Microsoft

-

All things MSFT related

-

Msft has been in the news lately-this time in the field of Quantum computing. Is it a threat to Nvidia? In short, no.

Quantum computers are not designed to perform memory intensive operations like AI and they require extreme conditions such as operating in a near absolute zero environment in a vacuum, making them impractical for most business cases.Quantum computers are very good at solving complex scientific problems by simulating interactions from almost infinity large permutations.

Nvidia is a leader in providing researchers(msft/Goog) with the software and hardware to make progress in quantum computers possible (DGX Quantum(servers), CUDA-Q(a quantum dev platform) and cuQuantum SDK(libraries and dev tools).

Jensen Huang recently stated 'practical uses for quantum computers are between 10 and 30 years away'.Microsoft has just announced a major breakthrough in quantum computing with its new Majorana 1 chip. This chip is built using a special type of particle called Majorana fermions, which are unique because they act as their own antimatter counterparts. The idea is that this will make quantum computers more stable and less prone to errors, something that’s been a huge challenge so far.

The big deal? Microsoft believes this chip could scale up to a million qubits—the building blocks of quantum computers—which would be a massive leap forward. Currently, most quantum computers only work with a few hundred qubits at best.

This news has shaken up the tech industry, with investors reacting quickly to the potential of this technology.Microsoft’s CEO, Satya Nadella, has said this technology could help revolutionise industries like cybersecurity, drug discovery, and climate science by solving problems that traditional computers can’t handle. However, while the Majorana 1 chip is a major step forward, it will still take more research and development before quantum computing becomes widely usable.

-

Transcript from an interview with Bill Gates, Steve Ballmer and Satya Nadella to celebrate 50 years of MSFT(Friday April 4)

Nadella: What we are really supplying is intelligence. It started in 1975 with Bill and software was the thing. And today nobody is going to get up and say, hey, we need less of it. I need more of it and I need it daily. One thing is certain, the world needs more compute in the future. We will adjust to the geopolitical shifts and see how that shakes out.(Nadella). Bill Gates- I’d like to say that the biggest trend in the world today, way beyond any political shifts is the arrival of AI. We just turned 50 as a company but the next decade will probably be the most profound. Asked about potential over supply of AI compute, Nadella: Do we have to be matched up to it, perfect matching of demand and supply every second? No. So is this something we are absolutely committed to to building our data centres across 60 regions? We are absolutely going to do this. Sure there are always adjustments.

Steve Ballmer: There is a bright future in intelligence and the biggest mistake we could make is to slow investment due to a short term hiccup. Bill Gates: you will always go through periods of having a bit too much supply but over the next 10 years you will probably find we are always going to be in a shortage vs demand so what is key is having a large capital budget to maintain the investment build out.

Nadella: Heres the interesting thing. We have found the thing (AI) I am not looking for any other things. Intelligence will power everything . I am building our infrastructure to support the need in the future. The need from a robotics company, an autonomous driving company, a medical research and drug company.

