Busy couple of weeks on results front

-

Taiwan Semiconductor Manufacturing reported a nearly 42% surge in Q1 revenue, fueled by strong demand for AI servers

They also split out March(month) which was +46% i.e accelerating

-

Australia has rejected China's offer to "join hands" and respond to the escalating trade war, after U.S. President Donald Trump ramped up tariffs on Chinese goods.

"We're not going to be holding hands with China in respect to any contest that's going on in the world," Deputy Prime Minister Richard Marles told Sky News Australia.

-

I suspect anyone who 'joins hands' with China will get their arm broken by the U.S

-

A new list of goods to be exempted from the latest round of tariffs on U.S. importers was released, and it includes smartphones, PCs, servers, and other technology goods, many of which are assembled in China.

Apple is the clear, MU memory and 'other components' found in Servers

-

What an utter jerk he is though, just faffing around with stuff as it enters his tiny brain/suits him and his cronies personally. Next thing, he’ll find out that the sauce in his cheeseburger is made in China and he’ll exempt that as well. Talk about fuelling the uncertainty.

-

We all understand the frustration, Cappo. We've held 3 Investment Comm meetings over the past 3 weeks but ultimately came to the conclusion we would wait and see. Not because doing nothing was the easy option, but we believed we held quality, the man would likely pivot in short order (and what next).

The golden rule with investing, you sell when:

- You find a better opportunity for your capital

- The factors which drove your investment in the first instance have materially changed with a degree of permanency.

We didn't see tariffs having a permanent effect.

Have a good weekend, all

-

Material pops after hours on top of a solid day due to the U.S administration stating ‘ The president and the administration are setting the stage for a deal with China," she said to reporters(press sec). "Everyone involved wants to see a trade deal happen, and the ball is moving in the right direction."

We will see.

-

He is slowly having to completely back down from his ludicrous TariffTheWorld

game 🫣

game 🫣

No doubt he will then claim total victory

& Wall Street has had a bunch of fun, & I fully believe some people on the inside have made a load of money off the back of the shenanigans

️

️

Bizarre. -

Yep….its been one big cluster f,,k….mates rates for the big boys …

-

Some progress

China Halts 125% Tariffs on Semiconductor from the United States

According to the customs declaration system "Single Window" on April 24, 2025, the declared tax calculation shows that customs will cease the additional 125% tariff on integrated circuits originating from the United States.

For other goods, the additional 125% tariff will still temporarily follow the stipulations in Tax Commission Announcement No. 6 of 2025

-

Apple plans to shift assembly of all iPhones sold in the U.S. to India starting next year — from the FT.

All sounds like a lot to me and may not be an issue given movement on tariffs negotiations-although that too could change (again)

-

Reported by CNBC yesterday and a great example of the fake news which circulates to manipulate investors.

Amazon and Nvidia executives said Thursday that the construction of artificial intelligence data centres is not slowing down, as recession fears have some investors questioning whether tech companies will pull back on some of their plans.

“There’s been really no significant change,” Kevin Miller, Amazon’s vice president of global data centres, said at a conference organised by the Hamm Institute for American Energy. “We continue to see very strong demand**, and we’re looking both in the next couple years as well as long term and seeing the numbers only going up.”**

The comments run contrary to worrying buzz building on Wall Street about tech companies changing data centre buildout plans. Wells Fargo analysts said Monday that Amazon Web Services is pausing some leases on data centre commitments, citing industry sources. (fake)The magnitude of the pause was unclear, the analysts said, but the comments raised fears that Amazon was doing something similar to Microsoft’s recent move to pull back on some early stage projects. This too was fake-MSFT have cancelled some DC projects simply because OpenAI is now self reliant. Meta and GOOG assumed the lease obligations Msft walked away from but strangely committed that fact. I guess it didn't fit the 'fear' narrative.

Miller(the boss at AMZN DC)said “there’s been little tea leaf reading and extrapolating to strange results” about Amazon’s plans. In other words-nonsense

Nvidia is also not seeing signs of a slowdown, said Josh Parker, the chipmaker’s senior director of corporate sustainability.

“We haven’t seen a pullback,” Parker said. China’s artificial intelligence startup DeepSeek sparked a sell-off in power stocks earlier this year as investors worried that its artificial intelligence model is more efficient and data centers might need as much energy as originally anticipated.

But Parker said Nvidia sees compute and energy demand only rising due to AI, describing the reaction to DeepSeek as “kneejerk.” Anthropic co-founder Jack Clark said 50 gigawatts of new power capacity will be needed by 2027 to support AI. That is the equivalent of about 50 new nuclear plants. Note 50GW is an insane amount of power. Equiv to $2.5T in AI infrastructure spending

“Anthropic and the other AI companies, what we’re seeing is tremendous growth in the need for new baseload power. We’re seeing unprecedented growth,” Clark said.

The executives were speaking at a gathering of tech and energy companies at a conference in Oklahoma City organised by the Hamm Institute to discuss how the U.S. can address the growing energy needs for AI. There is a growing consensus in both industries that natural gas will be needed to meet the power needs.

-

Ok. Numpty Q here. Get ready to laugh (a lot).

Share values have been going up of late, but portfolio values haven't been quite as buoyant. I presume that's because the pound has been strengthening against the dollar, non?

