Nvidia News

-

The Trump administration is reportedly pressing Congress to reject a proposed provision that would require Nvidia (NVDA) to prioritise sales of its advanced artificial intelligence chips to US-based companies before exporting them to China or other restricted countries, according to a Bloomberg report published today.

The measure under discussion is the bipartisan GAIN AI Act, which remains in its early stages. It seeks to establish a formal “America-first” allocation system for controlled AI semiconductors and is being considered for inclusion in the annual National Defence Authorisation Act (NDAA).

The White House’s intervention is regarded as a significant victory for Nvidia, which has actively lobbied the incoming administration to preserve greater flexibility in its export policy. China had previously been a major revenue contributor for the company until successive US export controls prompted Nvidia earlier this year to exclude the market from its forward sales forecasts amid heightened geopolitical risk.

-

Highlights from the company's Q3 earnings + Call:

Financial HighlightsRevenue: $57.0 billion (+62% YoY, +22% QoQ) → record $10 billion sequential increase

Data Centre: $51.2 billion (+66% YoY)

Networking: $8.2 billion (+162% YoY)

Gaming: $4.3 billion (+30% YoY)

Professional Visualisation: £760 million (+56% YoY, record)

Automotive: $592 million (+32% YoY)

Non-GAAP Gross Margin: 73.6% (beat guidance)

Q4 FY26 Guidance: $65 billion ±2% (mid-point +14% QoQ)

FY27 Gross Margin target: mid-70s (despite rising input costs)Strategic & Demand Highlights $0.5 trillion Blackwell + Rubin revenue visibility from Jan 2025 → Dec 2026 → Colette confirmed “the number will grow”

New major commitments announced on/around the call pushing visibility higher:

– Anthropic: deep partnership + up-to-1 GW commitment (first time Claude runs natively on NVIDIA)

– KSA / HUMAIN: 400k–600k additional GPUs over 3 years

– AWS / HUMAIN: up to 150k GB300 accelerators + 500 MW flagship facility

– OpenAI: strategic partnership + potential NVIDIA investment; NVIDIA helping build ≥10 GW of OpenAI-owned data centres

Blackwell ramp: GB300 now >⅔ of Blackwell revenue; seamless transition, already shipping at scale to major CSPs

Rubin platform: on track for 2H 2026 ramp, another “X-factor” leap; silicon already back, bring-up proceeding well

China exposure: essentially $0 data-centre compute revenue assumed (H20 only ~$50 million in Q3)Jensen’s Big-Picture MessagesThree simultaneous platform shifts driving demand: General-purpose → accelerated computing (post-Moore’s Law)

Classical ML → generative AI (already transforming hyperscaler recommender systems, search, ads)

Generative → agentic & physical AI (fastest-growing apps in history)Inference is exploding because of reasoning / chain-of-thought; GB200/GB300 with NVLink-72 delivering 10–15× performance vs H200

NVIDIA content per gigawatt rising every generation

– Hopper era: ~$20–25 billion/GW

– Blackwell (Grace-Blackwell): $40+ billion/GW

– Rubin: higher still (I expect revenue tempo to pop again, from +$10 to +$15B)

No sign of supply catching demand in next 12–18 months; every installed GPU (new & old generations) remains fully utilised

Strategic investments (OpenAI, Anthropic, xAI, Mistral, etc.) are about expanding the CUDA ecosystem and co-development, not just financial betsBottom Line NVIDIA is still in the early innings of a multi-year, multi-trillion-$ AI infrastructure build-out, remains supply-constrained, and continues to increase both performance-per-watt and $-per-GW with each architecture. Demand visibility is growing faster than the already enormous $0.5 trillion base case.

As we said in the past, their tempo QoQ very much looks like 60(Q3)-70-80-90-100. Which would equate $340B over the next 4 quarters and $380B for calendar 2026 with estimated earnings of over $200B whilst constrained. Their PE imo is circa 23.

There may be bubbles forming in some names but not here. And what is amusing is the bears(some), having been embarrassed again by getting it wrong have resorted to saying the company financials are made up.

The result was very important, setting up the direction into the year end across the wider market and particularly in tech. I would think it should give all investors, the ones that listen and think, a lot of confidence in the space and specifically our names, none of which are stretched and many being very fairly priced.

We have discussed putting in the work and understanding the detail. An immersive exercise where you literally live and breath it day in day out for years-that is how you gain confidence, de-risk and de-stress about the daily, weekly and randomness of the market. We have a very special business here and imo they really are just getting started. I look forward to following their journey and updating/commenting on every twist and turn.

-

I'm not overly concerned about the power infrastructure. Where is a will, there is a way.

-

Numpty Q here.

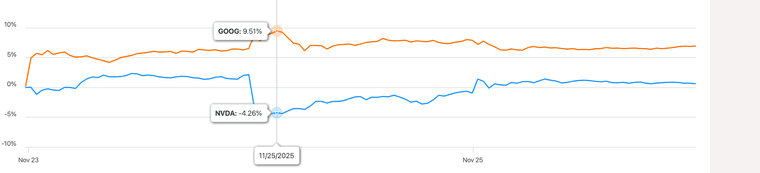

NVDA took a wallop a couple of days ago because apparently Alphabet (GOOG) think they can gain the upper hand in the chip race.

My question is not whether this aspiration is realistic; it's why GOOG hasn't pushed upwards given this news? It's actually slightly down on it's position 48 hours ago.

Just wondering. And if the answer is 'markets are irrational' then I guess I'll have to stop thinking about it.

