Micron Technology

-

Write up tomorrow. 9.3b and 1.91. The guide was high in the extreme. 2.35-2.60 and 11b. This is quarter to quarter remember. Brilliant result well ahead of the highest expectations. Bodes very well for the related sectors.

They blew it away and guided ‘off the charts’

-

Here are Microns results plus highlights from their post earnings conference call. Top line growth , EPS growth driven by margin expansion. Could not have asked for a better report card!

Record Q3 revenue of USD 9.3 billion, up 37% YoY and 15% QoQ, driven by robust demand for DRAM and NAND products.

Earnings per share (EPS) of USD 1.91, surpassing analyst expectations of USD 1.59 (20.13% surprise), up 200% YoY and 22% QoQ.

Gross margin improved to 39%, up 110 basis points QoQ, reflecting optimised pricing and cost management.

Free cash flow reached over USD 1.9 billion, the highest in six years, indicating robust financial health.

Data centre revenue more than doubled YoY, reaching a record level, fuelled by AI-driven demand.

High-bandwidth memory (HBM) revenue grew nearly 50% QoQ, exceeding USD 1 billion, with HBM sold out for calendar 2025.

Technology and Product Leadership:

Record DRAM revenue with the 1-gamma DRAM node (using EUV) offering 20% lower power, 15% better performance, and over 30% improvement in bit density compared to 1-beta DRAM.Gen9 NAND node is the industry’s fastest TLC-based NAND, with disciplined ramp-up to balance supply and demand.

HBM3E offers 20% lower power consumption than competitors’ 8-high solutions, with 50% higher memory capacity and industry-leading performance. HBM4 is expected to ramp in 2026 with over 60% bandwidth increase.

Leadership in low-power (LP) memory for data centres, reducing memory power consumption by over two-thirds compared to D5, with a transition to SOCAMM form factor planned.

Strategic Positioning and Investments:

Well-positioned for AI-driven demand, with CEO Sanjay Mehrotra emphasising Micron’s role in the “transformative era” of AI.Significant investments in U.S. manufacturing and R&D, including a new HBM advanced packaging facility in Singapore, to support future growth.

Achieving share gains in high-margin product categories, strengthening customer relationships.

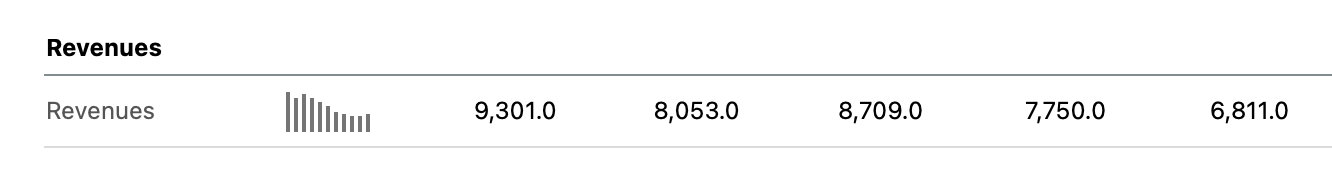

Key Financial Metrics (Q3 2025) with YoY and QoQ Changes, Plus Q4 2025 Guidance

Revenue: USD 9.3 billion

YoY: +37% (from USD 6.8 billion in Q3 2024)QoQ: +15% (from USD 8.1 billion in Q2 2025)

Earnings Per Share (EPS): USD 1.91

YoY: +200% (from USD 0.64 in Q3 2024)QoQ: +22% (from USD 1.57 in Q2 2025)

Gross Margin: 39%

YoY: Not explicitly stated, but significantly improved from negative or low margins in Q3 2024 due to market recoveryQoQ: +110 basis points (from 37.9% in Q2 2025)

Free Cash Flow: USD 1.9 billion

YoY: Highest in six years, specific YoY change not providedQoQ: Significant increase, specific QoQ change not provided

Q4 2025 Guidance:

Revenue: USD 10.7 billion (±USD 200 million)Gross Margin: 42% (±50 basis points)

EPS: USD 2.51 (±USD 0.10)

-

Talking heads don't know what they are talking about.:) The stock is at its multi month high-most likely derivatives out of the money calls-option writers don't need the hedge(the shares) so sell them. No concerns here. It's a cyclical business yes but this cycle is going to last a very long time so I would say it's secular plus other memory segments which have been depressed due to consumer electronics being flat can only get better. The fed PE is about 11X which is dirt cheap imo.

