General News

-

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

-

What I wrote above is precisely why stocks which have grown the most recently, also fell the most yesterday. Easy come/easy go.

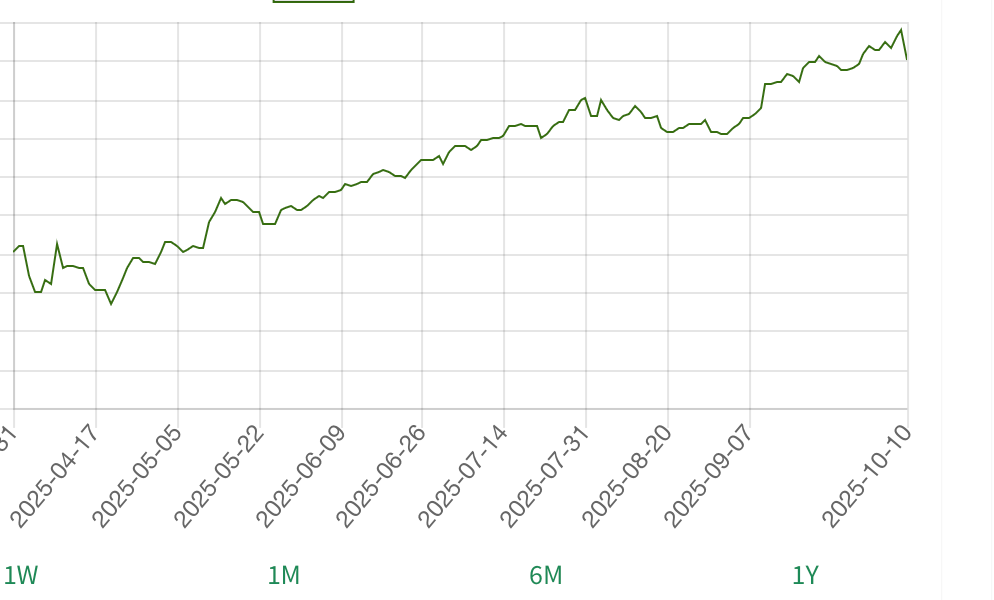

here is the tech graph which puts it all into some perspective

-

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

@Ronski said in General News:

I knew yesterday wasn't looking good (it started off OK), and was not surprised to find it was down to Trump, so wasn't looking forward to looking at the dashboard to log my figures this morning, but it wasn't as bad as I thought it would be - still marginally up on last Saturday overall, but yesterday won't hit Nest until Monday but that's another week.

Just another dip on Trumps roller coaster.

Pretty much my thoughts. Checking the charts I am back to roughly where I was at the start of this month, so lost a week and a half's gains. Although there may be more to lose early next week.

'Roller Coaster', 'mountain climbs' ... all true. Two figures matter in the game of investing; how much it was worth when you bought it and how much it is worth when you sell it. Any number between those two points is just a number on a screen.

-

-

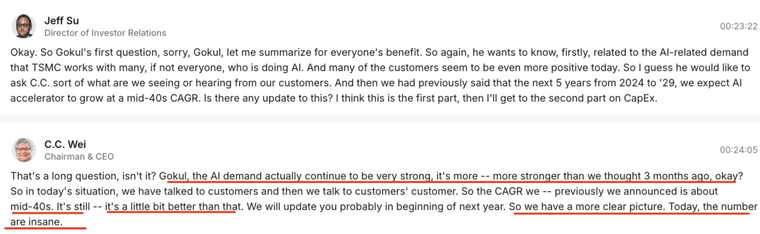

When TSMs C.C Wei speaks, you should pay attention. This comment from their earnings conference call.

If you look back at our analysis we said the go fwd growth in this segment would be circa 50%-and here he confirms that is still the case. Interesting, such a conservative person actually refers to growth as insane.

-

Just on the Trump/WhiteHouse notes….there is a wealth of evidence for TACO

Pretty easy for him to de-escalate - the Tariff Wars were started by him.I am more concerned how he plans to meet Putin again in Hungary. No doubt to the detriment of Ukraine. Putin clearly has some deep muck on The Don. Dictators (& wannabe) stick together

But that’s not a relevant topic for this thread!

