Apple News

-

Apple’s Project Mulberry introduces an AI-powered virtual health coach, Health+, set to enhance the Health app with iOS 19.4 in spring/summer 2026.

This service uses data from iPhones, Apple Watches, and AirPods to deliver personalised health advice on fitness, nutrition, sleep, and mental wellbeing. Trained with input from in-house doctors and specialists, the AI aims to mimic a doctor’s guidance, though it’s a wellness tool, not a diagnostic one.

The revamped Health app will prioritise food tracking, rival apps like MyFitnessPal, and offer real-time workout analysis via device cameras, potentially linking to Fitness+. Apple is also producing educational health videos, filmed near Oakland, and seeking a prominent doctor to front the service. Privacy remains central, with user data secured.

From a monetisation perspective, Health+ is a savvy move. Apple could integrate it into Fitness+ or offer it as a premium subscription, tapping into the growing digital health market. By leveraging its ecosystem, Apple ensures user retention, driving device sales and recurring revenue. -

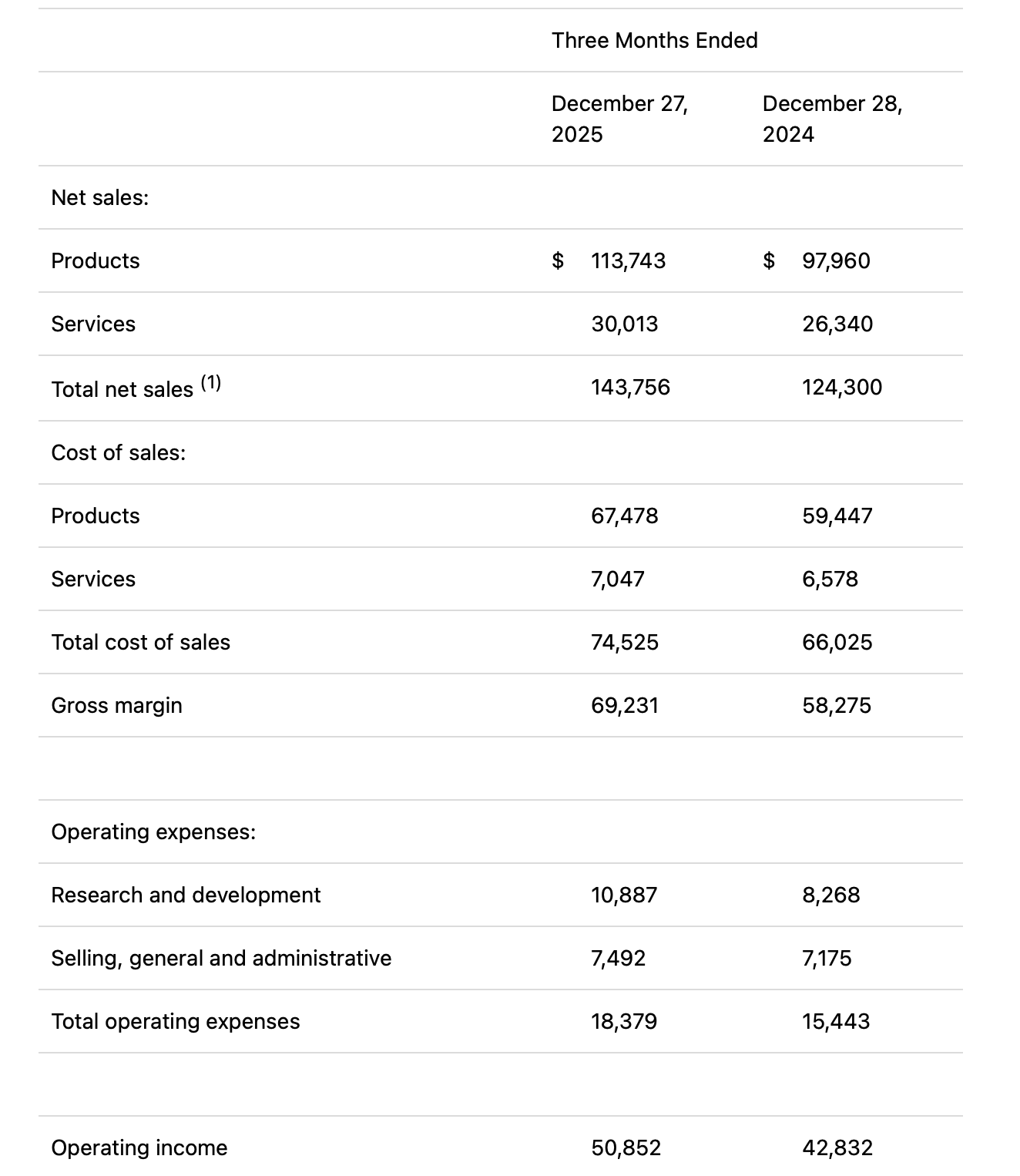

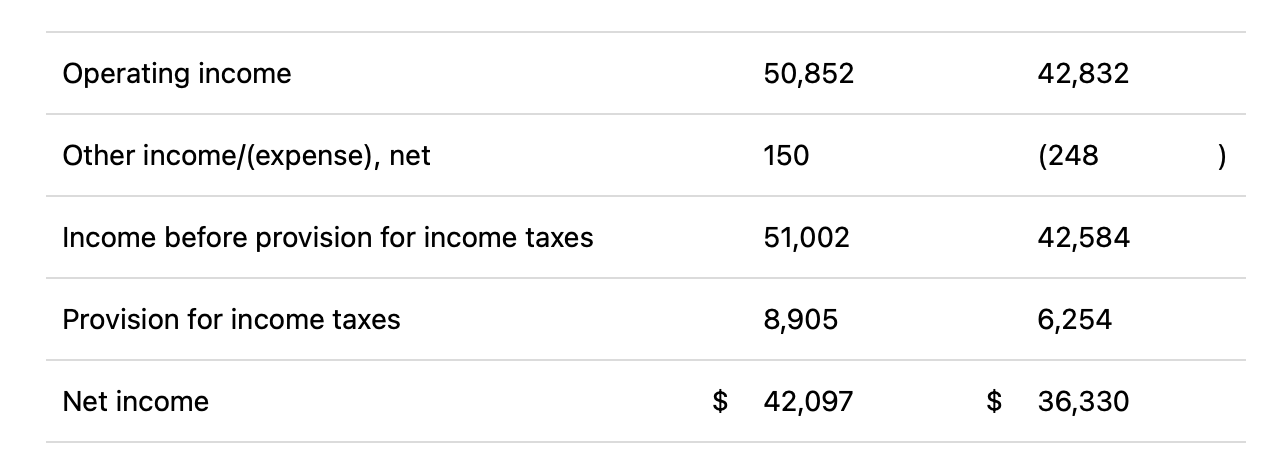

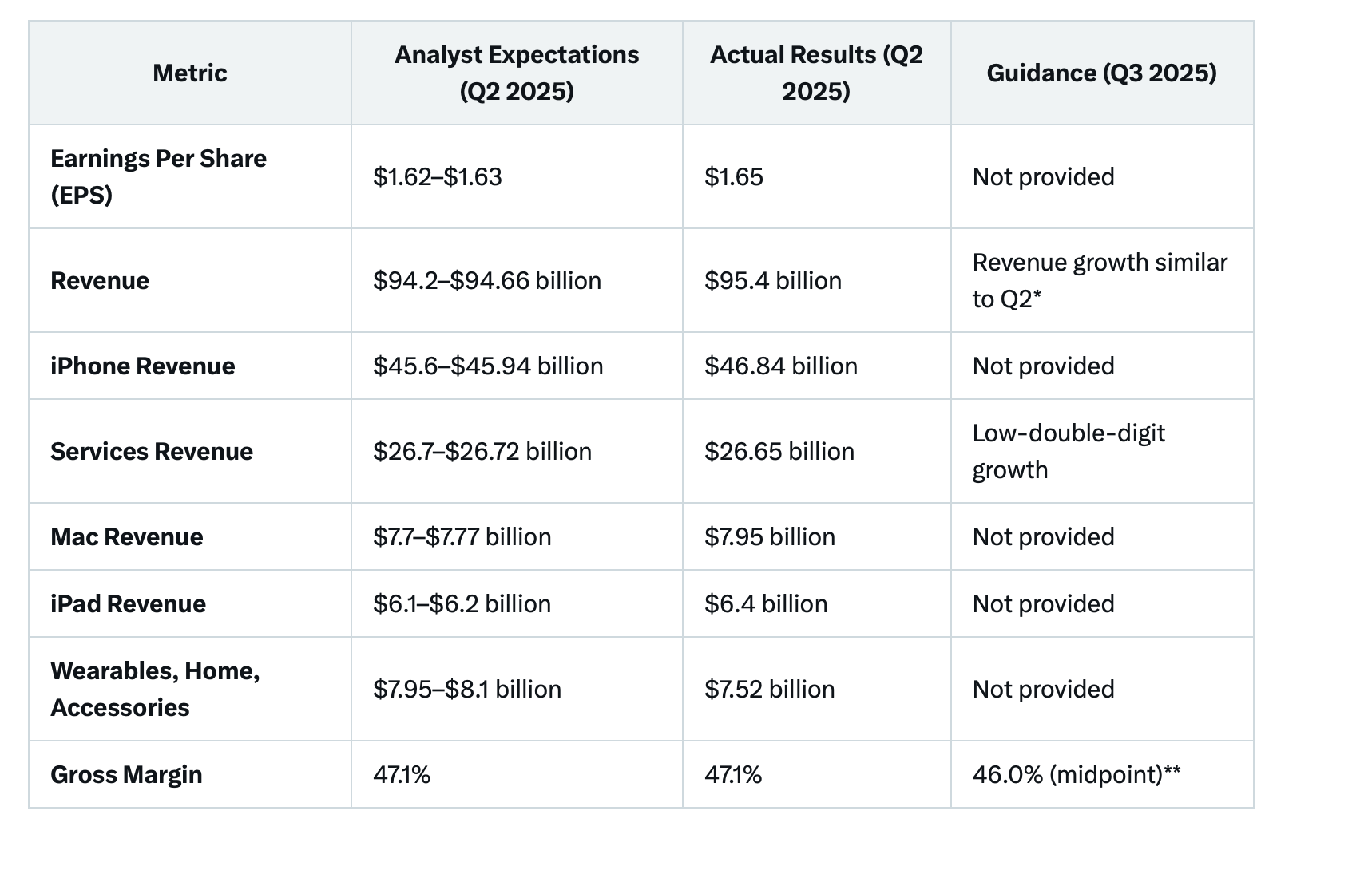

