Micron Technology

-

Micron Technology(MU) has emerged as a leading force in the high-margin, high-value enterprise SSD (eSSD) market, driven largely by the explosive growth of AI workloads.

Its eSSD portfolio, including the 6600 ION series with up to 122 TB and upcoming 245 TB drives, is designed for high-density, energy-efficient storage, precisely what modern AI and data centre applications demand.

With enormous amounts of data comes the need to store it and eSSD is the solution. Current demands are for 45 Billion TB of AI DC storage rising to an estimated 500 Billion TB by 2030. These are very high quality enterprise grade SSDs able to hold 250TB+ in a small form factor, priced in the $20k+ range. This segment will be the source of considerable growth for Micron which holds are material position (Nr 2) in the market.

-

Who is the No 1 in this game if you don’t mind me asking

-

Samsung, currently. As we have mentioned before, Samsung produce just about everything. This product is moving the MU needle but probably won't for Samsung.

Being the biggest in any given market does not always translate to most profitable, not when you are big in everything. And we wanted to invest specifically in the AI related memory, HBM and SSD so were drawn towards a pure play such as Micron

-

Prepared remarks from management:

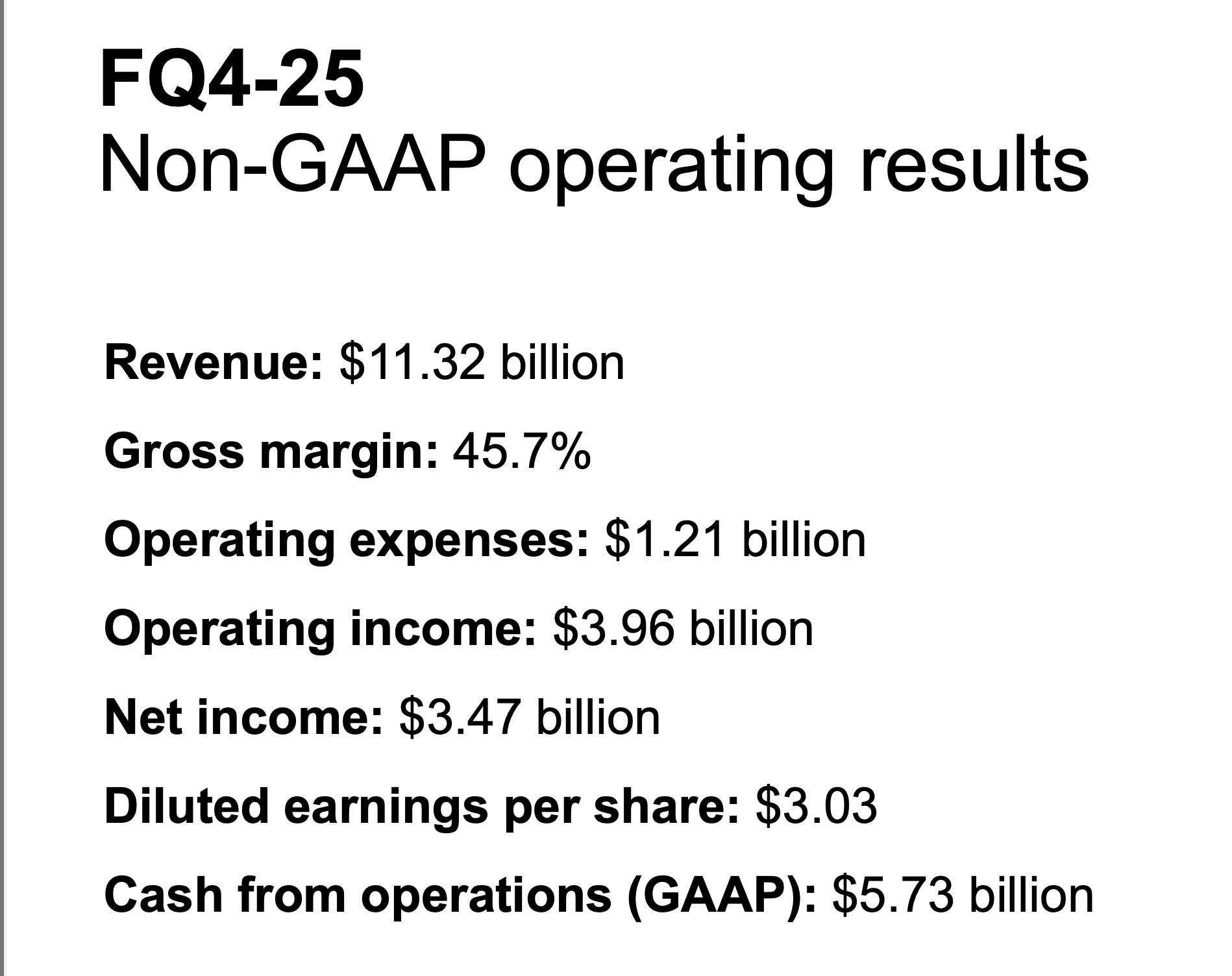

