Busy couple of weeks on results front

-

Issued shares will be greater than the float 'available to sell' because insiders and institutions just don't sell. Relatively few shares to buy and shorts must buy to close their position. Supply and demand. If 100 buyers for every share you will pay a hefty price-

With MedP Short Sellers picked the wrong stock and are paying dearly, now. Medpace daily volume is always very low. The CEO owns 20%-he aint selling

-

A bunch of silly people thought they could profit from selling the stock-the opposite of someone buying. This is called 'short selling'. A short position can only be closed/realised by buying the stock back. If the price moves down you profit because you can buy it back cheaper. If the price goes up you lose because you pay a higher price.

In this example short sellers want to close(Buy), relatively few sellers as liquidity is low(owners of medpace dont want to sell) so the short seller bids the price up a lot!. I suspect many got margin called and various brokers closed their positions(by buying at whatever price they could get)

-

Thanks. So this sounds like short selling going wrong (vs stories we've seen in past where short sellers have taken actions to push prices down like unfavourable reports etc). Think SMCI or one of the PHT stocks had that happen to them right?

This seems like that games company type scenario

-

Live event at 6pm GMT today-looks like GPT 5 is going live.

Altman said recently...GPT-5 may look and feel like early AGI to some users—especially in its autonomous, agent-like behaviours and self-directed reasoning.

“It's not AGI—but parts of it will feel like magic.”

-

This month, Elon Musk ordered the shutdown of Tesla’s Dojo supercomputer team, with its leader Peter Bannon departing and remaining staff reassigned to other projects. Dojo, designed to process vast amounts of video data for Tesla’s autonomous driving and Optimus robot initiatives, was once projected to add significant value to Tesla. However, Musk’s decision signals a strategic pivot, with Tesla increasing reliance on Nvidia and Samsung for AI compute and chip manufacturing. This move suggests Musk acknowledges Nvidia’s dominance in AI hardware, as Tesla faced challenges securing enough Nvidia GPUs and developing Dojo to compete effectively. The shift aligns with Tesla’s broader focus on integrating external AI technologies to advance its self-driving and robotics ambitions.

Makes perfect sense given his out sized investment in Colossus.

-

Taiwan’s July exports soared 42% year-on-year to US$56.68 billion, the fastest growth in 15-years and beating an estimated 28.7%, led by AI-related demand as exports to the US leaped 62.8% to $18.65 billion.

