-

It doesn't annoy me :). I'm used to seeing such articles. Written by attention seekers(and paid by others to write it) who have been consistently wrong on the industry and AI's obvious potential. This author wrote a scathing article on Broadcom in September 24 when the stock was $160(SELL rating)-months later the stock was $250. Called Apple a 'disaster' in May 2024($175) and the stock went on to $260 and issued a SELL report on Twilio in Dec 2022 when the stock was $48. Twilio exploded from that date to $150-We sold at $140 btw.

The common denominator with these 'experts' is they churn out copious amounts of 'research'. Research is defined as 1 hour to formulate a narrative to support their, usually paid-for negative opinion. And that is what you need to understand. Most of this garbage is produced at the request of someone short. Someone with an agenda.

Remember when at last Earnings Jensen Huang said ‘now that Blackwell is out you won’t be able to give Hopper away’

This weekHuang said that, Supermicro got pinched by companies seeing Blackwell and Blackwell Ultra GPU systems, who didn’t cancel orders so much as push them out with the new and improved compute engines and interconnects that come with Blackwell machines.

In other words SMCI took a hit from that comment and Huang acknowledged it!

I think SMCI will be a big turn around story. I am quite sure they have XAi and Meta as customers, amongst others-there is some evidence they will supply the Stargate project. We know what these customers are spending. We know they want GB300 given its 40X increase in perf over GH200. I'm prepared to give them a couple of quarters to deliver that. This quarter should be good(June), September should be 'massive' (7-8B) and upwards significantly from there.

Given we are in @$26.50, there is a nice margin of safety

Edited to add: This investment in particular is classic Risk Vs Reward. Our risk is low, having already realised 200% so nobody can take that away from us, both literally and figuratively.

As everyone knows, with quarterly reporting, anything goes when you are dealing with a fast paced industry, an architecture (iterations) changing annually. Quarterly results will be clunky but the trend is quite clear.

You can not look at a headline gross margin and say 'it fell' = bad-well a financial illiterate will (my point) but what goes into 'gross margin' a whole lot of costs unassociated with the corresponding revenue. Factory improvement/depreciation, all factory labour cost and overhead, tooling. 20-30 million of costs plus $100M hopper provisions which may reverse. The company is spending a lot of money preparing for the big roll out. Given where we sit today, they now deserve a couple of quarters to show us their hand.

-

Breaking news:

DataVolt Announces Landmark Deal with Supermicro to Accelerate Adoption of Rack-Scale Total Liquid Cooling IT Solutions for Future-Ready AI Data Centres

This announcement details a significant multi-year partnership between DataVolt, a Saudi Arabian data center company, and Super Micro Computer , a U.S.-based leader in energy-efficient server solutions. The agreement, valued at $20 billion, aims to accelerate the delivery of advanced GPU platforms and rack systems for DataVolt’s hyperscale AI campuses in Saudi Arabia and the U.S. Key points include:

Strategic Alignment: DataVolt’s CEO, Rajit Nanda, highlighted the favourable business environment fostered by the Trump Administration and Saudi Arabia’s Crown Prince Mohammed bin Salman, emphasising renewable energy and net-zero green hydrogen power paired with cutting-edge server technology.Sustainability and Scale: The partnership leverages U.S.-made supply chains for GPU systems, enabling DataVolt to scale its investments while prioritizing sustainability.

Innovation Hub: Supermicro’s CEO, Charles Liang, emphasised the collaboration’s role in advancing AI and compute infrastructure, supporting Saudi Arabia’s ambition to become a global technology hub.

Take away: We spoke about their efficiency and the fact that they are the only US rack scale manufacturer which would have benefits. Great news for Supermicro. It's a huge endorsement for their best in class systems and will it be the first of many 'Saudi-region' deals.

The stock is $42 in Pre-market

-

Alpha maybe eating humble pie this week

-

Talk about eating a foot sandwich-timed to perfection.

The over riding facts which only a fool would ignore are:

SMCI make the best racks bar none, using a system that is in very high demand now and will soon be indispensable. If you aren't using DLC you aren't making a viable data centre. Anyone who says AI racks are a commodity and 'anyone can build them' is talking out of their rear. Efficiency matters when you're burning $2M/day in power costs. A current NVL-72 is hoovering 130KW/hr, even at 12c/kwh thats $16/rack per hour or $384/day. Musk will scale to 1 million chips within 8 months(Xai)-thats $5.3M per day in power. If you can buy a rack which saves up to 40%(power) don't you think it will be a strong proposition. Clear some have different views but there is an idiot born every minute.

-

-

The company has confirmed this week:

-

Increased DLC monthly capacity to 3,000 racks. Up from 2,000 in December. It's worth noting these are currently $3-$4M racks and will soon be 5-6M with GB300.

-

By December they will have $50B revenue run rate (capacity).

But it's not enough! NB: A new Saudi facility is approved, clearly a strong signal of many more projects in the pipe line.