• Micron had an outstanding finish to fiscal 2025, delivering fiscal Q4 revenue,

gross margin and EPS all above the high end of our updated guidance ranges.

• We achieved record revenue in Q4, driven by pricing execution and strong

performance across end markets.

• In our March 2024 earnings call, we said that we expect Micron to be one of

the biggest beneficiaries of AI in the semiconductor industry, and that we

expect to deliver record revenue and significantly improved profitability in fiscal

2025.

• I’m pleased to report that in fiscal 2025, Micron’s revenue grew nearly 50% to a

record $37.4 billion, and gross margins expanded by 17 percentage points to

41%. This performance was supported by the ramp of our high value data

center products and our broad-based DRAM pricing strength across end

markets.

Micron’s HBM4 12H (12-high) remains on track to support customer platform

ramps even as the performance requirements for HBM4 bandwidth and pin

speeds have increased.

• We have recently shipped customer samples of our HBM4 with industry-leading

bandwidth exceeding 2.8 TBps and pin speeds over 11 Gbps.NB: NIvidia original Rubin spec was 9 Gbps and recently pressed Micron for 10-analysts considered this onerous. The idea being to materially increase GPU bandwidth from:

At 9 Gbps: 6 stacks × ~2.3 TB/s = ~13.8 TB/s total.

At 11 Gbps: 6 stacks × ~2.8 TB/s = ~16.8 TB/s totalmost 17TB of data /sec is insane.

