Micron Technology

-

We can be patient with this one-not that gains have been slow having paid just under $90 in Feb 25! That being said, if they execute, they grow materially from here and for 'years'

The company reported $2B in HBM memory this quarter which translates to an annual run rate of $8B-more actually given QoQ growth. 12 months ago they estimated their market share by 2030 would be 30% of a TAM(total addressable market) in HBM of $100B (and that TAM will likely grow).

Interesting fact. HBM is the most expensive component of a GPU

-

Micron hits a new ALH

News today highlights intense demand for enterprise SSDs, driven by U.S. cloud service providers (CSPs) like Google and Meta securing significant NAND flash production for AI data centres (eSSDs-we spoke about this memory last week).

This has tightened supply, with lead times extending up to a year and NAND spot prices rising materially—QLC up 10% and TLC 5-7% in Q3 2025, with Q4 forecasts at 8-15% increases. Micron, a U.S.-based NAND leader, benefits immensely.

Its enterprise SSDs generated billions in FY 2025, with record market share gains. As spot prices climb, Micron’s high-capacity QLC SSDs (e.g., 9650 NVMe) command premium pricing, boosting NAND revenue . With U.S.-centric fabs (plants) and CSP-favoured supply chains, Micron avoids geopolitical risks, ensuring stable contracts. Rising spot prices could add $1-2B annually to revenue, with NAND margins nearing mid-30s% by 2026, solidifying Micron’s AI-driven growth.

GOOG and META apparently have offered some companies open contracts to buy entire fabs production.

-

Micron hits an all time high today on the back of Citi analyst Buy opinion. Are we surprised-No, we saw this coming 6 months ago. The only surprise is their target of $230 puts their multiple on 10. I think it deserves a lot more than 10.

From the client note:Micron Technology shares rose +6.5% to $204 after Citi raised its price target from $200 to $240, while maintaining a Buy rating.

Key points from Citi analyst Christopher Danely:

Believes DRAM demand will be “unprecedented” owing to AI growth.

Expects DRAM to secure long-term contracts within the AI supply chain — similar to NVIDIA (NVDA), AMD, and Broadcom (AVGO).

Predicts higher and more sustainable DRAM pricing, enabling Micron’s gross margins to return to around 60%, with peak earnings per share (EPS) above $23 (nearly double the previous high of $12.26).

Updated financial forecasts:

FY2026 revenue: $62.5 billion (up from $56 billion)

FY2026 EPS: $21.05 (up from $16.93)

Estimates for FY2027 and FY2028 were also raised.

Context:

The optimism reflects a growing sentiment in the market that Micron will be a major beneficiary of the AI hardware boom, not just GPU manufacturers, as memory demand surges to support AI model training and inference workloads. -

MU management commented today that constraints will persist despite building material capacity.

An interesting fact. HBM memory is the largest cost component when looking at a GPU BOM (Bill of materials). Everything is on target in regards HBM4 and Microns solutions are the most power efficient in the industry.

Still trading at a PE of 10!

The stock hit an all time high today of $214 and change.

