General News

-

yes, just noticed that. It should be shortly-they are doing some maintenance . The values are up on the day

-

China sabre rattling again over rare-earth metals. What's all this noise about? Nvidia, 100%.

We said it recently, China wants better silicon, not just the nerfed H20. They want Blackwell and imo Trump will give it to them. Or at least a pathway to B200 and B300, likely as the West moves onto Rubin-just keeping them behind somewhat.

The positive take away being, Nvidis is the Star of the show and Jensen has DTs ear.

In other news It is clear that Jensens very recent praise of Elon Musk and direct investment 'in everything Elon does' is a play to counter the OpenAi/AMD deal. So now get ready for even bigger Colossus investment. SMCI are their main supplier so further business spread across the portfolio.

-

I’ll write a long piece over the weekend as to why it’s just part of the journey and ‘normal’. The portfolios have gained at unprecedented levels. Today whilst irritating is nothing but politics and posturing. Fundamentals are paramount, and they are excellent.

-

I'm of much the same opinion, but from a position of total ignorance. Trump (and I remain a fan) seems to trade in dramatic statement followed by swift pull-back. The timing of this alongside his significant achievement in Israel/Gaza is no accident.

Plus investing is a marathon, not a sprint. Rough needs to be taken with the smooth. It's been a cracking week and I have no doubt there will be more of the same to come.

-

-

So, what set off this elevator-down tumble? It’s all down to ramping US-China tensions over AI chips, sparked by Trumps comments. China slapped new curbs on rare earth exports—stuff that’s vital for semiconductors and EV batteries—and Trump hit back with threats of 100% tariffs on Chinese goods.

Yesterday’s whack showed how geopolitics can flip that script fast, cranking up the market’s “velocity asymmetry”—that term for why stocks creep up the stairs but plunge like an elevator.

Why Stocks Climb in the Long Run

Over decades, the S&P 500 (and the Nasdaq) tends to head upwards. Why? A mix of economic growth (more profits), inflation (prices creeping up), risk rewards , reinvested cash, and central banks pumping money into the system. It’s like scaling a mountain with the odd slip—overall, you’re still going up.Short-Term Chaos vs. Long-Term Drift

Short term: Loads of tiny gains, broken by sharp drops.

Long term: Those little wins pile up as recoveries build from higher spots. Compounding!What It All Means

The market ticks up more often than it drops (more good days).

But when it falls, it’s a steeper slide—the average loss beats the average gain.Cue the “stairs up, elevator down” saying. If you charted the ups and downs:

Up days are a more gentle/steady. Down days are bigger in size and move faster. These are facts based on decades of emperical data.Making Sense of It?

This is the numbers game behind “easy come, easy go.”

Psychology -wise: People ease in when confident → small, steady wins. Panic and forced sales → big, fast losses.Disposition Effect

Humans love selling winners too soon and clinging to losers way too long.

It’s a behavioural quirk that shapes the market’s “velocity asymmetry”:

The herds sell on gains → slows down the rallies.

Few bail on losses till panic sets in → sharp, quick drops.Regret & Pride

Cashing in after a gain feels like a pat on the back (proof you’re smart).

Hanging onto a loss dodges the regret of admitting you messed up.

Together, this makes climbs gradual and corrections sudden/fast.Summed Up:

“Easy come, easy go” isn’t just chat—it’s how our brains play out in the market.

Gains invite profit-taking (calm exits). Losses spark panic (quick getaways).Add millions of these gut reactions, and you get markets that shuffle up the stairs and dive down the elevator.

The Psychology Behind “Easy Come, Easy Go”

When people bag big gains, they often get itchy to lock them in—even if it means selling early or swallowing small losses later.

This has a few psychological roots-and I learned this from my wife who studied it in detail and it's a fascinating subject when applied to markets and investing. Exceptionally gifted investors and traders have a rare predisposition to manage this hard wired flawProspect Theory (Kahneman & Tversky)

We hate losing more than we love winning—losing £1 stings more than gaining £1 feels good.