A beat on the top and bottom lines from Apple, delivering a solid quarter

Notes:

EPS and Revenue: Apple surpassed analyst expectations, reporting an EPS of $1.65 (vs. $1.62–$1.63) and revenue of $95.4 billion (vs. $94.2–$94.66 billion), a 5% year-over-year increase, driven by robust iPhone and hardware sales.iPhone Revenue: Rose 2% to $46.84 billion, exceeding forecasts, despite stable iPhone unit sales, reflecting strong demand for the iPhone 16 series.

Services Revenue: Grew 11.65% to $26.65 billion, slightly below expectations ($26.7 billion), supported by over 1 billion subscriptions across services like the App Store and iCloud.

Mac and iPad Revenue: Mac sales increased 6.6% to $7.95 billion, and iPad sales rose 15% to $6.4 billion, both outperforming estimates, fuelled by new MacBook Air and iPad Air models launched in March.

Wearables, Home, Accessories: Declined 5% to $7.52 billion, missing expectations, due to a challenging comparison with the Vision Pro launch in Q2 2024.

Greater China Revenue: Dropped to $16 billion (vs. $16.8 billion expected), impacted by competition from local brands such as Vivo and Huawei.

Guidance for Q3 2025: Apple anticipates revenue growth “similar to” Q2’s 5% year-over-year growth, despite a 2% foreign exchange headwind. Services revenue is expected to grow in the low-double digits. Gross margin is projected at approximately 46.0% (midpoint), affected by a $900 million tariff cost. Operating expenses are forecasted at $15.6–$15.8 billion, with other income/expense around negative $300 million and a tax rate of about 16%.

AI and CapEx Details from Earnings Call

AI (Apple Intelligence): CEO Tim Cook emphasised Apple Intelligence as a core strategic priority, integrated into iOS 18 and the iPhone 16 lineup. However, delays in generative AI features for Siri, now expected in 2026, raised questions about Apple’s competitive position against Google and Microsoft. Cook highlighted increased research and development (R&D) expenditure, representing 7% of Q2 net sales (approximately $6.7 billion), to advance AI capabilities. Apple Intelligence is set to expand to additional languages in April 2025.CapEx: Apple does not disclose precise CapEx figures. However, Cook noted significant investments in supply chain diversification to counter tariff impacts, including manufacturing iPhones in India for the US market and sourcing other products from Vietnam.