Plans.

Silicon Valley Green Computing Park (B20-B23)

Rack-scale integration with liquid coolingDatacentre BBS and cloud services-this part of SMCI 4.0 which will be discussed in detail next week at Computex.

APAC Science and Tech Centre (B62)

New land under negotiation for B63Supermicro Malaysia Campus with partners

High-volume subsystem and rack-scale production onlineFuture site plans

New Silicon Valley facilities in progress (B31, B32)New Silicon Valley facility in progress (#1081, Milpitas)

New BV (Netherlands) production facility in progress

New US site in plan – East Coast

New Saudi Arabia and other international sites in plan

-

-

The future is bright …the future is SMCI…looking exciting and good for the share price

-

clearly they are planning for way beyond $50B annual run rates.

Not speculation-they are Nr 1 in Generative AI systems and their AI side of the business grew 500% YoY.I want to see them return to a tax paid Net margin of 10% min. I think with scale and DCAAS (DC as a service) they will. But I work off of, say $50B = $5B net

-

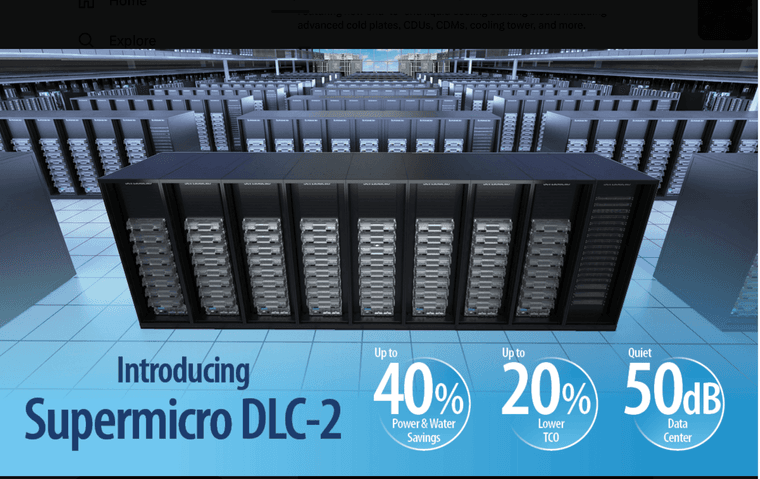

Supermicro Introduces DLC-2, the Next Generation of its Direct-to-Chip Liquid-Cooling Solution

Featuring new end-to-end liquid cooling building blocks including advanced cold plates, CDUs, CDMs, cooling tower, and more.

Acronyms:

CDU-Cooling Distribution Units

CDM-Cooling Distribution Manifold

Cooling Towers

and more

50dB is quiet. A typical data centre is in the 92-96dB range. Irradiating noise is significant plus for employees and the neighbouring environment.

Details are starting to emerge and will peak next week when it is formally launch at Computex.

-

The company is touting this as revolutionary. We will see

Don’t miss , CEO and Founder of Supermicro, as he unveils our revolutionary Data Center Building Block Solutions

(DCBBS) at Supermicro Innovate!

(DCBBS) at Supermicro Innovate!

-

Good article here explaining whats new with SMCI DLC-2. Previously just the GPU/CPU had cold plates, the latest systems have cold plates on all the major components inc memory, power supplies, voltage regulators etc.

https://www.nextplatform.com/2025/05/15/pushing-ai-system-cooling-to-the-limits-without-immersion/

Nice to see SMCI lead the market with these developments

-

Supermicro (SMCI) Embarks on Major Recruitment Drive in Saudi Arabia Following a $20 Billion Agreement

Supermicro has been actively recruiting in Saudi Arabia for roughly the past month. The positions are quite varied, spanning roles such as Senior Service Engineer and Senior Sales Manager.

Notably, as previously highlighted, Supermicro began its hiring efforts in Saudi Arabia even before officially announcing its partnership with DataVolt. This reflects the strong trust that the global leader in liquid-cooled AI rack solutions has in its new Saudi collaborators.

In a further noteworthy update, Supermicro has unveiled its latest innovation, the DLC-2, a cutting-edge liquid-cooling system designed to cut water and energy use in data centres by up to 40 percent. The technology is also said to lower a data centre’s Total Cost of Ownership (TCO) by as much as 20 percent.

These reductions are made possible by expanding the cold plate coverage across server components, which enables fewer fans to operate at reduced speeds.

Moreover, Supermicro’s DLC-2 liquid-cooling system can reportedly capture 98 percent of the heat produced by a server rack, allowing for higher inlet liquid temperatures (up to 45 degrees Celsius). The company states:

This is, naturally, a significant benefit for data centres in Saudi Arabia’s desert environment, where high daytime temperatures and limited water availability pose challenges.SMCI has officially confirmed it is building a factory in Saudi. Clearly, they expect many more deals in the ME-and why not. They seem to have the best product for the job!

