-

Based on this info should we see a good next quarter …

-

Yes we should. We are def looking for QoQ restoration of the story

-

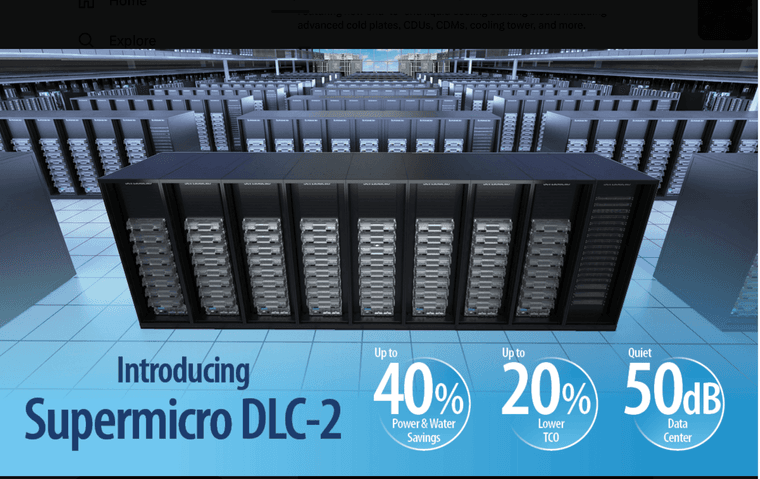

This is DLC-2-the ability to deliver racks > 250Kw. We believe the primary customers for this are Meta and Xai

-

Positive Highlights from SMCI Q3 2025 Earnings Call

Robust Revenue Growth:

SMCI reported Q3 fiscal 2025 revenue of $4.6 billion, driven by strong demand for AI infrastructure and data centre solutions (70% of revenue).Confident Q4 Guidance:

SMCI issued Q4 revenue guidance of $5.6 billion to $6.4 billion, indicating sequential growth and confidence in recovering demand.

Non-GAAP EPS for Q4 is projected at $0.40 to $0.50, reflecting anticipated operational improvements despite a one-time inventory write-down impacting Q3.

Charles Liang’s $6 Billion Minimum Outlook, a record if achieved:Liang’s commentary highlighted a robust pipeline and production capacity, supporting the potential to meet or exceed $6 billion in quarterly revenue, particularly as shipments of NVIDIA’s Blackwell GPUs accelerate.

Reasons for Timing Differences:

Q3 revenue and EPS ($4.6 billion and $0.31, respectively) fell short of expectations due to delayed customer commitments, as clients evaluated AI platforms and transitioned from NVIDIA’s Hopper to the forthcoming Blackwell GPUs.

Charles Liang clarified that these delays stemmed from strategic pauses by customers awaiting next-generation technology, not from lost market share, and SMCI is well-positioned to deliver these solutions this Quarter and next. This is highly credible due to the companies key customers(Meta and Xai)Confidence in June, September, and Beyond:

Liang expressed strong confidence that delayed commitments would materialise in the June and September quarters (Q4 FY2025 and Q1 FY2026), driven by Blackwell GPU availability and SMCI’s ready capacity for liquid-cooled AI solutions.He reiterated a long-term revenue target of $40 billion for fiscal 2026, supported by a growing product pipeline, underutilised production capacity in the USA, Taiwan, and Malaysia, and robust customer engagements.

Malaysian DLC Expansion:

SMCI highlighted its expansion of Direct Liquid Cooling (DLC) capabilities in Malaysia, enhancing production capacity to meet rising demand for energy-efficient, high-performance AI data centre solutions.Charles Liang’s comments in the Q3 2025 earnings call tie directly to xAI and Meta, two US-based customers with massive AI CapEx commitments, believed to be among SMCI’s key clients. Their focus on bleeding-edge AI technology, as Liang noted, makes them highly sensitive to transitions like NVIDIA’s B200 and B300 systems, leading to delayed Q3 2025 orders as they awaited Blackwell availability. This contributed to the US geographic segment’s revenue decline in March, supporting the timing difference narrative. Liang’s confidence in Q4 recovery ($5.6–$6.4 billion) and fiscal 2026 ($40 billion) reflects SMCI’s strong positioning to serve xAI’s Colossus and Meta’s Llama 4 projects with first-to-market Blackwell solutions.

Liang highlighted the DLC-2 (Direct Liquid Cooling-2) total IT solution as a transformative offering, with a full reveal planned for the Supermicro Innovate- CEO Keynote at Computex 2025 on 19 May 2025.

