Micron Technology

-

Just a reminder. The recent days set piece by Semi Analysis stating Nvidia havent ordered HBM4 from MU which is causing the softness, is intentional and conflated. The first HBM4 chips are needed by March/April. Micron have always planned for an H2 ramp, so stating they aren't included is just stating the obvious. They never planned to be. But SA have presented their (rag) article in a way to sew the seeds of doubt.

The CEO is presenting tomorrow and I am sure he will put this FUD to rest.

Micron Chairman Sanjay Mehrotra comments in Dec in conjunction with Q1 reporting : "We have completed agreements on price and volume for our ENTIRE CALENDAR 2026 HBM SUPPLY, INCLUDING MICRON'S INDUSTRY-LEADING HBM4.

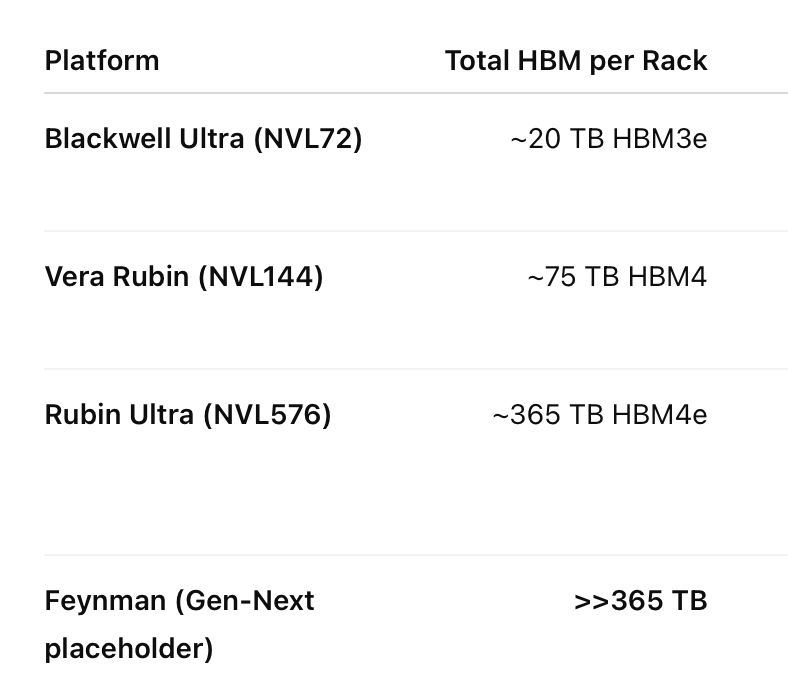

.We forecast an HBM TAM CAGR (COMPOUND ANNUAL GROWTH RATE) of 40% through 2028 from approx. $35 billion in 2025 to around $100 billion in 2028 (projected to arrive two years earlier than our previous outlook.".

MICRON'S HBM4, WITH INDUSTRURY LEADING SPEED of over 11 Gbps, is on track to ramp with high yields in the second calendar quarter of 2026. -

The Wolfe conference starts at GMT 1.50pm today.

Buyers feeling that the CEO (Sanjay Mehrotra) will reaffirm the super positive narrative and dispel the rumours?

Not only is Sanjay an exceptional business leader, he is also a gifted engineer, holding Masters degrees in Engineering and Computer Science from Berkley and further Business programmes at Stanford. He co-founded Sandisk (SNDK) and holds 70+ patents in non volatile/flash memory. He is what drew me to Micron.

He is a giant in the memory sector who is very direct and I fully expect him to shut the door on any negative rumours.

-

CFO just rubbished the rumours and actually said:

Full production is 1 Quarter early

Shipping HBM4 now (early)

Industry leading > 11Gbits/s

Yield is as expected

100% HHM4 sold out into 2027Sellers regret. Maybe they should have been buying rather than selling?

But the authors of the 'analysis' achieved their goal? shake out some weak hands and make profits on a short position for their paymasters

-

'Since our earnings (where they had a Nvidia esq guide) our financial position has strengthened somewhat. I like this guy a lot

-

We are only meeting 50% of some customers memory needs-I liked this comment, 'we are sweating our assets to grow production'.

-

On the demand side-token generation is increasing, that is demanding more memory and storage, more of it and higher performance. In time the edge will become increasingly important (robotics). Agentic AI will place even higher demands. The market is very broad, very strong and getting stronger. We are toiling to get incremental bits out. Node transitions to supply additional bits until new Greenfield sites come on line.

Brilliant presentation and a shot in the arm

-

For those interested here are they key points from the investor conference:

Extraordinary business trajectory and strengthened outlook —

Since the last earnings call, Micron’s financial outlook has improved further, driven by robust demand outpacing supply significantly (both for Micron and the industry overall). The setup is described as the best competitive position in the company’s history(47 years) at an ideal time.

Sustained tight supply-demand balance —

Demand remains significantly higher than available supply, with tightness expected to persist beyond 2026. This creates a favourable pricing environment, contributing to the improved outlook (though specifics on price changes were not quantified).

Strong AI-driven demand across products —

AI advancements (larger models, longer context windows, intensive reasoning) are driving needs for higher-performance memory and storage. This includes proliferation of high-performance memory in data centre architectures, growth in server demand (from single digits to mid-teens percentages in 2025, with continuation expected), and spillover to edge devices (e.g., smartphones, PCs, future autonomous/robotics applications). Hyperscaler CapEx has surged dramatically (approaching USD 800 billion in 2026 vs. under USD 200 billion a few years ago). The key takeaway here being longer context windows, zero shot inference and next gen models having the ability to remember/retain content for 'years', all means more memory.

