Nvidia News

-

Just a quick one.

News of China going all green and restricting ai chips because they are power hungry

New from Alibaba 'why is the US spending so much on AI'and some people fall for it-pretty much all I have to say. The biggest polluter on the planet-the biggest builder of Coal fired power plants has concerns over power use. And Alibaba who can't access enough US silicon and is far far behind says 'it's not needed;.

China don't buy a lot of US chips. a few billion. Every chip not bought by china will be sold to someone else. Banning all chips to china won't have much impact. Not now or in the future because the company can only produce so much and has 10X demand for that limited supply.

@Adam-Kay said in Nvidia News:

The biggest polluter on the planet-the biggest builder of Coal fired power plants has concerns over power use.

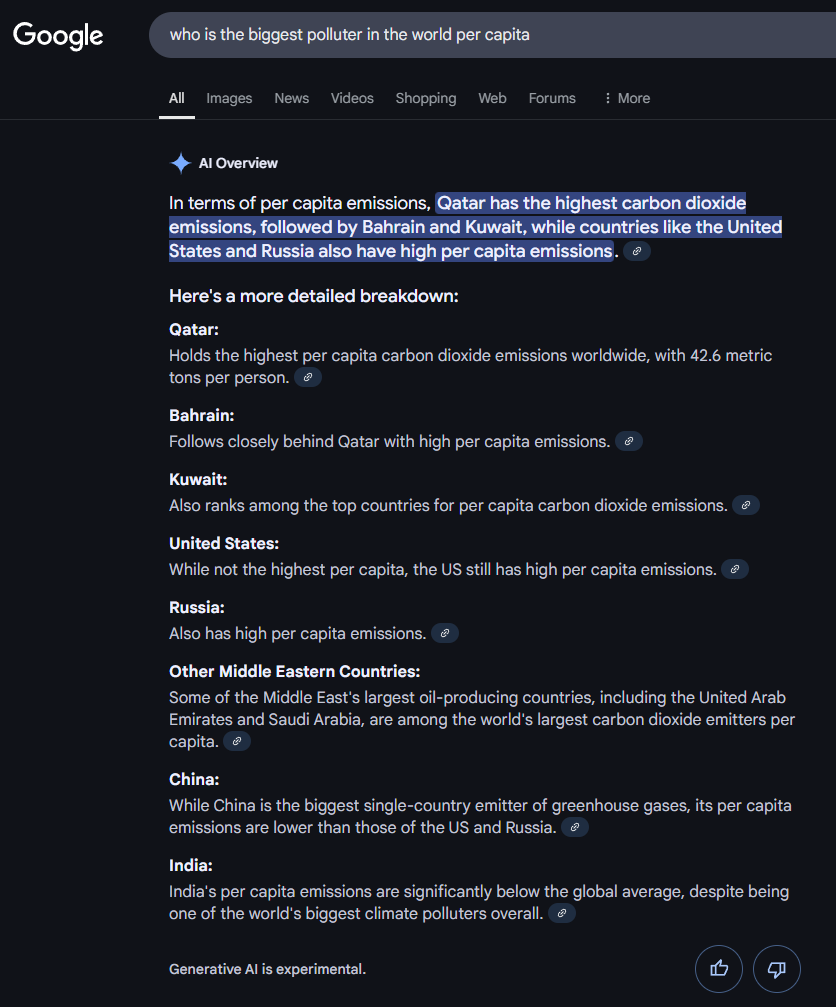

If you take the country as a whole, then China is the biggest polluter, followed by the US, which generates about half of what China does. But that's not really looking at the whole picture is it?

If you use pollution level per capita, which is a far better way to look at it, then the whole picture changes drastically.

China population 1.411 billion

US population 340.1 millionAI tells me the biggest polluter per capita is Qatar, with China some way down that list. Per capita the US is a bigger polluter than China, and likely to get bigger given Trumps drill baby drill stance.

