PHE and PHT

-

@Adam-Kay said in PHE and PHT:

Hi LP,

Guys,

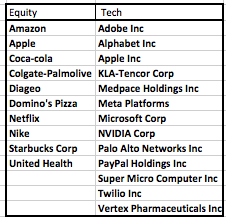

Presuming this is OK with Adam/Nik/Cobens, would it be OK to have a thread where the up-to-date holdings of PHE and PHT are listed?

I've found this list from Adam but it's nigh on a year old and I know that things have changed since then.

A nice chap called Peter (peter.*******@gmail.com) did a clever Google Doc showing the listings in each portfolio with a simple performance tracker, but that is now out-of-date (it doesn't show Oracle, which I understand is a new part of PHT).

Thanks.

-

Hi O,

Out:

PYPL/PANW/TWLOIN:

MU/ORCL/AVGO -

The Equity portfolio, save for weight changes, remains unchanged, for now

-

@Adam-Kay said in Oracle (ORCL):

Medpace

I did mention it here and an email will go out, probably next week

According to the above (which is from the Oracle thread) I thought Medpace was to be sold

-

I have the following for PHT

NASDAQ:AAPL Apple Inc

NASDAQ:SMCI Super Micro Computer Inc

NASDAQ:MSFT Microsoft Corp

NASDAQ:NVDA NVIDIA Corp

NASDAQ:GOOG Alphabet Inc Class C

NASDAQ:META Meta Platforms Inc

NASDAQ:VRTX Vertex Pharmaceuticals Inc

NASDAQ:AVGO Broadcom Inc

NASDAQ:KLAC KLA Corp

NYSE:ORCL Oracle Corp

NASDAQ:MU Micron Technology Inc

NASDAQ:ADBE Adobe Inc -

Yep-medp too. Ron’s list is correct

-

19.18% YTD net of all fees as at 24/7

-

Equity is -12.5%

We have 19 Portfolios. 18 are positive YTD.

-

Out of interest, what portfolios have people spread there money across.

I'm in3x portfolios

Global growth

Defensive

Ph technology,

Slightly biased to tech and I'm happy with this spread would be interesting to know what others are doing. -

I don't mind disclosing the following with the caveat, everyone's situation is different by virtue of their:

age

appetite for volatility

time to retirement

total liquid assets

lifestyle and cash requirementsFor example, we do have clients of advanced years(80+) with 100% of their assets with us in Tech. I happen to know that number represents less than 10% of their liquid funds.

Conversely we have JISA accounts where their trustee has chosen MM or bonds.

The point being, investment selection is based on many factors which you must weigh. Investment decisions should not be made based on a poll. If anyone wants to discuss their investment choices myself or Nik are happy to discuss. Our guidance service is FOC.

Total assets under management % split and 3 year rank(1-5) performance:

Lifestyle 40% (2)

Tech 18%(1)

IMOP 12%(4)

PHE 8.5%(5)

Index 8%(3)

Other