-

-

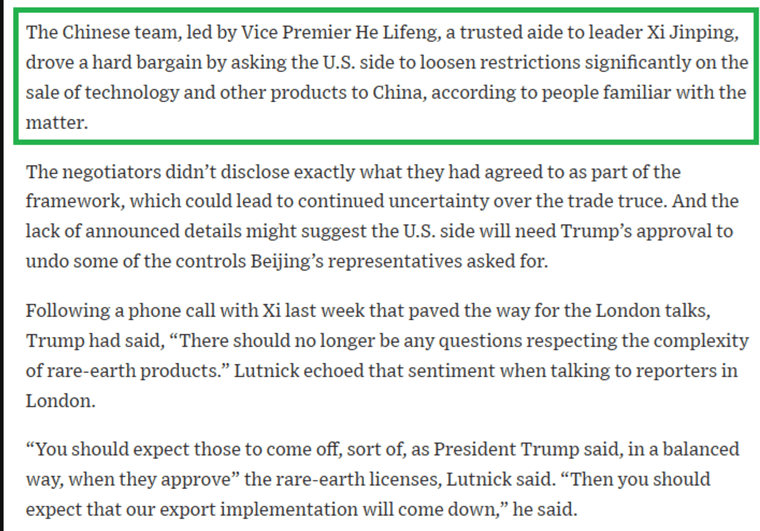

Looks like the US/China trade deal/truce is taking shape in a positive way. Markets should like it!

-

Interesting-and a tangible benefit which is quite logical when you think about it. I think big firms will continue to evolve and reinvent their offering but it's an obvious use case

-

Breaking:

The US Senate has taken a major step to end the weeks-long budget deadlock, moving a bill that would keep the government running and prevent further disruption. The measure, approved late on Sunday with support from both parties, would fund federal agencies until 30 January 2026 and include full-year budgets for key departments like Veterans Affairs and Agriculture. Eight Democrats joined Republicans, showing frustration with the record-length shutdown.

The bill also guarantees back pay for furloughed workers and restores full benefits for food aid programmes. Some issues, such as health-care tax credits and wider spending priorities, remain unresolved, so further clashes are possible. The measure now heads to the House, and if approved, it will go to DT to be signed into law. For now, it’s the biggest breakthrough in ending the funding crisis.

Futures Nas +400

-

Yes, a nice rebound all round. Micron making a new ATH amongst a broad based reversion

-

Saw an interesting graph just now - shows US job openings and the value of the S&P 500.

https://www.reddit.com/r/dataisbeautiful/comments/1or18rc/oc_us_job_openings_jtsjol_vs_sp_500_with_vertical

The vertical line shows the release date of ChatGPT.

Jobs no longer move in line with the stock market. Fewer workers needed to create growth 🫣 -

Seeing as it’s Reddit-tin foul hat central, I bit. My thoughts… the chart looks interesting at first glance, but it’s pretty misleading once you dig into it. The main issue is that it implies ChatGPT’s release somehow caused the drop in US job openings or the rise in the S&P 500, when there’s absolutely no evidence of that.

Correlation isn’t causation, and just because two things happen around the same time doesn’t mean one caused the other.

Both job openings and the stock market are influenced by a huge range of factors — things like interest rate hikes, inflation, and post-pandemic adjustments — all of which were already shaping the economy before ChatGPT came out. Plotting two upward (or downward) trending lines together often makes them look related when they’re not, especially when each one uses its own scale.It’s a visual supporting a narrative. it’s basically just a coincidence dressed up as a correlation. The scales are mathematically wrong too.

-

Ah, one for the old “spurious correlations”, perhaps - https://web.archive.org/web/20140509212006/http://tylervigen.com

Marriage rates in Alabama correlates with Murders with a Blunt Object

-

Michael Burry has liquidated everything in his Scion Capital fund and returned money to all investors. He has quit. Burry stated 'scion returns now and for some time have been out of step with the market'. In 'short' he admits to losing a lot of money.

-

Michael Burry has liquidated everything in his Scion Capital fund and returned money to all investors. He has quit. Burry stated 'scion returns now and for some time have been out of step with the market'. In 'short' he admits to losing a lot of money.

@Adam-Kay said in General News:

Michael Burry has liquidated everything in his Scion Capital fund and returned money to all investors. He has quit. Burry stated 'scion returns now and for some time have been out of step with the market'. In 'short' he admits to losing a lot of money.

Hang on - is this the fella that just shorted NVDA (again)?