.C. Wei and founder Morris Chang.When reporters asked TSMC's C.C. Wei about the meeting, he laughed and said:

"He asked for wafers, of course."Jensen confirmed it openly: “Yes, yes. Because the business is very strong, and it’s growing month by month, stronger and stronger. And so, TSMC is doing an excellent job and I came to encourage them and thank them for their hard work.”

He also praised TSMC effusively: “Thank you for helping me build NVIDIA… You are really the pride of Taiwan, you are also the pride of the world.”

TSMC's capacity is still razor-tight into 2026, but they're expanding 3nm from ~100k to 160k wafers/month in southern Taiwan—and a big chunk of that extra output is reportedly earmarked for NVIDIA's next-gen Rubin AI chips.In short: Jensen flew halfway around the world literally to beg for MORE—and TSMC basically said "we're on it." AI demand is still absolutely insane.

-

Jensen was in Taiwan late last week visiting TSM and dined at Lui Family Hot Pot restaurant with C.C Wei.

What he actually said (direct quotes from the Taiwan trip):At TSMC Fab 18 (Friday afternoon, Nov 7):

“We’re now seeing Rubin on the production line.”

(He said this while walking the floor with reporters – meaning real Rubin R100 wafers are already moving through the fab right now.)

At the TSMC executive dinner (Friday night):

“Rubin has already begun entering production… We’re now seeing Rubin on the production line.”

(Multiple analysts who were in the room posted this verbatim.)Why this is a massive green flag for the ramp:“On the production line” = volume production, not just risk/trial wafers

This is ~3 months ahead of even the most bullish leaks from August

TSMC instantly responded by bumping Fab 18B 3nm capacity from 100k → 160k wpm specifically for Rubin . The media have said this benefits Blackwell but they are wrong. Blackwell uses the 4NP node. Rubin uses the 3nm node.

Jensen spent his entire 24-hour trip begging for even more CoWoS-L capacity for 2026 – that only happens when yields are clean and demand is off the chartsBottom line: the Rubin ramp isn’t just “going well” – it’s printing ahead of schedule and already forcing TSMC to add 60% more 3nm wafers per month.

Clear evidence things at Nvidia are yet again, exceeding all expectations.

-

Interesting comments from Jensen at the UBS conference:

Roll on Tuesday

Custom ASICs are often "science projects": Many get built but fail the real-world revenue test. Smart CEOs do the maths – AI factories impact revenues, not just costs.

NVIDIA is the only proven, revenue-generating alternative: Competitors are still desperately trying to catch up to Hopper; no one has a credible rival yet, while NVIDIA's roadmap is already pushing the limits of physics.

It's not about a chip – it's the full AI factory platform: NVIDIA delivers the entire impossibly complex stack (chips, systems, networking, switches, software, scale-up/scale-out architecture) that the entire industry has standardised on.......(you hear AMD bleat on about their chip. One chip is irrelevant. 100k chips sewn together matters and AMD can't do it!) nor have they even produced it yet and 2nm is no joke so expect issues. So what JH is saying is, who is going to bet $100B on a speculative solution-no one is the answer. Current forecasts show AMD producing 400k chips in 2027 against Nvidia 16M. Oops

Unmatched focus and resources: 35,000 people dedicated to one thing; decades of experience; pushing every dimension (compute, networking, systems, software) to the absolute limit.

Hundreds-of-billions betting decision: If you need a giant AI data centre operational in two years, you must place the purchase order today. There is literally only one architecture you can confidently bet $100B+ on right now – NVIDIA's.

No one else has the depth or derisking capability: NVIDIA is the only company placing its own $100B+ POs and building the end-to-end supply chain (from upstream semiconductors to power companies, cooling, infrastructure partners like BlackRock, Vertiv, Schneider).

The risk is existential: With capex now measured in hundreds of billions to trillions, certainty of performance, execution, and future roadmap is everything. Custom ASICs cannot provide that certainty at scale.

Bottom line: NVIDIA is not just selling silicon – it is the de facto platform and the only realistic foundation on which the world's AI infrastructure will be built. Everyone in the industry already knows this and has effectively surrendered to it.

-

Interesting

-

I'll post some comments by Jensen...