Analysts estimate Apple’s annual CapEx at $10–$12 billion, directed towards AI infrastructure, production facilities, and retail. The $900 million tariff cost projected for Q3 2025 reflects challenges from US tariffs on Chinese imports, prompting Apple to optimise its global supply chain. Cook stated that Apple’s on-device AI approach reduces the need for extensive data centre investments compared to competitors building large-scale AI models.Apple stock in our opinion looks fully priced-not stretched. It is a perhaps the strongest brand in the world and has a credit rating equivalent to government debt, and is trading on a similar basis. Our carrying weight had been trimmed over the past quarters to reflect this.

-

& will never happen.

Trumps latest market manipulation is just dire.

His crazy tariff game enables those in the know to make HUGE gains from the market swings, & shoe-horning crypto fan Atkins in as SEC Chief helps him avoid the glare of investigation (for now).

I am sure things will back up, but it is just appalling how he can get away with stuff. The ambush on Ramaphose with a mixup of totally fake news the other day was awful to watch, like Zelenskyy’s but worse, with the “dim the lights” cr@p. Just reality show nonsense. -

If there is a tariff on phones, Apple will raise global prices to smooth the spikes. It’s not a sustainable model so best to ignore it as yet about pet project of DT. With earnings next week(Nvidia) it’s all eyes elsewhere.

-

Apple is reportedly preparing to initiate development of its first foldable smartphone in the second half of 2025, with contract manufacturing partner Foxconn. I would think, it true, it will spur a super upgrade cycle. I'm keen

-

I bet it is mucho bucks. £1,800 maybe, which is ridiculous but it will sell very well. It will look something like this, it's not official (the image)

-

Makes perfect sense given the development costs would surely be 10s of billions- and Apple are late to the party imo

-

Samsung will commence production of OLED screens in Q4, which will be used in Apple's first foldable phone-scheduled for release in H2, 2026. Expect the iPhone foldable to retail for circa £2K!

-

Dan Ives had the following to say in an investors note and raised their PT (price target) to $310 (which hinges on their AI strategy imo. To date it has been none existent :

Entering the iPhone 17 cycle, we anticipated a strong but not exceptional upgrade cycle. However, a significant pent-up consumer demand, with our estimate of 315 million out of 1.5 billion iPhones globally not upgraded in the past four years, combined with notable design enhancements, has driven a robust start, according to Ives and his team.

The analysts suggest that Wall Street’s projection of approximately 230 million iPhone units for fiscal year 2026 may be conservative, with estimates now ranging between 240 million and 250 million units based on current momentum.“Demand in China will be pivotal to the iPhone 17 upgrade cycle, as the negative growth trends of recent years are expected to reverse into positive growth in FY26,” the analysts observed.

Although the iPhone Air faces delays in China due to regulatory approval for its eSIM, the analysts anticipate resolution within the next month, enabling its availability in stores and online. They noted that Apple must intensify efforts to drive growth in China, where domestic competitors like Huawei and Xiaomi present significant challenges.

“The critical issue remains Apple’s understated AI strategy. With a global installed base of 2.4 billion iOS devices and 1.5 billion iPhones, now is the time for Apple to accelerate its AI initiatives through strategic partnerships,” Ives and his team stated.Following the recent victory for Alphabet (GOOG, GOOGL) and Apple in Google’s antitrust case, which restricts “exclusive deals” for search, the analysts believe the groundwork is laid for Apple to maintain its existing agreement.

They expect Apple to deepen its AI collaboration with Google Gemini, integrating it into the iPhone ecosystem (a positive for both).The analysts estimate that AI monetisation could contribute $75 to $100 per share to Apple’s valuation over the coming years.“No ‘AI premium’ is currently reflected in Apple’s stock price, making it an attractive large-cap technology investment heading into year-end and 2026,” they concluded.

I personally think if Apple can offer AI as a service which add utility and they probably will, there will be very wide adoption given their installed base. A true assistant that can navigate across the Apple ecosystem would add considerable value.