Key points from Liang’s remarks include:

Competitive Advantage: Liang stated that the DLC-2 solution would place SMCI “firmly ahead of the competition,” positioning the company as a leader in AI and high-performance computing (HPC) infrastructure. He attributed this to SMCI’s ability to deliver end-to-end, plug-and-play solutions optimised for next-generation AI workloads.

Components: The DLC-2 solution integrates compute, GPU, storage, networking, rack-scale infrastructure, cabling, advanced liquid cooling (including cold plates, coolant distribution units [CDUs], manifolds, and water towers), and end-to-end management software (e.g., SuperCloud Composer).Liang referenced ongoing progress with SMCI’s Datacenter Building Block Solutions (DCBBS) and DLC technologies in Q3, noting that the upcoming reveal would showcase a comprehensive solution to address customer needs for rapid deployment and energy efficiency. The Computex 2025 keynote is the likely venue for this unveiling, aligning with SMCI’s history of showcasing innovations at this event.

In my opinion we are now at the very bottom of the cycle. The regulatory issues are behind us. The company actually generated record operating cashflow of > $600M during the quarter. One must question what is the risk/reward for short sellers now, given the guidance: Ending 2025(June with $22B-ish(2024 $15) and reiterating $40B+ for the next 12 months with better margins.

With the exception of Nvidia, SMCI has been the greatest investment we have made. Buying at $25, selling at $75 and getting back in at $26.50. It's been a tough year for the company however we've done very well and are now holding with a significant margin of safety (and used profits to reinvest).

-

You could look it another way. After cashing-in we had an opportunity to buy in again at the ground floor. $30 is far too low imo. There is far more to DLC-2 than meets the eye. The big money is in services 'data centre as a service or DCAAS' see below.

-

Let's see how close our thoughts are on what he announces at Computex in 10-12 days. It's very easy to think their expenditure is up, profits down but fail to understand why:

Fiscal Year 2024: R&D spend $463 million, a substantial 50% increase from FY 2023. 2025 to date(3 quarters) is $452M. They are cooking us something important.

Charles Liang's discussion of DLC-2 likely refers to Supermicro's "Datacentre Building Block Solutions" (DCBBS), a comprehensive, modular approach designed to streamline the construction and operation of AI-ready data centres. This initiative aims to significantly reduce deployment times and enhance efficiency in data centre operations.

What Is DCBBS?

Supermicro's DCBBS is a holistic solution that integrates various components necessary for modern data centres, including:

AI compute hardware

Servers and storage systems

Networking infrastructure

Racks and cabling

Direct Liquid Cooling (DLC) systems

Facility water towers

End-to-end management software

Onsite deployment services and maintenance

This integrated approach allows for the transformation of smaller or older facilities in as little as six months, compared to the traditional three-year timeline for building new AI-ready data centres .

What Makes It Unique?

End-to-End Integration

Most competitors offer piecemeal solutions—servers, cooling, or facility services separately. Supermicro combines:Hardware (AI compute, storage)

Direct Liquid Cooling (DLC)

Water towers and facility retrofitting

Software and management tools

Full deployment & support services

→ This "one-stop shop" model is rare in the industry.Accelerated Deployment Time

Traditional data centers take 2–3 years to build or retrofit for AI. Supermicro claims DLC-2 deployments can be completed in 6 months—a major edge in a rapidly evolving market.Focus on AI-Ready Infrastructure

With the explosion in generative AI and HPC (high-performance computing), cooling and density are critical. Their DLC technology allows high-density AI clusters with up to 40% power savings—tailored for AI, not legacy enterprise needs.Facility-Level Offerings (e.g., water towers)

Most server companies stop at rack-level. Supermicro extends to infrastructure-level engineering—rare for a server vendor and appealing for customers who don’t want to coordinate multiple vendors.Branching out into services and full-stack solutions like DLC-2 is strategically smart and likely very positive for margins, especially for these reasons:

Why Services Improve Margins

Higher Gross Margins than Hardware Alone

Traditional server hardware is a low-margin, competitive business (gross margins typically ~10–20%).

Services — especially consulting, integration, cooling infrastructure, and ongoing management — often carry gross margins of 30–60%.

Supermicro moving upstream into design, deployment, and facilities management lets it capture this premium layer.

Recurring Revenue Streams

Ongoing management, monitoring, support, and cooling infrastructure maintenance can generate recurring revenue, unlike one-time hardware sales.

This creates more financial predictability and long-term customer lock-in.