-

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

@mikeiow said in Nvidia News:

Pretty sure Google continues to be a big buyer from Nvidia. Not an expert like Adam in this area, but I wouldn't bet against Nvidia on this one....

No - I have a position in both NVDA and GOOG and am happy with things as they are. I was just curious why GOOG didn't go up as NVDA went down.

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

-

There is no GOOG upper hand at Nvidia's expense. If GOOG can sell a few billion TPUs to Meta, happy days but it has no impact whatsoever on Nvidia's supremacy. We've been over this, TPU good for one thing (not prog). GPU is programmable.

TSM also dropped when investors thought less chips to be sold then realised-oh wait, TSM make TPUs as well.

The market is wrong, again but I'll take the big GOOG pop. Recall we said it was grossly undervalued for a long time

@Adam-Kay said in Nvidia News:

... I'll take the big GOOG pop.

What GOOG pop was that then? Down just over 1% today, up 0.1% since Tuesday close. I like my pops bigger than that!

Having said that, the rest of the figures look quite handsome today and I'm hopeful for a gain when the numbers are out tomorrow.

-

Only FX tomorrow-Thanks Giving-market closed. Half day on Friday

-

@Adam-Kay said in Nvidia News:

... I'll take the big GOOG pop.

What GOOG pop was that then? Down just over 1% today, up 0.1% since Tuesday close. I like my pops bigger than that!

Having said that, the rest of the figures look quite handsome today and I'm hopeful for a gain when the numbers are out tomorrow.

-

Thanks Adam. Google Finance is now showing me a graph very similar to that when I compare GOOG with NVDA over the last week, although I am sure it was giving different figures yesterday and the day before. It does indeed look like a nice pop from GOOG and one I am happy to have!

-

Colette Kress absolutely smashed it at the UBS conference yesterday, proper bullish vibes everywhere! She told the room to forget any “AI bubble” nonsense – this is a multi-trillion-dollar revolution that’s only just kicking off. She’s calling for $3–4 trillion of data-centre spend by the end of the decade, with half of it flowing straight into NVIDIA’s GPUs. Insane numbers.

Demand is 'overwelming' (the only way to describe it): $500 billion already booked for Blackwell and Rubin chips through 2026, and every single chip they finish ships instantly. Inventory is exploding because they literally cannot build them fast enough. Then layer on the monster OpenAI deal (up to $100 billion still in play) and Anthropic’s billions waiting in the wings – the growth runway is endless.

Competition? Forget about it. Blackwell is flying out the door, Rubin’s already taped out and lands in 2026 with another massive leap, and NVIDIA’s full-stack systems are light-years ahead. Margins staying fat in the mid-70s, inference now a proper money-spinner, and the whole AI flywheel is accelerating like mad.

Honestly, she made NVIDIA look unstoppable. And I would add, she chooses her words carefully-always precise and not one to get carried away, so her comments are very pleasing.

-

Developing news- US Govt in talks to approve mid tier Nvidia silicon into China. Stock is moving up. Watch this space.

-

It’s up again after hours to 190. Save the kittens

-

Trump green lights H200 to select/approved customers in China. The Govt taking a 25% share of any sales. It's a net positive given zero previous sales. Will the CCP allow it. It will be hard to resist given it is by far the most powerful chip available in China. My take being anything is better than nothing. I would expect 500k chips give or take equating to $30B over the next 12 months.

-

The assertion that China will refuse to purchase NVIDIA’s H200 chips appears to be FUD imo.

Economic imperatives and technological realities strongly suggest otherwise.Recent policy shifts under the Trump administration have relaxed restrictions, permitting H200 exports to pre-approved Chinese customers subject to a 25% surcharge earmarked for United States purposes (Reuters).For hyperscalers such as Tencent, ByteDance, and Alibaba, which have been constrained by the limited performance of the sanctioned H20 or by reliance on smuggled inventory, the H200’s 989 BF16 TFLOPS represent a roughly sevenfold leap over the H20’s 148 TFLOPS.Domestic alternatives, principally Huawei’s Ascend 910C, remain markedly inferior. Independent benchmarks place the 910C at approximately 76% of H200 performance per chip (15,840 TPP vs 12,032 TPP) and significantly lower efficiency at cluster level, with power consumption up to 2.3 times higher for equivalent throughput.

Production is further hampered by SMIC’s 7 nm yields, reportedly below 30%, creating chronic supply shortages. Beijing’s reported requirements—mandatory justification for foreign purchases and restrictions on public-sector use—are largely procedural and political signalling rather than outright prohibition.

President Xi’s recent “positive” remarks on United States-China technology co-operation reinforce pragmatic acceptance. In the absence of a credible domestic substitute capable of training frontier-scale models, Chinese enterprises are expected to acquire H200s in volume, potentially generating 10s of billions USD in additional revenue for NVIDIA in 2026–2027.

-

Reports, the first H200 chips from inventory will ship(China) in February with new capacity soon entering production. The Feb $ circa 3 billion. Every little helps

-

Reported by Reuters today

The sudden reopening of the Chinese market for Nvidia's H200 AI chips represents an explosive catalyst for the company's revenue trajectory in 2026 and beyond.

Chinese tech giants have already placed orders for more than 2 million H200 units targeted for 2026 delivery, far outstripping Nvidia's current 700,000-unit inventory. Priced at approximately $27,000 per chip (with variations by volume and including both standalone H200 GPUs and GH200 superchips), fulfilling this backlog could deliver over $54 billion in gross revenue—before the U.S. government's 25% export fee and final adjustments.

Bring it on!