PHE and PHT

-

I reckon that you're a tad optimistic

Almost everything else took a kick in the balls.

Its a marathon not a sprint, I'm still about 1% off the yearly high thus far, been a fight to get back up there the past couple of months.

Post election rally into Christmas, hopefully

-

PHT was modestly up. I would estimate +35bps. The wider market fell approx 100bps. Gainers were limited to AI related stocks due to SMCI stating that they had what is a record quarter due to DLC server shipments. Their quarterly result will be interesting. Last quarter they delivered 1,350 DLC and it sounds like they have delivered 2,000 this quarter which would equate to 128,000 GPU although some will be air cooled. I won't second guess actual revenue but it looks promising. In Q4 they reported $5.31B and their guide was wide; $6B-$7B. Based on the above it looks, and there is some fill in the gaps work here, an additional 650 DLC servers which are circa 2.5M each , or $1.6B which would put them at the very high end of their guide of $7B. If EPS also comes in as per the guide, this would be $8.27 and 65M shares which translates to $546M net or 7.8% vs 7.6% the previous quarter. I am hoping to see a gross margin in the early 12s although the above looks very promising.

-

There non gaap share count is 66M. Also pointing out that their revenue just 2 quarters ago(very recent) was $3.8B so as you can see they are growing very rapidly. We very much to see their margin start to improve which is should with the opening of their Malaysia factory and expansion of US operations. They need to file their 10-k within the next 4 weeks ideally.

-

@Adam-Kay said in PHE and PHT:

Hi LP,

Guys,

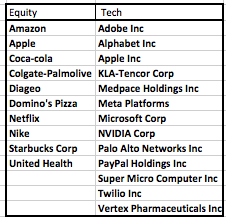

Presuming this is OK with Adam/Nik/Cobens, would it be OK to have a thread where the up-to-date holdings of PHE and PHT are listed?

I've found this list from Adam but it's nigh on a year old and I know that things have changed since then.

A nice chap called Peter (peter.*******@gmail.com) did a clever Google Doc showing the listings in each portfolio with a simple performance tracker, but that is now out-of-date (it doesn't show Oracle, which I understand is a new part of PHT).

Thanks.

-

Hi O,

Out:

PYPL/PANW/TWLOIN:

MU/ORCL/AVGO -

The Equity portfolio, save for weight changes, remains unchanged, for now

-

@Adam-Kay said in Oracle (ORCL):

Medpace

I did mention it here and an email will go out, probably next week

According to the above (which is from the Oracle thread) I thought Medpace was to be sold

-

I have the following for PHT

NASDAQ:AAPL Apple Inc

NASDAQ:SMCI Super Micro Computer Inc

NASDAQ:MSFT Microsoft Corp

NASDAQ:NVDA NVIDIA Corp

NASDAQ:GOOG Alphabet Inc Class C

NASDAQ:META Meta Platforms Inc

NASDAQ:VRTX Vertex Pharmaceuticals Inc

NASDAQ:AVGO Broadcom Inc

NASDAQ:KLAC KLA Corp

NYSE:ORCL Oracle Corp

NASDAQ:MU Micron Technology Inc

NASDAQ:ADBE Adobe Inc -

Yep-medp too. Ron’s list is correct

-

19.18% YTD net of all fees as at 24/7

-

Equity is -12.5%

We have 19 Portfolios. 18 are positive YTD.