Nvidia News

-

-

Or even the Beeb

Nvidia expects $5.5bn hit as US tightens chip export rules to China https://www.bbc.com/news/articles/cm2xzn6jmzpo

️

️

Still, since federal officials had advised them the licence requirement "will be in effect for the indefinite future", it feels safe to assume it will be reversed by teatime 🫣 -

Hi Mike,

Tying tech restrictions like the H20 license requirement to tariff negotiations fits his pattern of using multiple levers to extract concessions. China’s domestic alternatives (e.g., Huawei’s Ascend 910B) lag in performance for certain workloads, and U.S. restrictions on advanced chipmaking tools (e.g., ASML’s EUV machines) limit China’s ability to close the gap quickly. This dependency gives the U.S. leverage to demand trade concessions.

Trump is betting on China buckling under pressure rather than escalating.

Real impact. Historically $4B/Q, however a rumoured $16B in Q1, 2025 in anticipation of a ban. Is this credible and if so how much did they ship. We won’t know until earnings Q&A.

My view is and always has been, China was an iffy market due to various restrictions. The mentioned $5.5B is a one time reserve to write down any remaining inventory and or compensate for purchase commitments. It amounts to 3 weeks earnings. In some ways it lifts the overhang of future speculation regarding GPUs and China. With this administration, nothing is certain and I would speculate that even this policy is subject to change.

Without China it doesn’t change the investment decision

-

True….although I’m will to bet that Trump betting on China buckling under pressure will prove to be false.

The Chinese would sooner starve themselves than lose face, & trump has already showed signs of weakness in his badly thought out tariff wars…flipyflappy U-turns, the bond market appearing to flex it’s strength against him

️

️ -

Time will tell-in the mean time expect the unexpected.

-

NVIDIA likely sold approximately three times its typical quarterly revenue in China during Q1 2025, generating substantial gross profit that offset the ($5.5 billion) charge from the H20 export ban, maintaining net income comparable to a standard quarter(for China). In all liklihood the ensuing ban was known in advance and their customer behaviour (reports of $18B orders in Q1) support this. This financial resilience provides NVIDIA with a buffer to negotiate with TSMC to redirect purchase commitments to alternative chips like the H200 or Blackwell.

Additionally, it grants NVIDIA time to lobby for amendments to the U.S. export licence requirement, potentially easing restrictions and further mitigating the impact on future quarters.

What really matters is the future with respect to the Chinese market and that is where it is opaque. Stating the obvious-we have an administration which changes its plan, daily. Peak China is approx $18B in any previous calendar year which sounds large however as their revenue is growing > 65% per annum+, it becomes less significant. It's unfortunate but doesn't change the decision to stick with the company. China would contribute circa $5B annually to their bottom line and given they will earn well in excess of 100B this year it isn't something to get bent out of shape about.