Bundling Power

By offering a "one-stop shop," Supermicro can bundle solutions, increasing deal size and customer dependency — and reduce pricing pressure compared to commoditised hardware sales.

This can help defend margins even as competition intensifies.

Differentiation Reduces Price Wars

Unlike Dell, HPE, or Lenovo (which largely still compete on specs and price), Supermicro’s unique full-stack data centre approach makes it harder to directly compare or undercut.

That strategic differentiation supports better pricing power.

Upsell & Cross-sell Opportunities

Once Supermicro owns the physical and digital infrastructure, it’s in prime position to sell additional capacity, upgrades, or services — all with higher margins.

Big Picture

This evolution from hardware seller to infrastructure enabler shifts Supermicro up the value chain — much like how AWS began with servers and now dominates cloud services. If Supermicro executes well, this could materially boost long-term profitability and valuation multiples.

Notable/interesting strategic partnerships:

Eviden (an Atos business)

Announced in March 2024, Supermicro and Eviden joined forces to distribute AI SuperClusters based on the NVIDIA GB200 NVL72 architecture across EMEA and South America. These clusters are optimised for training and inference of large AI models. Eviden has been selected as a vendor for StargateVAST Data

Supermicro and VAST Data announced their partnership in February 2024 to offer a unified AI platform that combines VAST’s disaggregated storage architecture, Supermicro’s high-performance servers, and NVIDIA GPUs. This platform simplifies deployment and scaling of AI pipelines.Motivair

Supermicro has formed a strategic collaboration with Motivair to deliver direct liquid cooling (DLC) solutions, including use of Motivair’s Dynamic Cold Plate Technology. This supports high-performance computing workloads while reducing thermal loads in rack-scale environments, even in facilities without centralised chilled water.Sovico Group

In September 2024, Supermicro signed a Memorandum of Understanding (MoU) with Vietnam's Sovico Group to collaborate on AI data centre development. This partnership aims to support the build-out of an AI data centre ecosystem in Vietnam, aligning with Supermicro's DCBBS approach.Borealis Data Centre (Iceland/Finland)

Announced in August 2024, Borealis Data Center now supports Supermicro for comprehensive post-sales services, enhancing its AI and High-Performance Computing (HPC) offerings. This collaboration provides AI enterprises with improved response times, high-quality service, and scalability, reinforcing Supermicro's Total IT Solution strategy. -

Adam ..it’s very interesting reading your posts here and then reading what information is featured on line etc …just seen one this morning from Alpha whose headline was …SMCI un investable is an understatement….polar opposites….must really frustrate and annoy you

-

It doesn't annoy me :). I'm used to seeing such articles. Written by attention seekers(and paid by others to write it) who have been consistently wrong on the industry and AI's obvious potential. This author wrote a scathing article on Broadcom in September 24 when the stock was $160(SELL rating)-months later the stock was $250. Called Apple a 'disaster' in May 2024($175) and the stock went on to $260 and issued a SELL report on Twilio in Dec 2022 when the stock was $48. Twilio exploded from that date to $150-We sold at $140 btw.

The common denominator with these 'experts' is they churn out copious amounts of 'research'. Research is defined as 1 hour to formulate a narrative to support their, usually paid-for negative opinion. And that is what you need to understand. Most of this garbage is produced at the request of someone short. Someone with an agenda.

Remember when at last Earnings Jensen Huang said ‘now that Blackwell is out you won’t be able to give Hopper away’

This weekHuang said that, Supermicro got pinched by companies seeing Blackwell and Blackwell Ultra GPU systems, who didn’t cancel orders so much as push them out with the new and improved compute engines and interconnects that come with Blackwell machines.

In other words SMCI took a hit from that comment and Huang acknowledged it!

I think SMCI will be a big turn around story. I am quite sure they have XAi and Meta as customers, amongst others-there is some evidence they will supply the Stargate project. We know what these customers are spending. We know they want GB300 given its 40X increase in perf over GH200. I'm prepared to give them a couple of quarters to deliver that. This quarter should be good(June), September should be 'massive' (7-8B) and upwards significantly from there.

Given we are in @$26.50, there is a nice margin of safety

Edited to add: This investment in particular is classic Risk Vs Reward. Our risk is low, having already realised 200% so nobody can take that away from us, both literally and figuratively.

As everyone knows, with quarterly reporting, anything goes when you are dealing with a fast paced industry, an architecture (iterations) changing annually. Quarterly results will be clunky but the trend is quite clear.

