Busy couple of weeks on results front

-

Just in. Futures turn 3 digits positive from negative.

-

US Inflation Cools in May, Strengthening Case for Rate Cuts

US CPI inflation for May rose 0.1% month-over-month, yielding a 2.4% annual rate, below the expected 0.2% monthly and 2.4% yearly forecasts. Core CPI, excluding food and energy, increased 0.2% monthly, steady at 2.8% annually. A 1.0% drop in energy prices, led by gasoline, offset a 0.3% rise in shelter costs(rents).

With inflation nearing the Fed’s 2% target, markets see a stronger case for rate cuts, possibly starting September 2025, with a 25–50 basis point reduction by year-end. Despite tariff concerns, this data supports easing monetary policy to bolster growth.

-

Last night Israel targeted Iranian nuclear facilities, its military and scientist personnel . Futures are down a lot and oil is up. Given the nuclear watchdogs scathing report on Iran being close to having weapons grade uranium and the breaches of their agreement, it is not surprising. As in the past, don't worry too much about it and it should all calm down pretty quickly

-

Adobe reported earnings last week. They beat. I didn't say anything about it because our position is now immaterial. The IC took the decision in February to take most of the weight out of our Adobe holdings, simply because their valuation vs their growth was getting stretched-growth is low and we saw better opportunities elsewhere. The last big sale was at $453 and that proved to be the correct decision as the stock is now $390. Not only that but we used the proceeds to buy new positions in ORCL amongst others(AVGO/MU), which are all up substantially.

-

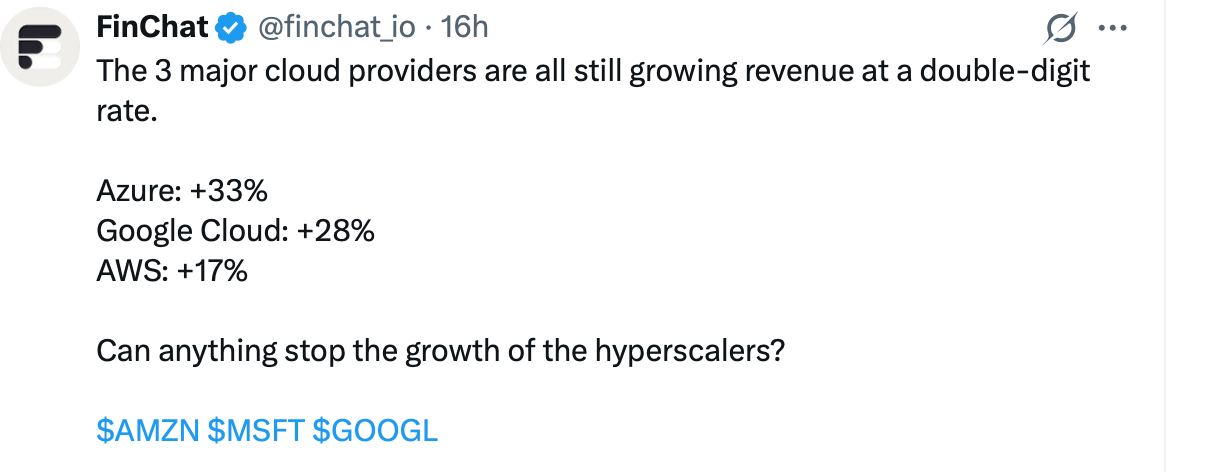

This metric is captured monthly and is on a YoY basis. One would think this business, being mature, would flatten out-but no.

-

Some stability for now!

-

GBP/USD-USD strengthens 75 bps today as Trump weighs joining Israel in escalation. Why. The USD is a safe haven.

-

Iran and Israel agreed to a ceasefire. Futures +380

-

Some June 'month' performance figures. All net of fees

Tech +11.4%

Lifestyle +6.45%

100 index. +2.89%

Optimum GG & I +1.86%

Equity +1.65%Comps:

Nest Sharia +1.79%

Fundsmith +0.57% -

Proof the US economy is doing well!

June nonfarm payrolls: +147K vs. +110K consensus and +144K in May (revised from +139K), according to data released by the U.S. Bureau of Labour Statistics on Thursday.

The unemployment rate moved down, below consensus. -

Markets closed early today for the 4th of July weekend.

Cobens Technology at an all time high. Regained its Feb 2025 high and we've battled an 8.6% fx headwind. Very happy where we are.

-

That’s great news….can you just sort out the dollar / pound exchange rates please ….

-

It's def a team effort and thank you all for your kind words

-

Will be good if this trend can continue.

-

All I can tell you Jason is when you have Cobens Tech up 14.7% YTD net of all fees which is Nr1 in 2025, was Nr 1 in 2024 and Nr 1 in 2023 against most 'funds being still under water or barely broken even, you will see consolidation and volatility given the recovery has been very rapid over a short time scale. Lifestyle is similarly performing very well.

However, I can also tell you with confidence that the businesses we hold will continue to grow and growth means stock price appreciation over time. Short term we are exposed to the musings of a volatile President. Some days he helps us, others he doesn't, but over time the business fundamentals will be what drives the performance, not tax policy or public feuds.