-

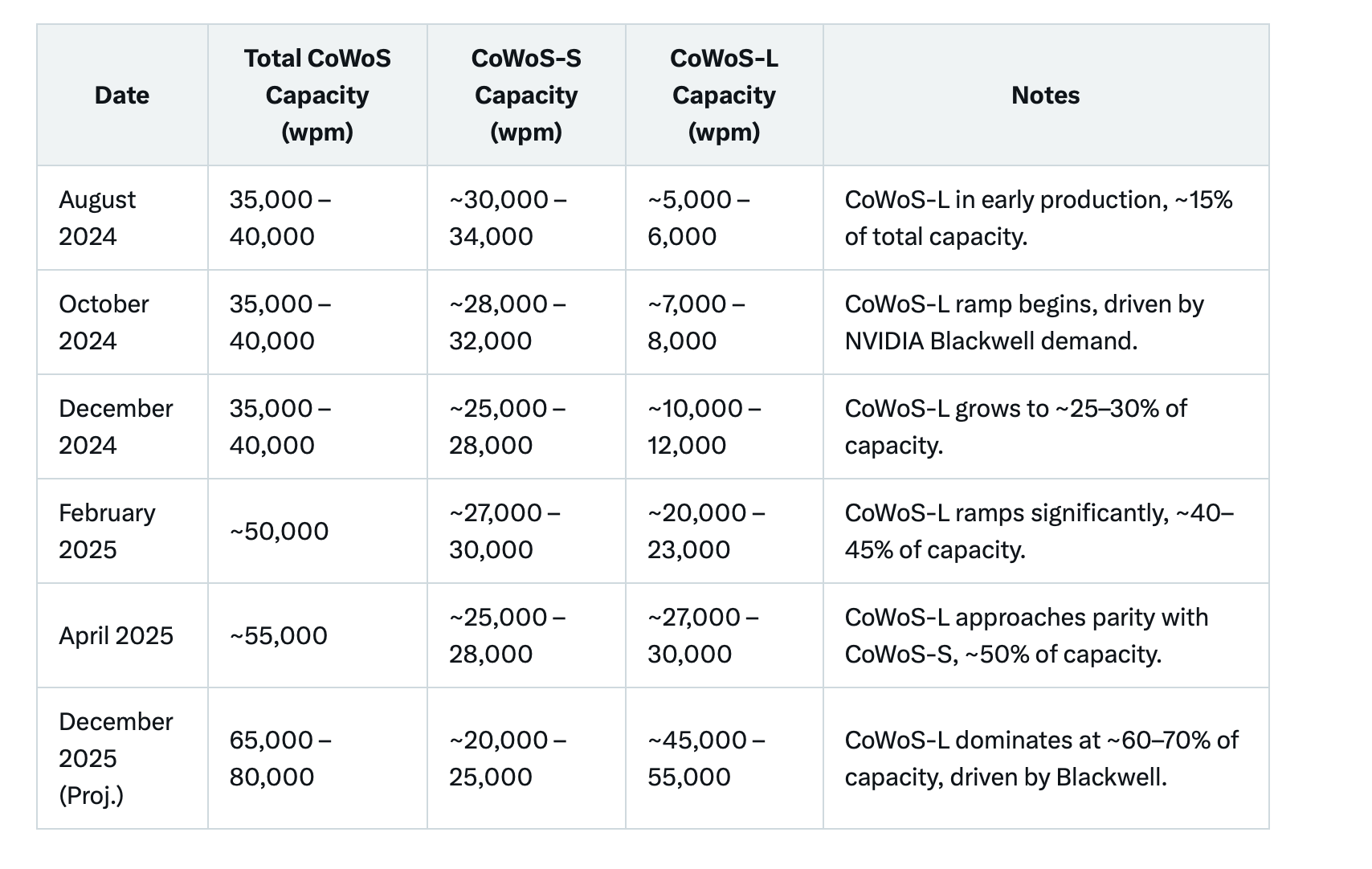

TSMC reported record earnings for their quarter ended March and made some comments regarding CoWoS packaging-a positive.

CEO C.C. Wei stated that CoWoS demand remains extremely strong. He noted that TSMC is working diligently to double its CoWoS capacity in 2025 to meet customer demand, but supply is still expected to fall short of demand. Wei expressed optimism about achieving a better supply-demand balance by 2026. Takeaway-no change to the plan and demand supply balance still shows constraint.