You can not look at a headline gross margin and say 'it fell' = bad-well a financial illiterate will (my point) but what goes into 'gross margin' a whole lot of costs unassociated with the corresponding revenue. Factory improvement/depreciation, all factory labour cost and overhead, tooling. 20-30 million of costs plus $100M hopper provisions which may reverse. The company is spending a lot of money preparing for the big roll out. Given where we sit today, they now deserve a couple of quarters to show us their hand.

-

Breaking news:

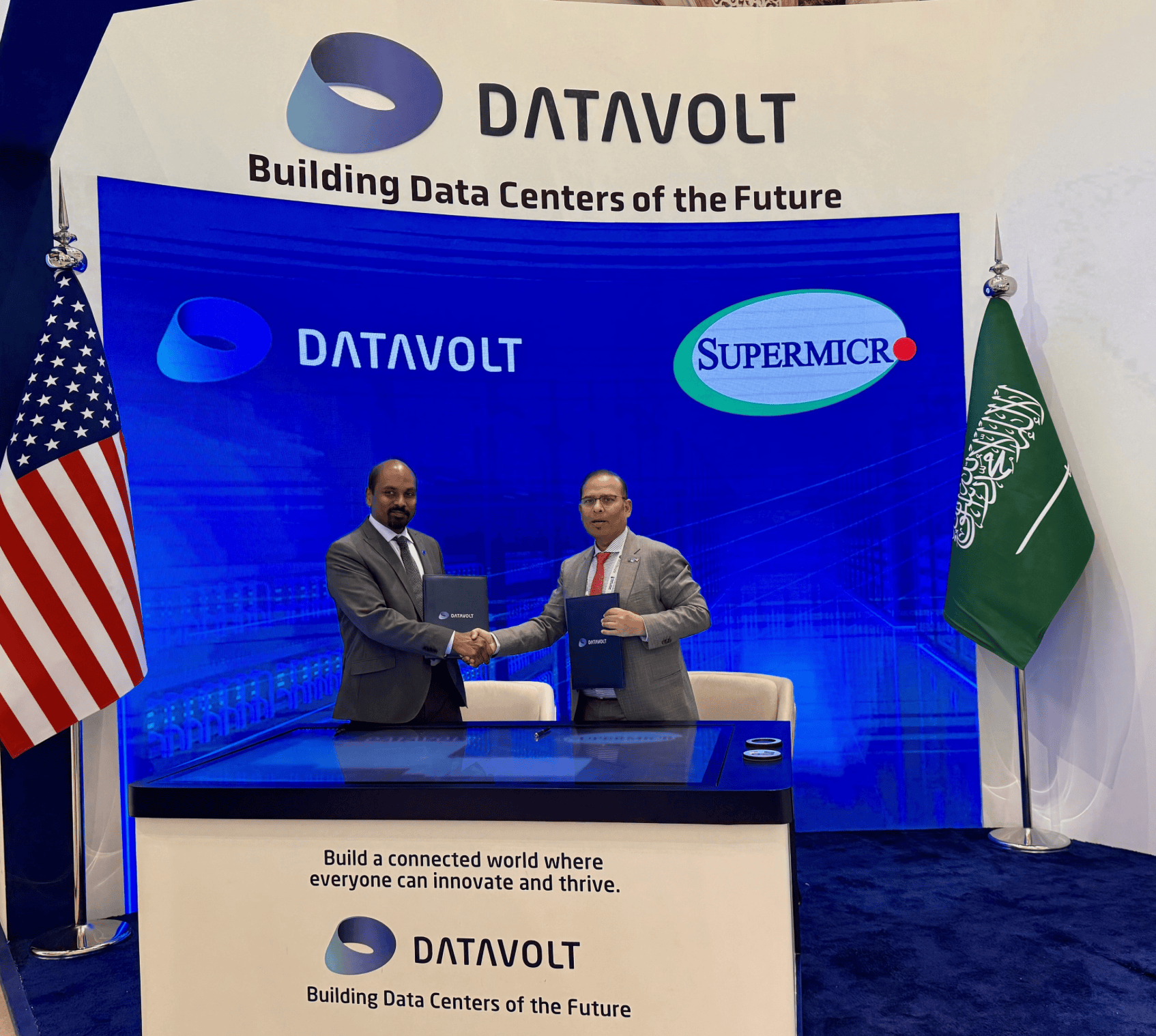

DataVolt Announces Landmark Deal with Supermicro to Accelerate Adoption of Rack-Scale Total Liquid Cooling IT Solutions for Future-Ready AI Data Centres

