Nvidia News

-

Jensen was in Taiwan late last week visiting TSM and dined at Lui Family Hot Pot restaurant with C.C Wei.

What he actually said (direct quotes from the Taiwan trip):At TSMC Fab 18 (Friday afternoon, Nov 7):

“We’re now seeing Rubin on the production line.”

(He said this while walking the floor with reporters – meaning real Rubin R100 wafers are already moving through the fab right now.)

At the TSMC executive dinner (Friday night):

“Rubin has already begun entering production… We’re now seeing Rubin on the production line.”

(Multiple analysts who were in the room posted this verbatim.)Why this is a massive green flag for the ramp:“On the production line” = volume production, not just risk/trial wafers

This is ~3 months ahead of even the most bullish leaks from August

TSMC instantly responded by bumping Fab 18B 3nm capacity from 100k → 160k wpm specifically for Rubin . The media have said this benefits Blackwell but they are wrong. Blackwell uses the 4NP node. Rubin uses the 3nm node.

Jensen spent his entire 24-hour trip begging for even more CoWoS-L capacity for 2026 – that only happens when yields are clean and demand is off the chartsBottom line: the Rubin ramp isn’t just “going well” – it’s printing ahead of schedule and already forcing TSMC to add 60% more 3nm wafers per month.

Clear evidence things at Nvidia are yet again, exceeding all expectations.

-

Interesting comments from Jensen at the UBS conference:

Roll on Tuesday

Custom ASICs are often "science projects": Many get built but fail the real-world revenue test. Smart CEOs do the maths – AI factories impact revenues, not just costs.

NVIDIA is the only proven, revenue-generating alternative: Competitors are still desperately trying to catch up to Hopper; no one has a credible rival yet, while NVIDIA's roadmap is already pushing the limits of physics.

It's not about a chip – it's the full AI factory platform: NVIDIA delivers the entire impossibly complex stack (chips, systems, networking, switches, software, scale-up/scale-out architecture) that the entire industry has standardised on.......(you hear AMD bleat on about their chip. One chip is irrelevant. 100k chips sewn together matters and AMD can't do it!) nor have they even produced it yet and 2nm is no joke so expect issues. So what JH is saying is, who is going to bet $100B on a speculative solution-no one is the answer. Current forecasts show AMD producing 400k chips in 2027 against Nvidia 16M. Oops

Unmatched focus and resources: 35,000 people dedicated to one thing; decades of experience; pushing every dimension (compute, networking, systems, software) to the absolute limit.

Hundreds-of-billions betting decision: If you need a giant AI data centre operational in two years, you must place the purchase order today. There is literally only one architecture you can confidently bet $100B+ on right now – NVIDIA's.

No one else has the depth or derisking capability: NVIDIA is the only company placing its own $100B+ POs and building the end-to-end supply chain (from upstream semiconductors to power companies, cooling, infrastructure partners like BlackRock, Vertiv, Schneider).

The risk is existential: With capex now measured in hundreds of billions to trillions, certainty of performance, execution, and future roadmap is everything. Custom ASICs cannot provide that certainty at scale.

Bottom line: NVIDIA is not just selling silicon – it is the de facto platform and the only realistic foundation on which the world's AI infrastructure will be built. Everyone in the industry already knows this and has effectively surrendered to it.

-

Interesting

-

I'll post some comments by Jensen...

The Rubin platform is on track to ramp in the second half of 2026. Powered by 7 chips, the Vera Rubin platform will once again deliver an X-factor improvement in performance relative to Blackwell. We have received silicon back from our supply chain partners and are happy to report that NVIDIA teams across the world are executing to bring up beautifully.

Rubin is our third-generation rack-scale system substantially redefined the manufacturability while remaining compatible with Grace Blackwell. Our supply chain data centre ecosystem and cloud partners have now mastered the build to installation process of NVIDIA's rack architecture. Our ecosystem will be ready for a fast Rubin ramp.

Growth accelerated to +62% YoY and 22% QoQ! Impressive. Faster than any company I know and priced lower too.

-

The Trump administration is reportedly pressing Congress to reject a proposed provision that would require Nvidia (NVDA) to prioritise sales of its advanced artificial intelligence chips to US-based companies before exporting them to China or other restricted countries, according to a Bloomberg report published today.

