Broadcom (AVGO)

-

The place to discuss Broadcom

-

ASIC Market and AI Revenue:

Broadcom has positioned itself as a critical supplier of custom AI chips (ASICs, often referred to as XPUs in their terminology) for hyperscale customers. AI revenue has been a significant growth engine, surging 220% year-over-year to $12.2 billion for fiscal 2024 and climbing 77% to $4.1 billion in Q1 fiscal 2025 alone. The company projects AI revenue to hit $4.4 billion in Q2 fiscal 2025, a 44% year-over-year increase.Management has forecasted a massive serviceable addressable market (SAM) for AI chips, estimating $60 billion to $90 billion by fiscal 2027, driven by demand from its three largest customers. Analysts suggest Broadcom could capture 70% or more of this opportunity, with AI chip revenue potentially reaching $44 billion by 2027 under conservative estimates, implying annual growth rates exceeding 50% through that period.

Design Wins with Mag 7 Customers:

Broadcom’s CEO, Hock Tan, has highlighted deepening engagements with hyperscale customers, including three major cloud providers already deploying its AI chips and four additional hyperscalers in the pipeline as of Q1 2025. While not explicitly named, these are widely understood to include Mag 7 players like Google, Meta, and potentially OpenAI (via reported collaborations), alongside existing partners.The shift by these tech giants toward custom ASICs—designed to optimize energy efficiency and performance for AI workloads—positions Broadcom as a go-to partner, reducing reliance on off-the-shelf GPUs from competitors like Nvidia. This trend is expected to yield new design wins, further boosting revenue as AI infrastructure investments escalate.

Software Integration (VMware):

The $69 billion acquisition of VMware in November 2023 has supercharged Broadcom’s infrastructure software segment, which grew 47% year-over-year to $6.7 billion in Q1 fiscal 2025. The company anticipates $6.5 billion in Q2, a 23% increase, as it shifts VMware customers to subscription models. This diversification beyond semiconductors enhances Broadcom’s growth stability and recurring revenue potential.

Overall Revenue Outlook:

Broadcom’s total revenue grew 44% in fiscal 2024 to $51.6 billion and 25% in Q1 fiscal 2025 to $14.9 billion. For Q2 fiscal 2025, it guides $14.9 billion, slightly ahead of analyst expectations. Analysts project fiscal 2025 revenue to range between $59 billion and $61 billion, with AI driving much of the upside. Longer-term, earnings growth is forecast at 29.5% annually over the next three years, outpacing the U.S. market’s 14.1%.

Size of Earnings Margin

Broadcom’s profitability remains a hallmark of its business model, with industry-leading margins reflecting its operational efficiency and premium positioning in high-demand markets.

Gross Margin:

In Q1 fiscal 2025, Broadcom reported a non-GAAP gross margin of 76.9%, among the highest in the semiconductor industry. This reflects its ability to command strong pricing for AI ASICs and networking solutions, alongside cost efficiencies from its fabless model and selective in-house manufacturing (e.g., FBAR filters for Apple).

Adjusted EBITDA Margin:

The company’s adjusted EBITDA margin hit 66% in Q1 fiscal 2025, with $10.1 billion in adjusted EBITDA on $14.9 billion in revenue. For fiscal 2024, it was 62% ($31.9 billion on $51.6 billion). This metric excludes one-time costs and highlights Broadcom’s cash-generating prowess.

Net Profit Margin:

On a GAAP basis, the net profit margin was lower at 11.43% as of October 31, 2024, due to acquisition-related amortization and other expenses. However, on a non-GAAP basis, adjusted net income of $7.82 billion in Q1 fiscal 2025 implies a much higher effective margin (around 52% when adjusted for typical exclusions), showcasing underlying profitability.

Margin Growth

Broadcom’s margins have shown resilience and growth, bolstered by its AI and software businesses:

Historical Trend:

Adjusted EBITDA grew 37% year-over-year in fiscal 2024, outpacing revenue growth of 44%, indicating slight margin compression due to VMware integration costs. However, Q1 fiscal 2025’s 41% EBITDA growth (to $10.1 billion) on 25% revenue growth signals margin expansion as integration matures.