-

I see we had another “expert” making noises yesterday that the second half business will be poor for Micron

-

every quarter will be better than the last. Micron will double revenue and earnings over the next 4-5 years.

-

Today Micron updated the market on its current quarters guidance and the stock is up in pre market trading.

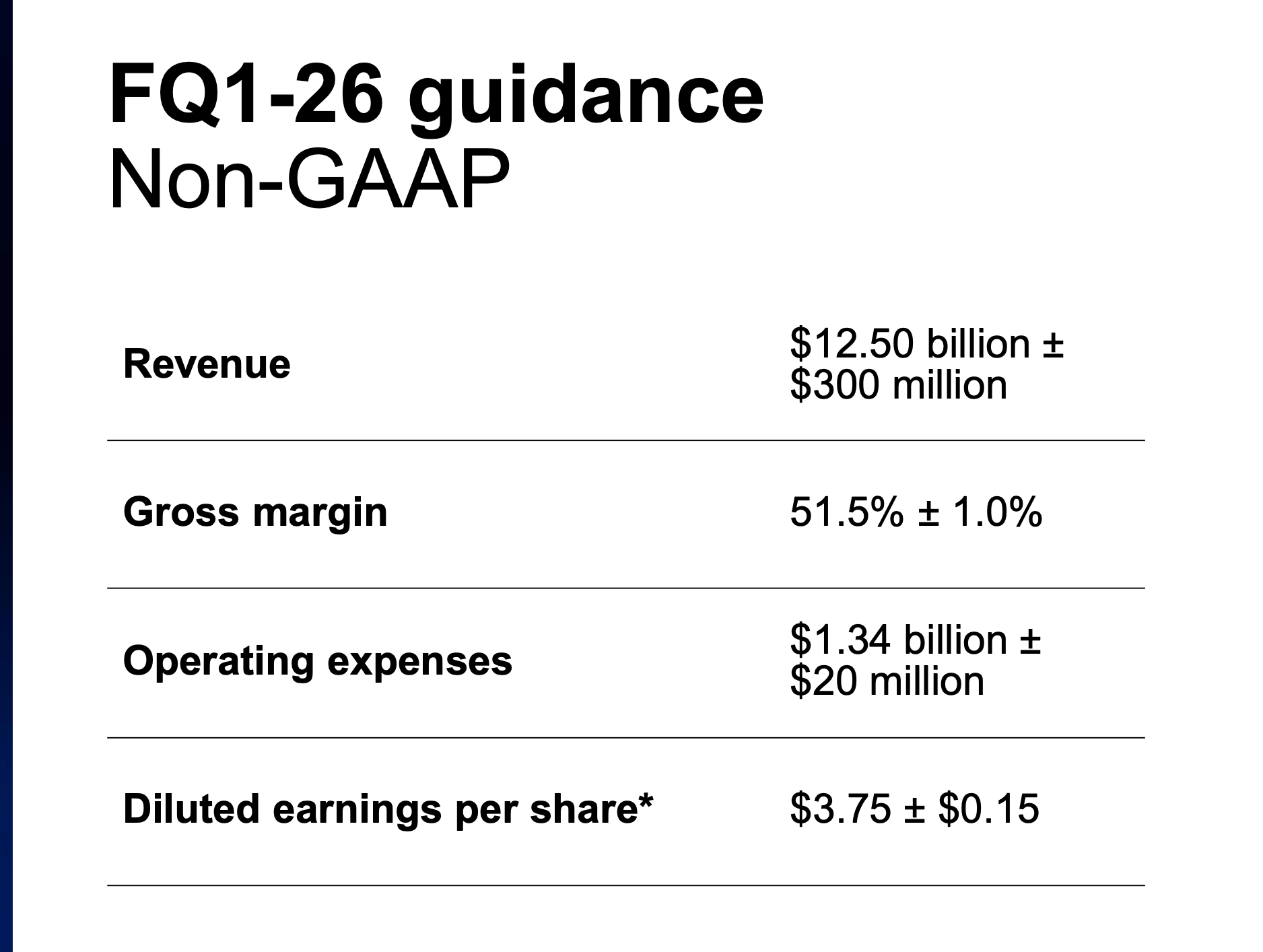

Micron has today revised its projections for revenue, gross margin, operating expenses, and earnings per share (EPS) for the fourth quarter of fiscal 2025, concluding on 28 August 2025. Previously, the Company forecasted revenue of $10.7 billion ± $300 million, non-GAAP gross margins of 42.0% ± 1.0%, and non-GAAP EPS of $2.50 ± $0.15 for the fiscal fourth quarter.The Company has now updated its outlook for the fourth quarter of fiscal 2025, projecting revenue of $11.2 billion ± $100 million, non-GAAP gross margins of 44.5% ± 0.5%, and non-GAAP EPS of $2.85 ± $0.07.