The measure under discussion is the bipartisan GAIN AI Act, which remains in its early stages. It seeks to establish a formal “America-first” allocation system for controlled AI semiconductors and is being considered for inclusion in the annual National Defence Authorisation Act (NDAA).

The White House’s intervention is regarded as a significant victory for Nvidia, which has actively lobbied the incoming administration to preserve greater flexibility in its export policy. China had previously been a major revenue contributor for the company until successive US export controls prompted Nvidia earlier this year to exclude the market from its forward sales forecasts amid heightened geopolitical risk.

-

Highlights from the company's Q3 earnings + Call:

Financial HighlightsRevenue: $57.0 billion (+62% YoY, +22% QoQ) → record $10 billion sequential increase

Data Centre: $51.2 billion (+66% YoY)

Networking: $8.2 billion (+162% YoY)

Gaming: $4.3 billion (+30% YoY)

Professional Visualisation: £760 million (+56% YoY, record)

Automotive: $592 million (+32% YoY)

Non-GAAP Gross Margin: 73.6% (beat guidance)

Q4 FY26 Guidance: $65 billion ±2% (mid-point +14% QoQ)

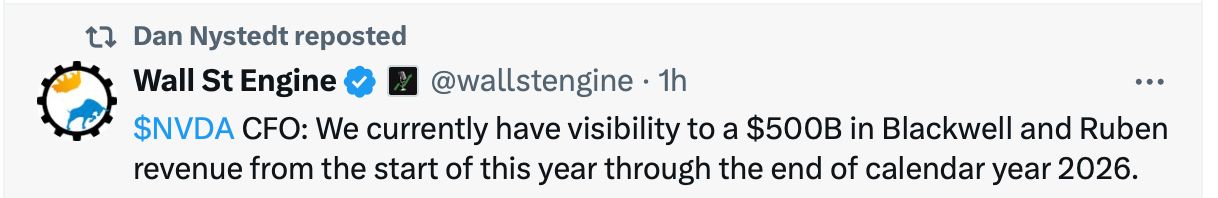

FY27 Gross Margin target: mid-70s (despite rising input costs)Strategic & Demand Highlights $0.5 trillion Blackwell + Rubin revenue visibility from Jan 2025 → Dec 2026 → Colette confirmed “the number will grow”

New major commitments announced on/around the call pushing visibility higher:

– Anthropic: deep partnership + up-to-1 GW commitment (first time Claude runs natively on NVIDIA)

– KSA / HUMAIN: 400k–600k additional GPUs over 3 years

– AWS / HUMAIN: up to 150k GB300 accelerators + 500 MW flagship facility

– OpenAI: strategic partnership + potential NVIDIA investment; NVIDIA helping build ≥10 GW of OpenAI-owned data centres

Blackwell ramp: GB300 now >⅔ of Blackwell revenue; seamless transition, already shipping at scale to major CSPs

Rubin platform: on track for 2H 2026 ramp, another “X-factor” leap; silicon already back, bring-up proceeding well

China exposure: essentially $0 data-centre compute revenue assumed (H20 only ~$50 million in Q3)Jensen’s Big-Picture MessagesThree simultaneous platform shifts driving demand: General-purpose → accelerated computing (post-Moore’s Law)

Classical ML → generative AI (already transforming hyperscaler recommender systems, search, ads)

Generative → agentic & physical AI (fastest-growing apps in history)Inference is exploding because of reasoning / chain-of-thought; GB200/GB300 with NVLink-72 delivering 10–15× performance vs H200

NVIDIA content per gigawatt rising every generation

– Hopper era: ~$20–25 billion/GW

– Blackwell (Grace-Blackwell): $40+ billion/GW

– Rubin: higher still (I expect revenue tempo to pop again, from +$10 to +$15B)

No sign of supply catching demand in next 12–18 months; every installed GPU (new & old generations) remains fully utilised

Strategic investments (OpenAI, Anthropic, xAI, Mistral, etc.) are about expanding the CUDA ecosystem and co-development, not just financial betsBottom Line NVIDIA is still in the early innings of a multi-year, multi-trillion-$ AI infrastructure build-out, remains supply-constrained, and continues to increase both performance-per-watt and $-per-GW with each architecture. Demand visibility is growing faster than the already enormous $0.5 trillion base case.