AI and Software Drivers:

The AI segment’s high-margin profile (likely exceeding 80% gross margin for custom ASICs) is lifting overall profitability. Meanwhile, VMware’s shift to subscriptions is expected to stabilize and grow software margins, with analysts eyeing a 10% growth rate for that division.

Guidance for a 66% adjusted EBITDA margin in Q2 fiscal 2025 suggests continued margin strength, potentially rising as AI scales and software synergies deepen.

Long-Term Outlook:

With R&D investments in next-generation AI accelerators and a broadening customer base, Broadcom aims to sustain or grow its margins. Analysts see its Return on Equity reaching 41.4% in three years, reflecting efficient capital use and margin upside. -

We recently acquired Broadcom-AVGO and Oracle ORCL into the technology portfolio(they may also be held elsewhere), selling PANW (+85%) and MEDP (102%). Normal emails will go out in due course.

-

We paid 165 initially

-

That gain is point to point. The actually gain will be more because we were selling it in the 400’s too

-

We recently acquired Broadcom-AVGO and Oracle ORCL into the technology portfolio(they may also be held elsewhere), selling PANW (+85%) and MEDP (102%). Normal emails will go out in due course.

-

The post is correct. We haven't 'released' the email yet. Probably will in May.

-

Hi Ron,

Because our quarter end official meeting is on Friday. Official comms will be the following week. Regards

Adam -

Broadcom will report earnings on Thursday after the close. I will provide a summary of expectations and recently highlights, tomorrow.

-

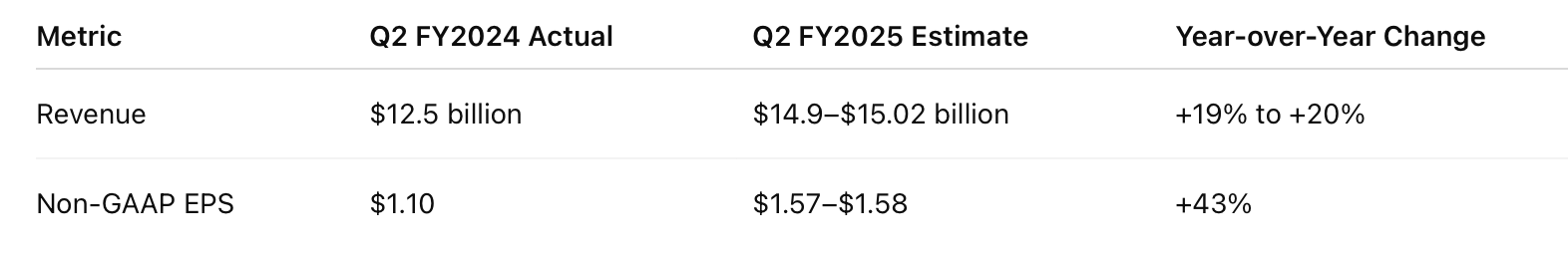

AVGO is due to report Q2 earnings tomorrow. Here is what is expected. They will almost certainly beat and guide higher. We will be watching for comments around their ASICS segment and VMWare. A fantastic business, acquired at a fair price.

We acquired the stock on 18 March @ $193 and today it sits at an all time high of $260.