Once there’s a profit cushion, it feels like “house money,” and risk feels different.

Some sell to “bank the wins” → faster profit-taking.

Others hold losing bets longer (“it’ll bounce back”) → slower recoveries.Result: Markets creep up slowly (hesitant buying) and drop fast (scared selling).

House Money Effect Gains feel like free cash, so traders treat them as less precious.

After a big run-up, many cash out or gamble bigger—both can spark volatility spikes.

Disposition Effect-Selling winners early and holding losers too long.

It’s a behavioural tic that shapes the market’s “velocity asymmetry.” (in short declines are more rapid than inclines)The investor sells on gains → throttles the rally speed.

Few sell on losses till panic hits → sharp, fast drops.

So in trader lingo: “Easy come, easy go” → in quant terms = volatility asymmetry or leverage effect. Or as traders say: “Markets take the stairs up and the elevator down.”With the US-China spat, the “easy come, easy go” hit hard. AI euphoria had sent Nvidia and co. soaring 150%+ in the past year . But when Trump’s tariff threat dropped a clanger.

So,“keep calm and carry on” is the way to go. Reflexivity(Soros-discussed before) shows these drops can overshoot due to herd behaviour, not just facts. Panicking and selling low locks in losses when the market’s likely to rebound as the noise fades. Long-term, stocks trend up on growth and innovation—yesterday’s dip is just a blip on that mountain climb.

-

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

-

What I wrote above is precisely why stocks which have grown the most recently, also fell the most yesterday. Easy come/easy go.