-

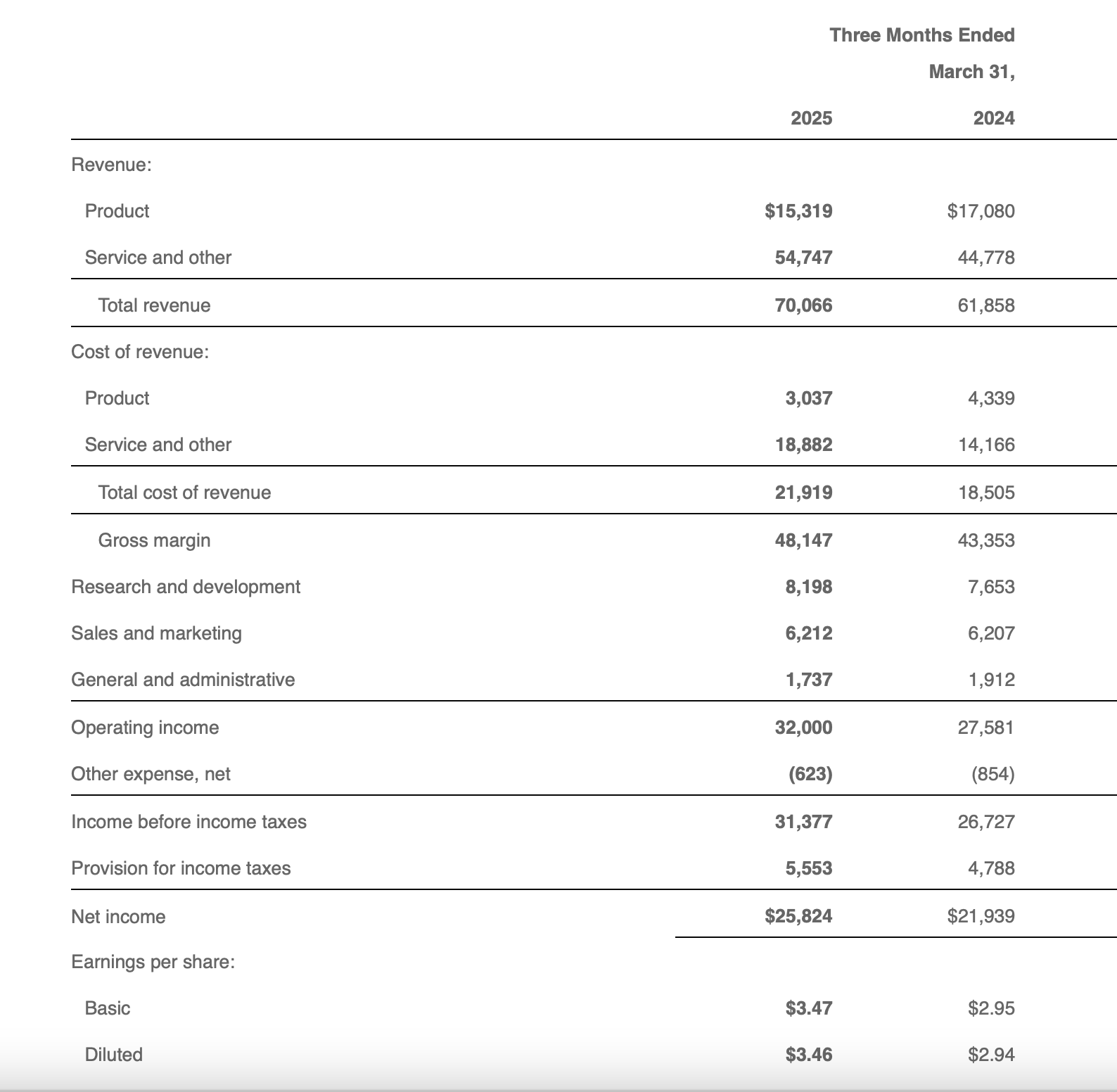

Microsoft GAAP EPS of $3.46 beats by $0.24, revenue of $70.06B beats by $1.62B

A Big beat. Details tomorrow

-

Management Perspective

Chief Executive Satya Nadella celebrated a record-breaking quarter, with Microsoft Cloud revenue surpassing $42 billion, reflecting a 22% rise in constant currency. He underscored robust demand for AI and cloud solutions, noting that clients such as Coca-Cola and ServiceNow are expanding their Azure usage. Adoption of PostgreSQL among Fortune 500 firms has also surged. Nadella highlighted advancements in AI, with Microsoft Fabric now boasting over 21,000 paying customers and GitHub Copilot reaching more than 15 million users. He also pointed to significant growth in AI-enhanced productivity tools like Microsoft 365 Copilot, which tripled its customer base year-on-year.Finance Director Amy Hood reported Q3 revenue of $70.1 billion, up 13%, with earnings per share at $3.46, an 18% increase. She highlighted strong growth in commercial bookings, up 18%, driven by Azure commitments and long-term client contracts.

Outlook

Microsoft anticipates Q4 revenue for the Productivity and Business Processes segment to range between $32.05 billion and $32.35 billion, equating to 11%–12% growth in constant currency. M365 Commercial Cloud revenue is expected to grow by approximately 14% in constant currency. Intelligent Cloud revenue is projected to be between $28.75 billion and $29.05 billion, with Azure revenue growth forecast at 34%–35% in constant currency. More Personal Computing revenue guidance is set between $12.35 billion and $12.85 billion, with Windows OEM revenue expected to decline in the low to mid-single digits.Financial Performance

Microsoft Cloud revenue reached $42.4 billion, up 20% in constant currency. The gross margin percentage for Microsoft Cloud was 69%, slightly lower due to the expansion of AI infrastructure. The Productivity and Business Processes segment generated $29.9 billion in revenue, fuelled by growth in Microsoft 365 and LinkedIn, with Dynamics 365 revenue rising 16% in constant currency. Intelligent Cloud revenue totalled $26.8 billion, with Azure and other cloud services growing 33% in constant currency, including notable contributions from AI services. More Personal Computing revenue was $13.4 billion, with Search and news advertising revenue (excluding traffic acquisition costs) increasing 21% in constant currency.Q&A Session

Keith Weiss, Morgan Stanley: Enquired about the AI-driven data centre strategy. Nadella explained that build and leasing adjustments are being made to align with workload growth, emphasising supply chain optimisation. Hood added that power constraints are region-specific, with continued infrastructure investment.