-

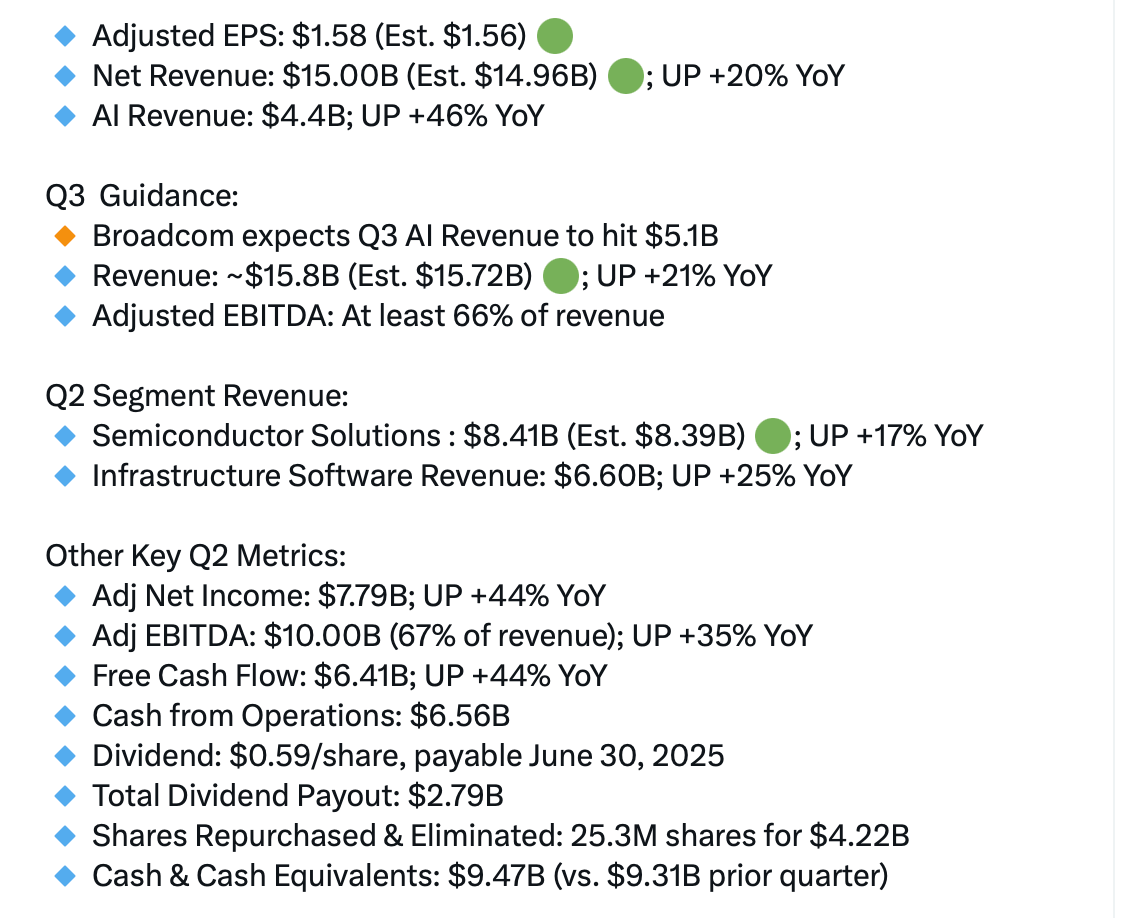

A solid result from AVGO, beating expectations and guiding higher-ahead of consensus expectations. Asics is growing dramatically with the growth trend continuing through 2026.

Q2 FY2025 Results:

Revenue: $15.004 billion, up 20% year-on-year, meeting estimates of $14.99 billion.

AI Semiconductor Revenue: $4.4 billion, up 46% year-on-year.

Infrastructure Software Revenue: $6.6 billion, up 25% year-on-year, exceeding guidance of $6.5 billion.

Semiconductor Solutions Revenue: $8.4 billion, up 17% year-on-year.

Adjusted EBITDA: $10.0 billion, up 35% year-on-year (67% of revenue).

Free Cash Flow: $6.4 billion, up 44% year-on-year (43% of revenue).

Capital Allocation: Paid $2.8 billion in dividends and repurchased $4.2 billion in shares.

Q3 FY2025 Guidance:

Revenue: $15.8 billion, up 21% year-on-year, slightly above estimates of $15.72–$15.79 billion.

AI Semiconductor Revenue: $5.1 billion, up 60% year-on-year.

Semiconductor Revenue: $9.1 billion, up 25% year-on-year.

Infrastructure Software Revenue: $6.7 billion, up 16% year-on-year.

