General News

-

Notably analyst comments from CES Vegas this week....

Nvidia CEO Jensen Huang unveiled Alpamayo, a family of open models aimed at autonomous driving, and confirmed that Vera Rubin, the company’s next-generation computing platform and successor to Grace Blackwell, has entered full production.

AMD introduced a new chip, the MI440X, targeted at smaller enterprise data centres, and also launched the AMD Ryzen AI Embedded processors.

Analysts led by Dan Ives said, “We see the robotics and autonomous technology sector as an additional market opportunity for Nvidia, supporting our view that the company could surpass a $5 trillion market cap soon and potentially reach $6 trillion.”

They also noted that Nvidia’s new foundation model for autonomous vehicles is a positive for Tesla (TSLA), as it aims to accelerate AV technology and capture growth in the autonomous vehicle market over the next decade. Tesla bots use Nvidia 'brains', will they now use Nvidia ADAS stack(part)

“After CES, we are even more bullish on Nvidia and the AI revolution, as upcoming investments and technologies could usher in a new era for the tech world. Global companies are expected to deploy between $3 trillion and $4 trillion in AI capital expenditure over the next three years,” Ives added.

This year’s CES may prove pivotal, analysts said, as more IT leaders recognise a “once-in-40-year” paradigm shift in technology spending that is still unfolding.

J.P. Morgan analysts who attended keynotes from Nvidia, AMD, and Intel (INTC) expect 2026 to be another strong year for AI compute demand and a steady year for traditional PC/server demand.“Both NVDA and AMD emphasised rapid growth in inference token generation as a primary driver of compute demand, with many clients already constrained and seeking more capacity. NVDA’s Vera Rubin and AMD’s Helios MI455X platforms remain on track for customer ramp-ups in H2 2026. Both companies also highlighted physical AI as a significant, largely untapped opportunity—though NVDA appears better positioned to capture a larger share of the total addressable market,” said analysts led by Harlan Sur.

Intel showcased its Intel Core Ultra 3 Series (Panther Lake) for edge AI, delivering up to 180 TOPS and capable of handling a 70-billion parameter model. Analysts highlighted that, given concerns around cloud performance, privacy, security, and costs, localised computing is increasingly compelling. Intel is leveraging its scale and ecosystem to expand AI processing across PCs and edge devices.

Morgan Stanley analysts noted no major surprises but said confidence in Rubin should be positively received, given competitive noise around broader Tensor Processing Unit (TPU) traction in 2025. TPUs are developed by Google (GOOG). (AK-anyone who think that simply doesn't understand what TPUs can't do)

“While Rubin’s specs and timelines are unchanged, the stock remains about 10% below highs following Jensen Huang’s $500 billion comments at GTC DC. Numbers have since increased post-earnings and were reinforced today, so investor enthusiasm could return as results materialise this year,” said Joseph Moore.

Regarding AMD, analysts said there was little news to alter their stock thesis. They reaffirmed confidence in the MI455 as a leading product, supported by OpenAI as an anchor customer, expecting a strong ramp in Q3 and Q4 2026.

“AMD’s success still largely depends on robust overall compute demand rather than an emerging cost advantage versus competitors.(i.e a rising tide lifts all ships). Nvidia’s continued innovation across the tech stack may limit AMD’s near-term gains(spot on!). AMD have a very fast chip (emphasis on the single chip). They can not compete at scale. A quick recap:

AMD’s main bottleneck in large-scale AI workloads is interconnect bandwidth. While their latest chips are fast individually, AMD lacks a high-speed switch fabric comparable to NVIDIA’s NVSwitch or the upcoming Blackwell/Blink architecture.

NVSwitch enables many 1000's of GPUs to communicate with extremely low latency and coherent memory, effectively behaving like a single massive accelerator. AMD relies on standard Ethernet or InfiniBand fabrics for scale-out, which are far slower and increase latency. This limits tight multi-GPU scaling beyond a single rack. In practice, AMD excels at distributed clusters but struggles to match NVIDIA’s efficiency in tightly coupled, large-scale GPU workloads. Second, CUDA is a massive moat, without which, makes all development slower and more costly.

-

As you know Ollie we dont pay much attention to daily/weekly/monthly moves. We look for evidence of company strategy which will pay off in the longer term. Patience is key. In saying that several other holdings did very well today. Micron, KLA, Vertex. Whilst past performance is no indication of future returns, today was a very positive day I would guesstimate 5-6% ytd on tech. Micron and KLA are +20% and +15% YTD! (and for the avoidance of doubt, yes that is 2026).

-

As you know Ollie we dont pay much attention to daily/weekly/monthly moves. We look for evidence of company strategy which will pay off in the longer term. Patience is key. In saying that several other holdings did very well today. Micron, KLA, Vertex. Whilst past performance is no indication of future returns, today was a very positive day I would guesstimate 5-6% ytd on tech. Micron and KLA are +20% and +15% YTD! (and for the avoidance of doubt, yes that is 2026).

@Adam-Kay said in General News:

As you know Ollie we dont pay much attention to daily/weekly/monthly moves. We look for evidence of company strategy which will pay off in the longer term. Patience is key. In saying that several other holdings did very well today. Micron, KLA, Vertex. Whilst past performance is no indication of future returns, today was a very positive day I would guesstimate 5-6% ytd on tech. Micron and KLA are +20% and +15% YTD! (and for the avoidance of doubt, yes that is 2026).

You're right Adam - I'm being a bit naughty!

And today (yesterday) was indeed a cracking day for many companies. I'm looking forward to seeing the figures when the website updates in a couple of hours time.