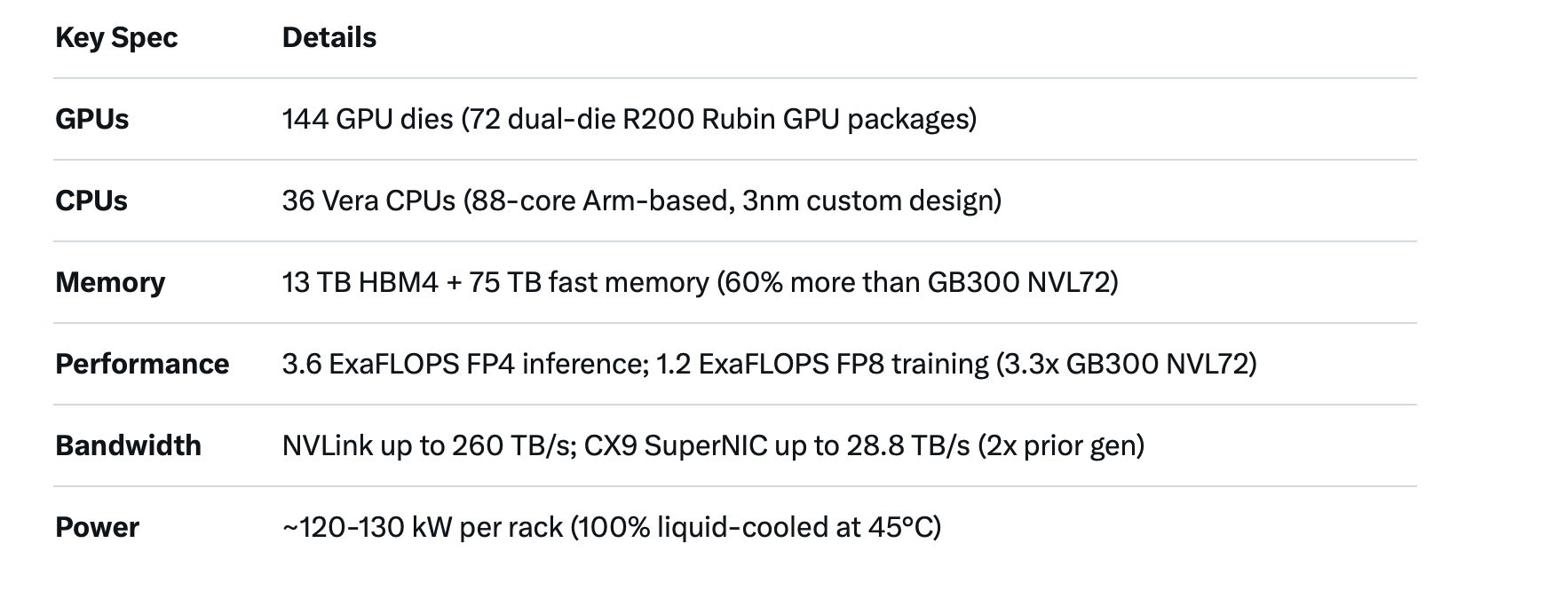

The Rubin platform is on track to ramp in the second half of 2026. Powered by 7 chips, the Vera Rubin platform will once again deliver an X-factor improvement in performance relative to Blackwell. We have received silicon back from our supply chain partners and are happy to report that NVIDIA teams across the world are executing to bring up beautifully.

Rubin is our third-generation rack-scale system substantially redefined the manufacturability while remaining compatible with Grace Blackwell. Our supply chain data centre ecosystem and cloud partners have now mastered the build to installation process of NVIDIA's rack architecture. Our ecosystem will be ready for a fast Rubin ramp.

Growth accelerated to +62% YoY and 22% QoQ! Impressive. Faster than any company I know and priced lower too.

-

The Trump administration is reportedly pressing Congress to reject a proposed provision that would require Nvidia (NVDA) to prioritise sales of its advanced artificial intelligence chips to US-based companies before exporting them to China or other restricted countries, according to a Bloomberg report published today.

The measure under discussion is the bipartisan GAIN AI Act, which remains in its early stages. It seeks to establish a formal “America-first” allocation system for controlled AI semiconductors and is being considered for inclusion in the annual National Defence Authorisation Act (NDAA).

The White House’s intervention is regarded as a significant victory for Nvidia, which has actively lobbied the incoming administration to preserve greater flexibility in its export policy. China had previously been a major revenue contributor for the company until successive US export controls prompted Nvidia earlier this year to exclude the market from its forward sales forecasts amid heightened geopolitical risk.