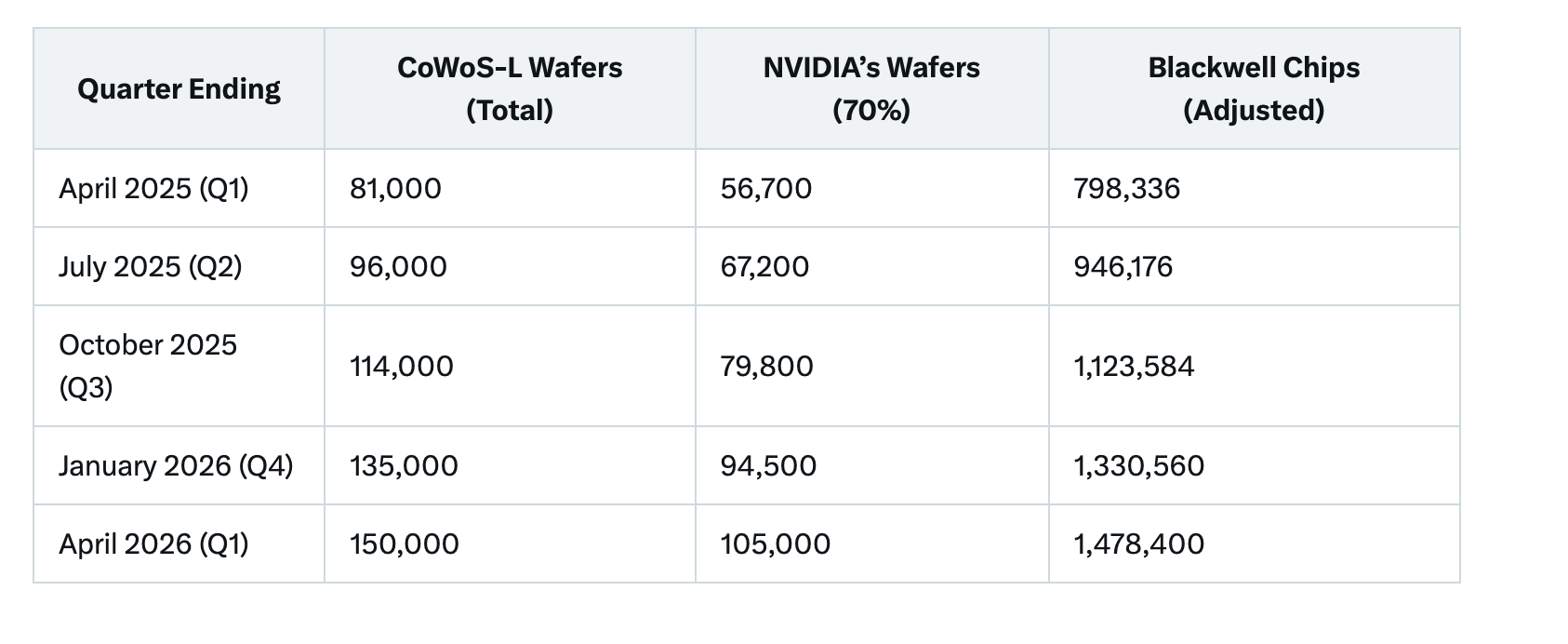

Targeted capacity is 80k wafers per month by end of 2025 and 125K by end of 2026. Nvidia has secured 70% of total output

We know that 1 wafer yields 16 good chips. Below is estimated quarterly 'Blackwell' chip supply

This number is the fundamental revenue driver. We expect around 800k chips being available to ship in Q1(ending April 25) up from around 250k in the previous Q(Q4)

-

Today Joseph Moore (JPM) issued a research note to clients saying that their checks with industry users show demand for inference compute is 'Explosive'. Adding 'any thought of AI consumption plateauing is laughable'. Moore added that any uncertainty over tariffs and trade wars is having no impact on demand from core customers, who, Moore said are monetising their AI applications and can not keep pace with demand.

Bodes well!

-

The NVIDIA Blackwell Ultra B300 GPU was originally expected to enter production in the latter half of 2025, with some projections pointing to Q3 or later.

News, today, however, suggest that production has been brought forward to May 2025, utilising TSMC’s 5nm process and CoWoS-L packaging. These reports indicate an earlier start to meet demand.

Nvidia are playing 'catch me if you can'

NVIDIA’s aggressive push to advance production of the Blackwell Ultra and accelerate the Rubin AI platform positions it as a frontrunner in the AI hardware race, creating a significant gap with competitors. -

That’s good news

Did I read a report that talked about problems with some components last week which might delay the production or was it the usual misinformation spread bad news etc -

Hi C,

Just the usual misinformation.

Jensen Huang made the following comment 4 weeks ago. I'll take his word for it. He's a very reliable/honest source.

"Blackwell is in full production, and the ramp is incredible. Customer demand is incredible and for good reason."

As we have mentioned. The most critical process in the supply chain is packaging (CoWoS-L packaging) and TSMC are doing a very good job of ramping capacity, as planned or better. You can see my table, detailing the approx ramp and chip yield.

It's worth pointing out that with limited CoWoS and the China H20 consuming this precious resource-given the H20 ban, the accelerated transition to B300 could very well be because they have abandoned the H20 packaging which allows 'CoWoS-S lines to be tooled for 'L'.

What appears to be a negative is in fact a positive. Nvidia want to keep the Chinese customers happy but if their hands are tied, this change is most likely a net gain because the B300 has margins twice as high as the H20. This is my take.

In a matter of days now we will get to hear from SMCI which will add some colour to the wider landscape.

-

Jensen Huang, Nvidia’s chief executive, is urging the Trump administration to revise AI diffusion policies, particularly export restrictions on AI technology. Speaking in Washington on 30 April 2025, he called for policies to “accelerate the diffusion of American AI technology” globally, criticising Biden’s 15 May 2025 framework that limits advanced AI chips and model weights to non-allied nations like China.

Huang highlighted China’s rapid progress, noting Huawei’s advanced AI chips, and stressed the need for US competitiveness. He endorsed Trump’s domestic manufacturing push, pledging Nvidia’s potential $500 billion AI infrastructure investment, and advocated for an energy policy to support AI’s electricity demands.