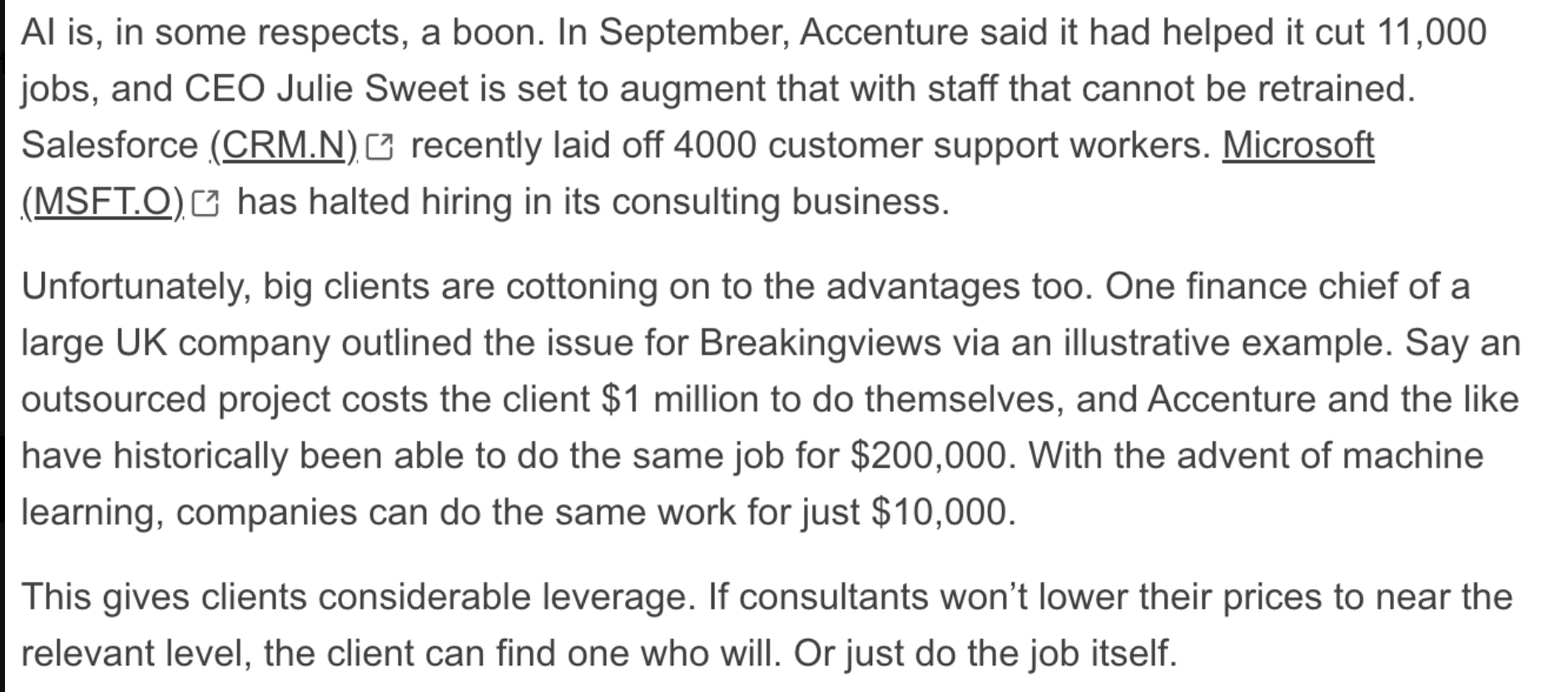

here is the tech graph which puts it all into some perspective

-

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

@Ronski said in General News:

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

Pretty much my thoughts. Checking the charts I am back to roughly where I was at the start of this month, so lost a week and a half's gains. Although there may be more to lose early next week.

'Roller Coaster', 'mountain climbs' ... all true. Two figures matter in the game of investing; how much it was worth when you bought it and how much it is worth when you sell it. Any number between those two points is just a number on a screen.

-

-

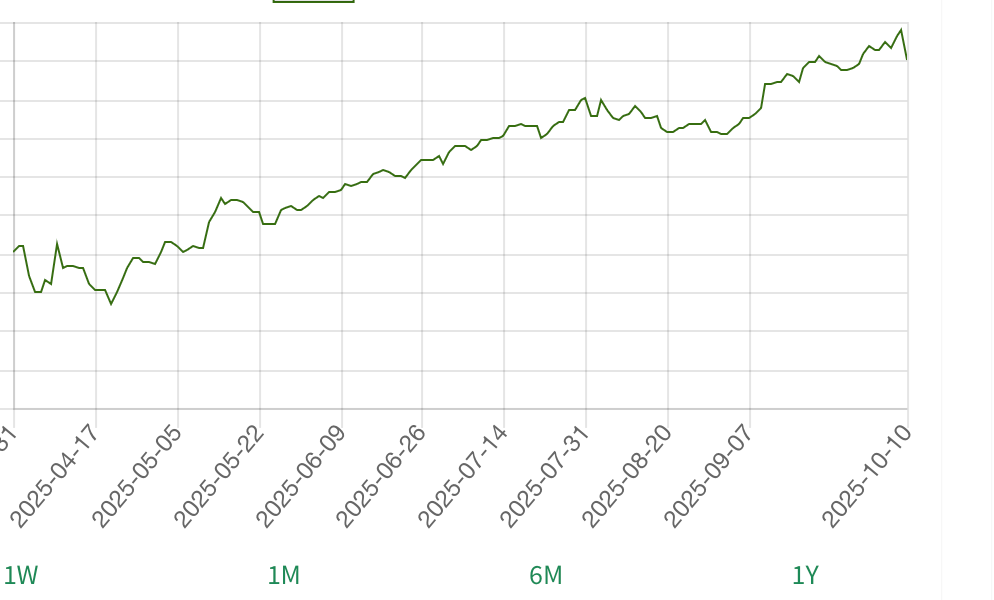

When TSMs C.C Wei speaks, you should pay attention. This comment from their earnings conference call.

If you look back at our analysis we said the go fwd growth in this segment would be circa 50%-and here he confirms that is still the case. Interesting, such a conservative person actually refers to growth as insane.

-

Just on the Trump/WhiteHouse notes….there is a wealth of evidence for TACO

Pretty easy for him to de-escalate - the Tariff Wars were started by him.I am more concerned how he plans to meet Putin again in Hungary. No doubt to the detriment of Ukraine. Putin clearly has some deep muck on The Don. Dictators (& wannabe) stick together

But that’s not a relevant topic for this thread!

