Nvidia News

-

-internally generated I should say.

-

Talking up their own book?

One could read it and dismiss it out of hand-many companies spin this sort of stuff, right.A few factors to consider.

-

We don't have to realise this sort of scale. 25% works, such is the position today. The near term numbers are solid, the longer dated, clearly some speculation.

-

Jensen Huang is a businessman but he is also very credible, has high integrity and he has an excellent track record. Remember, he was planning this 10 years ago.

-

Many other highly credible people/organisations agree. C. C Wei (TSM), he's building the factories to support it. And the customers are buying/building it at unprecedented scale/pace.

-

As we have said before, the decision has been made to aim high (AGI/ASI) and in the words of Masa San, this will require 200M GPU and $7T. And the big players are racing to get their first. Zuckerberg himself stated, his fear is not scaling quickly enough.

-

From where we sit, the numbers today more than stack up (Nvidia revenue and earnings). Imo valuation is not stretched and I would challenge anyone to put forward a credible argument against this. We have several more years of rapid build out before a determination is widely accepted, success, great success or, they hit a brick wall. In the mean time we are watching very closely and very much enjoying, not just the financials evolve but the technology.

I also wanted to add. Picking a good investment isn't just about quantitative research. Anyone can do that. The interpretation of those numbers/metrics are very important. Two people will draw different conclusions.

Often overlooked is the qualitative factors. Management quality, credibility, track record.

The common denominator-experience. I've been doing this for a very long time, I've seen a lot and you really only understand a business if you have followed them for years(through thick and thin) and have the tools to actually understand what the numbers mean. Experience is knowing a stock correction is structural or a market whim (buy the dip or bail) with much higher confidence (no one is right all the time). Staying calm vs panic. And I would argue many of these attributes can not be learned, not in the short term at least.

