Micron Technology

-

Bodes well for Micron

-

What are the thoughts on the upcoming earnings report

-

They will beat and raise. The company has a captive market and the wind at its back. What I see(and saw when we invested) is a secular shift in their key memory segments. Next year we are looking at $20 eps. It's multiple is very low and it should rerate when the shift is confirmed.

-

A lot to be said about this result and its wider positive flow on effect. But for now:

Micron Technology has just delivered an absolutely stellar fiscal Q1 2026 performance, shattering records and fuelling explosive growth driven by insatiable AI demand.

The company posted record-breaking revenue of $13.64 billion, a massive leap from $8.71 billion in the same quarter last year, whilst non-GAAP earnings per share soared to $4.78, trouncing analyst consensus of around $3.95.

But the real showstopper? Micron's jaw-dropping Q2 guidance: revenue guided to approximately $18.7 billion (± $400 million) – that's a staggering nearly 32% above the Wall Street consensus of about $14.2 billion – with adjusted EPS at $8.42 (± $0.20), almost double what analysts were expecting. Think about that. The expected guide was $4.xx and they said 'hold my beer-how about $8 bucks .Gross margins are projected to hit an astonishing 68% which is 30 whole points higher than last year, underscoring phenomenal pricing power in HBM and DRAM amid tight supply.

This is a proper drop-the-mic moment for Micron: HBM supply sold out for all of 2026 (including cutting-edge HBM4), data centre revenue at all-time highs, and CEO Sanjay Mehrotra signalling continued strength through fiscal 2026 on booming AI infrastructure spend. He also said demand is so great that the TAM, thought to be 100b by 2030 will now be that big by 2028. Now think about what that means for the wider GPU, rack scale demand cf the noise. Happy days.

-

Nice summary to get some perspective on just how big these results and this is a great set up for 2026 across the board.

Micron just delivered a gross margin of 56.8%, up from 45.7% last quarter, and is guiding to 68% next quarter, with further expansion expected in FY26.

For the quarter, management reported gross margin expansion of 1,110 basis points to 56.8% and is guiding to 68% next quarter—another 1,120 basis points of improvement.What Morgan Stanley is saying:

“This earnings result is the biggest surprise in U.S. semiconductor history, excluding Nvidia.”

Translation:

Micron’s earnings beat was exceptional, on a scale rarely seen in semiconductors.

Only Nvidia’s AI-driven blowouts over the past two years were larger.

Morgan Stanley is explicitly putting Nvidia in its own historical category.

This wording is deliberate. Analysts do not use phrases like “biggest in history” lightly.

Why Micron’s blowout matters for Nvidia (and not negatively)

Micron’s results confirm three structural tailwinds that directly support Nvidia:- AI memory demand is real and accelerating

HBM (high-bandwidth memory) demand is surging.

Every Nvidia GPU requires large amounts of HBM.

Strong Micron results mean Nvidia’s supply chain is tightening, not weakening.

GPUs do not ship without memory. Micron just confirmed the constraint is supply, not inventory. To address that the company is going 'further and faster' re it's fab build out and have committed $20B - Data-centre capex is expanding, not peaking

Micron guided to multiple quarters of sustained strength.

That implies hyperscalers are still increasing spend.

Nvidia remains the primary beneficiary of that capex.

This directly undermines the “AI digestion” or “capex pause” narrative—again. - Pricing power is returning across the stack

Micron demonstrated both margin expansion and pricing leverage.

When upstream suppliers regain pricing power, it usually means:

– Customers are less price-sensitive

– Demand urgency outweighs cost concerns

That is exactly the environment in which Nvidia performs best.

- AI memory demand is real and accelerating

-

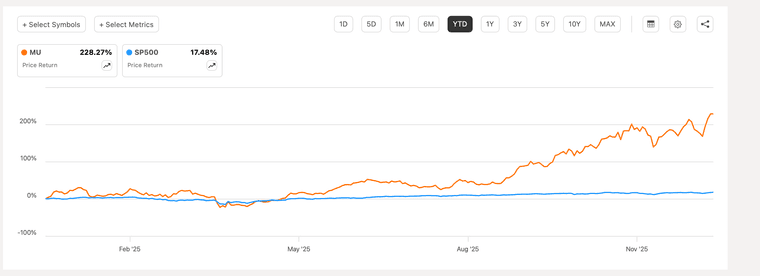

And the winner for the Year goes to: MICRON

And given its 1 yr Fwd PE is a mere 7 (base on $40 eps), it's still looking very cheap.

