Busy couple of weeks on results front

-

Adobe reported earnings last week. They beat. I didn't say anything about it because our position is now immaterial. The IC took the decision in February to take most of the weight out of our Adobe holdings, simply because their valuation vs their growth was getting stretched-growth is low and we saw better opportunities elsewhere. The last big sale was at $453 and that proved to be the correct decision as the stock is now $390. Not only that but we used the proceeds to buy new positions in ORCL amongst others(AVGO/MU), which are all up substantially.

-

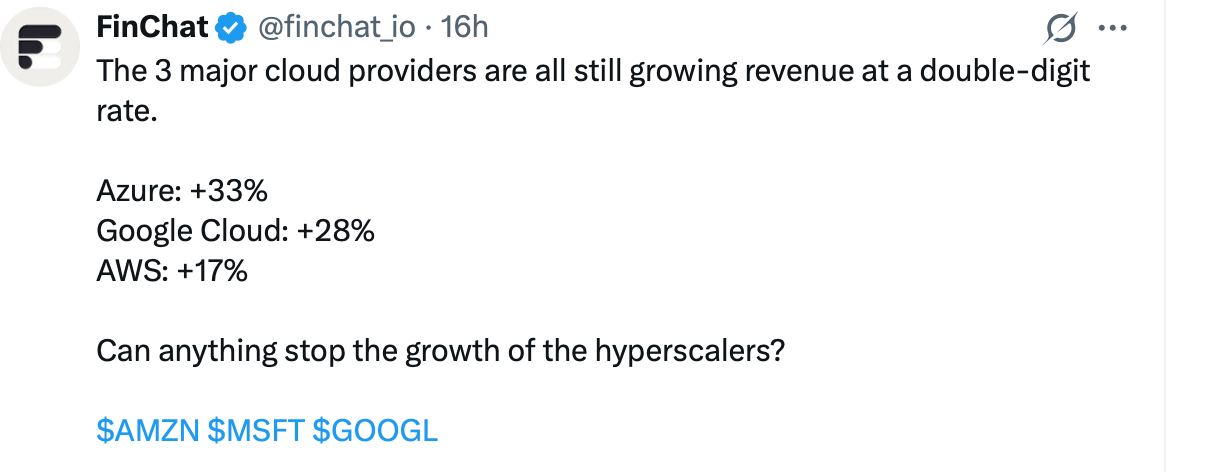

This metric is captured monthly and is on a YoY basis. One would think this business, being mature, would flatten out-but no.

-

Some stability for now!

-

GBP/USD-USD strengthens 75 bps today as Trump weighs joining Israel in escalation. Why. The USD is a safe haven.

-

Iran and Israel agreed to a ceasefire. Futures +380

-

Some June 'month' performance figures. All net of fees

Tech +11.4%

Lifestyle +6.45%

100 index. +2.89%

Optimum GG & I +1.86%

Equity +1.65%Comps:

Nest Sharia +1.79%

Fundsmith +0.57% -

Proof the US economy is doing well!

June nonfarm payrolls: +147K vs. +110K consensus and +144K in May (revised from +139K), according to data released by the U.S. Bureau of Labour Statistics on Thursday.

The unemployment rate moved down, below consensus. -

Markets closed early today for the 4th of July weekend.

Cobens Technology at an all time high. Regained its Feb 2025 high and we've battled an 8.6% fx headwind. Very happy where we are.

-

That’s great news….can you just sort out the dollar / pound exchange rates please ….

-

It's def a team effort and thank you all for your kind words

-

Will be good if this trend can continue.

-

All I can tell you Jason is when you have Cobens Tech up 14.7% YTD net of all fees which is Nr1 in 2025, was Nr 1 in 2024 and Nr 1 in 2023 against most 'funds being still under water or barely broken even, you will see consolidation and volatility given the recovery has been very rapid over a short time scale. Lifestyle is similarly performing very well.

However, I can also tell you with confidence that the businesses we hold will continue to grow and growth means stock price appreciation over time. Short term we are exposed to the musings of a volatile President. Some days he helps us, others he doesn't, but over time the business fundamentals will be what drives the performance, not tax policy or public feuds.

-

That's the idea SZ. The aim is to inform and answer questions. There are a lot of misconceptions with investing and the stock market. Usually peddled through ignorance.

-

TSM reported record numbers-chairman CC. Wei.

Wei emphasised TSMC’s leadership in advanced packaging like CoWoS, with plans to more than double capacity by end-2025 to meet AI demand, particularly from key clients like NVIDIA.He described demand for TSMC’s technologies as “extremely robust” and expressed optimism about long-term growth, stating that AI and high-performance computing would drive “healthy growth” for years. No significant concerns or disruptions were highlighted; it was largely business as usual with a strong focus on capitalising on AI and semiconductor market tailwinds. Wei reinforced TSMC’s strategic investments and market dominance.

All Good!