-

-

breaking news-

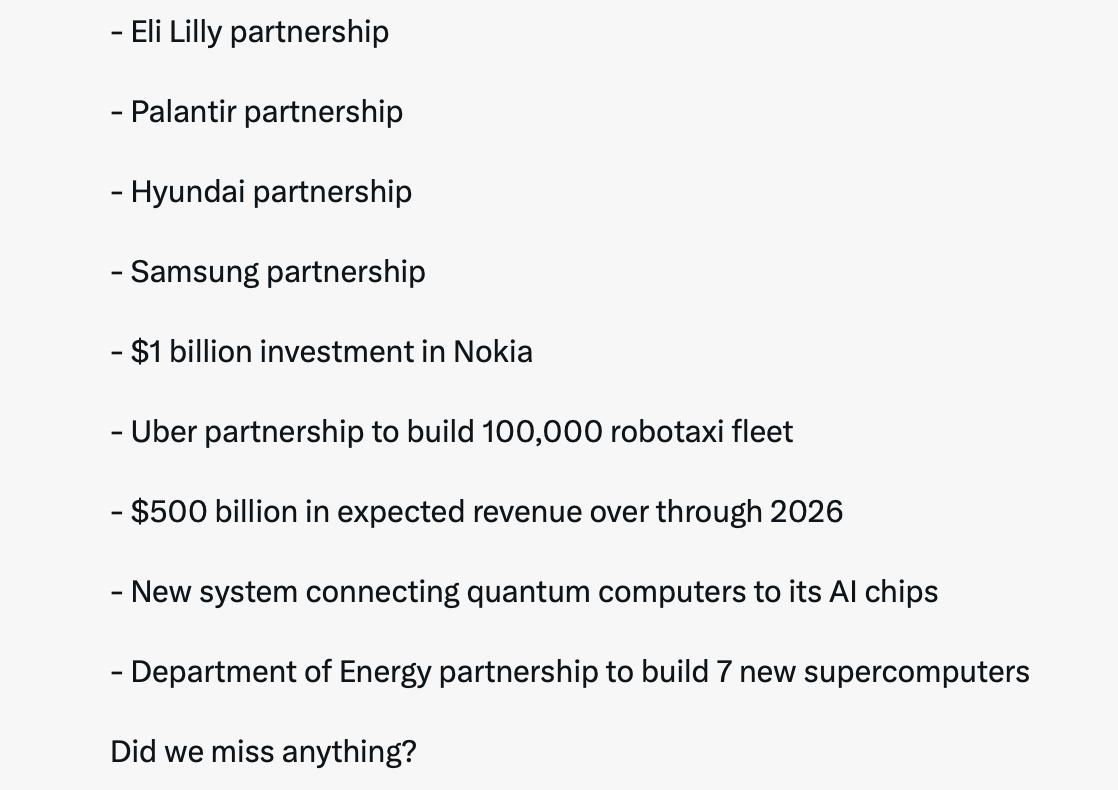

On 15 October 2025, BlackRock's Global Infrastructure Partners (GIP)-led AI Infrastructure Partnership (AIP)—including NVIDIA, Microsoft, xAI, and MGX—announced a $40 billion acquisition of Aligned Data Centers, a U.S. hyperscale operator with 15+ facilities. This landmark deal, one of the largest in AI infrastructure, encompasses debt and targets expansion to $100 billion via equity and financing, focusing on acquiring existing sites and building new renewable-powered data centres (DCs) optimised for AI workloads.