-

I would say:

I think Nvidia's stock price has treaded water for the past 6 months, all the while getting stronger. The doom merchants have tried every tactic to drive the price down, from fake stories about supply, to blatant lies about their superiority(re AMD and Asics), it failed. The company is at the centre of everything technology and is years ahead of its closest competitor. There are 39 analysts 'following' the company. Their average target price is $259 and the top price target is $352. Whilst I don't put much stock into what analysts have to say I do think the company is worth considerably more than today's price and 2026 is when we might see a break out.

As to Micron, we still haven't seen an expansion of their multiple, in fact it's fallen-it wasn't that long ago(2 months) that wall street was expecting $22 eps next year and now it's $40! The average target is $300 and the top target is $500. And at $500 its PE would be 12.5, so I think there is scope for plenty more upside. The market still thinks the business is cyclical, which it is to a point but the changes of late are structural/secular and Micron imo will continue to grow their business for many, many years.

-

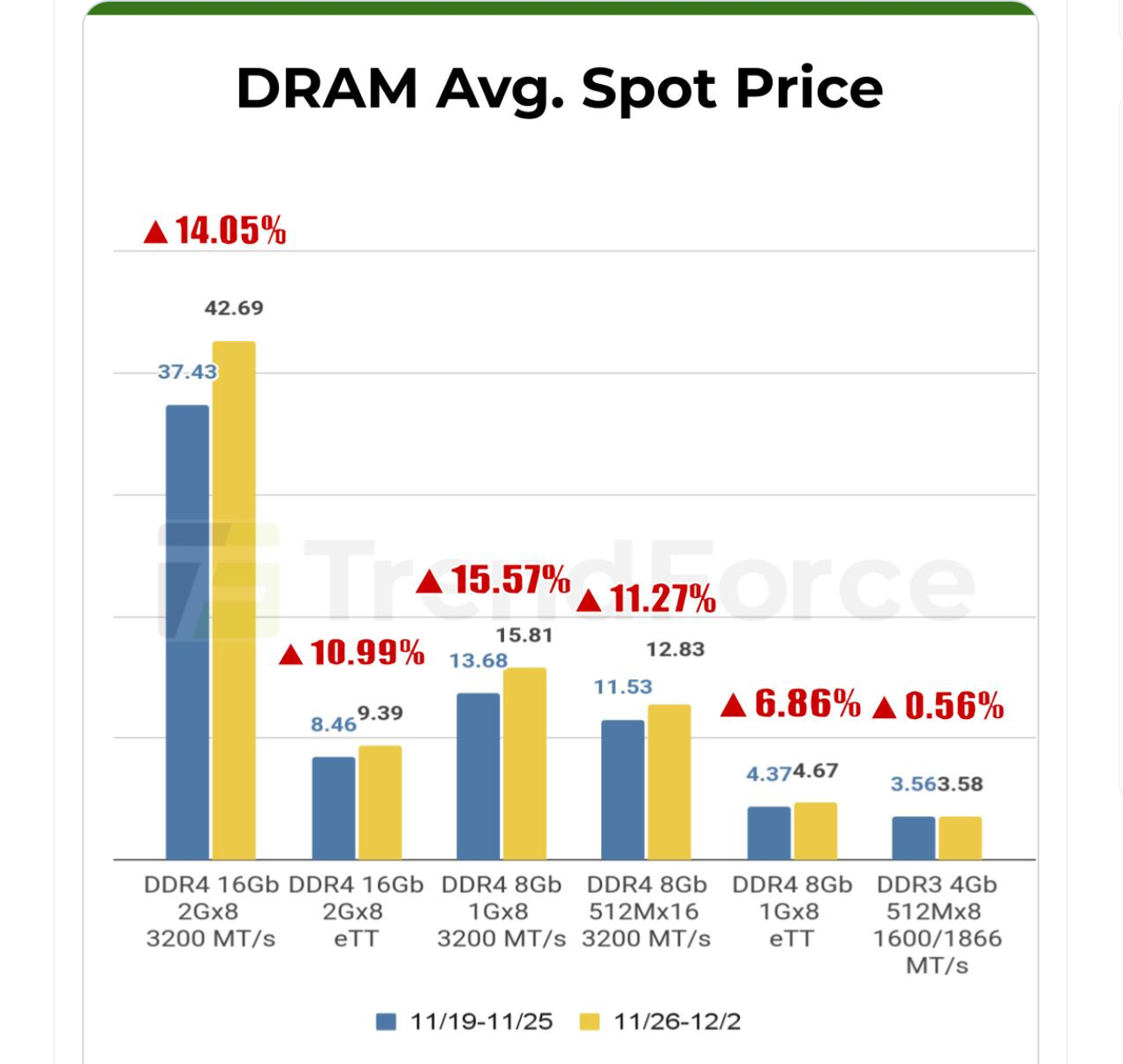

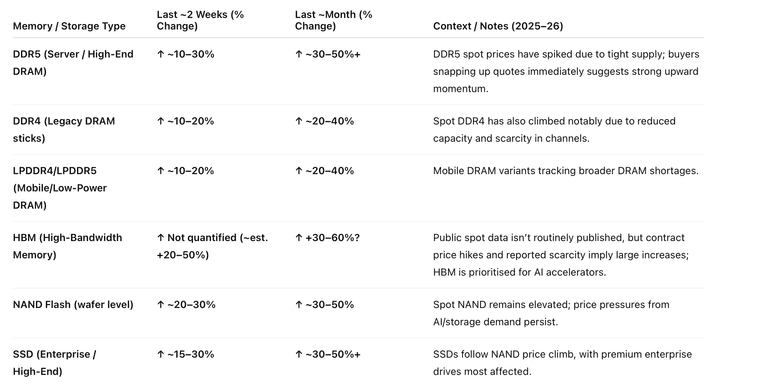

Some spot price updates. Memory prices are up strongly.

This is a great environment for Micron, full stop.

Memory pricing is rising across DRAM, HBM, and NAND at the same time that AI demand is structurally stronger than past cycles. That combination is rare. Supply is tight, not just because demand is high, but because manufacturers are disciplined and prioritising high-margin products.Micron directly benefits from that discipline through higher ASPs, better mix, and operating leverage. AI servers are memory-hungry, and Micron is selling into the exact parts of the stack where customers care more about availability and performance than price.

That translates into real pricing power, not promotional volume. Unlike previous upcycles driven by PCs or phones, this one is anchored in data centre capex, which is larger, longer-lived, and stickier. Margins expand faster than costs, inventories remain lean, and earnings rebound strongly.

-

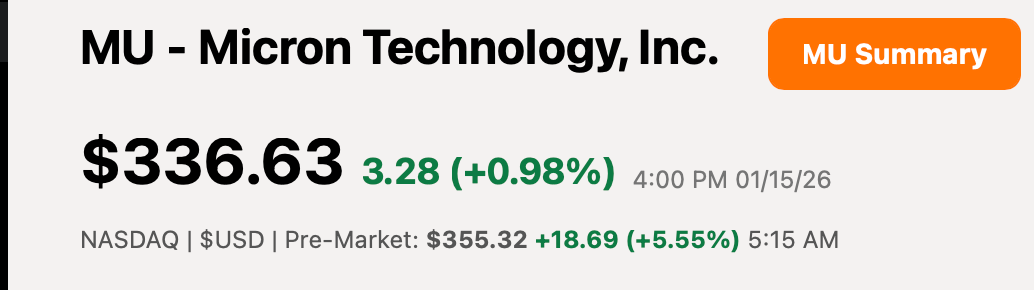

Insiders sell for all sorts of reasons but buying at ALT and with conviction sends a much stronger message.

