Broadcom (AVGO)

-

We paid 165 initially

-

That gain is point to point. The actually gain will be more because we were selling it in the 400’s too

-

We recently acquired Broadcom-AVGO and Oracle ORCL into the technology portfolio(they may also be held elsewhere), selling PANW (+85%) and MEDP (102%). Normal emails will go out in due course.

-

The post is correct. We haven't 'released' the email yet. Probably will in May.

-

Hi Ron,

Because our quarter end official meeting is on Friday. Official comms will be the following week. Regards

Adam -

Broadcom will report earnings on Thursday after the close. I will provide a summary of expectations and recently highlights, tomorrow.

-

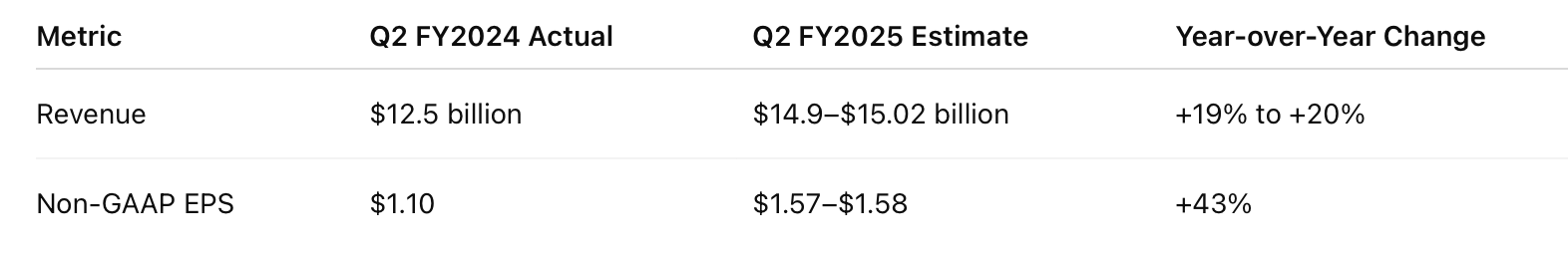

AVGO is due to report Q2 earnings tomorrow. Here is what is expected. They will almost certainly beat and guide higher. We will be watching for comments around their ASICS segment and VMWare. A fantastic business, acquired at a fair price.

We acquired the stock on 18 March @ $193 and today it sits at an all time high of $260.

-

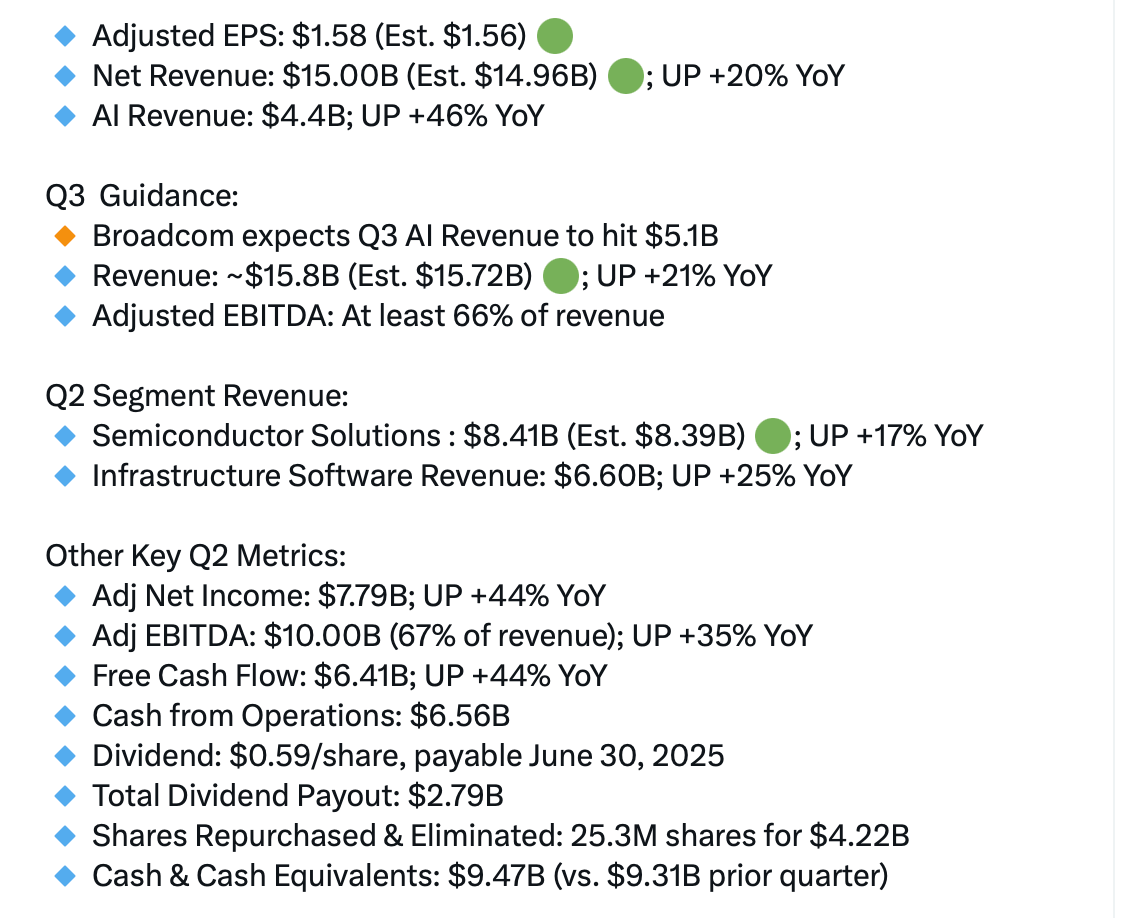

A solid result from AVGO, beating expectations and guiding higher-ahead of consensus expectations. Asics is growing dramatically with the growth trend continuing through 2026.