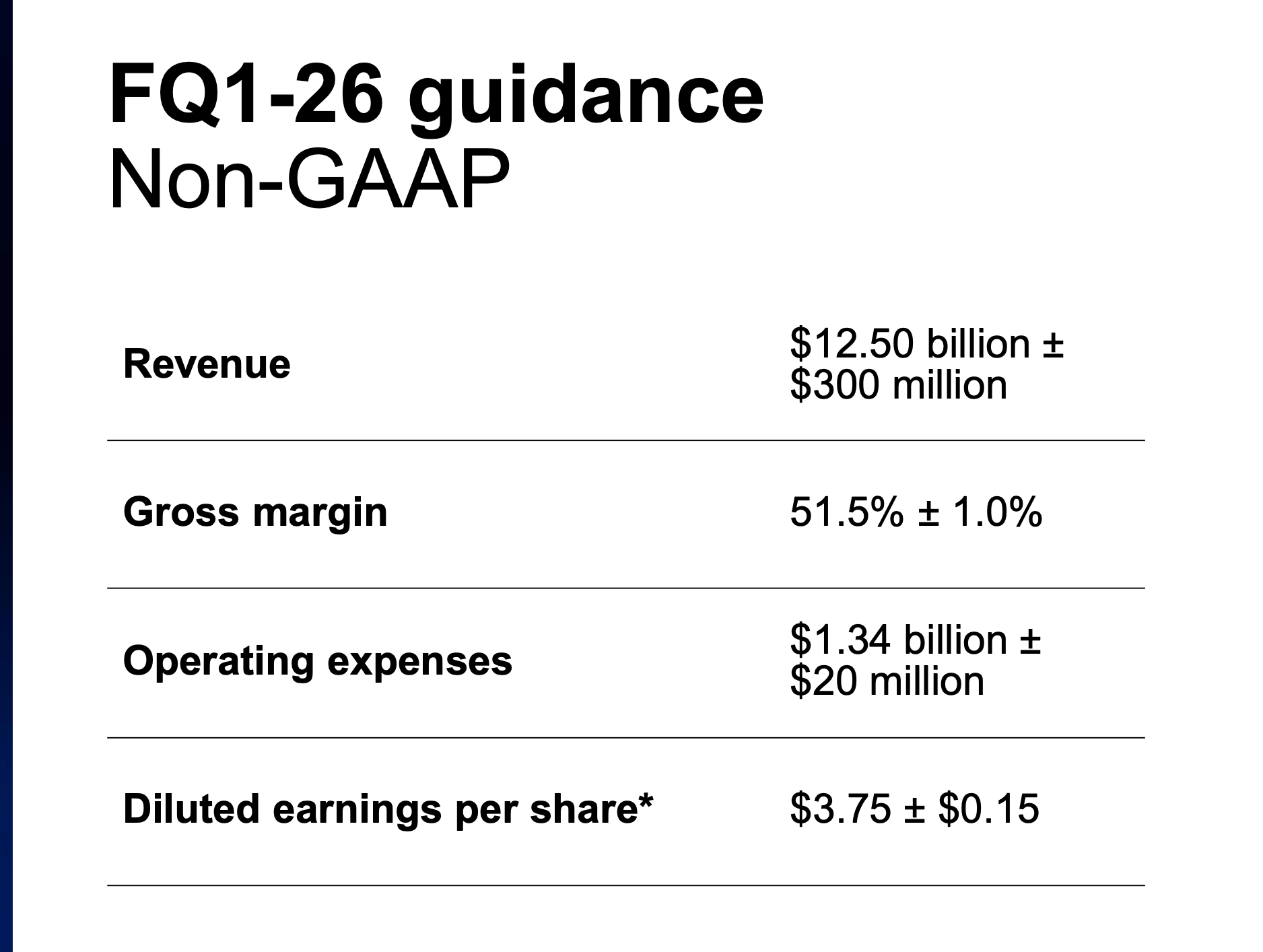

The guide is for $3.75 and we know that's light($4?). Expectations were $3.03! Margin 500bps higher. Why this stock is trading at a multiple of 10 is interesting to say the least. In fact it's less than 10 because imo they will earn over $18 and probably $20/share 'this year'(Q1 to Q4 ending August 28 2026).

Micron is growing revenue/margins almost as fast as Nvidia in percentage terms (though off a smaller base), yet trades at a fraction of the multiple.

Street numbers still lag Micron’s trajectory — consensus hasn’t fully caught up to the raised guidance and likely beats.

Historically, the market slaps a low multiple on memory because of volatility. But if AI/HBM becomes structural demand (multi-year, not cyclical), the market’s framework could shift.

This sets up what looks like a valuation anomaly — Micron at 9–10× forward vs peers 20–40×.Very pleasing result, a huge margin of safety and the cheapest AI story on wall street.

-

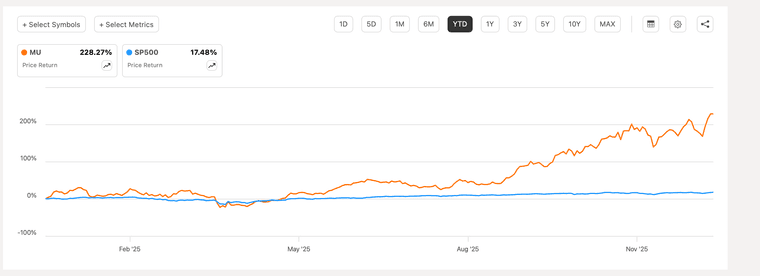

We can be patient with this one-not that gains have been slow having paid just under $90 in Feb 25! That being said, if they execute, they grow materially from here and for 'years'

The company reported $2B in HBM memory this quarter which translates to an annual run rate of $8B-more actually given QoQ growth. 12 months ago they estimated their market share by 2030 would be 30% of a TAM(total addressable market) in HBM of $100B (and that TAM will likely grow).