-

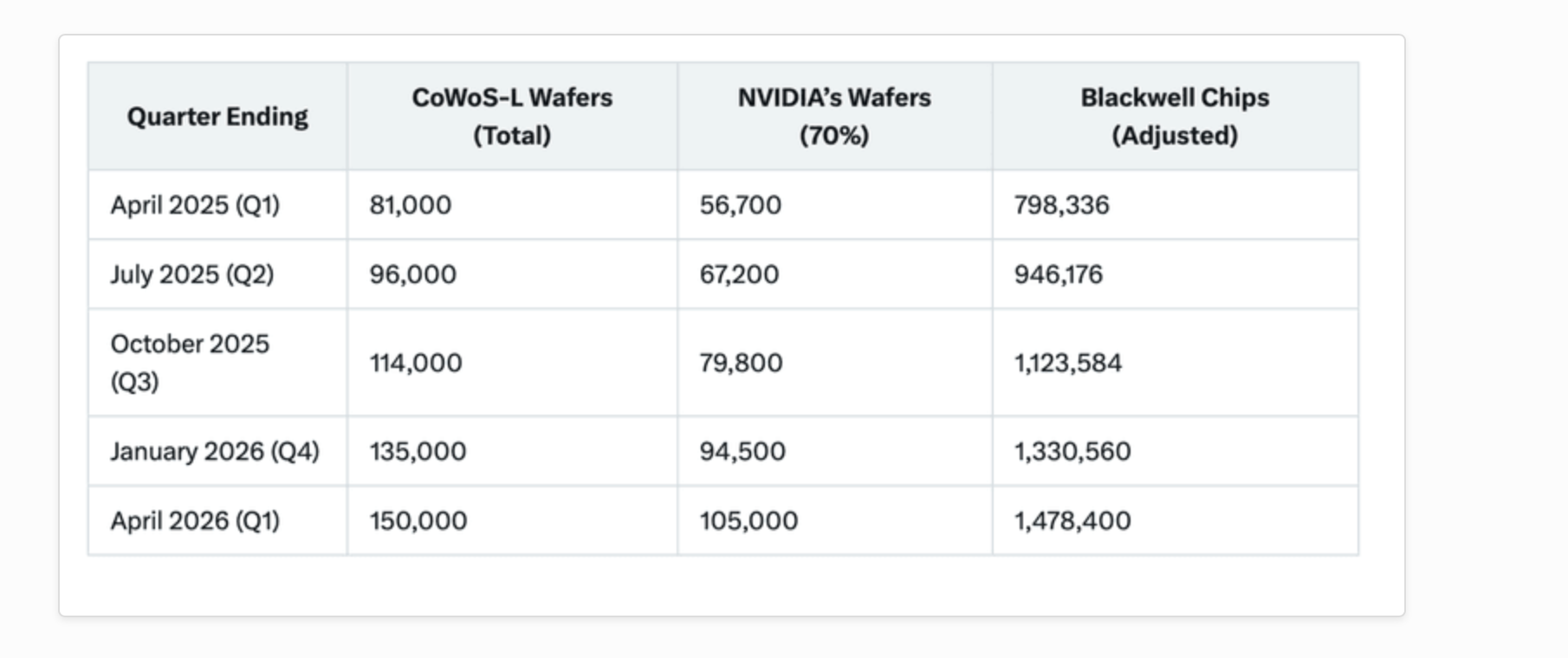

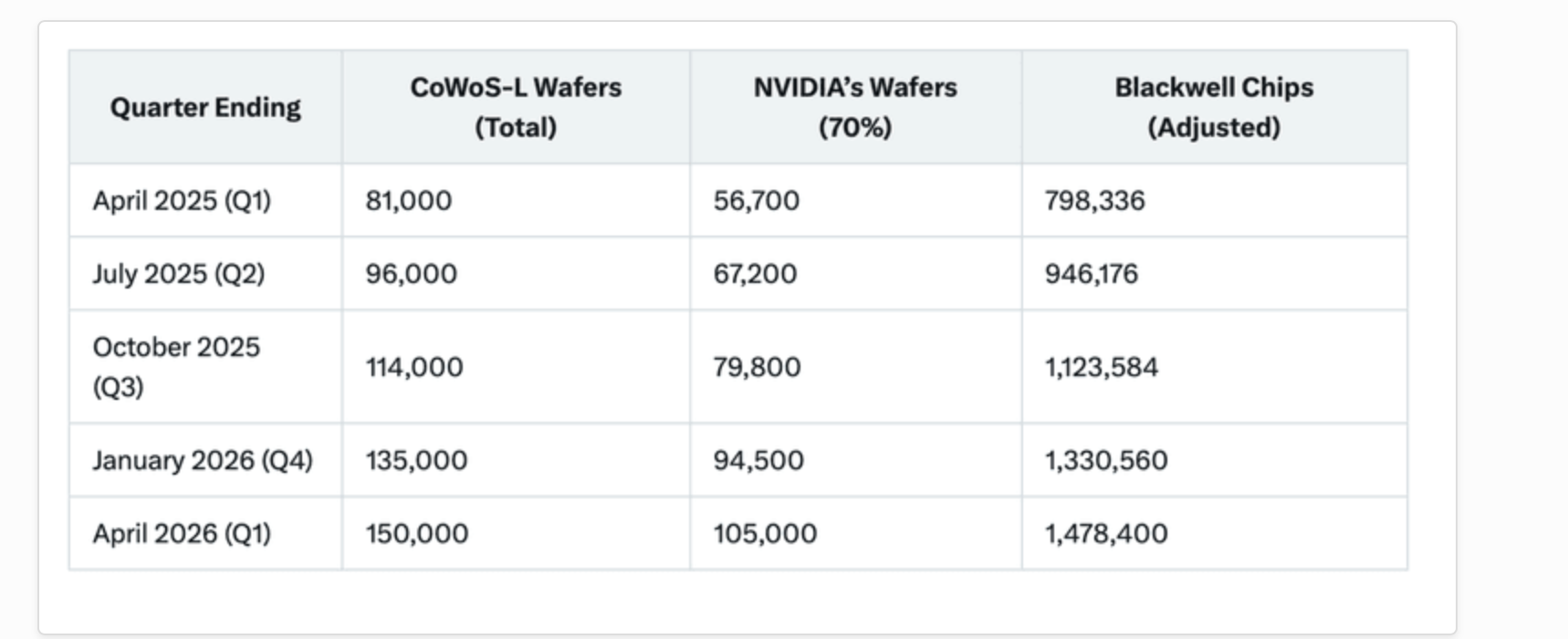

HSBC Research today issued a report on Cowos capacity, stating, they see evidence of Nvidia wafer allocation at 800k units through 2027. This is the first sign of wafer accelerated growth since June 2025. A recap