-

-

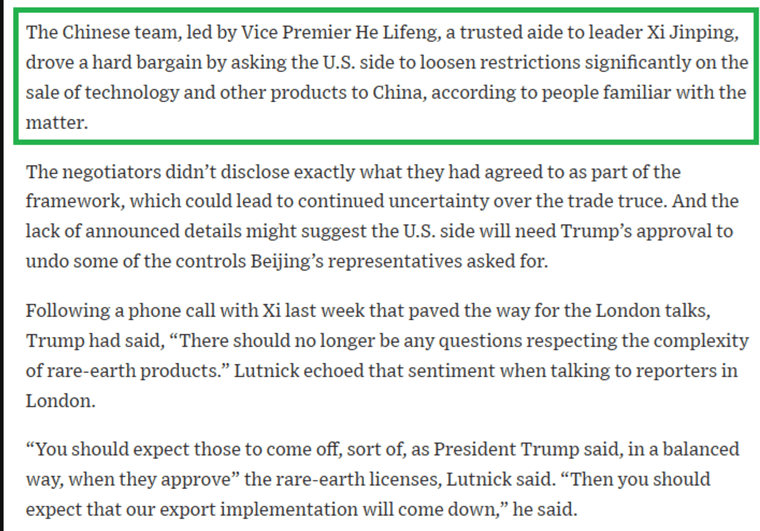

Looks like the US/China trade deal/truce is taking shape in a positive way. Markets should like it!

-

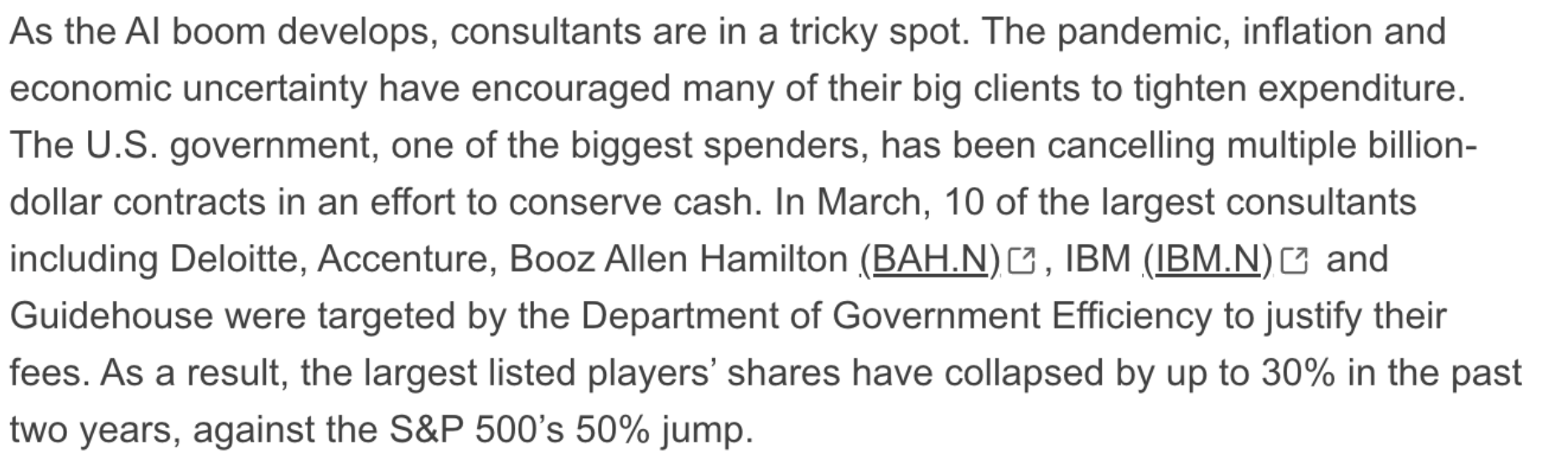

Interesting-and a tangible benefit which is quite logical when you think about it. I think big firms will continue to evolve and reinvent their offering but it's an obvious use case