Interesting fact. HBM is the most expensive component of a GPU

-

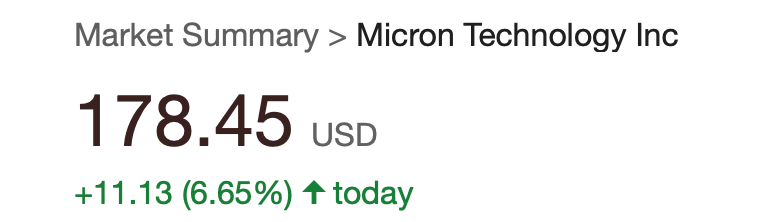

Micron hits a new ALH

News today highlights intense demand for enterprise SSDs, driven by U.S. cloud service providers (CSPs) like Google and Meta securing significant NAND flash production for AI data centres (eSSDs-we spoke about this memory last week).

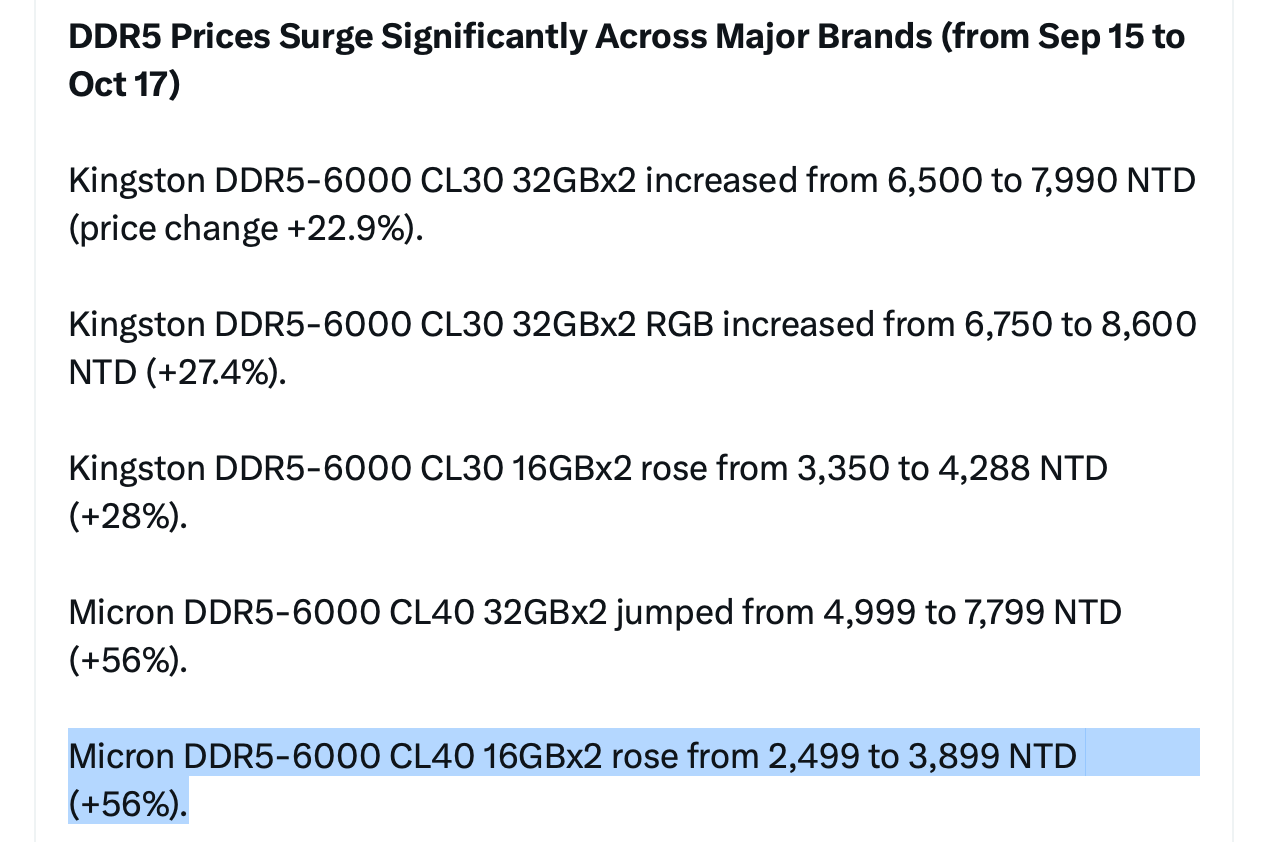

This has tightened supply, with lead times extending up to a year and NAND spot prices rising materially—QLC up 10% and TLC 5-7% in Q3 2025, with Q4 forecasts at 8-15% increases. Micron, a U.S.-based NAND leader, benefits immensely.

