Busy couple of weeks on results front

-

It's def a team effort and thank you all for your kind words

-

Will be good if this trend can continue.

-

All I can tell you Jason is when you have Cobens Tech up 14.7% YTD net of all fees which is Nr1 in 2025, was Nr 1 in 2024 and Nr 1 in 2023 against most 'funds being still under water or barely broken even, you will see consolidation and volatility given the recovery has been very rapid over a short time scale. Lifestyle is similarly performing very well.

However, I can also tell you with confidence that the businesses we hold will continue to grow and growth means stock price appreciation over time. Short term we are exposed to the musings of a volatile President. Some days he helps us, others he doesn't, but over time the business fundamentals will be what drives the performance, not tax policy or public feuds.

-

That's the idea SZ. The aim is to inform and answer questions. There are a lot of misconceptions with investing and the stock market. Usually peddled through ignorance.

-

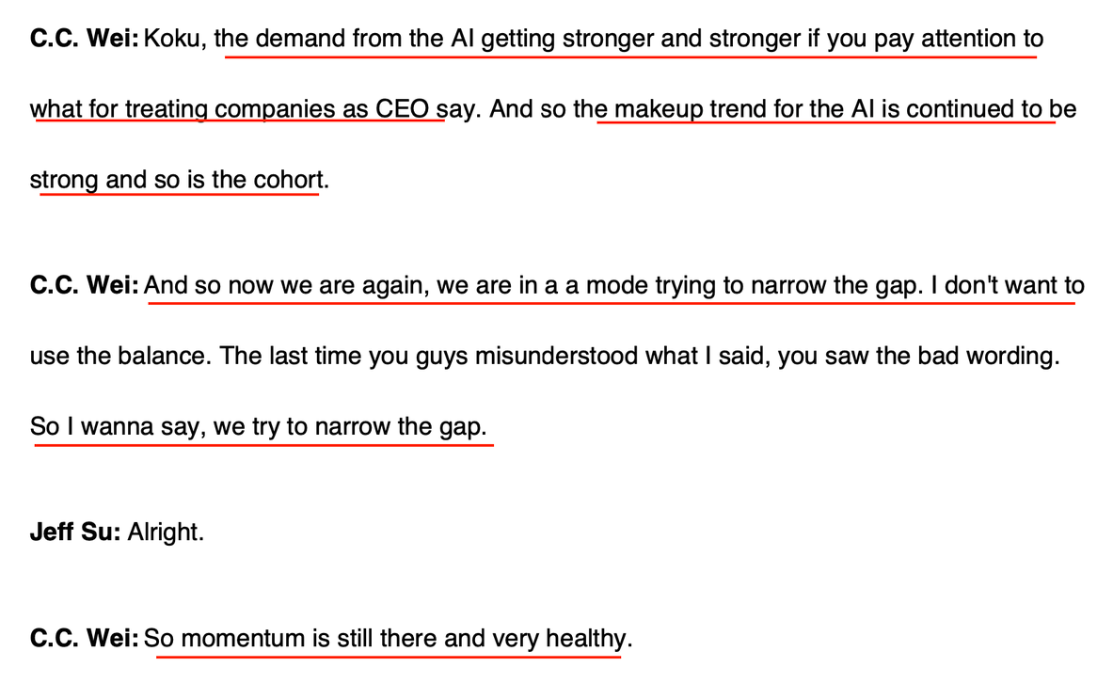

TSM reported record numbers-chairman CC. Wei.

Wei emphasised TSMC’s leadership in advanced packaging like CoWoS, with plans to more than double capacity by end-2025 to meet AI demand, particularly from key clients like NVIDIA.He described demand for TSMC’s technologies as “extremely robust” and expressed optimism about long-term growth, stating that AI and high-performance computing would drive “healthy growth” for years. No significant concerns or disruptions were highlighted; it was largely business as usual with a strong focus on capitalising on AI and semiconductor market tailwinds. Wei reinforced TSMC’s strategic investments and market dominance.

All Good!

-

Well I'm happy the way tech is going, I've just put a little more in to it. Onwards and upwards.

Well done team. -

a couple of typo is this transcript, taken from TSM earnings call. He means 'if you listen to what company CEOs are saying. Jensen Huang said the same exact thing 2 months before dropping the big Sovereign AI news 'AI factories'. If you pay attention and listen 'but you are not listening' Huang said.

Only last week some analysts said TSM were slowing down and I remember thinking 'I'll wait to hear from CC Wei' The most honest and straight executive out there. Actually they are going faster 'to catch up to demand'

-

It seems to me most of these analysts and so called experts are away with fairies

-

Not really-they write what pays

-

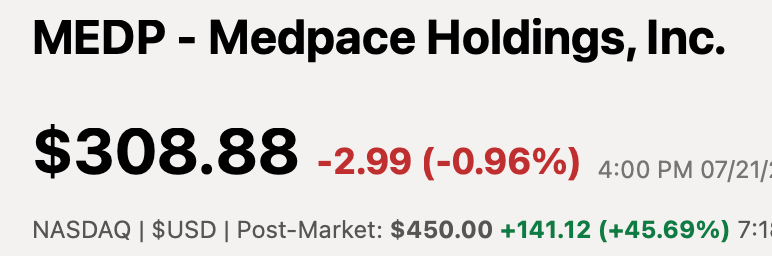

Revisiting a holding we sold in February.

Medpace just reported-a decent but unremarkable report. Why the massive pop-Silly Shorts took a big position and got caught. 13% of the float short and no willing sellers = price explosion!

This is why you don't play games you don't understand

We sold for $330(paid $165) BUT the money was put into ORCL and we are up 60% on that to date

-

Revisiting a holding we sold in February.

Medpace just reported-a decent but unremarkable report. Why the massive pop-Silly Shorts took a big position and got caught. 13% of the float short and no willing sellers = price explosion!

This is why you don't play games you don't understand

We sold for $330(paid $165) BUT the money was put into ORCL and we are up 60% on that to date

@Adam-Kay said in Busy couple of weeks on results front:

13% of the float short and no willing sellers = price explosion!

what does this mean in simple terms?

-

Issued shares will be greater than the float 'available to sell' because insiders and institutions just don't sell. Relatively few shares to buy and shorts must buy to close their position. Supply and demand. If 100 buyers for every share you will pay a hefty price-

With MedP Short Sellers picked the wrong stock and are paying dearly, now. Medpace daily volume is always very low. The CEO owns 20%-he aint selling