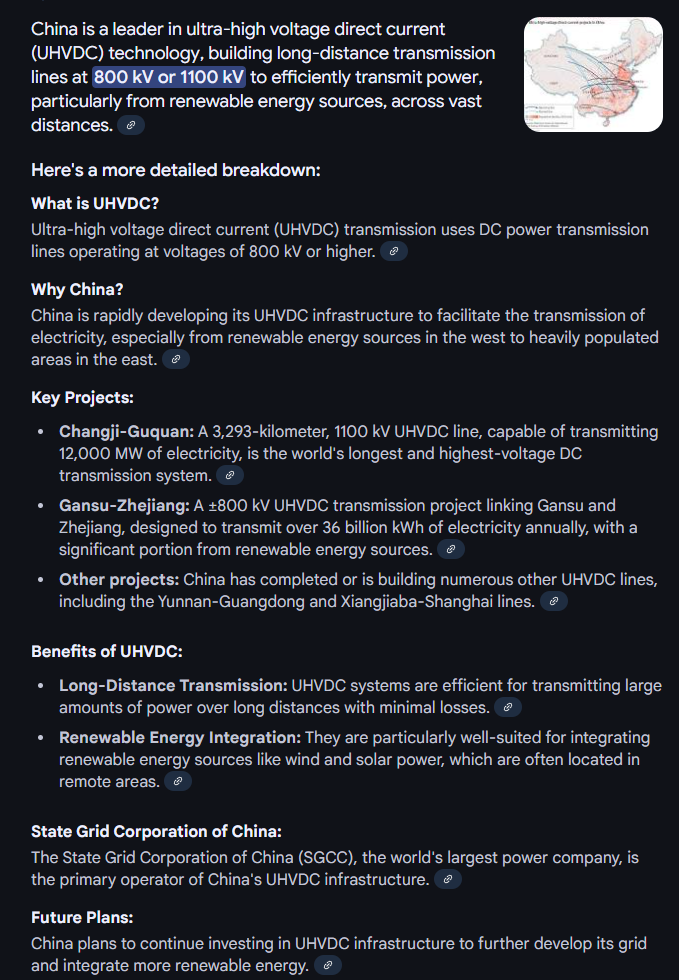

China actually leads the world in PV generation, and ultra high DC long distance transmission lines to move that power where's its needed. China apparently has 393GW of PV accounting for 37.3% of global PV capacity.

-

Any country with a huge pool of slave labour ( in the literal sense of the word ) could dominate a low cost high volume infrastructure.

To borrow one of the words.... " apparently" Chinese internal media which is highly circulated by their wide network of paid shills , can also turn out a load of utter bollox statistics too .Just type in the question another way and the MI ( Moron Intelligence) engine spits out different rubbish

-

Staying within the chip power restrictions relating to approved China exports, Nvidia has updated its Hopper (H20) variant to the H20E, with E denoting use of HMB3(E) memory. The chips will enter mass production next quarter. The H20E. The H20E will be even more efficient due to the use of lower power HBM(3E) it's basically a nerfed Hopper H100 and will be priced at around $17,000 each. Nvidia would likely sell between 1.2 and 1.5M of these chips in China in 2025 and it outsells Huawei Ascend chip 2:1 which is the best the chinese can produce and still not really compete with a neutered old architecture, the H100.

Here is a great example of efficiency and TCO (total cost of ownership). A 17k chip vs a 50k chip (blackwell).

Blackwell uses 1/12th the power per operation and is literally 100X faster when inferencing. It's $1.7M on H20 or $50K on Blackwell for the same performance.

You're flogging a dead horse with old architecture. It also hows you just how far behind China are.News that China has 'cracked the code' Deepseek is completely fake, evidenced by the fact they didn't use Huawei silicon, they used illegally sourced US spec Nvidia silicon.