Its enterprise SSDs generated billions in FY 2025, with record market share gains. As spot prices climb, Micron’s high-capacity QLC SSDs (e.g., 9650 NVMe) command premium pricing, boosting NAND revenue . With U.S.-centric fabs (plants) and CSP-favoured supply chains, Micron avoids geopolitical risks, ensuring stable contracts. Rising spot prices could add $1-2B annually to revenue, with NAND margins nearing mid-30s% by 2026, solidifying Micron’s AI-driven growth.

GOOG and META apparently have offered some companies open contracts to buy entire fabs production.

-

Micron hits an all time high today on the back of Citi analyst Buy opinion. Are we surprised-No, we saw this coming 6 months ago. The only surprise is their target of $230 puts their multiple on 10. I think it deserves a lot more than 10.

From the client note:Micron Technology shares rose +6.5% to $204 after Citi raised its price target from $200 to $240, while maintaining a Buy rating.

Key points from Citi analyst Christopher Danely:

Believes DRAM demand will be “unprecedented” owing to AI growth.

Expects DRAM to secure long-term contracts within the AI supply chain — similar to NVIDIA (NVDA), AMD, and Broadcom (AVGO).

Predicts higher and more sustainable DRAM pricing, enabling Micron’s gross margins to return to around 60%, with peak earnings per share (EPS) above $23 (nearly double the previous high of $12.26).

Updated financial forecasts:

FY2026 revenue: $62.5 billion (up from $56 billion)

FY2026 EPS: $21.05 (up from $16.93)

Estimates for FY2027 and FY2028 were also raised.

Context:

The optimism reflects a growing sentiment in the market that Micron will be a major beneficiary of the AI hardware boom, not just GPU manufacturers, as memory demand surges to support AI model training and inference workloads. -

MU management commented today that constraints will persist despite building material capacity.

An interesting fact. HBM memory is the largest cost component when looking at a GPU BOM (Bill of materials). Everything is on target in regards HBM4 and Microns solutions are the most power efficient in the industry.

Still trading at a PE of 10!

The stock hit an all time high today of $214 and change.

