Busy couple of weeks on results front

-

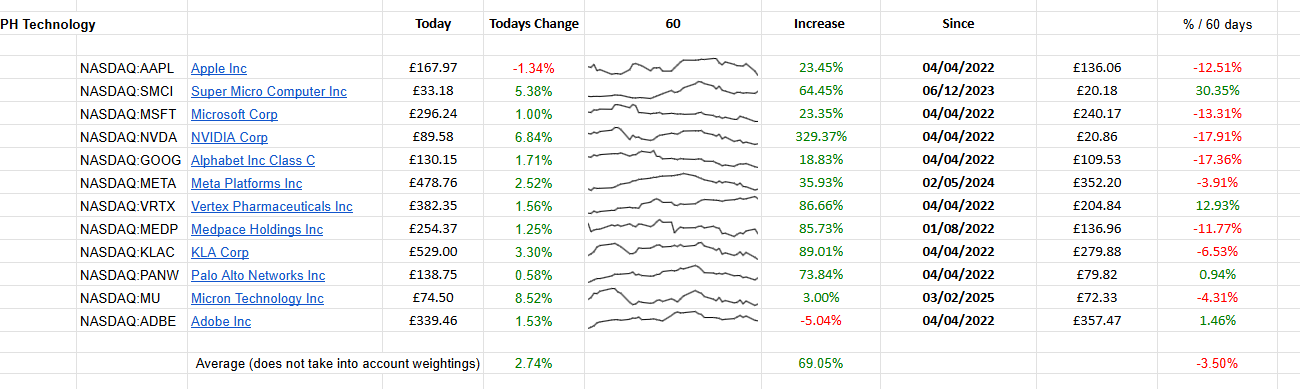

If it's any consolation cappo, we have faired better than the index(benchmarks) and that 10% was rather swiftly gained. As I have mentioned previously, this isn't a structural decline. It's speculative . It will pass. The correction in July 2024 was just as bad. The question you want to ask yourself is, will the businesses we invest in really make less money? By and large I would say, little to no impact operationally. We don't actually know what the policy is because it changes every 5 minutes. It's a Tempest/Squall.

The chances of chip tariffs on Taiwan have abated significantly (due to the massive US investment undertakings). As always I would suggest 'keep calm' and carry on.

-

And also don't forget that 1/3rd of the drop+, 4.5% is actually the USD which has weakened (pushing 1.30)-due to the UK being a a bit of a mess and having sticky inflation, resulting in higher rates which draws in ££ seeking a higher yield.

-

We believe we are in the very early stages of a technology/growth revolution. And we only have to be half right. There is no point looking too far out beyond ones nose (10 years) because it just becomes guess work. However the investment in this space is not going to slow down-so says every tech leader and the manufacturers, TSMC, AVGO, MU, META et al. When management at Nvidia say(last week) that they believe for them alone, the health and drug segment(one segment) looks like $100B in revenue for them-they have strong belief based on adoption and progress in this space. The beauty is, we don't have to agree entirely to justify investing in them because today they are the fastest growing company on the planet and have a PE the same as Coke KO. If that doesn't put 'valuation' into perspective,im not sure anything will.

-

It's looking fruity today in pre market today. With the two AI kings leading the way

-

Thanks Adam, always good to get some reassurance! I should look back at mine over 12 months or something and see what the overall chart looks like.

Might survive a few more weeks without resorting to value pasta and cheap ketchup

@Cappo said in Busy couple of weeks on results front:

Thanks Adam, always good to get some reassurance! I should look back at mine over 12 months or something and see what the overall chart looks like.

Might survive a few more weeks without resorting to value pasta and cheap ketchup

Hey - what’s wrong with value pasta & cheap ketchup?

#loveabargain! -

That is correct Ron. Markets always oscillate -The focus in your graphic is the 'Increase'. DT doesn't determine the prospects of these holdings in the long term.

-

Dear Stock Market,

Another few days like yesterday please.

Yours,

Steve

-

Hi Steve-it was a solid day yesterday. +3.56%/2.46%/0.98% (Tech/IML/Equity). GTC is on deck next week. And as has been mentioned before, this is not a structural move, it's based on fear(unknown). The holdings are sound and coupled with the new additions, will in particular, make the growth portfolio's just how I would want them.

-

TSMC foundries require huge parcels of land. They had planned on buying a golf course, in fact they have bought it. One snag. the members are refusing to leave. Even offers of paying each golf club member USD 24,000 to walk away couldn't persuade them and there appears to be an impasse (code for 'we want 50k each!) . Officials now say, our takeover of the property will be postponed.

That was for Renmure who requested some more humour.

-

Meow!!

-

Check out the latest humanoid robot from Boston Dynamics. It’s impressive. I doubt it will long before the military get involved.

Trained on Isaac Sim-Nvidia robot gym

Robot hardware-nvidia Jetson -

The future of warefare

Reminds me of this dramatic “demo”, now 7 years old

https://youtu.be/TlO2gcs1YvMSee https://autonomousweapons.org for more…

-

The Wall Street Journal is claiming that the Trump administration won't impose tariffs on Taiwan Semiconductors-given the scale of committed US investment. It doesn't mean they're correct-even they like a bit of fake news however I've always thought it would be resolved based on the evidence, being massive new investment and more recently Jensen Huang also stated that he didn't think the impact would be anything more than minor (whatever the outcome is). He would know more than most.

-

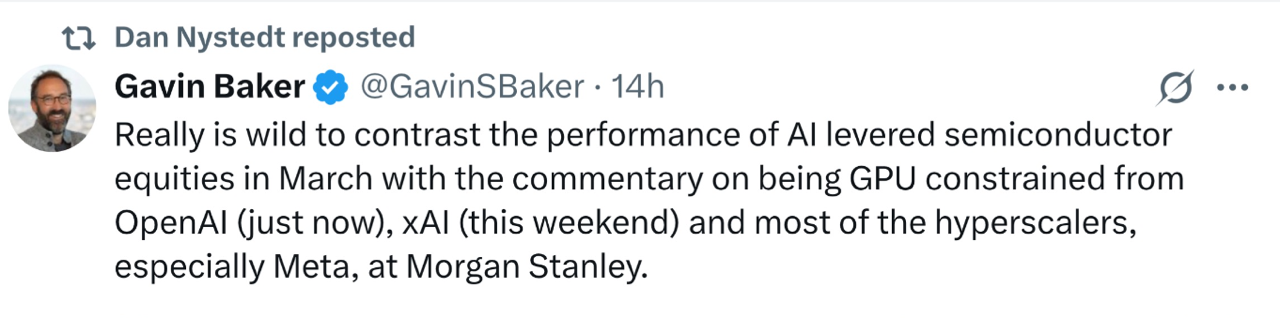

The disconnect between markets and reality-and why one should have confidence in business being positive.