Busy couple of weeks on results front

-

Certainly been a nicer experience looking at the dashboard over these last couple of days...

-

Agreed Steve, the headless chicken action is not pleasant for anyone.

-

Colossus-2 (Xai):

Colossus 2, targets 1 million NVIDIA GPUs ( Blackwell B200/B300) by December 2025, with potential expansion to 2 million by December 2026. Requiring 1,641 MW for 1 million GPUs and 3,281 MW for 2 million, it will use SMCI’s liquid-cooled servers and NVIDIA’s high-performance networking. Located in Memphis, it leverages TVA’s 1.2 GW power commitment and Tesla MegaPacks. This cluster is xAI’s primary vehicle for massive GPU scale-out, designed to train advanced AI models.Demand aint slowing down! Min this is another $50 billion

This is approx 15,625 racks if 64 config and 13,888 if 72.

Mega packs onsite- $150 Million in batteries.

Why batteries are used.

Power Smoothing: Batteries, often part of an Uninterruptible Power Supply (UPS) system, help stabilise power delivery. Data centres, especially those running AI workloads, have massive and fluctuating power demands due to high-performance computing (e.g., GPUs for AI training). Batteries smooth out spikes and dips in power draw, ensuring consistent voltage and preventing damage to sensitive equipment. -

TSMC Chairman C.C. Wei statements at annual shareholder meeting Tuesday 3 June, via media reports.

“Overall AI demand is still very strong”, TSMC still cannot meet chip demand, and related business opportunities continues to increase.

All AI orders are with TSMC, including Nvidia and ASICs.

Humanoid robot-related chips are already making a significant contribution to TSMC’s revenue

TSMC has no plans to build chip fabs in the Middle East

It takes time to build a chip cluster (chip manufacturing location complete with supply chain), and currently such clusters only exist in the US, Taiwan, Japan, Europe and China.

TSMC’s business remains robust and we continue to expand to meet customer demand.

TSMC still sees revenue and earnings reaching new record highs this year despite tariffs, currency volatility.

TSMC technology “cannot be stolen” due to robust safeguards and the complexity of its capabilities.

It is the result of 10,000 R&D engineers and thousands more production engineers who optimise and refine the chip production technology.

“If our technology could be stolen that easily, TSMC wouldn’t be where it is today,” he said, adding “it’s beyond the capacity of an individual, 10 people, or even a hundred, to steal.

Tariffs won’t affect TSMC because importers usually bear the cost, not exporters like TSMC.

But if tariffs can lead to higher prices, or could cause global economic growth to slow, which could affect TSMC

TSMC has talked with the US about the impact of tariffs on importing chip-making equipment to TSMC Arizona, and there appears to be some flexibility.

-

CoreWeave’s #1 ranking in MLPerf Training v5.0, announced June 4, 2025, confirms their dominance in cloud AI infrastructure.

They achieved this by using SMCI-manufactured NVIDIA HGX B200 8-GPU systems, showcasing both compute density and performance scalability.This reinforces SMCI’s strategic role in the generative AI supply chain, particularly after their earlier statements about leading in AI infrastructure — including liquid cooling, high-density GPU designs, and rapid deployment capabilities.

The result not only validates CoreWeave's architecture, but also cements SMCI's position as a critical enabler behind top-tier AI benchmarks.

-

President Trump has commented on a personal call with President Xi, framing it a very positive and the two plan to meet soon in China. Markets like it

-

U.S. Labor Market Resilience Shines in May 2025 Nonfarm Payrolls

The U.S. labour market continues to display remarkable resilience, as evidenced by the May 2025 Nonfarm Payrolls report released today. Employers added 139,000 jobs, surpassing the consensus forecast of 130,000 and signaling steady growth despite global economic uncertainties and tariff concerns. While slightly below April’s robust 177,000, the figure underscores a labour market that remains a pillar of strength for the U.S. economy.

The unemployment rate held firm at 4.2%, aligning with expectations and reflecting stability. Average hourly earnings rose by a modest 0.3%, consistent with forecasts, indicating controlled inflationary pressures. The average workweek stayed at 34.3 hours, suggesting businesses are maintaining steady operations without overextending.

This balanced report highlights the labour market’s ability to absorb shocks, from geopolitical tensions to monetary policy shifts. Investors may view this as a "Goldilocks" outcome—growth that’s neither too hot to spur aggressive Federal Reserve tightening nor too cold to signal recession. -