Huang’s influence may yield results. Nvidia’s pivotal role in AI and Huang’s prior engagements with Trump, led to a pause on curbing Nvidia’s H20 chip exports to China, which earned $16 billion in Q1 2025. The administration appears open to adjusting rules, possibly using chip exports in trade talks. However, challenges persist.Lawmakers, including House China committee leaders, demand stricter controls, citing security risks from Chinese firms like DeepSeek exploiting loopholes. Given Nvidia’s clout and the administration’s flexibility, Huang has a fair chance of securing targeted policy changes, such as export exemptions, but a complete overhaul of the framework seems less likely amid security and trade concerns.

-

Nvidia is back to developing AI chips specially made for China, after facing tighter U.S. export restrictions that blocked sales of its high-end processors.

The company had previously created slightly downgraded chips like the A800 and H800 to get around earlier rules, but those were eventually banned too. Now, Nvidia’s rolling out new products — the HGX H20, L20, and L2 — that meet the latest U.S. guidelines while still keeping business ties in China.

These new chips are toned-down versions of Nvidia’s top-performing H100, aimed at staying within legal limits while continuing to serve major Chinese clients. CEO Jensen Huang has stressed that Nvidia will keep working closely with the U.S. government to stay compliant, all while trying to hold onto its slice of China’s massive AI market.

-

you may be wondering why they'd bother or why China would buy an even less powerful chip when apparently Huawei is so good.

AI developers in China overwhelmingly rely on frameworks built around CUDA: PyTorch, TensorFlow, and many enterprise-grade AI solutions.

Huawei’s chips (like Ascend) use a different architecture (e.g., based on MindSpore, their own AI framework), which is not yet as mature or widely supported.

So even if Huawei’s hardware is close in performance, software compatibility, tools, and ecosystem support matter more in many real-world applications.Nvidia full stack is already ingrained in their data centres so it's very very difficult to switch-it's the same reason why AMD is an also-ran.

Second-it's fake news that Huawei can produce commercial quantities. Double masked, poor yield and power hungry.

-

Nvidia H20 Chip Modification

Nvidia is modifying its existing H20 chip, rather than developing a new one, to comply with US export restrictions for the Chinese market.

The modified chip is expected to be ready by July 2025, allowing Nvidia to resume sales in China. The $5.5 billion reserve set aside due to the initial export ban in April 2025, which halted H20 sales and impacted inventory and commitments, is likely to be reversed in subsequent quarters as Nvidia adapts to the new regulations and resumes shipments.This news is highly relevant to recent discussions about news and articles and of course, reaction to same.

The headline 'Nvidia lose China', cue a slew of new opinions. All wrong-again. As soon as the export ban came in Huang flew out to China (the following day). Obviously he knew it was coming, he sits at the presidents table. The $5.5B provision, under GAAP is required because certainty to the contrary wasn't present at the time and it was inside their April 27th quarter end.

They may or may not amend that reserve for Q1 but most of it will unwind in Q2 and Q3.

What is also interesting. Nvidia have pre announced earnings misses twice (2011 and 2022) both 8 days after the Q end and on a Monday. That would correspond with May 5th. We haven't heard anything about a miss. A $5.5B hit not causing an earnings miss? (impossible, right?).

Perhaps we give it until next Monday-special company which is very much misunderstood by most. And frankly, hated by those that missed out

-

I did read somewhere a day or two ago (sorry can't provide a source, think it was the Telegraph) that Nvidia chips were being acquired on the black market by China.

Is there evidence of this and if so are the quantities sufficient enough to have an impact on the supply/market/share price etc?

-

I'm sure it happens. To the extent some would have you believe, no. What chip is highly valuable-Blackwell. It's much much faster than Hopper. Blackwell chips are in super-high demand and allocation to even big US customers is tight, so where exactly would China get these from. Hopper, I suppose they can but is that a big problem for the 'AI Race'. I don't think so. Hopper will be much slower.

The Nvidia chip restriction debate is layered with conflicting perspectives. Huawei’s CloudMatrix 384 AI cluster, powered by Ascend 910C chips, is designed to rival Nvidia’s high-end AI systems like the GB200 NVL72. It's inefficient and expensive but it is powerful enough to get the job(any AI job) done. What it lacks is CUDA which will def slow them down.

China won't be stopped, rather slowed down. And that is the aim. It will actually push the US to keep innovating and investing

When all is said and done, China will keep buying Nvidia chips through legal and other channels due to the software stack. It's a nice market to have for sure but if it slows down(unlikely) it's not material when you look at the rest of the World.

I noticed a day or so ago that Open AI (Stargate) are offering OpenAI for countries. A fully built DC stack for Sovereign purposes with US Government backing. A turn-key solution.