Nvidia News

-

Hi A,

Micron is +30% over the last month alone. What we want to see is strong HBM growth-very strong. How the market reacts is unknown and largely unimportant for us investors.

As for Nvidia. It's well deserved imo. It is the most valuable company in the world by a long way

-

Yesterday Jensen Huang during the company's AGM, said the following:

Just beyond AI agents, the next wave is already coming. The next wave is physical AI—robots that see, reason, and interact with the physical world. Robots and all the AI infrastructure to train them will be the next multi-trillion-dollar industry. NVIDIA builds the AI factories to train them, the digital twin worlds to simulate them(Ominiverse), and the robotic computers deploy them. We give them intelligence in an AI factory, fine-tune their skills in a virtual gym(Omnivores), and eventually deploy them into factories, warehouses, and homes to increase the world's labour force.

Today, nearly 100 NVIDIA AI-powered AI factories and buildouts are underway around the world. That’s double what we saw a year ago, and they’re getting larger. The average number of GPUs per factory has also doubled. These breakthroughs drove strong performance. Revenue more than doubled to $130 billion. Operating income and EPS grew 147%.

We’re at the beginning of a decade-long AI infrastructure buildout. Demand for sovereign AI is growing around the world. We’re partnering with companies and governments across Europe, Japan, South Korea, Taiwan, Canada, Southeast Asia, the Middle East, Latin America, and Africa to build regional AI infrastructure.

AI factories, a new type of data centre, are being established across the globe to manufacture AI and empower these next-generation applications. AI factory projects require tens of gigawatts of AI infrastructure(how much is 10s? 25 = $1T). It’s set to be built in the coming years, and NVIDIA is uniquely positioned to capture this opportunity with our full-stack approach(we repeat this over and over-the stack not the chip, not the rack 'total solution), systems engineering expertise, and large ecosystem of technology partners.

-

This is clarification from OpenAi due to fake news being circulated a few days prior or maybe OpenAI were thinking about buying another product and Jensen called Sam :). And it also confirms what we believe. You can offer an alternative product but you still can't usurp the King for a number of reasons. Nvidia make no secret of the fact that you get allocation based on a number of criteria. Loyalty being one. Nvidia hold the cards, have a massive moat and stronghold on this entire industry. Right now I would think there are 10 buyers for every 1 chip and the demand supply imbalance will prevail for many many years imo because we know supply is limited to packaging scale up.

-

The first company in history to reach a valuation of $4T. What a legend, Jensen Huang.

-

Less, it was $20 in Jan 2023 and in June 2023 it popped to $40 ($1T). We paid $25.60.It's always interesting looking back. I save articles by so-called experts that I couldn't be more diametrically opposed and yes, get a kick out of them continuing to shout at the clouds. And a shout out to guy vert who posted against the herd on PH some time back saying he wasn't selling and why!. A lone voice on that thread of 'experts'.

Nothing goes up in a straight line and at every new high, some decide to cash in their chips. It matters not. I think the company has a lot left to offer, as do several others which also hit ATHs today-and for good reason.

Please, I dont need thanks-someone might come along and tell me 'no thanks from me'

-

Less, it was $20 in Jan 2023 and in June 2023 it popped to $40 ($1T). We paid $25.60.It's always interesting looking back. I save articles by so-called experts that I couldn't be more diametrically opposed and yes, get a kick out of them continuing to shout at the clouds. And a shout out to guy vert who posted against the herd on PH some time back saying he wasn't selling and why!. A lone voice on that thread of 'experts'.

Nothing goes up in a straight line and at every new high, some decide to cash in their chips. It matters not. I think the company has a lot left to offer, as do several others which also hit ATHs today-and for good reason.

Please, I dont need thanks-someone might come along and tell me 'no thanks from me'

@Adam-Kay said in Nvidia News:

Please, I dont need thanks-someone might come along and tell me 'no thanks from me'

Haha. It’s a tough crowd some nights!