Adjusted EBITDA: Expected at 66% of revenue.

Management Insights

Hock E. Tan, CEO, highlighted, “Our record Q1 and Q2 revenues of $15.004 billion reflect strong AI demand and VMware momentum.” He noted AI networking (Ethernet-based) contributed 40% of AI revenue and introduced the Tomahawk 6 switch, enabling efficient AI clusters with 102.4 terabits per second capacity. Tan projected “accelerated XPU demand in late 2026 for inference and training.” Kirsten M. Spears, CFO, added, “Gross margins of 79.1% in Q1 and 79.4% in Q2 exceeded forecasts due to a favourable product mix.”

Outlook and 2026 Expectations

Broadcom anticipates continued growth, with Q3 revenue guidance of $15.8 billion and AI semiconductor revenue expected to sustain its FY2025 growth rate into FY2026. Management expressed confidence in organic growth, supported by innovations like Tomahawk 6 and strong VMware Cloud Foundation adoption (over 85% of top 10,000 customers).

Risks and Challenges

Non-AI semiconductor revenue remains sluggish, with slow recovery.

Free cash flow is impacted by VMware acquisition debt interest and higher taxes.The stock is at an all time high so we would expect a bit of churn as recently macro events play out and the stock forms a solid base to spring board to the next level. A fantastic business that has a very bright future.

-

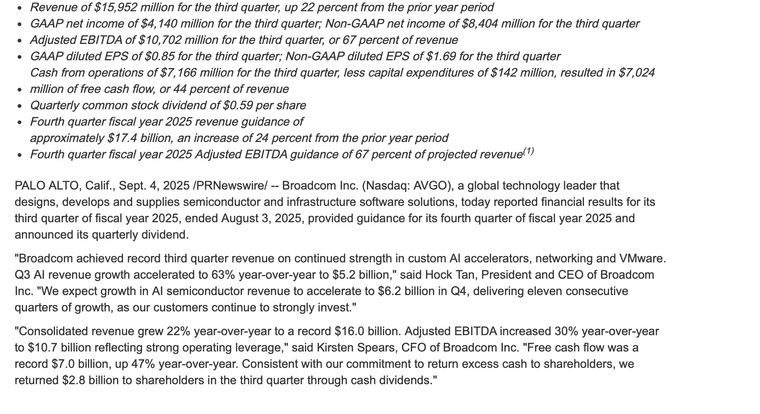

Brilliant result last night with a very strong guide. The stock popped after hours. It’s my anniversary, back Monday :). Full analysis then

-

Come on man!! Priorities!!

-

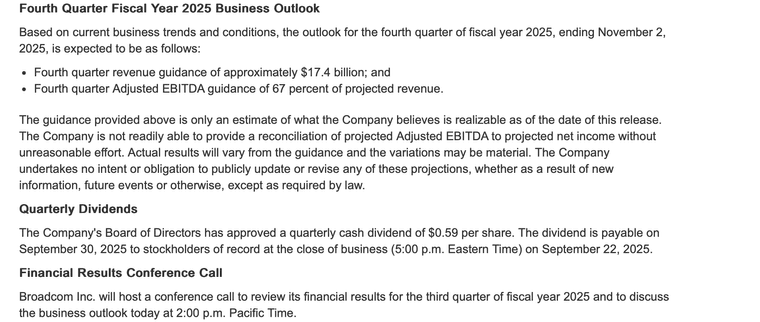

The summary results for AVGO. Everything is a record and the guide is higher still, and no doubt low balling. The backlog is now a staggering $110 billion!

Not much for me to add (hence the cut from their release) apart from Ive also heard they just signed a 10B chip deal with Open AI.

Broadcom is the perfect accompaniment to Nvidia. Will they hurt each other, imo no, because they operate in very distinct markets, save for some networking.

-

Breaking news-more to follow.

OpenAI sign a deal today with AVGO/Broadcomm for the design of a new Aspics accelerator. The size of the deal is circa 10GW which would be at least $150B. AVGO is up about $40