This revised forecast reflects improved pricing, particularly for DRAM, and robust operational performance. Basically HBM sales are surging significantly. And I think they are still being conservative, $3 EPS? Maybe

Curiously it popped on Friday so someone knew this was coming. If todays pre market pop holds this would amount to a 15% gain in the last week.

The market has been wrong about MU consistently -thinking Samsung would dominate, however Samsung has struggled to obtain certification from Nvidia due to heat management and following that issue through the news over time, one could deduce that other players would gain share. That's exactly what happened.

Historical Q revenue. Now > $11B and its PE is actually about 10- Looks good value particularly given the growth rates.

-

Great news ….i wonder what that expert will be writing about this week after his views from a few weeks ago ….

-

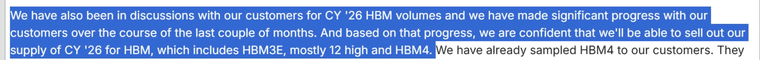

Further, yesterday Micron's Chief Business Officer said the following. Basically they are 'sold out' until Dec 26.

What companies like Micron do is the bulk of the product will now be under contract. Micron will reserve some inventory to also sell on the spot market at potentially, much higher prices and of course they will likely increase yield through efficiency.

HBM4 is a key component in Rubin architecture (Blackwell-Next)

-

I was reading yesterday that Dram spot prices continue to surge due to tight supply (high demand). This bodes very well for Micron who have been materially surprising with their earnings beats over the past several quarters. They are due to report on the 23rd of this month. They certainly have the wind at their back.

-

This just in from Citi...

"We expect the company to report in-line results and guide well above consensus driven by higher DRAM and NAND sales and pricing," said Citi analysts, led by Christopher Danely, in a Thursday investor note. "We believe the continued memory upturn is being driven by limited production and better than expected demand, particularly from the data center end market (55% of Micron revenue)."

Citi increased its full-year fiscal 2026 revenue estimate to $56B from $54.5B and its earnings per share estimate to $15.02 from $14.62. Its full-year EPS estimate is 26% more than the consensus. Citi expects first quarter revenue guidance of $13B and first quarter EPS guidance of $3.23.

This would put their 1 yr fwd PE on 9.3X and I think their figures are light.

Granted memory is a cyclical business but we think this time it's a super cycle and Micron is very cheap. When you look at Palantir trading at a PE 30+ times(times!) higher-close to 300.

-

Micron Technology(MU) has emerged as a leading force in the high-margin, high-value enterprise SSD (eSSD) market, driven largely by the explosive growth of AI workloads.

Its eSSD portfolio, including the 6600 ION series with up to 122 TB and upcoming 245 TB drives, is designed for high-density, energy-efficient storage, precisely what modern AI and data centre applications demand.

With enormous amounts of data comes the need to store it and eSSD is the solution. Current demands are for 45 Billion TB of AI DC storage rising to an estimated 500 Billion TB by 2030. These are very high quality enterprise grade SSDs able to hold 250TB+ in a small form factor, priced in the $20k+ range. This segment will be the source of considerable growth for Micron which holds are material position (Nr 2) in the market.

-

Who is the No 1 in this game if you don’t mind me asking

-

Samsung, currently. As we have mentioned before, Samsung produce just about everything. This product is moving the MU needle but probably won't for Samsung.