Looks like another beat and raise coming. -

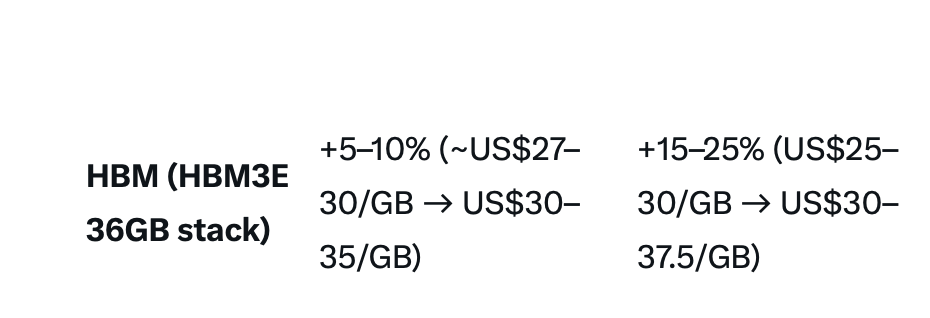

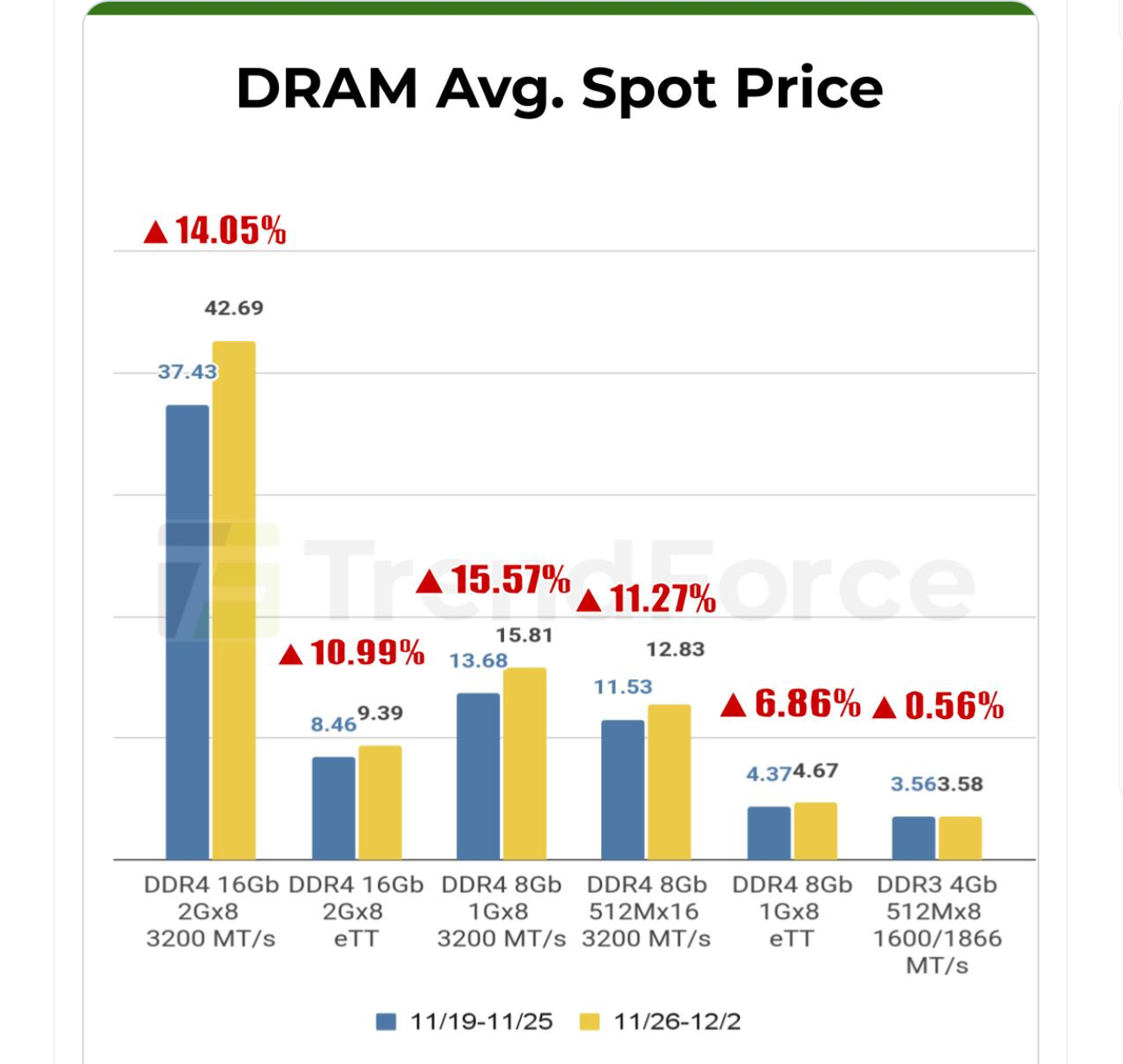

some monthly memory spot price info:

Critical weekly and monthly price changes AI HBM

Setting up another beat and raise.

-

Micron surged > 8% today to an ATH, spurred on by reports that a competitor has increased their HBM4 prices by 50% over HBM3. HBM4 will debut in the new Rubin racks scheduled for release early next year(ish) and Micron is currently negotiating prices on this bleeding edge tech.

It's a great example to reference the previous post about yesterday being painful and was it the catalyst for a correction. Micron fell 6% yesterday on zero news.

-

Samsung raises prices of memory chips by up to 60% amid supply shortage

Micron pops.