If I'm looking at lists of share values and movements and comparing currency exchange rates as well then an increasing USD:GBP is bad, non?

(Yes, I iz well fick. Sorry.)

-

Amazon has launched its first 27 Project Kuiper satellites, a major milestone in its $10 billion venture to provide high-speed broadband internet from space, competing with SpaceX’s Starlink. Deployed using a United Launch Alliance Atlas V rocket from Florida, these satellites aim to connect underserved and remote areas globally. The project plans to deploy 3,236 satellites, utilising Amazon’s cloud computing expertise to challenge Starlink’s dominance.

The company will report earnings after the market close on 1 May (Thursday). Expectations are for Revenue of $155.1B and EPS $1.36

-

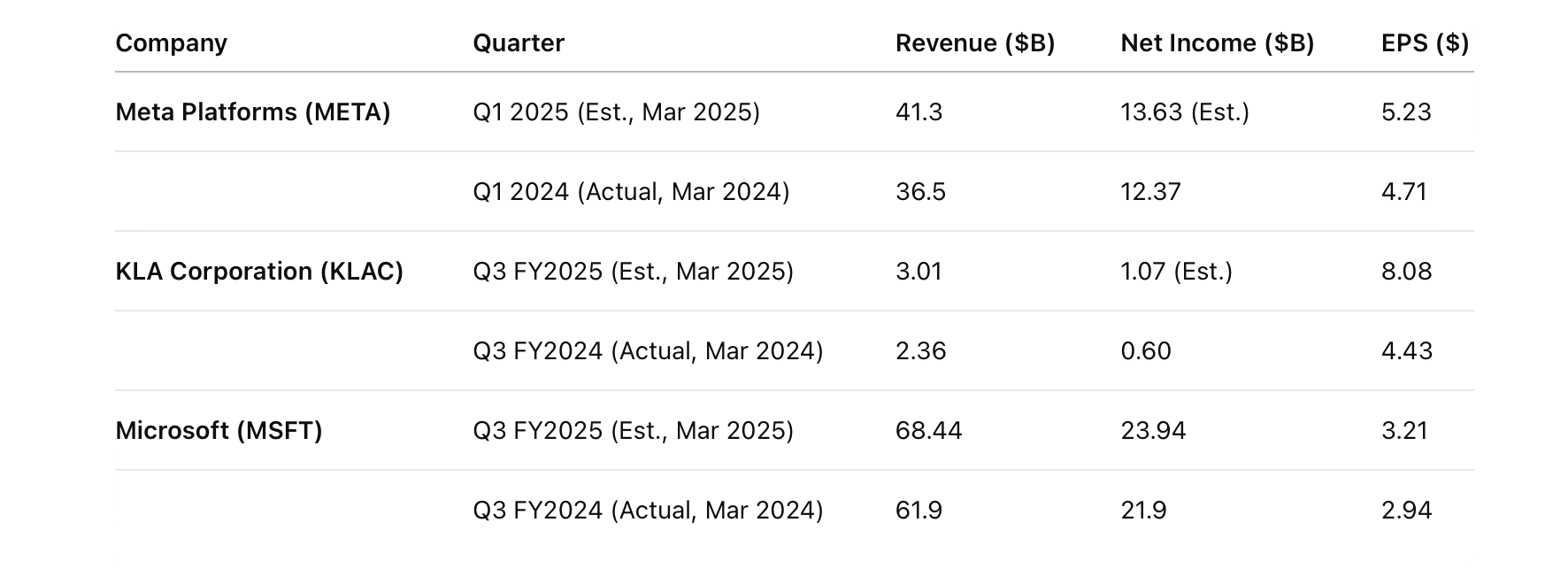

Earnings on deck tonight:

KLA

META

MSFThere are the estimates with comparative prior periods

I would expect beats, particularly for Meta. Their business is really firing. Look for comments on their chatgpt competitor.

KLA will be heavily involved in the COWOS ecosystem and we know demand and capacity expansion is very strong. Further, the cycle for smart devices has improved which should also bode well. I expect KLA to reaffirm their 2025 guides+. This is one company where we are investing in management just as much as the 'product'-they are at the top of their game.

MSFT-I expect Azure to continue to grow and for management to reaffirm their Capex ($80B) and at the same time say they have a lot more demand than their ability to supply re AI infrastructure

-

The latest slew of earnings reports confirm a common thread. Earnings are very strong(records) with the main driver being monetisation of AI driven technology which runs contrary to some suggesting the industry has yet to monetise this new productivity tool. Case in point, Meta says AI has driven a 30% increase in Reels ad spend.

The other consistent comment from CEO's is they can't get enough and they are committed to adding more capacity. Again this shuts the door on the rhetoric of bubbles and demand peaks.

There will always be choppy production and build outs-MSFT noted their data centre re-organisation, which the media took to be cancellations was in actual fact, due to some regions (they are global) running out of available power and the physical building out being slower than their needs. This is to be expected with anything new. And what we need to remember is you can't just click your fingers and have a multi billion dollar 'building' just appear. In saying that they are standing these structures up at a staggering pace.

The future for Big-Tech looks very positive. Inflation in the US, as reported yesterday is still falling, there appears to be more calm re the Trump taxation plans and we may even see some progress in the Russia/Ukraine situation.