-

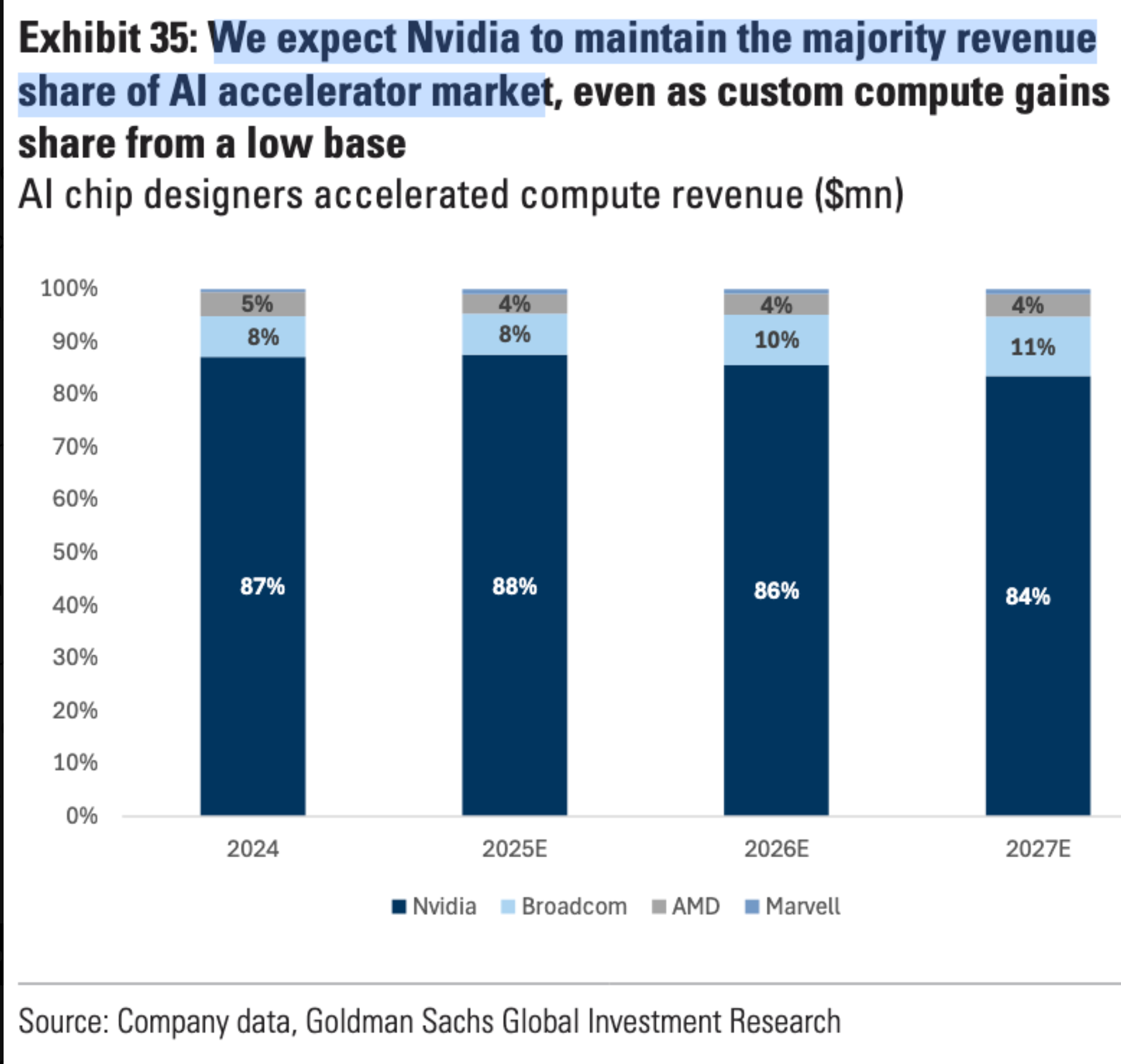

Grom GS today-nothing we don't already know. Obviously the TAM is growing at a large rate. In fact they are speculating on beyond 2025 but I can live with 84% market share

-

Nvidia CEO Jensen Huang will hold a media briefing in Beijing on July 16, Reuters reports, raising hopes a new China-focused chip may be unveiled that meets US export controls.

Looks like the B30 GPU, designed specifically to meet export controls, will be announced-availability set for September with several large customers in China having already placed preliminary orders worth billions. I would think around 2M chips per year @ $8k per chip is the size of the market-call it $4B/Q.

The export controls, limit two critical chip features. Bandwidth and Speed(operations/s). Bandwidth is nerfed vis DDR memory as opposed to HBM.

Useful insight. Why, if the B30 is significantly less powerful than local competing alternatives, namely the Ascend range from Huawei, proving to be in high demand? CUDA! The backbone of their moat now and for the next decade at least.

-

Almost certainly Nvidia based-Huang met Trump at the WH last Friday for one on one talks. Slowing down?

-

This is big.

Nvidia’s getting the green light to restart H20 chip sales to China after U.S. assurances on export licences, a big win after a $5.5 billion hit from unsold stock and potentially $15 billion in lost sales. This reverses a Trump-era ban , boosting Nvidia’s shares(almost certainly) and lifting tech stocks, a $17 billion market for Nvidia, can now access H20 chips for AI development, fuelling firms like Baidu, Tencent, Alibaba. Nvidia’s also launching the RTX Pro GPU, a cheaper, export-compliant chip for smart factories. It’s a massive deal for Nvidia’s bottom line and keeps them in China’s AI race.