Being the biggest in any given market does not always translate to most profitable, not when you are big in everything. And we wanted to invest specifically in the AI related memory, HBM and SSD so were drawn towards a pure play such as Micron

-

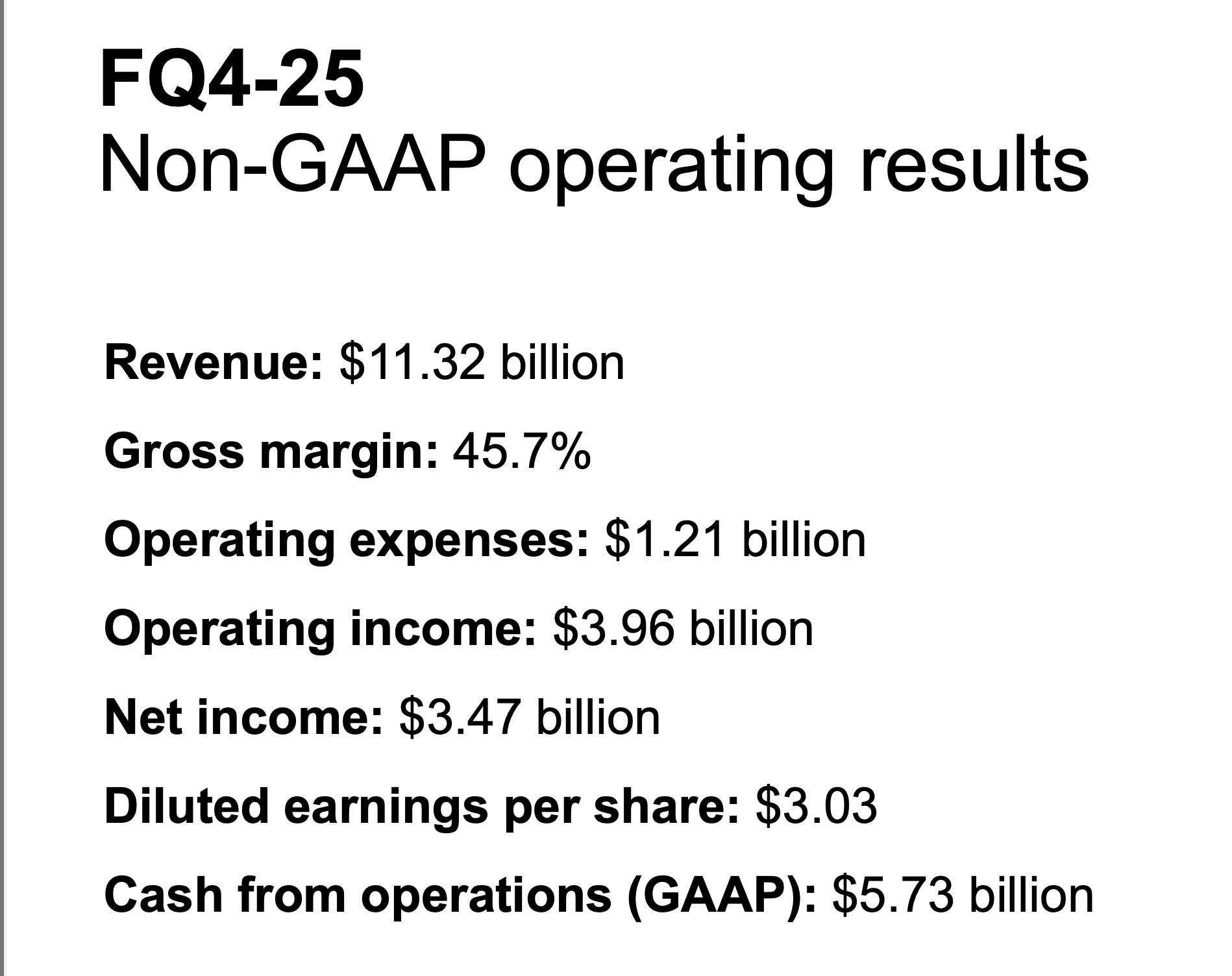

Prepared remarks from management:

• Micron had an outstanding finish to fiscal 2025, delivering fiscal Q4 revenue,

gross margin and EPS all above the high end of our updated guidance ranges.

• We achieved record revenue in Q4, driven by pricing execution and strong

performance across end markets.

• In our March 2024 earnings call, we said that we expect Micron to be one of

the biggest beneficiaries of AI in the semiconductor industry, and that we

expect to deliver record revenue and significantly improved profitability in fiscal

2025.

• I’m pleased to report that in fiscal 2025, Micron’s revenue grew nearly 50% to a

record $37.4 billion, and gross margins expanded by 17 percentage points to

41%. This performance was supported by the ramp of our high value data

center products and our broad-based DRAM pricing strength across end

markets.