—Shares rose after the company disclosed that its director, Teyin Liu, bought 23.2K shares of common stock in a total transaction size of $7.8M. The purchases were made at prices ranging from $336.63 to $337.50 per share.

-

Micron will buy Powerchip’s Tongluo fab in Taiwan for US$1.8 billion, giving it cleanroom space of 300,000 square feet in a 12-inch (300mm) fab, to boost capacity amid growing global memory chip demand, Micron said. The firms inked a letter of intent and will close the deal by the 2nd quarter this year, and Micron expects the acquisition to contribute meaningful DRAM output in 2nd half-2027

-

Investing in the future

Today, Micron broke ground on our $100 billion leading‑edge memory manufacturing complex in Onondaga County, NY! With up to 4 fabs, it will be the largest U.S. semiconductor facility, generating 50,000 jobs in New York.

Made possible by strong partnership across government, industry, academia, and our local community, this project will be home to the most advanced memory manufacturing in the world

-

Taiwan DRAM makers Winbond and Nanya Tech are signing long-term contracts thru-2030 using a “locked volume, floating price” method, which put a ceiling on profitability, media report. They now require a 2-year minimum contract, up from 1-year, previously.

Micron Technology's future growth appears almost assured through 2028–2030, driven by structural AI demand for high-bandwidth memory (HBM) and advanced DRAM, persistent supply shortages, and the company's strategic positioning.Micron's CEO has stated that tight conditions in DRAM and NAND will persist through and beyond 2026, with the company able to meet only 50–66% of customer needs amid exploding AI data centre requirements. HBM, crucial for AI accelerators, consumes three times more wafer area than standard DRAM, creating a supply vacuum. Micron has sold out its entire calendar 2026 HBM supply (including HBM4), with multi-year agreements securing pricing and volumes.

The HBM total addressable market (TAM) is forecast to grow at ~40% CAGR from ~$35 billion in 2025 to ~$100 billion by 2028—two years earlier than prior estimates—and larger than the entire DRAM market in 2024. This trajectory supports sustained high margins and revenue visibility, as AI infrastructure build-outs (e.g., hyperscalers like Microsoft, Google, Meta) drive insatiable demand.

Micron is aggressively expanding capacity: Idaho fabs start output mid-2027 (with a second by end-2028), and a New York fab breaks ground in 2026 for supply in 2030+. Fiscal 2026 capex rises to ~$20 billion, prioritising HBM and advanced nodes like 1-gamma DRAM. Analysts project revenue near $75–77 billion for 2026 (up sharply from recent quarters), with consensus EPS around $33(far too low imo > $40, maybe $45, implying strong profitability.While memory remains cyclical, the AI supercycle—potentially extending to a $1.2 trillion market by 2030—shifts dynamics towards secular growth for leaders like Micron. Risks include potential oversupply post-2027 or AI capex slowdowns, but current shortages, sold-out high-margin products, and limited new capacity until late-decade make robust expansion highly likely through 2028–2030.

-

Taiwan DRAM makers Winbond and Nanya Tech are signing long-term contracts thru-2030 using a “locked volume, floating price” method, which put a ceiling on profitability, media report. They now require a 2-year minimum contract, up from 1-year, previously.

Micron Technology's future growth appears almost assured through 2028–2030, driven by structural AI demand for high-bandwidth memory (HBM) and advanced DRAM, persistent supply shortages, and the company's strategic positioning.Micron's CEO has stated that tight conditions in DRAM and NAND will persist through and beyond 2026, with the company able to meet only 50–66% of customer needs amid exploding AI data centre requirements. HBM, crucial for AI accelerators, consumes three times more wafer area than standard DRAM, creating a supply vacuum. Micron has sold out its entire calendar 2026 HBM supply (including HBM4), with multi-year agreements securing pricing and volumes.

The HBM total addressable market (TAM) is forecast to grow at ~40% CAGR from ~$35 billion in 2025 to ~$100 billion by 2028—two years earlier than prior estimates—and larger than the entire DRAM market in 2024. This trajectory supports sustained high margins and revenue visibility, as AI infrastructure build-outs (e.g., hyperscalers like Microsoft, Google, Meta) drive insatiable demand.