Here is my May 25 estimate based on TSM public comments-this proved accurate QoQ. The important column being Nvidia wafers, circa 105k by year end. I would think e are ahead of this. Remember, there is a direct correlation between wafers and revenue. And HSBC makes this very point.

If we extrapolated these numbers using the existing expansion cadence we would arrive at circa 570k wafer through 2027. HSNC claims the number is now up to 800K and have modelled GPU(DC) segment revenues of up to $400B. Accordingly they have modelled just under $10 EPS! Accordingly they have issued a new price target of $320.

Exciting times ahead

-

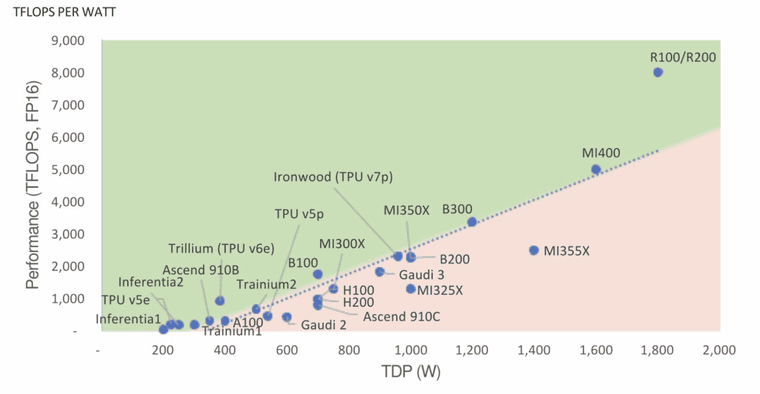

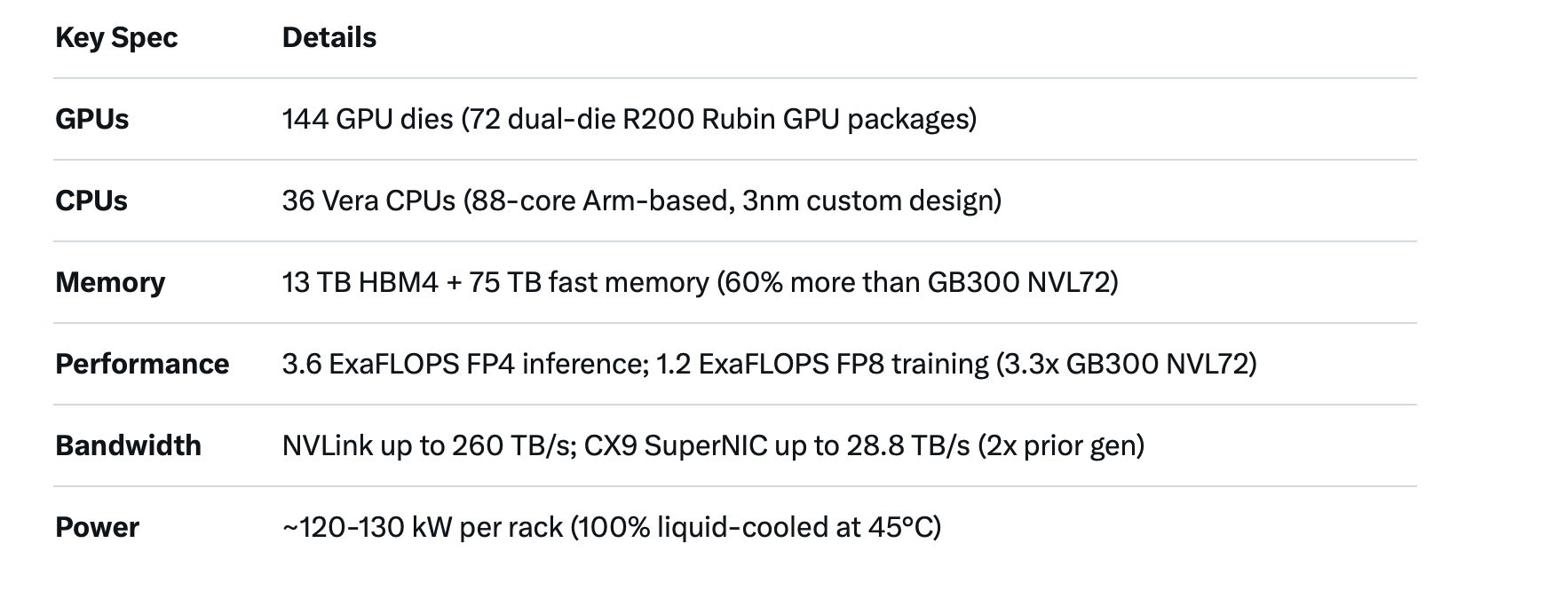

One GPU to rule them all. R100/R200 Rubin

-

News just in. Somethings cooking-quick catch up with Jensen before Trump meets Xi. We have speculated about an easing of export restrictions. It's likely imo.

U.S. President Donald Trump said he will meet Nvidia's CEO Jensen Huang on Wednesday.

Trump is on a visit to Japan and South Korea, where he will meet global leaders and industry chiefs at the Asia-Pacific Economic Cooperation, or APEC, events in Gyeongju, South Korea. Trump and Chinese President Xi Jinping are also expected to meet.

Trump made the remark about meeting Huang in an address to business leaders in Tokyo on Tuesday before traveling to South Korea.

-

If they get the green light it can only move upwards imo.