This announcement details a significant multi-year partnership between DataVolt, a Saudi Arabian data center company, and Super Micro Computer , a U.S.-based leader in energy-efficient server solutions. The agreement, valued at $20 billion, aims to accelerate the delivery of advanced GPU platforms and rack systems for DataVolt’s hyperscale AI campuses in Saudi Arabia and the U.S. Key points include:

Strategic Alignment: DataVolt’s CEO, Rajit Nanda, highlighted the favourable business environment fostered by the Trump Administration and Saudi Arabia’s Crown Prince Mohammed bin Salman, emphasising renewable energy and net-zero green hydrogen power paired with cutting-edge server technology.Sustainability and Scale: The partnership leverages U.S.-made supply chains for GPU systems, enabling DataVolt to scale its investments while prioritizing sustainability.

Innovation Hub: Supermicro’s CEO, Charles Liang, emphasised the collaboration’s role in advancing AI and compute infrastructure, supporting Saudi Arabia’s ambition to become a global technology hub.

Take away: We spoke about their efficiency and the fact that they are the only US rack scale manufacturer which would have benefits. Great news for Supermicro. It's a huge endorsement for their best in class systems and will it be the first of many 'Saudi-region' deals.

The stock is $42 in Pre-market

-

Alpha maybe eating humble pie this week

-

Talk about eating a foot sandwich-timed to perfection.

The over riding facts which only a fool would ignore are:

SMCI make the best racks bar none, using a system that is in very high demand now and will soon be indispensable. If you aren't using DLC you aren't making a viable data centre. Anyone who says AI racks are a commodity and 'anyone can build them' is talking out of their rear. Efficiency matters when you're burning $2M/day in power costs. A current NVL-72 is hoovering 130KW/hr, even at 12c/kwh thats $16/rack per hour or $384/day. Musk will scale to 1 million chips within 8 months(Xai)-thats $5.3M per day in power. If you can buy a rack which saves up to 40%(power) don't you think it will be a strong proposition. Clear some have different views but there is an idiot born every minute.

-

-

The company has confirmed this week:

-

Increased DLC monthly capacity to 3,000 racks. Up from 2,000 in December. It's worth noting these are currently $3-$4M racks and will soon be 5-6M with GB300.

-

By December they will have $50B revenue run rate (capacity).

But it's not enough! NB: A new Saudi facility is approved, clearly a strong signal of many more projects in the pipe line.

Plans.

Silicon Valley Green Computing Park (B20-B23)

Rack-scale integration with liquid coolingDatacentre BBS and cloud services-this part of SMCI 4.0 which will be discussed in detail next week at Computex.

APAC Science and Tech Centre (B62)

New land under negotiation for B63Supermicro Malaysia Campus with partners

High-volume subsystem and rack-scale production onlineFuture site plans

New Silicon Valley facilities in progress (B31, B32)New Silicon Valley facility in progress (#1081, Milpitas)

New BV (Netherlands) production facility in progress

New US site in plan – East Coast

New Saudi Arabia and other international sites in plan

-

-

The future is bright …the future is SMCI…looking exciting and good for the share price

-

clearly they are planning for way beyond $50B annual run rates.

Not speculation-they are Nr 1 in Generative AI systems and their AI side of the business grew 500% YoY.I want to see them return to a tax paid Net margin of 10% min. I think with scale and DCAAS (DC as a service) they will. But I work off of, say $50B = $5B net

-

Supermicro Introduces DLC-2, the Next Generation of its Direct-to-Chip Liquid-Cooling Solution

Featuring new end-to-end liquid cooling building blocks including advanced cold plates, CDUs, CDMs, cooling tower, and more.

Acronyms:

CDU-Cooling Distribution Units

CDM-Cooling Distribution Manifold

Cooling Towers

and more

50dB is quiet. A typical data centre is in the 92-96dB range. Irradiating noise is significant plus for employees and the neighbouring environment.

Details are starting to emerge and will peak next week when it is formally launch at Computex.

-

The company is touting this as revolutionary. We will see

Don’t miss , CEO and Founder of Supermicro, as he unveils our revolutionary Data Center Building Block Solutions

(DCBBS) at Supermicro Innovate!

(DCBBS) at Supermicro Innovate!

-

Good article here explaining whats new with SMCI DLC-2. Previously just the GPU/CPU had cold plates, the latest systems have cold plates on all the major components inc memory, power supplies, voltage regulators etc.

https://www.nextplatform.com/2025/05/15/pushing-ai-system-cooling-to-the-limits-without-immersion/

Nice to see SMCI lead the market with these developments