-

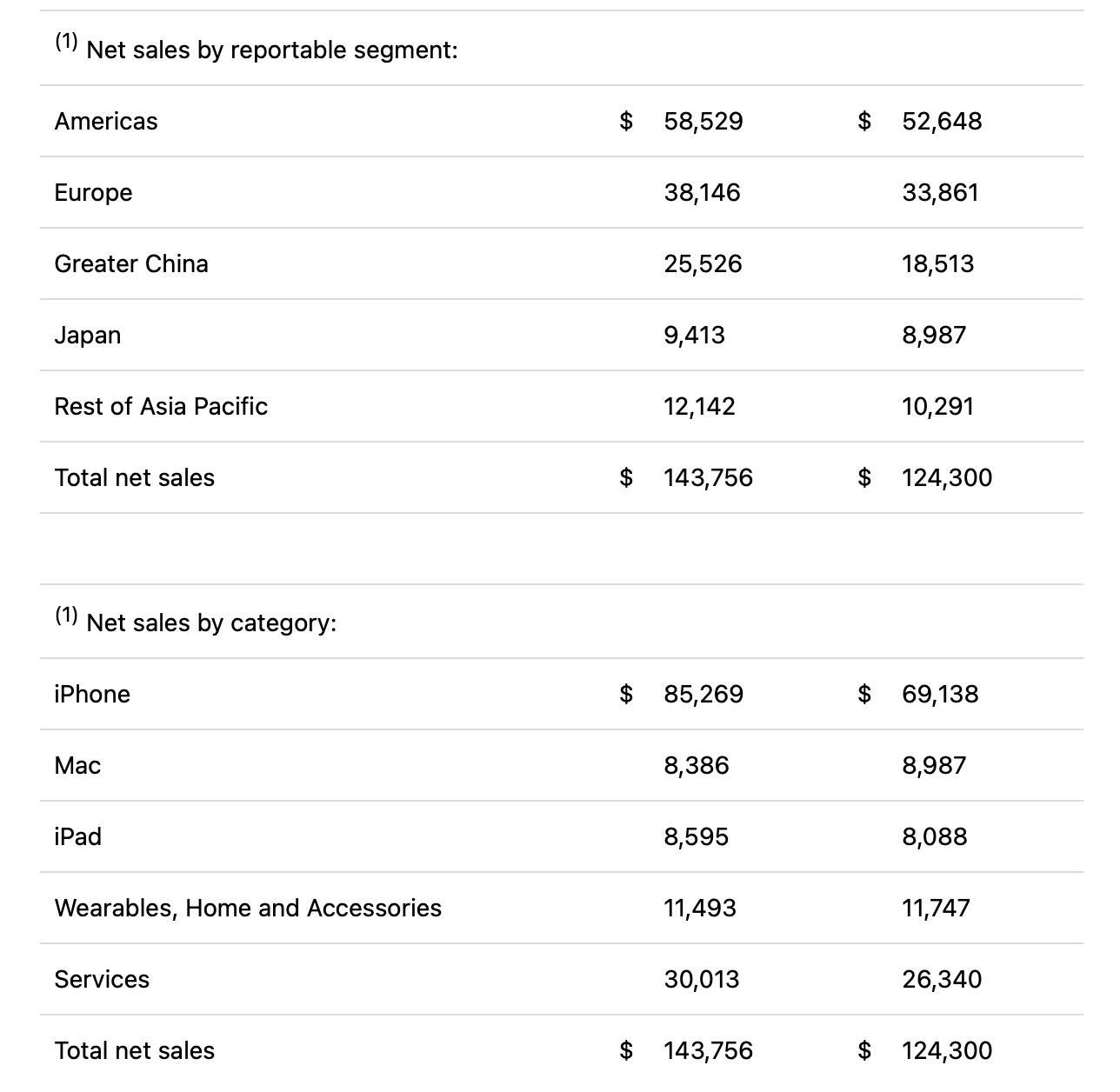

Apple results-and I have to say they really surprised me. Very strong. Take a moment to think about these numbers.

Just under 144B

$85B just iPhones segment

$30B in services which is almost pure profit

$42B tax paid profit

deep double digit growth and guiding for continued strength

It will take NVDA next Q to beat this sort of earnings with GOOG hot on their heels no doubt.