Busy couple of weeks on results front

-

Well I'm happy the way tech is going, I've just put a little more in to it. Onwards and upwards.

Well done team. -

a couple of typo is this transcript, taken from TSM earnings call. He means 'if you listen to what company CEOs are saying. Jensen Huang said the same exact thing 2 months before dropping the big Sovereign AI news 'AI factories'. If you pay attention and listen 'but you are not listening' Huang said.

Only last week some analysts said TSM were slowing down and I remember thinking 'I'll wait to hear from CC Wei' The most honest and straight executive out there. Actually they are going faster 'to catch up to demand'

-

It seems to me most of these analysts and so called experts are away with fairies

-

Not really-they write what pays

-

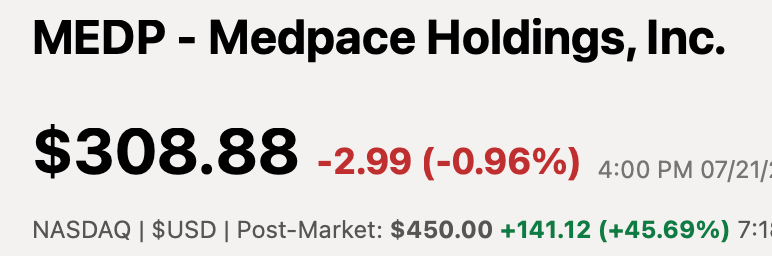

Revisiting a holding we sold in February.

Medpace just reported-a decent but unremarkable report. Why the massive pop-Silly Shorts took a big position and got caught. 13% of the float short and no willing sellers = price explosion!

This is why you don't play games you don't understand

We sold for $330(paid $165) BUT the money was put into ORCL and we are up 60% on that to date

-

Revisiting a holding we sold in February.

Medpace just reported-a decent but unremarkable report. Why the massive pop-Silly Shorts took a big position and got caught. 13% of the float short and no willing sellers = price explosion!

This is why you don't play games you don't understand

We sold for $330(paid $165) BUT the money was put into ORCL and we are up 60% on that to date

@Adam-Kay said in Busy couple of weeks on results front:

13% of the float short and no willing sellers = price explosion!

what does this mean in simple terms?

-

Issued shares will be greater than the float 'available to sell' because insiders and institutions just don't sell. Relatively few shares to buy and shorts must buy to close their position. Supply and demand. If 100 buyers for every share you will pay a hefty price-

With MedP Short Sellers picked the wrong stock and are paying dearly, now. Medpace daily volume is always very low. The CEO owns 20%-he aint selling

-

A bunch of silly people thought they could profit from selling the stock-the opposite of someone buying. This is called 'short selling'. A short position can only be closed/realised by buying the stock back. If the price moves down you profit because you can buy it back cheaper. If the price goes up you lose because you pay a higher price.

In this example short sellers want to close(Buy), relatively few sellers as liquidity is low(owners of medpace dont want to sell) so the short seller bids the price up a lot!. I suspect many got margin called and various brokers closed their positions(by buying at whatever price they could get)

-

Thanks. So this sounds like short selling going wrong (vs stories we've seen in past where short sellers have taken actions to push prices down like unfavourable reports etc). Think SMCI or one of the PHT stocks had that happen to them right?

This seems like that games company type scenario

-

Live event at 6pm GMT today-looks like GPT 5 is going live.

Altman said recently...GPT-5 may look and feel like early AGI to some users—especially in its autonomous, agent-like behaviours and self-directed reasoning.

“It's not AGI—but parts of it will feel like magic.”

-

This month, Elon Musk ordered the shutdown of Tesla’s Dojo supercomputer team, with its leader Peter Bannon departing and remaining staff reassigned to other projects. Dojo, designed to process vast amounts of video data for Tesla’s autonomous driving and Optimus robot initiatives, was once projected to add significant value to Tesla. However, Musk’s decision signals a strategic pivot, with Tesla increasing reliance on Nvidia and Samsung for AI compute and chip manufacturing. This move suggests Musk acknowledges Nvidia’s dominance in AI hardware, as Tesla faced challenges securing enough Nvidia GPUs and developing Dojo to compete effectively. The shift aligns with Tesla’s broader focus on integrating external AI technologies to advance its self-driving and robotics ambitions.