Q2 FY2025 Results:

Revenue: $15.004 billion, up 20% year-on-year, meeting estimates of $14.99 billion.

AI Semiconductor Revenue: $4.4 billion, up 46% year-on-year.

Infrastructure Software Revenue: $6.6 billion, up 25% year-on-year, exceeding guidance of $6.5 billion.

Semiconductor Solutions Revenue: $8.4 billion, up 17% year-on-year.

Adjusted EBITDA: $10.0 billion, up 35% year-on-year (67% of revenue).

Free Cash Flow: $6.4 billion, up 44% year-on-year (43% of revenue).

Capital Allocation: Paid $2.8 billion in dividends and repurchased $4.2 billion in shares.

Q3 FY2025 Guidance:

Revenue: $15.8 billion, up 21% year-on-year, slightly above estimates of $15.72–$15.79 billion.

AI Semiconductor Revenue: $5.1 billion, up 60% year-on-year.

Semiconductor Revenue: $9.1 billion, up 25% year-on-year.

Infrastructure Software Revenue: $6.7 billion, up 16% year-on-year.

Adjusted EBITDA: Expected at 66% of revenue.

Management Insights

Hock E. Tan, CEO, highlighted, “Our record Q1 and Q2 revenues of $15.004 billion reflect strong AI demand and VMware momentum.” He noted AI networking (Ethernet-based) contributed 40% of AI revenue and introduced the Tomahawk 6 switch, enabling efficient AI clusters with 102.4 terabits per second capacity. Tan projected “accelerated XPU demand in late 2026 for inference and training.” Kirsten M. Spears, CFO, added, “Gross margins of 79.1% in Q1 and 79.4% in Q2 exceeded forecasts due to a favourable product mix.”

Outlook and 2026 Expectations

Broadcom anticipates continued growth, with Q3 revenue guidance of $15.8 billion and AI semiconductor revenue expected to sustain its FY2025 growth rate into FY2026. Management expressed confidence in organic growth, supported by innovations like Tomahawk 6 and strong VMware Cloud Foundation adoption (over 85% of top 10,000 customers).

Risks and Challenges

Non-AI semiconductor revenue remains sluggish, with slow recovery.

Free cash flow is impacted by VMware acquisition debt interest and higher taxes.The stock is at an all time high so we would expect a bit of churn as recently macro events play out and the stock forms a solid base to spring board to the next level. A fantastic business that has a very bright future.

-

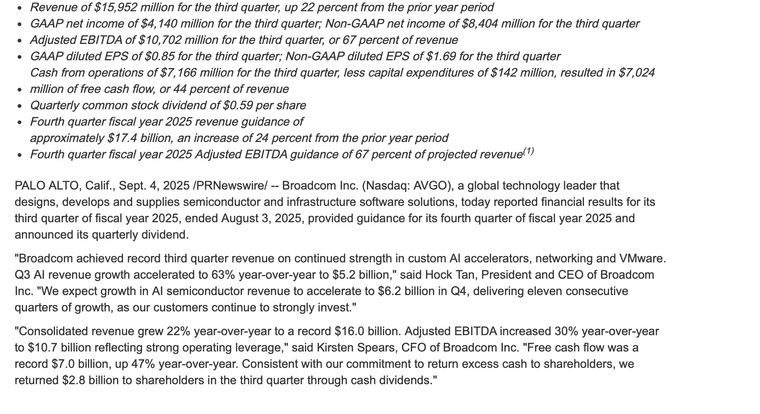

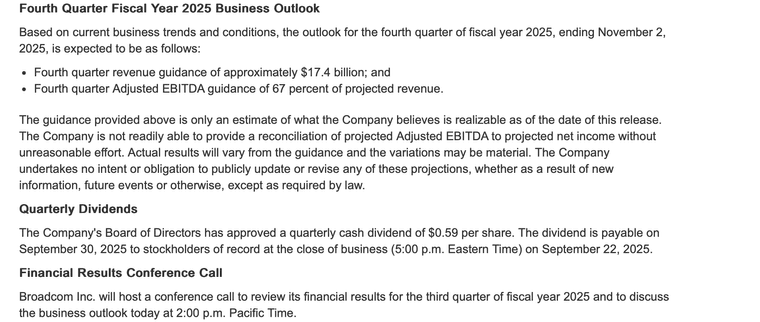

Brilliant result last night with a very strong guide. The stock popped after hours. It’s my anniversary, back Monday :). Full analysis then

-

Come on man!! Priorities!!

-

The summary results for AVGO. Everything is a record and the guide is higher still, and no doubt low balling. The backlog is now a staggering $110 billion!

Not much for me to add (hence the cut from their release) apart from Ive also heard they just signed a 10B chip deal with Open AI.

Broadcom is the perfect accompaniment to Nvidia. Will they hurt each other, imo no, because they operate in very distinct markets, save for some networking.

-

Breaking news-more to follow.

OpenAI sign a deal today with AVGO/Broadcomm for the design of a new Aspics accelerator. The size of the deal is circa 10GW which would be at least $150B. AVGO is up about $40