Micron’s HBM4 12H (12-high) remains on track to support customer platform

ramps even as the performance requirements for HBM4 bandwidth and pin

speeds have increased.

• We have recently shipped customer samples of our HBM4 with industry-leading

bandwidth exceeding 2.8 TBps and pin speeds over 11 Gbps.NB: NIvidia original Rubin spec was 9 Gbps and recently pressed Micron for 10-analysts considered this onerous. The idea being to materially increase GPU bandwidth from:

At 9 Gbps: 6 stacks × ~2.3 TB/s = ~13.8 TB/s total.

At 11 Gbps: 6 stacks × ~2.8 TB/s = ~16.8 TB/s totalmost 17TB of data /sec is insane.

The guide is for $3.75 and we know that's light($4?). Expectations were $3.03! Margin 500bps higher. Why this stock is trading at a multiple of 10 is interesting to say the least. In fact it's less than 10 because imo they will earn over $18 and probably $20/share 'this year'(Q1 to Q4 ending August 28 2026).

Micron is growing revenue/margins almost as fast as Nvidia in percentage terms (though off a smaller base), yet trades at a fraction of the multiple.

Street numbers still lag Micron’s trajectory — consensus hasn’t fully caught up to the raised guidance and likely beats.

Historically, the market slaps a low multiple on memory because of volatility. But if AI/HBM becomes structural demand (multi-year, not cyclical), the market’s framework could shift.

This sets up what looks like a valuation anomaly — Micron at 9–10× forward vs peers 20–40×.Very pleasing result, a huge margin of safety and the cheapest AI story on wall street.

-

We can be patient with this one-not that gains have been slow having paid just under $90 in Feb 25! That being said, if they execute, they grow materially from here and for 'years'

The company reported $2B in HBM memory this quarter which translates to an annual run rate of $8B-more actually given QoQ growth. 12 months ago they estimated their market share by 2030 would be 30% of a TAM(total addressable market) in HBM of $100B (and that TAM will likely grow).

Interesting fact. HBM is the most expensive component of a GPU

-

Micron hits a new ALH

News today highlights intense demand for enterprise SSDs, driven by U.S. cloud service providers (CSPs) like Google and Meta securing significant NAND flash production for AI data centres (eSSDs-we spoke about this memory last week).

This has tightened supply, with lead times extending up to a year and NAND spot prices rising materially—QLC up 10% and TLC 5-7% in Q3 2025, with Q4 forecasts at 8-15% increases. Micron, a U.S.-based NAND leader, benefits immensely.

Its enterprise SSDs generated billions in FY 2025, with record market share gains. As spot prices climb, Micron’s high-capacity QLC SSDs (e.g., 9650 NVMe) command premium pricing, boosting NAND revenue . With U.S.-centric fabs (plants) and CSP-favoured supply chains, Micron avoids geopolitical risks, ensuring stable contracts. Rising spot prices could add $1-2B annually to revenue, with NAND margins nearing mid-30s% by 2026, solidifying Micron’s AI-driven growth.

GOOG and META apparently have offered some companies open contracts to buy entire fabs production.

-

Micron hits an all time high today on the back of Citi analyst Buy opinion. Are we surprised-No, we saw this coming 6 months ago. The only surprise is their target of $230 puts their multiple on 10. I think it deserves a lot more than 10.

From the client note:Micron Technology shares rose +6.5% to $204 after Citi raised its price target from $200 to $240, while maintaining a Buy rating.

Key points from Citi analyst Christopher Danely:

Believes DRAM demand will be “unprecedented” owing to AI growth.

Expects DRAM to secure long-term contracts within the AI supply chain — similar to NVIDIA (NVDA), AMD, and Broadcom (AVGO).

Predicts higher and more sustainable DRAM pricing, enabling Micron’s gross margins to return to around 60%, with peak earnings per share (EPS) above $23 (nearly double the previous high of $12.26).

Updated financial forecasts:

FY2026 revenue: $62.5 billion (up from $56 billion)

FY2026 EPS: $21.05 (up from $16.93)

Estimates for FY2027 and FY2028 were also raised.

Context:

The optimism reflects a growing sentiment in the market that Micron will be a major beneficiary of the AI hardware boom, not just GPU manufacturers, as memory demand surges to support AI model training and inference workloads.