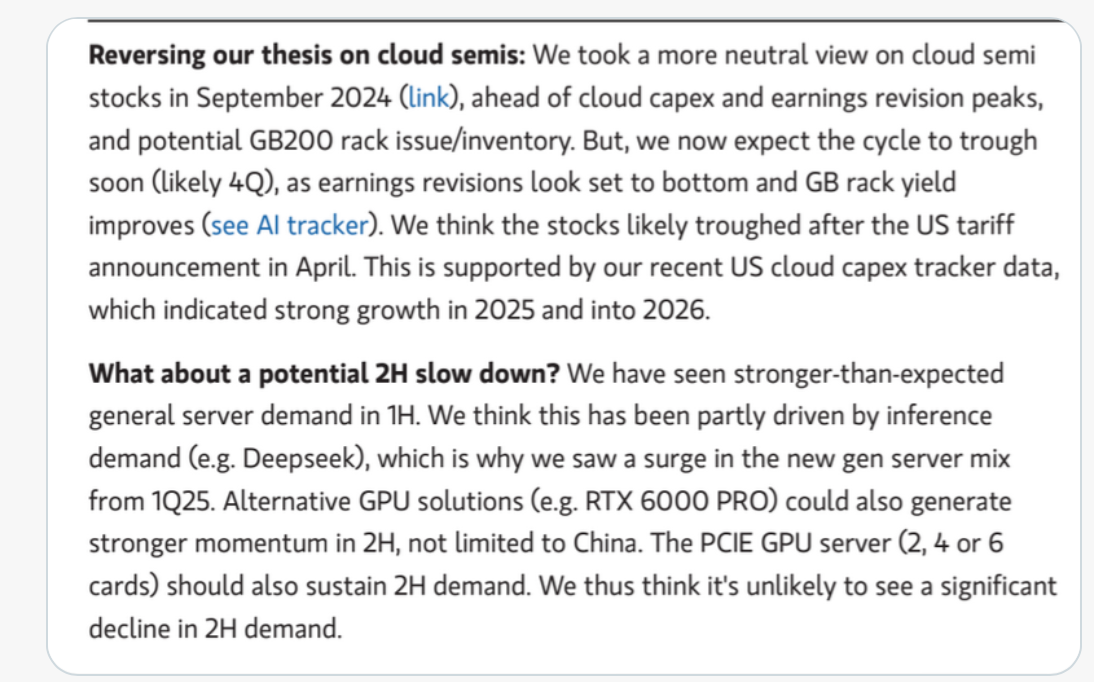

Morgan Stanley admitting they got it wrong in 2024

What they are saying is they think stock prices in the sector will go higher, not that they have a very good track record

'we got it wrong but now we are right'

'we got it wrong but now we are right' -

OpenAI have released figures showing the cost/revenue relationship for 'intelligence'

And OpenAI researcher Noam Brown says "intelligence curve will continue to improve rapidly."

This is the real revolution we are heading for. Intelligence too cheap to meter.

QuoteInput is now $2 per 1M(tokens) and Output is now $8 per 1M. The cost vs intelligence curve will continue to improve rapidly.

What this shows is $4 of revenue is created from $1 in cost. Proof AI is being monetised!

-

Just in. Futures turn 3 digits positive from negative.

-

US Inflation Cools in May, Strengthening Case for Rate Cuts

US CPI inflation for May rose 0.1% month-over-month, yielding a 2.4% annual rate, below the expected 0.2% monthly and 2.4% yearly forecasts. Core CPI, excluding food and energy, increased 0.2% monthly, steady at 2.8% annually. A 1.0% drop in energy prices, led by gasoline, offset a 0.3% rise in shelter costs(rents).

With inflation nearing the Fed’s 2% target, markets see a stronger case for rate cuts, possibly starting September 2025, with a 25–50 basis point reduction by year-end. Despite tariff concerns, this data supports easing monetary policy to bolster growth.

-

Last night Israel targeted Iranian nuclear facilities, its military and scientist personnel . Futures are down a lot and oil is up. Given the nuclear watchdogs scathing report on Iran being close to having weapons grade uranium and the breaches of their agreement, it is not surprising. As in the past, don't worry too much about it and it should all calm down pretty quickly

-

Adobe reported earnings last week. They beat. I didn't say anything about it because our position is now immaterial. The IC took the decision in February to take most of the weight out of our Adobe holdings, simply because their valuation vs their growth was getting stretched-growth is low and we saw better opportunities elsewhere. The last big sale was at $453 and that proved to be the correct decision as the stock is now $390. Not only that but we used the proceeds to buy new positions in ORCL amongst others(AVGO/MU), which are all up substantially.

-

This metric is captured monthly and is on a YoY basis. One would think this business, being mature, would flatten out-but no.

-

Some stability for now!

-

GBP/USD-USD strengthens 75 bps today as Trump weighs joining Israel in escalation. Why. The USD is a safe haven.

-

Iran and Israel agreed to a ceasefire. Futures +380

-

Some June 'month' performance figures. All net of fees

Tech +11.4%

Lifestyle +6.45%

100 index. +2.89%

Optimum GG & I +1.86%

Equity +1.65%Comps:

Nest Sharia +1.79%

Fundsmith +0.57% -

Proof the US economy is doing well!

June nonfarm payrolls: +147K vs. +110K consensus and +144K in May (revised from +139K), according to data released by the U.S. Bureau of Labour Statistics on Thursday.

The unemployment rate moved down, below consensus. -

Markets closed early today for the 4th of July weekend.

Cobens Technology at an all time high. Regained its Feb 2025 high and we've battled an 8.6% fx headwind. Very happy where we are.