No slow down

-

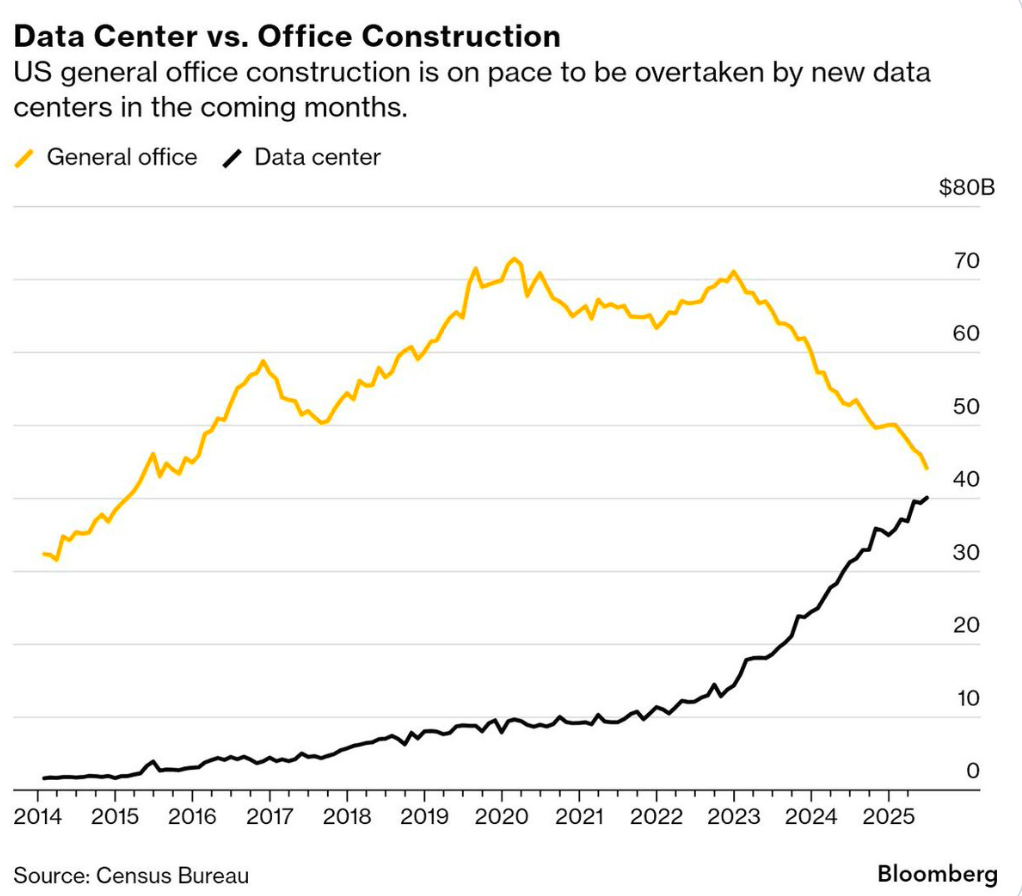

Interesting graphic. Source: Bloomberg

-

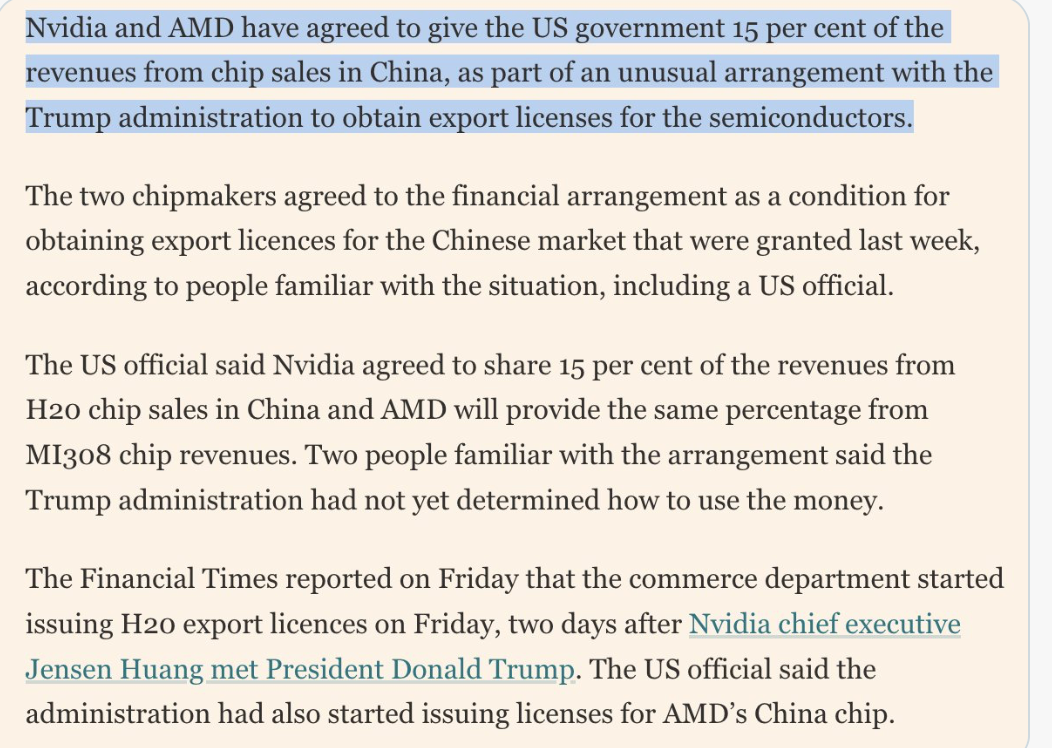

They probably made the customer pay the 15%. Then again, the FT has form making-stuff-up. Regardless 85% of $5B is better than 100% of nothing

-

Some may have noticed, Twilio reported last week, dropping 20% on the news to sub $100. We sold our position in February in the $140s.

Twilio keeps handing over stock to employees to the tune of $600M annually, at the expense of shareholders. One could tolerate this if there was strong growth but 10-11% top line growth and still no earnings. Feb saw the market massively over paying for the stock(imo) and we made the opportunistic decision to exit with a significant profit.