-

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

-

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

@Adam-Kay said in Nvidia News:

And to remind everyone. Nvidia not only took a huge hit last Q(5.5B), they have about $5B in inventory just sitting around. The accounting will be a reversal of the inventory provision +$5B+ PLUS the revenue generated from renewed sales, +$5B, probably next quarter. Will we see a monster guide for Q2.Likely. Something like +$13B top line QoQ and a huge margin improvement from the provision. With the current quarterly cadence of +$8B excluding China we can expect actual Q2 revenue of circa $60B and earnings of at least $32B

Sorry to be fick but I thought that NVidia was selling every scrap of whatever they could make, and had a backfilled order book for 18 months or more? If that's the case then how can they have $5bn of inventory sitting around?

I expect I've missed something somewhere.

-

During the Biden tenure the US banned the Hopper-H100 if you recall. Enter the H20 which was a restricted version, produced to meet two core prescriptive limits (for china), bandwidth and operations per seconds. Approx 4 months ago Trump restricted the H20 leaving Nvidia holding $5B of unsold inventory and pretty much ejected them from the China market. Nvidia said at the time 'we are taking a $5.5B charge to our earnings' and would have guided $52B for Q1 if not for the restriction. Instead they guided $43B and made the decision not to include any china revenue in their guide-obviously there were and still are China sales however, immaterial to the mass market which was H20.

Today's news is fantastic. Whether this is a one off, clear the inventory or something else, we don't know.

Nvidia also has the further restricted B30 on deck.

I personally think it is the right thing to do, purely on the basis, China would have found a way to acquire the technology, it's good for relations and US business. It's narrow minded to hurt US business, less tax dollars, less dollars for R&D and force China to innovate faster. Let's remember the US has Blackwell which is 30X more powerful than H20. They ought to lead with this technology, right.

-

During the Biden tenure the US banned the Hopper-H100 if you recall. Enter the H20 which was a restricted version, produced to meet two core prescriptive limits (for china), bandwidth and operations per seconds. Approx 4 months ago Trump restricted the H20 leaving Nvidia holding $5B of unsold inventory and pretty much ejected them from the China market. Nvidia said at the time 'we are taking a $5.5B charge to our earnings' and would have guided $52B for Q1 if not for the restriction. Instead they guided $43B and made the decision not to include any china revenue in their guide-obviously there were and still are China sales however, immaterial to the mass market which was H20.

Today's news is fantastic. Whether this is a one off, clear the inventory or something else, we don't know.

Nvidia also has the further restricted B30 on deck.

I personally think it is the right thing to do, purely on the basis, China would have found a way to acquire the technology, it's good for relations and US business. It's narrow minded to hurt US business, less tax dollars, less dollars for R&D and force China to innovate faster. Let's remember the US has Blackwell which is 30X more powerful than H20. They ought to lead with this technology, right.

@Adam-Kay said in Nvidia News:

Helpful Explanation

Thanks Adam - that was a very helpful explanation. I didn't realise that the excess stock you referred to was of stuff that they were prohibited from selling but the trading of which is no longer verboten.

This move from Trump therefore looks like good news indeed.

Thanks again for the explanation. (If you can persuade Nik to reply to my eMail of this morning then I'll be even more pleased!)

-

My take on the approval of the H20. The export controls have not been relaxed/rewritten. This is very much looking like a one time 'clear the inventory'. I believe Nvidia are holding $8B in chip stocks(H20). Going fwd the company has two approved chips:

B30: Employs GDDR7 to comply with export limits (capped at ~1.4–TB/s per U.S. regulations).

RTX Pro 6000D: Also uses GDDR7, with bandwidth estimates ranging from 1.1 TB/s (per some sources)

Chinese customers are fully aware and have ordered at least 2 million 6000D and around 1.5 million B30. This is good news

-

If you recall when the H20 'ban' came in, on these very boards we discussed the real possibility of it being:

Used as a bargaining 'chip' re Trump/China trade negotiations. That the $5.5b provision (hit to earnings) would likely be reversed. That sale of compliant GPUs would continue in China.

Going fwd the H20 will not reenter production. It is definitely a clear the inventory one time solution. Export limits are unchanged and Nvidia has two compliant chips to sell, having already secured material pre-orders from Chinese customers. The chips are known externally as:

B30

B40 (RTX pro 6kD)Whilst the internet was panicking we applied sound reason/logic to an untenable situation that would be resolved in time. And here we are. It's nice having a CEO who has a seat at the highest table. It bodes well for the years ahead. The President recognises Nvidia's importance to the US economy and future and will do whatever he can to help them succeed. And just as importantly, Jensen Huang is the consummate diplomat-he is well equipped to manage the relationship imo! ;)(to avoid any doubt I mean 'stay friends')

-

Is the news with the link with REE trades with Vhina