-

Micron released statement 'Winning':

sold out until 2027

Ahead of the competition in speed due to patented IP

Brilliant

Call out Taiwan for spreading FUD -

Good for Micron - looking for $16+ EPS next year

PC giants Lenovo, Dell and HP all warned the AI boom is using up memory chips, leading to tight global supplies next year, media report, citing Lenovo’s CFO saying the cost surge is “unprecedented” and confirming Lenovo is stockpiling memory chips, while Dell’s COO said he’s never seen memory costs “escalate at this pace” and HP’s CEO said the 2nd half of next year will be “particularly challenging” and HP will raise PC prices if necessary. The three PC giants all held quarterly earnings conferences recently

-

Bodes well for Micron

-

What are the thoughts on the upcoming earnings report

-

They will beat and raise. The company has a captive market and the wind at its back. What I see(and saw when we invested) is a secular shift in their key memory segments. Next year we are looking at $20 eps. It's multiple is very low and it should rerate when the shift is confirmed.

-

A lot to be said about this result and its wider positive flow on effect. But for now:

Micron Technology has just delivered an absolutely stellar fiscal Q1 2026 performance, shattering records and fuelling explosive growth driven by insatiable AI demand.

The company posted record-breaking revenue of $13.64 billion, a massive leap from $8.71 billion in the same quarter last year, whilst non-GAAP earnings per share soared to $4.78, trouncing analyst consensus of around $3.95.

But the real showstopper? Micron's jaw-dropping Q2 guidance: revenue guided to approximately $18.7 billion (± $400 million) – that's a staggering nearly 32% above the Wall Street consensus of about $14.2 billion – with adjusted EPS at $8.42 (± $0.20), almost double what analysts were expecting. Think about that. The expected guide was $4.xx and they said 'hold my beer-how about $8 bucks .Gross margins are projected to hit an astonishing 68% which is 30 whole points higher than last year, underscoring phenomenal pricing power in HBM and DRAM amid tight supply.

This is a proper drop-the-mic moment for Micron: HBM supply sold out for all of 2026 (including cutting-edge HBM4), data centre revenue at all-time highs, and CEO Sanjay Mehrotra signalling continued strength through fiscal 2026 on booming AI infrastructure spend. He also said demand is so great that the TAM, thought to be 100b by 2030 will now be that big by 2028. Now think about what that means for the wider GPU, rack scale demand cf the noise. Happy days.

-

Nice summary to get some perspective on just how big these results and this is a great set up for 2026 across the board.

Micron just delivered a gross margin of 56.8%, up from 45.7% last quarter, and is guiding to 68% next quarter, with further expansion expected in FY26.

For the quarter, management reported gross margin expansion of 1,110 basis points to 56.8% and is guiding to 68% next quarter—another 1,120 basis points of improvement.What Morgan Stanley is saying:

“This earnings result is the biggest surprise in U.S. semiconductor history, excluding Nvidia.”

Translation:

Micron’s earnings beat was exceptional, on a scale rarely seen in semiconductors.

Only Nvidia’s AI-driven blowouts over the past two years were larger.

Morgan Stanley is explicitly putting Nvidia in its own historical category.

This wording is deliberate. Analysts do not use phrases like “biggest in history” lightly.

Why Micron’s blowout matters for Nvidia (and not negatively)

Micron’s results confirm three structural tailwinds that directly support Nvidia:- AI memory demand is real and accelerating

HBM (high-bandwidth memory) demand is surging.

Every Nvidia GPU requires large amounts of HBM.

Strong Micron results mean Nvidia’s supply chain is tightening, not weakening.

GPUs do not ship without memory. Micron just confirmed the constraint is supply, not inventory. To address that the company is going 'further and faster' re it's fab build out and have committed $20B - Data-centre capex is expanding, not peaking

Micron guided to multiple quarters of sustained strength.

That implies hyperscalers are still increasing spend.

Nvidia remains the primary beneficiary of that capex.

This directly undermines the “AI digestion” or “capex pause” narrative—again. - Pricing power is returning across the stack

Micron demonstrated both margin expansion and pricing leverage.

When upstream suppliers regain pricing power, it usually means:

– Customers are less price-sensitive

– Demand urgency outweighs cost concerns

That is exactly the environment in which Nvidia performs best.

- AI memory demand is real and accelerating

-

And the winner for the Year goes to: MICRON

And given its 1 yr Fwd PE is a mere 7 (base on $40 eps), it's still looking very cheap.