-

Nice. The Godfather of AI is joining Charles Liang which is a big endorsement 5pm GMT tomorrow.

-

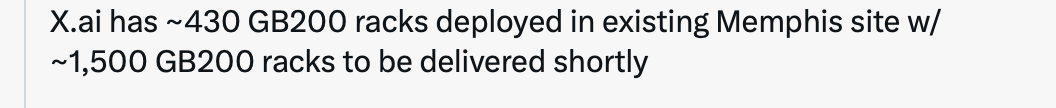

Elon Musk commented on June 2, 2025, about the Colossus 2 supercomputer. According to a Washington Post article published on June 1, 2025, Musk told CNBC that Colossus 2, described as the world’s “first gigawatt-class training cluster,” is expected to come online “in about six months, maybe nine,” implying a timeline of approximately December 2025 to March 2026

What we know so far :

168 Tesla Mega packs are onsite as of May 2025. This will provide 700MW in back up power.

The project is for +800,000 B200 and B300 chips. All Blackwell and liquid cooled.

Worst case scenario the racks will start being installed July through March. This is Q1, Q2 and Q3 of SMCI FY 2026.

The total rack spend is $40-$44 billion.

Based on Dell's own public statements they have secured $5 billion-actually their exact comment was ' we are close to securing $5B'

At the end of May Dell stated their backlog was $12 Billion, throwing shade over their historical 50% share of Xai projects! 50% would be min $20 billion, coupled with the fact Dell have other customers.

Dell has never supplied Xai with any DLC.

SMCI have set up local operations to support Xai long term. A very good sign of material collaboration.

It is yet to be confirmed but I think SMCI have secured 35-39 billion or 88% of the Colossus-2 expansion.

If true they will very soon file an 8-K noting material additional funding via debt, convertibles and possibly equity to support this project.

Do they have the capacity to deliver 10,000+ racks over 9 months? Yes they do. Current capacity is somewhere north of 2,500 DLC racks per month with a plan to expand to 5,000 pm within the next 18 months. 3k by Dec......

Is the Q1 guide about to sing? Probably

-

Nvidia’s quantum computing alliance with Supermicro, Quanta, and Compal is seriously interesting stuff.

Blackwell GPUs, are at the heart of it, powering hybrid quantum-classical setups that crunch data for things like quantum simulations or cracking optimisation puzzles.

Rubin & Feynman, Nvidia’s next-gen architecture (whispered to drop around 2026), could take this further, maybe with bespoke quantum control tech for tighter integration.Supermicro’s job? Building racks that make this magic happen. They’re designing setups with cryogenic chambers to keep quantum chips frosty at near absolute zero, right next to liquid-cooled Blackwell GPUs. High-speed Ethernet or InfiniBand ties it all together, ensuring quantum and classical bits talk without lag. They’re also adding electromagnetic shielding to stop qubits throwing a wobbly. These modular racks let researchers swap parts as quantum tech grows, making it practical for real-world uses like drug discovery or super-secure networks. With Taiwan’s Quanta testing hardware and Compal running simulations, this isn’t just a small deal—it’s a bold step toward making quantum computing a reality

Nice to see Nvidia lean on Supermicros engineering leadership-confirming their close partnership

-

Jacob Yundt, CoreWeave’s Director of Compute Architecture, praised Super Micro Computer (SMCI) as an “incredible partner” for their collaborative approach, particularly in working on future products and implementing changes.

You don't say that unless you're currently buying their solutions. Corrweave have committed to spend $23 Billion this year on expanding their Data Centre reach. Following the crumb

-

From Elon Musk in an interview yesterday, he stated that currently he is sleeping at the Data Centre and the team are working in shifts 24/7. '110,000 GPU are just about to go in based on GB200).

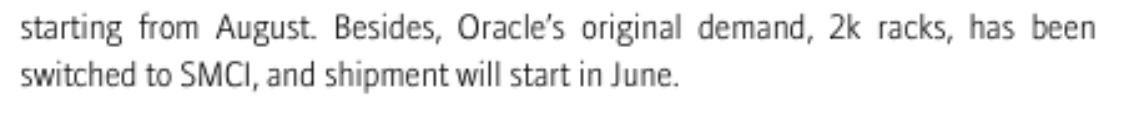

In other news, whilst it's unverified, channel checks suggest SM has won a 2k rack order from Oracle which wouldn't surprise me as SM has a long history of working with ORCL.

-

I figured subscribing to the local papers would yield some info:

On Wednesday, June 18, a Daily Memphian reporter observed dozens of natural gas turbines and energy equipment stockpiled in a field at 2979 Stateline Road West in Southaven. None of the equipment appeared to be running, but it does seem to be multiplying. Two weeks ago, the reporter saw only six or seven turbines on the same lot.

Stateline Road is the address of Xai Colossus

-

Breaking: Supermicro Announces Proposed Offering of $2.0 Billion of Convertible Senior Notes

I wonder why they need $2B

Great news