-

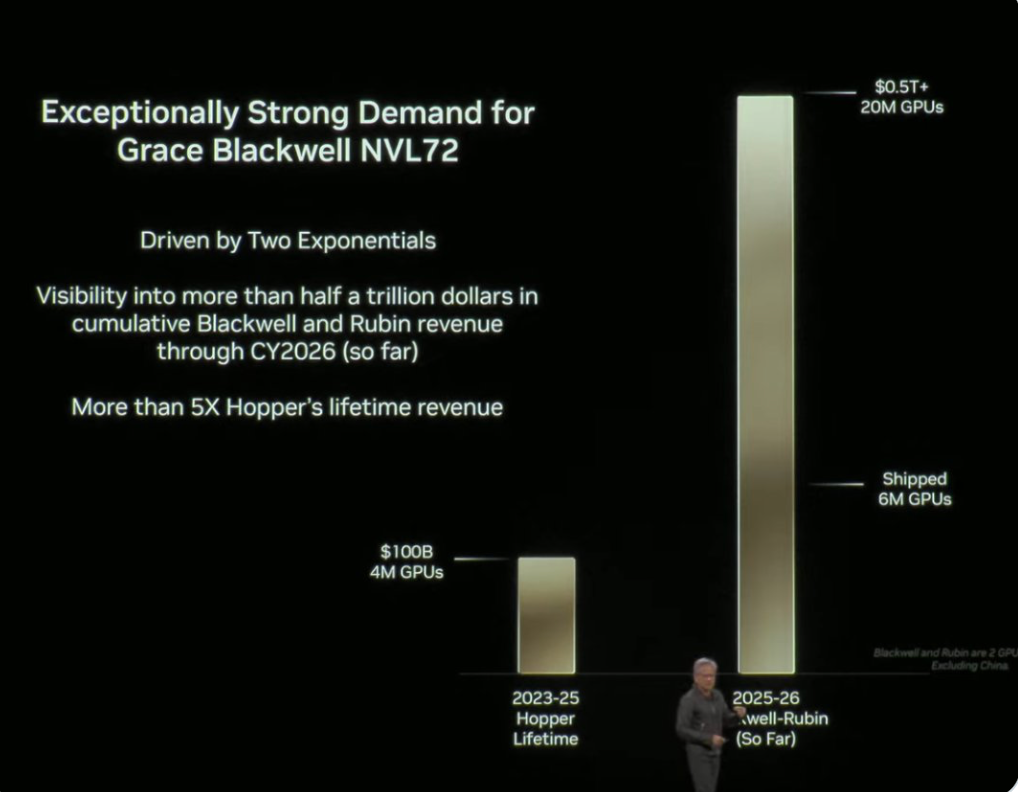

Jensen at a keynote 30 mins ago just said this:

"We now have $500 billion in committed business locked in over the next six quarters—that's take-or-pay contracts from our partners, with every slot in our production pipeline filled through 2027. This isn't speculation; it's the foundation of the AI revolution, powered by Blackwell and Rubin architectures, ensuring the United States leads the world in sovereign AI and energy-efficient computing."

Stock is now at $198, an ATH

-

Worth a watch to see what all the fuss is about...

-

Curiously, looking at todays slide deck:

compare it to the forecast made earlier in the year-and I can conform up to a quarter or so ago, was very accurate:

. 5.7M Blackwell predicted for 1 year starting and regardless if it's fiscal or calendar, Jensen is suggesting 6M 'today'. Interesting. It suggests they shipped 2M this quarter which is +$5B over their guide excluding gaming, visualisation, autonomous systems and omniverse which is approx 5-6B more. They could report $60B this Q. NB: here he is counting the GPU stand alone $. But it's GPU+DPU+CPU+NV Link+Switch+DGX basecommand+cloud access.

. 5.7M Blackwell predicted for 1 year starting and regardless if it's fiscal or calendar, Jensen is suggesting 6M 'today'. Interesting. It suggests they shipped 2M this quarter which is +$5B over their guide excluding gaming, visualisation, autonomous systems and omniverse which is approx 5-6B more. They could report $60B this Q. NB: here he is counting the GPU stand alone $. But it's GPU+DPU+CPU+NV Link+Switch+DGX basecommand+cloud access. -

Trump late last night commented on Nvidia's advanced Blackwell AI chips (specifically the GB200 Grace Blackwell Superchip) during a media scrum on October 28, 2025, ahead of his planned high-stakes meeting with Chinese President Xi Jinping on October 30, 2025. When asked about potential agenda items for the talks, which also include issues like fentanyl imports and U.S. agriculture, Trump highlighted the chips as a point of discussion, praising U.S. technological superiority.Key Quotes from Trump:"We'll be speaking about Blackwell, it's the super duper chip."

"That's our country. We're about 10 years ahead of anybody else in chips—in the highly sophisticated chips. I think we may be talking about that with President Xi."

A real sample was shown for the first time.

180KW and $8M give or take.

Just the HBM4 memory is > $2M. Go Micron! -

I like this:

-

No concerns-and on Tuesday week I expect a beat and raise. Earnings above $30B imo

NVIDIA CEO Jensen Huang made his fourth trip to Taiwan this year, flying in privately on Friday afternoon. His itinerary:First stop: Tainan, to tour TSMC's Fab 18 (the world's most advanced 3nm production facility).

Saturday: Attended TSMC's annual company-wide Sports Day in Hsinchu, where he spoke on stage alongside TSMC CEO C.C. Wei and founder Morris Chang.When reporters asked TSMC's C.C. Wei about the meeting, he laughed and said:

"He asked for wafers, of course."Jensen confirmed it openly: “Yes, yes. Because the business is very strong, and it’s growing month by month, stronger and stronger. And so, TSMC is doing an excellent job and I came to encourage them and thank them for their hard work.”