-

Highlights from the company's Q3 earnings + Call:

Financial HighlightsRevenue: $57.0 billion (+62% YoY, +22% QoQ) → record $10 billion sequential increase

Data Centre: $51.2 billion (+66% YoY)

Networking: $8.2 billion (+162% YoY)

Gaming: $4.3 billion (+30% YoY)

Professional Visualisation: £760 million (+56% YoY, record)

Automotive: $592 million (+32% YoY)

Non-GAAP Gross Margin: 73.6% (beat guidance)

Q4 FY26 Guidance: $65 billion ±2% (mid-point +14% QoQ)

FY27 Gross Margin target: mid-70s (despite rising input costs)Strategic & Demand Highlights $0.5 trillion Blackwell + Rubin revenue visibility from Jan 2025 → Dec 2026 → Colette confirmed “the number will grow”

New major commitments announced on/around the call pushing visibility higher:

– Anthropic: deep partnership + up-to-1 GW commitment (first time Claude runs natively on NVIDIA)

– KSA / HUMAIN: 400k–600k additional GPUs over 3 years

– AWS / HUMAIN: up to 150k GB300 accelerators + 500 MW flagship facility

– OpenAI: strategic partnership + potential NVIDIA investment; NVIDIA helping build ≥10 GW of OpenAI-owned data centres

Blackwell ramp: GB300 now >⅔ of Blackwell revenue; seamless transition, already shipping at scale to major CSPs

Rubin platform: on track for 2H 2026 ramp, another “X-factor” leap; silicon already back, bring-up proceeding well

China exposure: essentially $0 data-centre compute revenue assumed (H20 only ~$50 million in Q3)Jensen’s Big-Picture MessagesThree simultaneous platform shifts driving demand: General-purpose → accelerated computing (post-Moore’s Law)

Classical ML → generative AI (already transforming hyperscaler recommender systems, search, ads)

Generative → agentic & physical AI (fastest-growing apps in history)Inference is exploding because of reasoning / chain-of-thought; GB200/GB300 with NVLink-72 delivering 10–15× performance vs H200

NVIDIA content per gigawatt rising every generation

– Hopper era: ~$20–25 billion/GW

– Blackwell (Grace-Blackwell): $40+ billion/GW

– Rubin: higher still (I expect revenue tempo to pop again, from +$10 to +$15B)

No sign of supply catching demand in next 12–18 months; every installed GPU (new & old generations) remains fully utilised

Strategic investments (OpenAI, Anthropic, xAI, Mistral, etc.) are about expanding the CUDA ecosystem and co-development, not just financial betsBottom Line NVIDIA is still in the early innings of a multi-year, multi-trillion-$ AI infrastructure build-out, remains supply-constrained, and continues to increase both performance-per-watt and $-per-GW with each architecture. Demand visibility is growing faster than the already enormous $0.5 trillion base case.

As we said in the past, their tempo QoQ very much looks like 60(Q3)-70-80-90-100. Which would equate $340B over the next 4 quarters and $380B for calendar 2026 with estimated earnings of over $200B whilst constrained. Their PE imo is circa 23.

There may be bubbles forming in some names but not here. And what is amusing is the bears(some), having been embarrassed again by getting it wrong have resorted to saying the company financials are made up.

The result was very important, setting up the direction into the year end across the wider market and particularly in tech. I would think it should give all investors, the ones that listen and think, a lot of confidence in the space and specifically our names, none of which are stretched and many being very fairly priced.

We have discussed putting in the work and understanding the detail. An immersive exercise where you literally live and breath it day in day out for years-that is how you gain confidence, de-risk and de-stress about the daily, weekly and randomness of the market. We have a very special business here and imo they really are just getting started. I look forward to following their journey and updating/commenting on every twist and turn.

-

I'm not overly concerned about the power infrastructure. Where is a will, there is a way.

-

Numpty Q here.

NVDA took a wallop a couple of days ago because apparently Alphabet (GOOG) think they can gain the upper hand in the chip race.

My question is not whether this aspiration is realistic; it's why GOOG hasn't pushed upwards given this news? It's actually slightly down on it's position 48 hours ago.

Just wondering. And if the answer is 'markets are irrational' then I guess I'll have to stop thinking about it.

-

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

@mikeiow said in Nvidia News:

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

No - I have a position in both NVDA and GOOG and am happy with things as they are. I was just curious why GOOG didn't go up as NVDA went down.

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

@Adam-Kay said in Nvidia News:

... I'll take the big GOOG pop.

What GOOG pop was that then? Down just over 1% today, up 0.1% since Tuesday close. I like my pops bigger than that!

Having said that, the rest of the figures look quite handsome today and I'm hopeful for a gain when the numbers are out tomorrow.