HBM leadership and progress —

Micron rebutted recent inaccurate reports by confirming it is already in high-volume production of HBM4, with customer shipments commenced and volumes ramping successfully in calendar Q1 2026 (a quarter ahead of prior guidance from the December earnings call). HBM4 delivers over 11 Gbps speeds,(it didn't escape me this is Nvidia's revised target) with yields on track and high confidence in performance, quality, and reliability. Calendar 2026 HBM supply is fully sold out, underscoring strong positioning in this high-value AI segment.

Supply constraints support pricing and margins —

Broad-based shortages affect large and smaller customers (some meeting only 50–67% of needs). Micron is maximising existing assets, ramping the 1-gamma node for incremental bits in 2026(more bits = more supply), and investing in greenfield capacity (new sites) (e.g., new DRAM fab in New York, NAND fab in Singapore with first wafers in H2 2028, Tongluo site acquisition in Taiwan for DRAM support closing in Q2 2026). HBM’s higher silicon intensity further tightens overall DRAM supply.

Progress on multiyear customer agreements —

Customers are seeking longer-term deals with firm commitments (beyond traditional quarterly negotiations) due to memory’s critical role in AI systems, supply assurance needs, and Micron’s technology leadership (e.g., 30% lower power in HBM3E vs. competition, LPDRAM enabling 60% power savings in servers, strong NAND read-to-watt performance). These provide Micron with better visibility and commitment as it invests heavily in capacity and R&D. How long before management signal 'sold out through 2027? Not long imo.Innovation and portfolio strength —

Micron emphasised value delivery through products like LPDRAM for server “warm tier” (with a recent white paper highlighting tripled content potential and major inference improvements) and leading NAND in data centre SSDs (gaining share in performance TLC and capacity QLC, reaching >USD 1 billion run rate). This positions the company well for tiered memory/storage architectures in AI systems.

Margin and financial positivity — Gross margins guided to 68%(up from mid 50s), with expectations for expansion in the current quarter (Q3). How high will Q2 be? 75?Cost control, volume absorption, mix benefits (premium tech flexibility-selling what is at a premium), and pricing support further upside. NAND outlook has improved with market tightening, though it is a smaller segment.

Sustainability confidence —

Both demand (AI evolution, including agentic activities and edge proliferation) and supply factors (limited/fast supply additions via greenfield over node transitions) support a prolonged positive cycle, unlike typical past cycles. Micron is investing disciplinedly while reassessing the market continuously.

Overall, the tone was highly optimistic, portraying Micron as a technology and manufacturing leader perfectly aligned with the AI boom, with limited near-term supply relief and strong pricing/margin tailwinds. This aligns with positive market reactions (e.g., stock gains post-conference on HBM4 clarity and tightness outlook).

Some context. Imo Micron will earn $150 per share in the next 24 months. Think about that. It's a staggering number. What's it worth? I would argue a lot more than $400. Of course the market thinks the music might stop in 18 months yet TSM and Nvidia are both planning for a 7 year super cycle build out and then a trillion dollar maintenance programme. Who's right? We don't have to believe Mehrotra in isolation, but collectively Huang, CC Wei. The A Team, a lot of credibility there and this is before you look at the roadmap. The memory needs and this is the DC not the edge, pc, phone etc etc(cars)

-

“I’m back.” — The Matrix Reloaded (2003) – Agent Smith

-

Micron leading the industry. Contributing $1B in 2025 last Q (one product)and expected to grow to $15B in 2026! That's some growth. Physically the size of a deck of cards, this SSD can cost upwards of $15,000 each!

The Micron 9650 NVMe SSD is a groundbreaking enterprise-grade storage solution, marking the world's first PCIe Gen6 data centre SSD now in mass production as of early 2026.

Leveraging Micron's advanced 9th-generation (G9) NAND technology, it delivers unparalleled performance with sequential read speeds up to 28 GB/s—double that of leading Gen5 drives— Available in PRO (read-intensive, up to 30.72 TB) and MAX (mixed-use, up to 25.6 TB) variants, it supports E1.S and E3.S form factors with air or liquid cooling options, offering superior energy efficiency (up to 67% better for certain workloads compared to prior generations).

This makes it ideal for AI training, inference, vector databases, and KV cache tiering in hyperscale data centres, where high throughput and low latency eliminate bottlenecks in GPU-fed architectures.This product is undeniably cutting-edge and a big deal in the industry. As the sole Gen6 SSD currently available, it positions Micron as a first-mover in premium AI-optimised storage amid explosive demand from cloud providers and AI infrastructure buildouts.

Early qualifications with major OEMs and data centre customers underscore its rapid traction, contributing to Micron's record data centre NAND momentum.Regarding revenue potential: Exact figures for the 9650 are not broken out publicly, as Micron reports aggregated NAND/SSD results. However, with data centre NAND already exceeding $1 billion quarterly in late 2025 and analysts forecasting full fiscal 2026 NAND revenue around $15 billion (up ~79% year-over-year), the 9650—as a flagship high-margin product—stands to drive meaningful growth. In calendar 2026 (the first full ramp year), it could contribute several billion USD in sales, assuming scaling to hundreds of thousands or low millions of units at premium pricing ($5,000–$15,000+ per high-capacity drive).

-

Renaissance Technologies-the most successful hedge fund in the world has increased its Micron holding by $500M to almost $1B in their latest 13F filing.

This is not just another fund. It’s one of the most data-driven, disciplined, and historically successful quantitative hedge funds ever built.

We are in good company.