Brent Thill, Jefferies: Asked about growing demand for cloud migrations. Nadella noted consistent progress in migrations, data expansion, and cloud-native workloads as key drivers.

Karl Keirstead, UBS: Questioned Azure AI’s 16-point contribution to revenue growth. Hood clarified that non-AI services exceeded expectations, while AI services benefited from earlier-than-anticipated supply availability.Sentiment Analysis

Analysts conveyed positive sentiment, particularly regarding AI-driven Azure growth and commercial cloud momentum. Their tone was curious yet optimistic, focusing on growth sustainability. Management maintained a confident and upbeat outlook, with Nadella emphasising AI and cloud opportunities and Hood highlighting operational efficiencies and strategic foresight.Quarter-on-Quarter Comparison

Microsoft Cloud revenue rose from $40.9 billion in Q2 to $42.4 billion in Q3, driven by strong AI and cloud demand. Productivity and Business Processes revenue increased from $29.4 billion to $29.9 billion, supported by greater adoption of M365 and Dynamics 365. Q3 showed stronger-than-expected AI adoption, with notable growth in Copilot seat expansions and usage intensity. Management’s tone remained optimistic, with increased focus on AI’s role in future growth compared to the prior quarter.Risks and Concerns

Management acknowledged potential AI capacity limitations beyond June 2025, with Nadella stressing the need to balance long-term infrastructure investments with demand-driven expansion. Power and data centre space constraints were noted, with ongoing investments to address these challenges. More DC needed! Here the risk is not getting enough due to infrastructureFinal Takeaway

Microsoft’s Q3 2025 performance demonstrated strong revenue growth across its cloud and AI segments, underpinned by widespread adoption of AI-driven tools and enterprise solutions. The company forecasts continued momentum into Q4, with a focus on expanding AI capabilities and resolving capacity constraints to meet soaring demand. -

-

Microsoft’s $6.2 B, five-year agreement with Nscale Global and Aker to rent hyperscale AI infrastructure in Norway, underscores its aggressive push to scale AI capabilities. Announced today, the deal grants Microsoft access to high-performance AI compute capacity starting in 2026, leveraging Norway’s abundant renewable energy and stable regulatory environment. Nscale Global, a British data centre firm, and Aker, a Norwegian investment company, will deliver infrastructure tailored for AI workloads, which demand advanced cooling and high power density. Norway has an abundance of cheap hydro power and it's naturally cold

This move aligns with Microsoft’s $80 billion AI infrastructure investment through 2028, prioritising speed and flexibility over building new facilities. By leasing rather than constructing, Microsoft reduces capital costs and accelerates deployment, complementing its Azure expansion. The deal also reflects a strategic shift toward partnerships, mitigating risks in a dynamic AI market where hardware evolves rapidly, ensuring Microsoft remains competitive in cloud and AI services.

-

MSFT deploy their first Blackwell Ultra cluster. A mere 65 racks. Several hundred thousands additional GPUs coming.

-

Msft received multiple analyst upgrades last night prompting a pop to $550(+$20) in pre market. All eyes on tomorrow's earnings. It should be very strong.

MSFT and Apple might join the 4T club today!

-

MSFT signed an agreement with OpenAI valuing its stake at roughly $135 billion. Microsoft said it supports OpenAI’s move to form a public benefit corporation (PBC) and undertake recapitalisation.

Following the deal, Microsoft holds an investment representing around 27% of OpenAI Group PBC on an as-converted diluted basis, including employees, investors, and the OpenAI Foundation. Excluding recent funding rounds, Microsoft’s earlier stake was 32.5%.

OpenAI has also agreed to purchase $250 billion in Azure services, though Microsoft will no longer have exclusive rights to supply computing power. The partnership maintains Microsoft as OpenAI’s primary model collaborator, with exclusive intellectual property and Azure API rights until artificial general intelligence (AGI) is achieved.

Microsoft’s IP rights extend through 2032, excluding OpenAI’s consumer hardware, while OpenAI gains flexibility to collaborate with third parties. -

A very strong MSFT result- the softness AH is yet again concern over AI spending-odd given the Nr's are great.