He also praised TSMC effusively: “Thank you for helping me build NVIDIA… You are really the pride of Taiwan, you are also the pride of the world.”

TSMC's capacity is still razor-tight into 2026, but they're expanding 3nm from ~100k to 160k wafers/month in southern Taiwan—and a big chunk of that extra output is reportedly earmarked for NVIDIA's next-gen Rubin AI chips.In short: Jensen flew halfway around the world literally to beg for MORE—and TSMC basically said "we're on it." AI demand is still absolutely insane.

-

Jensen was in Taiwan late last week visiting TSM and dined at Lui Family Hot Pot restaurant with C.C Wei.

What he actually said (direct quotes from the Taiwan trip):At TSMC Fab 18 (Friday afternoon, Nov 7):

“We’re now seeing Rubin on the production line.”

(He said this while walking the floor with reporters – meaning real Rubin R100 wafers are already moving through the fab right now.)

At the TSMC executive dinner (Friday night):

“Rubin has already begun entering production… We’re now seeing Rubin on the production line.”

(Multiple analysts who were in the room posted this verbatim.)Why this is a massive green flag for the ramp:“On the production line” = volume production, not just risk/trial wafers

This is ~3 months ahead of even the most bullish leaks from August

TSMC instantly responded by bumping Fab 18B 3nm capacity from 100k → 160k wpm specifically for Rubin . The media have said this benefits Blackwell but they are wrong. Blackwell uses the 4NP node. Rubin uses the 3nm node.

Jensen spent his entire 24-hour trip begging for even more CoWoS-L capacity for 2026 – that only happens when yields are clean and demand is off the chartsBottom line: the Rubin ramp isn’t just “going well” – it’s printing ahead of schedule and already forcing TSMC to add 60% more 3nm wafers per month.

Clear evidence things at Nvidia are yet again, exceeding all expectations.

-

Interesting comments from Jensen at the UBS conference:

Roll on Tuesday

Custom ASICs are often "science projects": Many get built but fail the real-world revenue test. Smart CEOs do the maths – AI factories impact revenues, not just costs.

NVIDIA is the only proven, revenue-generating alternative: Competitors are still desperately trying to catch up to Hopper; no one has a credible rival yet, while NVIDIA's roadmap is already pushing the limits of physics.

It's not about a chip – it's the full AI factory platform: NVIDIA delivers the entire impossibly complex stack (chips, systems, networking, switches, software, scale-up/scale-out architecture) that the entire industry has standardised on.......(you hear AMD bleat on about their chip. One chip is irrelevant. 100k chips sewn together matters and AMD can't do it!) nor have they even produced it yet and 2nm is no joke so expect issues. So what JH is saying is, who is going to bet $100B on a speculative solution-no one is the answer. Current forecasts show AMD producing 400k chips in 2027 against Nvidia 16M. Oops

Unmatched focus and resources: 35,000 people dedicated to one thing; decades of experience; pushing every dimension (compute, networking, systems, software) to the absolute limit.

Hundreds-of-billions betting decision: If you need a giant AI data centre operational in two years, you must place the purchase order today. There is literally only one architecture you can confidently bet $100B+ on right now – NVIDIA's.

No one else has the depth or derisking capability: NVIDIA is the only company placing its own $100B+ POs and building the end-to-end supply chain (from upstream semiconductors to power companies, cooling, infrastructure partners like BlackRock, Vertiv, Schneider).

The risk is existential: With capex now measured in hundreds of billions to trillions, certainty of performance, execution, and future roadmap is everything. Custom ASICs cannot provide that certainty at scale.

Bottom line: NVIDIA is not just selling silicon – it is the de facto platform and the only realistic foundation on which the world's AI infrastructure will be built. Everyone in the industry already knows this and has effectively surrendered to it.