As we said in the past, their tempo QoQ very much looks like 60(Q3)-70-80-90-100. Which would equate $340B over the next 4 quarters and $380B for calendar 2026 with estimated earnings of over $200B whilst constrained. Their PE imo is circa 23.

There may be bubbles forming in some names but not here. And what is amusing is the bears(some), having been embarrassed again by getting it wrong have resorted to saying the company financials are made up.

The result was very important, setting up the direction into the year end across the wider market and particularly in tech. I would think it should give all investors, the ones that listen and think, a lot of confidence in the space and specifically our names, none of which are stretched and many being very fairly priced.

We have discussed putting in the work and understanding the detail. An immersive exercise where you literally live and breath it day in day out for years-that is how you gain confidence, de-risk and de-stress about the daily, weekly and randomness of the market. We have a very special business here and imo they really are just getting started. I look forward to following their journey and updating/commenting on every twist and turn.

-

I'm not overly concerned about the power infrastructure. Where is a will, there is a way.

-

Numpty Q here.

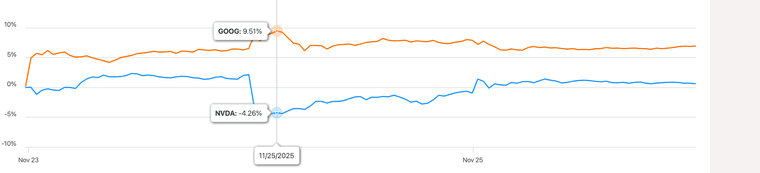

NVDA took a wallop a couple of days ago because apparently Alphabet (GOOG) think they can gain the upper hand in the chip race.

My question is not whether this aspiration is realistic; it's why GOOG hasn't pushed upwards given this news? It's actually slightly down on it's position 48 hours ago.

Just wondering. And if the answer is 'markets are irrational' then I guess I'll have to stop thinking about it.

-

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

@mikeiow said in Nvidia News:

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

No - I have a position in both NVDA and GOOG and am happy with things as they are. I was just curious why GOOG didn't go up as NVDA went down.

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

@Adam-Kay said in Nvidia News:

... I'll take the big GOOG pop.

What GOOG pop was that then? Down just over 1% today, up 0.1% since Tuesday close. I like my pops bigger than that!

Having said that, the rest of the figures look quite handsome today and I'm hopeful for a gain when the numbers are out tomorrow.

-

Only FX tomorrow-Thanks Giving-market closed. Half day on Friday

-

@Adam-Kay said in Nvidia News:

... I'll take the big GOOG pop.

What GOOG pop was that then? Down just over 1% today, up 0.1% since Tuesday close. I like my pops bigger than that!

Having said that, the rest of the figures look quite handsome today and I'm hopeful for a gain when the numbers are out tomorrow.

-

Thanks Adam. Google Finance is now showing me a graph very similar to that when I compare GOOG with NVDA over the last week, although I am sure it was giving different figures yesterday and the day before. It does indeed look like a nice pop from GOOG and one I am happy to have!

-

Colette Kress absolutely smashed it at the UBS conference yesterday, proper bullish vibes everywhere! She told the room to forget any “AI bubble” nonsense – this is a multi-trillion-dollar revolution that’s only just kicking off. She’s calling for $3–4 trillion of data-centre spend by the end of the decade, with half of it flowing straight into NVIDIA’s GPUs. Insane numbers.

Demand is 'overwelming' (the only way to describe it): $500 billion already booked for Blackwell and Rubin chips through 2026, and every single chip they finish ships instantly. Inventory is exploding because they literally cannot build them fast enough. Then layer on the monster OpenAI deal (up to $100 billion still in play) and Anthropic’s billions waiting in the wings – the growth runway is endless.

Competition? Forget about it. Blackwell is flying out the door, Rubin’s already taped out and lands in 2026 with another massive leap, and NVIDIA’s full-stack systems are light-years ahead. Margins staying fat in the mid-70s, inference now a proper money-spinner, and the whole AI flywheel is accelerating like mad.

Honestly, she made NVIDIA look unstoppable. And I would add, she chooses her words carefully-always precise and not one to get carried away, so her comments are very pleasing.

-

Developing news- US Govt in talks to approve mid tier Nvidia silicon into China. Stock is moving up. Watch this space.

-

It’s up again after hours to 190. Save the kittens