Micron is aggressively expanding capacity: Idaho fabs start output mid-2027 (with a second by end-2028), and a New York fab breaks ground in 2026 for supply in 2030+. Fiscal 2026 capex rises to ~$20 billion, prioritising HBM and advanced nodes like 1-gamma DRAM. Analysts project revenue near $75–77 billion for 2026 (up sharply from recent quarters), with consensus EPS around $33(far too low imo > $40, maybe $45, implying strong profitability.While memory remains cyclical, the AI supercycle—potentially extending to a $1.2 trillion market by 2030—shifts dynamics towards secular growth for leaders like Micron. Risks include potential oversupply post-2027 or AI capex slowdowns, but current shortages, sold-out high-margin products, and limited new capacity until late-decade make robust expansion highly likely through 2028–2030.

@Adam-Kay said in Micron Technology:

Risks include potential oversupply post-2027 or AI capex slowdowns ...

This kinda raises the question of when will the world stop spending big on AI? The current increase in expenditure on this particular tech will slow down eventually - it has to slow down - but when will the world have enough AI? When and where will it plateau?

-

When AI becomes self aware!!

I’ve seen the documentary with Arnold Schwarzenegger

-

Whenever anything 'grows' a question asked my many will always be 'when will the music stop'. It's a speculative question which is ill posed and isn't analytical. Spending won't stop and it may not plateau. It can't grow at 200% for ever nor is that necessarily important.

Near term, say 2 years, results are irrelevant. The investment will be made. Longer term more monetisation and LLM progress is important.

I don't think of it in terms of 'AI'. More HPC. For now and over the next 2 years I see little derailing the investment-our job is to keep our finger on the pulse and looking ahead to the next visible time frame. Our goal is to stay informed, stay consistent and stay focussed on the companies and the people that run them.

-

When AI becomes self aware!!

I’ve seen the documentary with Arnold Schwarzenegger

@Renmure-Jim said in Micron Technology:

When AI becomes self aware!!

I’ve seen the documentary with Arnold Schwarzenegger

I thought that was Will Smith

-

Micron Breaks Ground on $24 Billion Advanced Wafer Fabrication Facility in Singapore

Micron has broken ground on a new advanced wafer fabrication facility at its existing NAND manufacturing campus in Singapore, marking a major expansion of its global manufacturing footprint. The project represents a planned USD 24 billion investment and underscores Micron’s long-term commitment to Singapore as a strategic semiconductor hub.

The facility will be Singapore’s first double-storey wafer fab and is designed to deliver up to 700,000 square feet of cleanroom space when fully built out. Initial wafer production is scheduled to begin in the second half of calendar 2028, with capacity ramped in phases to match market demand.

Once operational, the fab will manufacture advanced 3D NAND memory wafers, supporting Micron’s latest and future generations of storage technology. Output from the facility will serve applications across AI infrastructure, data centres, enterprise and consumer solid-state drives, and mobile devices, where demand is rising rapidly due to data-centric and AI workloads.The new fab will form a core part of Micron’s NAND Center of Excellence in Singapore, providing critical capacity for ongoing technology transitions. Co-locating R&D and manufacturing is expected to improve efficiency, accelerate time-to-market and strengthen collaboration with academic and industry partners.

Micron also confirmed that its previously announced high-bandwidth memory (HBM) advanced packaging facility at the same site remains on track to contribute to HBM supply in calendar 2027, creating potential synergies across NAND and DRAM operations.

-

SK Hynix just reported, blowing away estimates and delivering new record revenue, margins and earnings, upped their dividend and share buy backs. Capex is up materially. This can only bode well for Micron. I believe Micron and others are in negotiations with their customers to lock in supply for 2027.

Context. The new Rubin NVL72 which uses HBM4. Each GPU requires '8 stacks' at $500ish/stack, $6,400 X 72 before packaging and integration so it's a safe bet that every server rack contains $500K of HBM4! It's not hard to see this turning into a Gold-Rush. Micron is expected to grow 100% in 2026 and at least 50% in 2027 and still it trades at a PE of 10

have a good day, all