Looks like another beat and raise coming. -

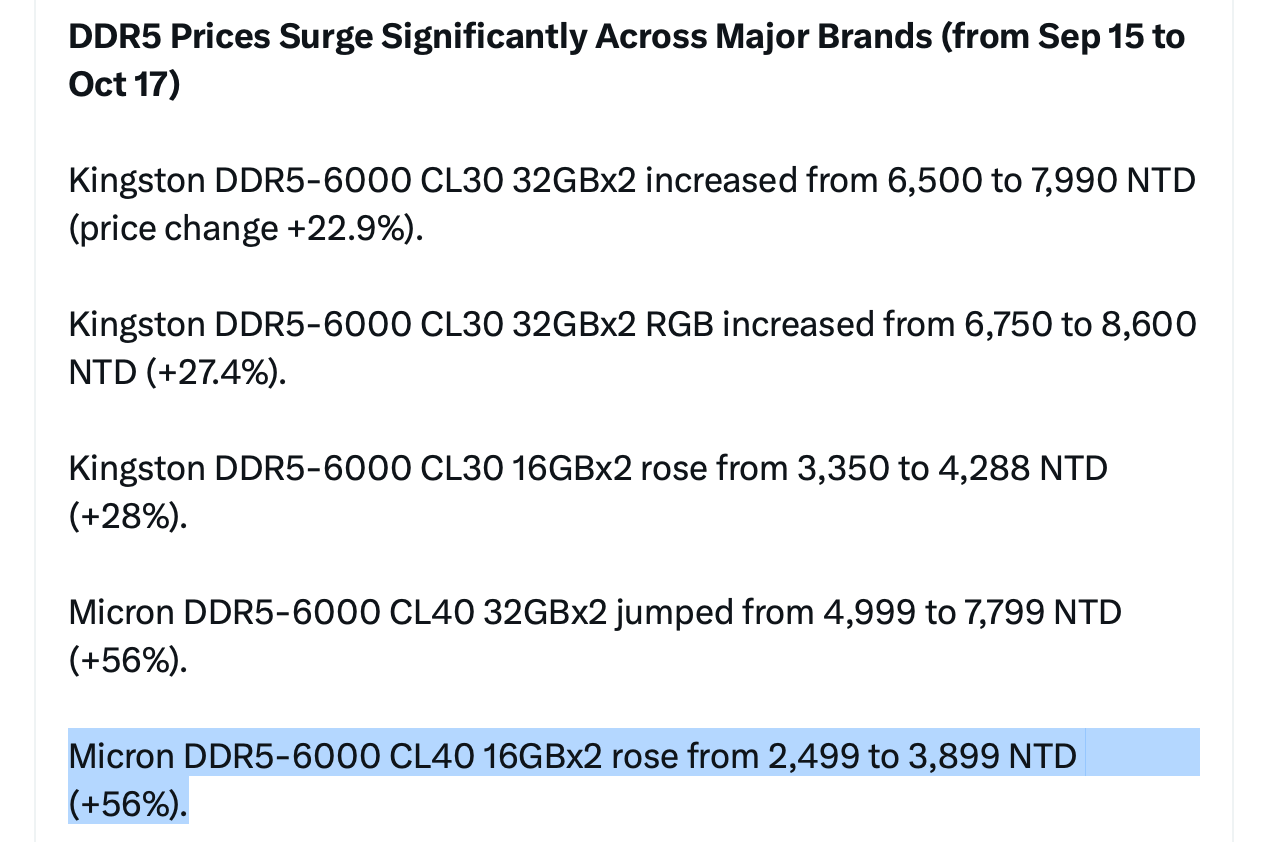

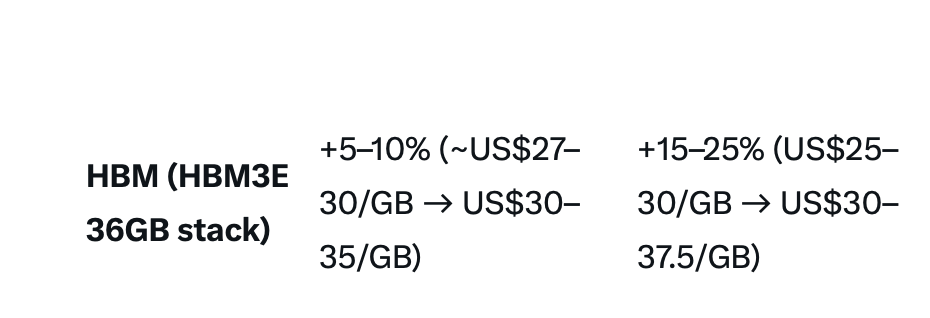

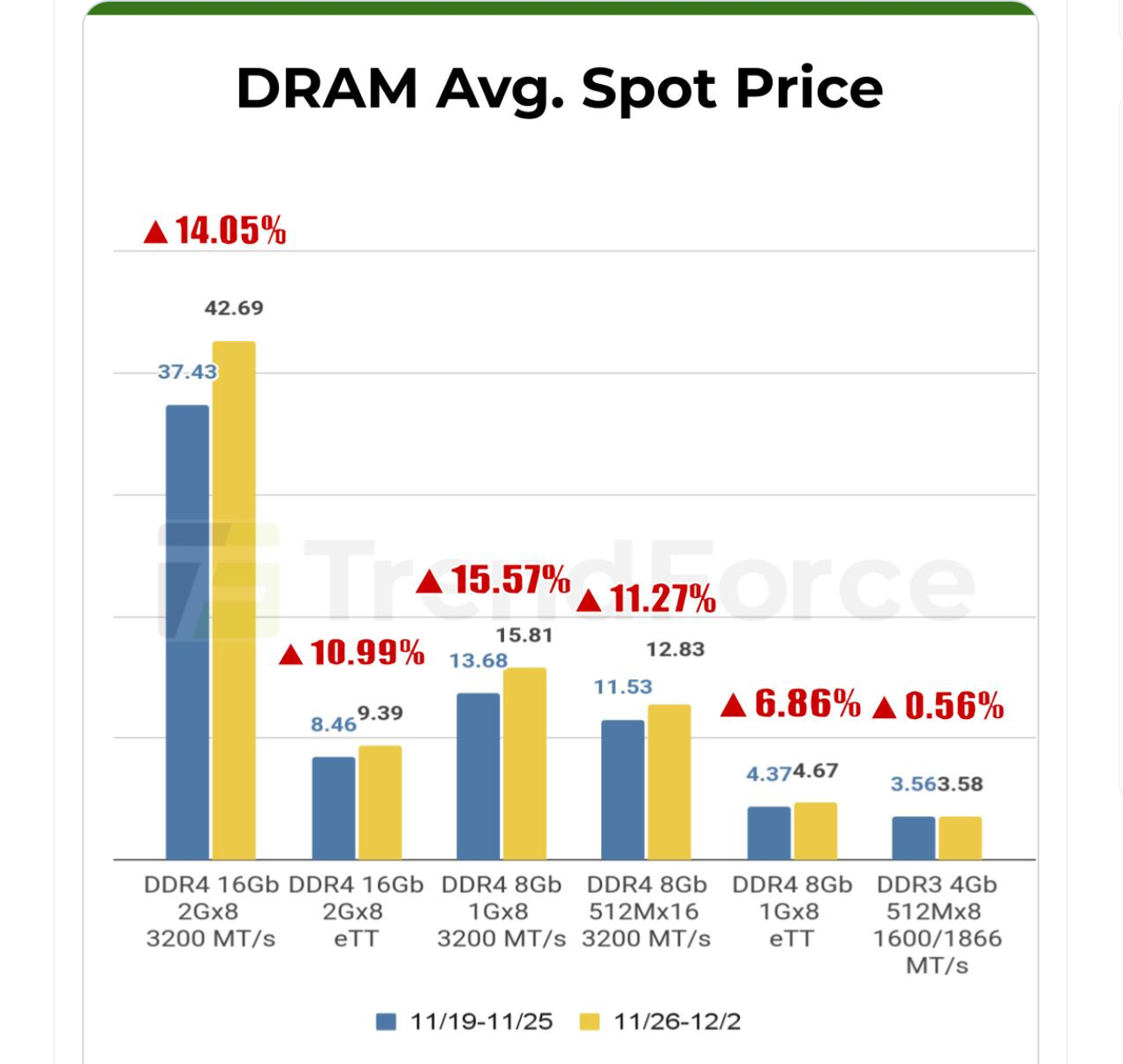

some monthly memory spot price info:

Critical weekly and monthly price changes AI HBM

Setting up another beat and raise.

-

Micron surged > 8% today to an ATH, spurred on by reports that a competitor has increased their HBM4 prices by 50% over HBM3. HBM4 will debut in the new Rubin racks scheduled for release early next year(ish) and Micron is currently negotiating prices on this bleeding edge tech.

It's a great example to reference the previous post about yesterday being painful and was it the catalyst for a correction. Micron fell 6% yesterday on zero news.

-

Samsung raises prices of memory chips by up to 60% amid supply shortage

Micron pops.

-

Micron released statement 'Winning':

sold out until 2027

Ahead of the competition in speed due to patented IP

Brilliant

Call out Taiwan for spreading FUD -

Good for Micron - looking for $16+ EPS next year

PC giants Lenovo, Dell and HP all warned the AI boom is using up memory chips, leading to tight global supplies next year, media report, citing Lenovo’s CFO saying the cost surge is “unprecedented” and confirming Lenovo is stockpiling memory chips, while Dell’s COO said he’s never seen memory costs “escalate at this pace” and HP’s CEO said the 2nd half of next year will be “particularly challenging” and HP will raise PC prices if necessary. The three PC giants all held quarterly earnings conferences recently

-

Bodes well for Micron

-

What are the thoughts on the upcoming earnings report

-

They will beat and raise. The company has a captive market and the wind at its back. What I see(and saw when we invested) is a secular shift in their key memory segments. Next year we are looking at $20 eps. It's multiple is very low and it should rerate when the shift is confirmed.