Microsoft reported its fiscal Q2 2026 results (quarter ended 31 December 2025) on 28 January 2026, after market close. The company delivered strong top- and bottom-line growth, driven primarily by its cloud and AI businesses, beating analyst expectations across key metrics. However, shares dropped around 6-7% in after-hours trading, reflecting investor concerns over escalating capital expenditure (capex), slightly moderating cloud growth rates, and margin pressures from AI investments.Key Financial Metrics with ComparativesHere is a table summarising the main figures, including year-over-year (YoY) changes, constant currency (CC) adjustments, and comparisons to analyst consensus estimates.Metric

Key Financial Metrics

Revenue: $81.3 billion (+17% YoY, +15% constant currency)

Operating Income: $38.3 billion (+21% YoY, +19% constant currency)

Net Income (GAAP): $38.5 billion (+60% YoY)

Net Income (Non-GAAP): $30.9 billion (+23% YoY, +21% constant currency)

EPS (GAAP): $5.16 (+60% YoY)

EPS (Non-GAAP): $4.14 (+24% YoY, +21% constant currency)

Microsoft Cloud Revenue: $51.5 billion (+26% YoY, +24% constant currency) — first time over $50 billion

Capex: $37.5 billion (+66% YoY)

Shareholder Returns: $12.7 billion (+32% YoY)Segment RevenueProductivity and Business Processes: $34.1 billion (+16% YoY, +14% constant currency)

Intelligent Cloud: $32.9 billion (+29% YoY, +28% constant currency)Azure and other cloud services: +39% YoY (+38% constant currency)More Personal Computing: $14.3 billion (-3% YoY)

Other HighlightsCommercial Remaining Performance Obligation (RPO): $625 billion (up significantly YoY)

Q3 FY2026 Guidance: Revenue $80.65–81.75 billion (15–17% growth); Azure growth 37–38% constant currencySegment BreakdownProductivity and Business Processes: $34.1 billion revenue (+16% YoY, +14% CC). Microsoft 365 Commercial cloud +17%, Consumer +29%, Dynamics 365 +19%, LinkedIn +11%. Solid demand for AI-integrated tools like Copilot.

Intelligent Cloud: $32.9 billion revenue (+29% YoY, +28% CC). Azure and other cloud services +39% (+38% CC), beating estimates. Commercial remaining performance obligation surged to $625 billion (up massively), indicating huge future backlog. This segment was the standout, fuelled by AI demand.

More Personal Computing: Revenue declined, dragged by Gaming (Xbox content/services down, hardware weakness) and other areas, though Windows OEM and search advertising showed some resilience.Guidance and OutlookQ3 FY2026 revenue:

$80.65-81.75 billion (midpoint $81.2 billion, in line with estimates).

Azure growth: 37-38% (CC), slightly below Q2's 39% and some higher expectations.

Overall revenue growth guided at 15-17%.

No major changes to full-year outlook, but continued emphasis on heavy AI investments. CFO Amy Hood noted capex will stay elevated to meet demand.Main Points and CommentaryMicrosoft absolutely blew it away on the headline numbers—consistent beats on revenue and EPS, with five straight quarters of surprises now.

Azure's 39% growth highlights leadership in the AI race, cloud revenue crossed $50 billion for the first time, and metrics like the surging performance obligations signal explosive long-term potential. **CEO Satya Nadella stressed accelerating AI adoption, with strong uptake in Copilot tools.**That said, the after-hours drop (to around $430-450 range from a close near $480) —it's a market reaction to near-term pressures in an already high-valuation AI story. Key triggers:Ballooning Capex: $37.5 billion (well above estimates) raises fears of an "AI tax" where infrastructure spending (data centres, GPUs) outpaces near-term monetisation. Investors question ROI timelines, especially with potential for $100 billion+ annual spend.

Cloud Growth: Azure's 39% was strong but a slight slowdown from prior acceleration, and Q3 guidance of 37-38% came in light for some. Capacity constraints were acknowledged as persisting.

Margin and Segment Weakness: Lighter margin outlook due to AI costs, plus drags from gaming and personal computing, shifted focus to risks over beats.

High Expectations: With the stock at a premium valuation, any hint of "not perfect" sparks sell-offs amid broader AI hype cooling.Overall, this looks like a classic overreaction and potential buy-the-dip—fundamentals are rock-solid, and AI demand isn't vanishing. Short-term volatility may linger until clearer signs of ROI from those investments emerge, but Microsoft has a history of conservative guidance proving beatable.