Makes perfect sense given his out sized investment in Colossus.

-

Taiwan’s July exports soared 42% year-on-year to US$56.68 billion, the fastest growth in 15-years and beating an estimated 28.7%, led by AI-related demand as exports to the US leaped 62.8% to $18.65 billion.

No slow down

-

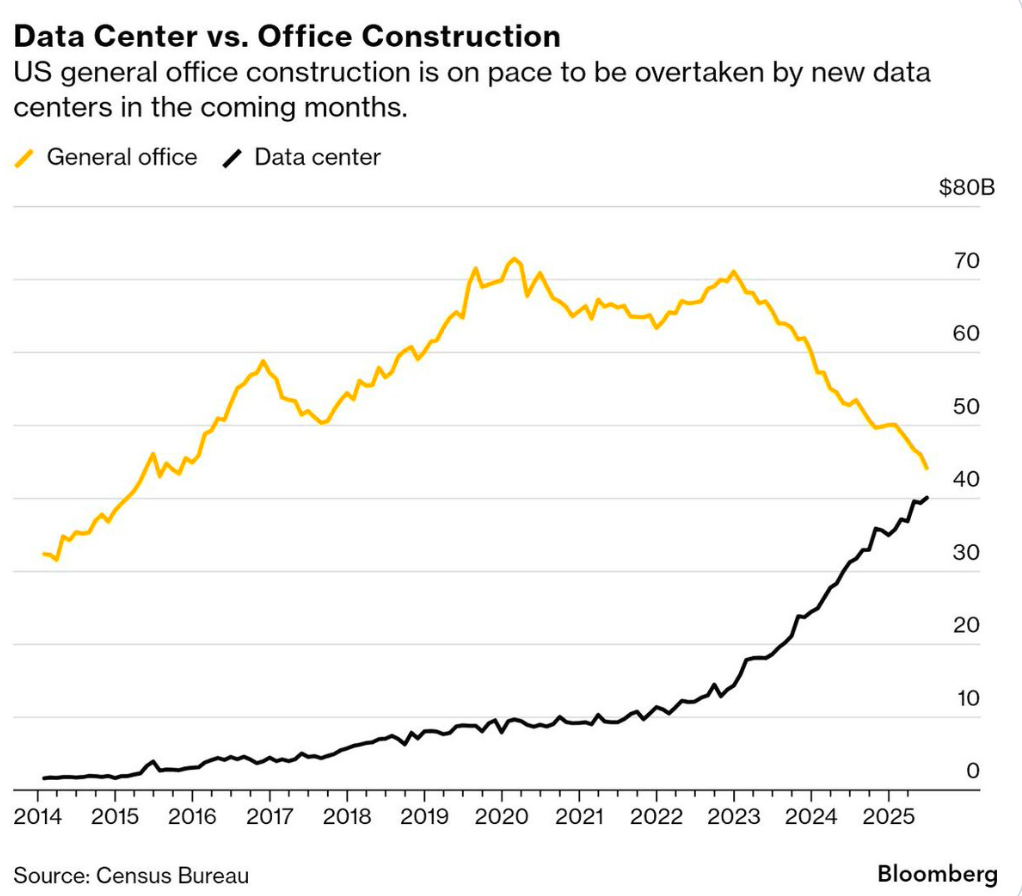

Interesting graphic. Source: Bloomberg

-

They probably made the customer pay the 15%. Then again, the FT has form making-stuff-up. Regardless 85% of $5B is better than 100% of nothing

-

Some may have noticed, Twilio reported last week, dropping 20% on the news to sub $100. We sold our position in February in the $140s.

Twilio keeps handing over stock to employees to the tune of $600M annually, at the expense of shareholders. One could tolerate this if there was strong growth but 10-11% top line growth and still no earnings. Feb saw the market massively over paying for the stock(imo) and we made the opportunistic decision to exit with a significant profit.