-

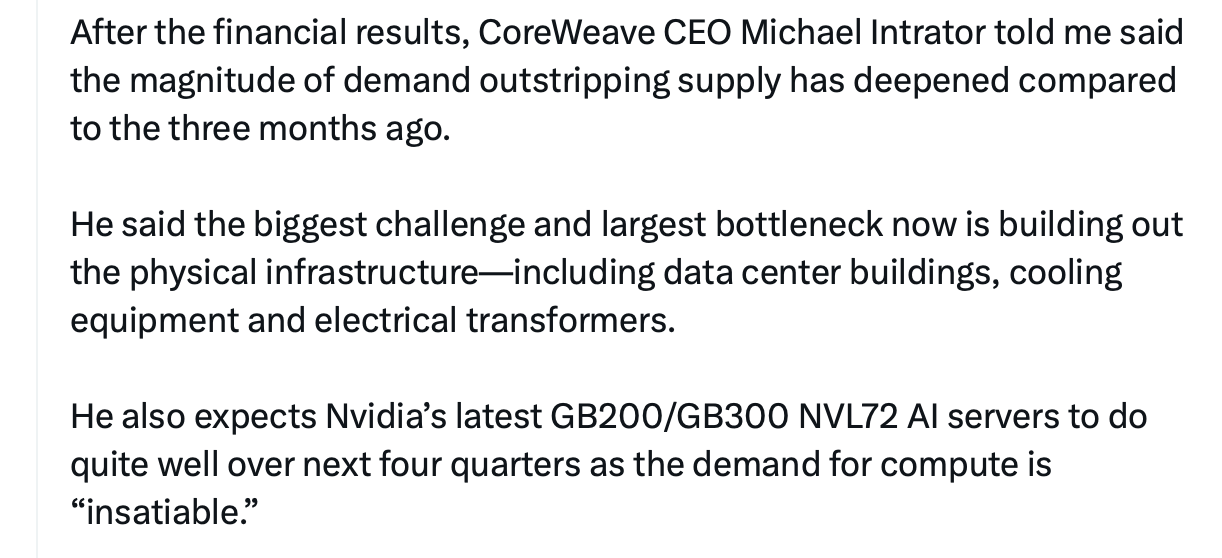

Coreweave CEO says demand for AI racks is insatiable with the demand/supply imbalance getting bigger.

As we have said before, supply has been the constraint and will remain same. In the 'years' ahead it will probably switch to Power constraint. We have looked at power infrastructure companies in the past, discussed it internally and here. My view was that power being a commodity is relatively low margin vs high capital cost(to scale it). What I didn't consider is the massive pull fwd the market gamblers would attribute to various stocks and bid them up to a bubbly froth. Utilities companies should not trade at multiples of 50+ and only we aint playing.

-

At Jackson Hole, Powell noted that a shifting balance of risks “may require adjusting our policy stance,” indicating potential readiness to lower the central bank’s policy rate if warranted.“Inflation risks are skewed upwards, while employment risks are downwards — a complex scenario,” Powell added.Consequently, the likelihood of a September rate cut increased, rising from ~71% before the speech to ~93% afterwards.

-

.... all of which made for a nice jump in the markets. Which is most welcome as they seem to have been stagnating of late.

(And an aside: the scrolling to the bottom of a long thread like this is a bit faff-y. Could it be split into pages, a la PH? Perhaps I should suggest this elsewhere.)

-

Hi O,

It's not stagnation more consolidation. Look where we have come from.

22/April to 22 July > 40% rally in Tech/Growth

22 July to 222 August has been flat.The rally isn't typical however the pause is. Many reasons for it.

Market awaits new information

The buyers that pushed prices higher step back

Stock holders take profit

We have given back 2-3% on the FX rateThe usual psychologies weigh on our minds as rapid gains prevail it's too easy to expect them daily/weekly. It doesn't work like that. There is also (still) a lot of DT noise we have to wade through.

Cheers

Adam

-

Exchange rate, usd weaker v gbp by 0.8% on expected rate cut following Jackson Hole commentary

@dingg said in Busy couple of weeks on results front:

Exchange rate, usd weaker v gbp by 0.8% on expected rate cut following Jackson Hole commentary

Also, I believe (I'm sure I'll be corrected if wrong) that the daily update of values we see is not from close of US markets, but some time before that, so if they rose, or fell, later in the session we may not see that next day?

-

All prices are taken after the US close. FX is taken at 23.30GMT. With trackers(Global) some of their holdings are on exchanges which have not closed/opened at that time so these specific holdings will not be that days close.