-

Have the figures updated from yesterday …

-

not yet. soon im told

-

they have now!

-

I recall someone asking if we are going to make any changes shortly. Possibly. The committee meets end of next week so no decision has been made and also, we won't make changes for change sake.

-

TSM's CC Wei quote this week-he's the most conservative man in tech (he did some DD before agreeing to spend $52B this year on Capex

"I also double checked their financial status: they are very rich […] much better than TSMC."

He was referring to TSMC's major customers—the hyperscalers (e.g., companies like Microsoft, Google/Alphabet, Meta, Amazon, and others driving AI demand via Nvidia GPUs and other chips fabricated by TSMC). Wei explained that he personally spoke with them over recent months to verify that AI investments were paying off for their businesses, showing real revenue growth and strong financial returns. He "double-checked" their overall financial health to confirm they had the cash and profitability to sustain massive ongoing orders for advanced chips. -

Yep….not too bad thou..expected around 2/3% drop

-

All that matters is the big names will be reporting next week-I'm expecting record earnings all round. The tech portfolio is still the best performer in town. Past performance is no indication of future returns.

-

Or a U turn.

-

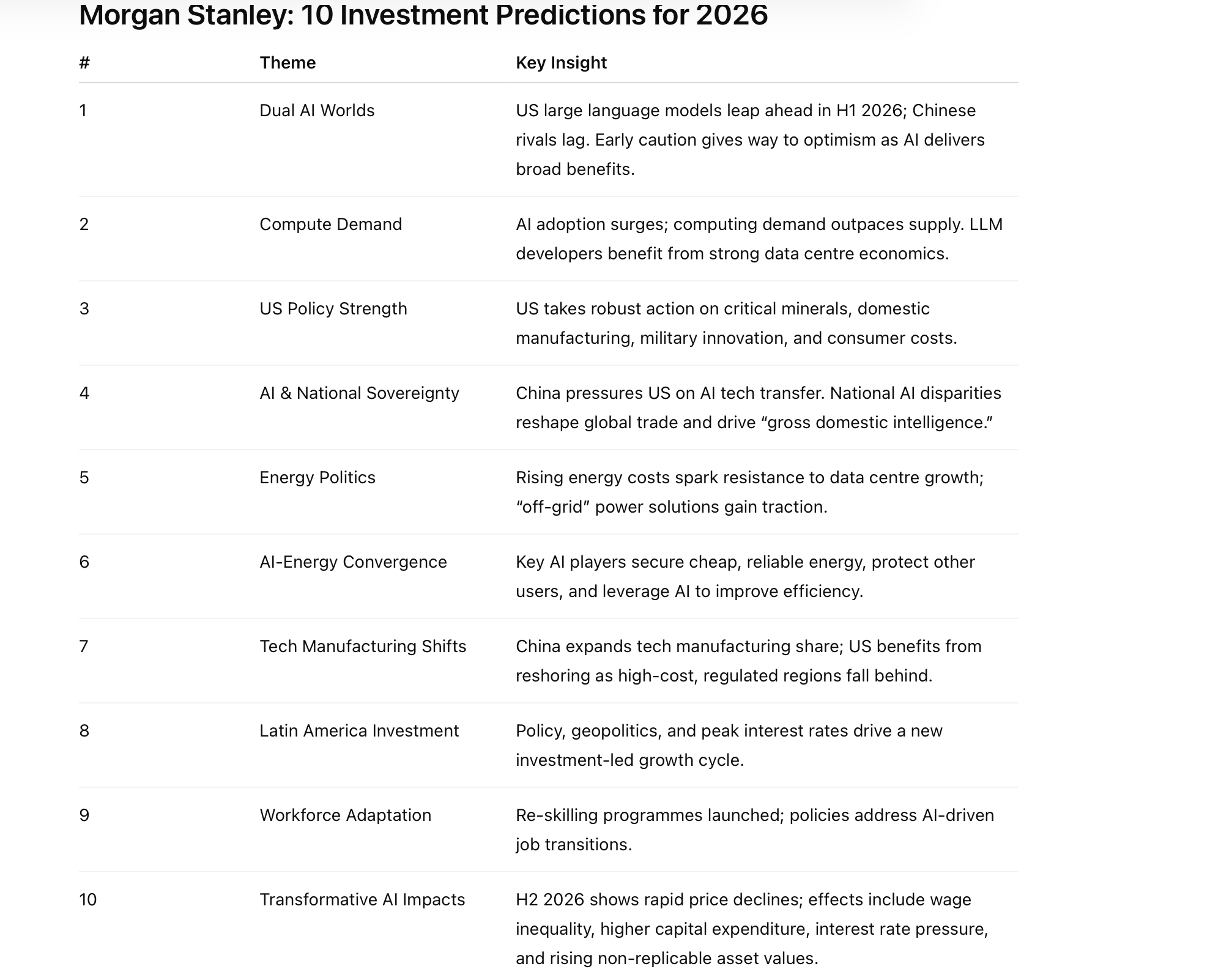

From a MS report today

-

Quick update. Both meta and msft beat nicely. Meta is plus 8% and msft is down 4%. Futures plus 250. Both results as posted earlier(solid beats). Happy with the results and regardless, the net portfolio impact is positive.

-

What a turn around that was. With metals and the Fed choice causing havoc over the weekend I was bemused, which is a good way to describe the nonsense. Checking in at 0630 seeing a sea of red a lot of head scratching ensued. Steadily back it came. But strong green(everywhere). Very nice to see.