-

In 2024, analysts estimated NVIDIA shipped around 1 million H20 chips to China, generating over $12 billion in revenue, according to Reuters. The H20, priced between $12,000 and $15,000 per unit, became the go-to AI chip for Chinese firms like Tencent, Alibaba, and ByteDance after U.S. export controls banned more advanced models like the H100 in 2023. This $12 billion figure aligns with NVIDIA’s fiscal 2025 China revenue of $17.11 billion (including Hong Kong), though that total covers all products, not just H20s. This fig reconciled to their 10-k disclosures

For 2025, demand has spiked further. The Information reported on April 2, 2025, that Chinese companies ordered at least $16 billion worth of H20 chips in just Q1 (January–March), driven by fears of tighter U.S. restrictions.

The China story has been done to death. Sell -they’re losing China has been the call for almost 2 years’. Every year China business grows.

The H20 is receiving an upgrade to the H20e for June time frame.the same performance just better efficiency.

-

If this extra tariff from China stays ….surely the chips they were getting if any would be diverted and snapped up by US companies

-

Whilst we can never predict short term price movements, the current price is ridiculously cheap imo. On fundamentals it is 40% cheaper than Coke which has no growth.

But there is a lot of confusion out there. I was asked yesterday 'what about other countries retaliating with tariffs on the U.S. What they meant was, how would Nvidia deal with a tariff from another country. I explained that Tariffs are attached to the country of origin, not the country of ownership. 85%+ of the built up cost of Nvidia hardware is Taiwan and non US countries so they don't apply. However the media is spinning the story to stir up fear.

If you take a longer term view the current price is an opportunity to be considered.

-

It’s mad…..didn’t Coke go up yesterday

-

The Trump Administration is apparently pausing the implementation of an export ban to China for Nvidia's H20 GPU

The H20 is the most advanced chip offered by Nvidia that is still allowed to be exported to China. Industry observers and Chinese tech companies had expected the H20 to be added to the list of other banned hardware.

Why? Simple. The H20 is significantly less powerful than even the Hopper H200 and the Blackwell chip leaves the Hopper in its dust. It's a positive that the Govt are avoiding anything that would impact(negatively) their most important company.

-

TSMC, is turning its AP8 facility in Southern Taiwan into a key production site for advanced chip packaging (CoWoS), mainly for AI technology. They bought this huge factory from another company in August 2024, and it’s already getting a big makeover. The plan was to start setting up the machines in mid-2025, but they’re now so eager to get going that they’ll begin in April 2025 instead. By the end of the year, they aim to have around 2,000 machines ready to roll.

The factory has a massive cleanroom—think a super-sterile space the size of several football pitches—much bigger than TSMC’s other plants. This makes it their largest site for this kind of work. Since the building was already there, it’s more about tweaking things rather than starting from scratch, which is speeding things up. They’re sorting out the cleanroom and fitting in all the necessary equipment as fast as they can.

The goal is to start making chips by the second half of 2025, maybe as early as July, with some test runs possibly happening a bit sooner. This facility will significantly boost Blackwell(and later Rubin output) TSMC wants to make chips to keep up with the huge demand for AI, hoping to have everything running smoothly by 2026.

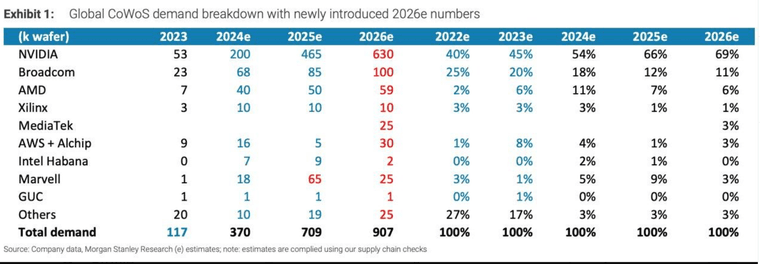

This dropped today, Morgan Stanley CoWoS demand/supply. Nvidia share is growing and accounts for 65-70% of total global demand. In thousands of wafers. With 1 wafer yielding 16 Blackwell GPU

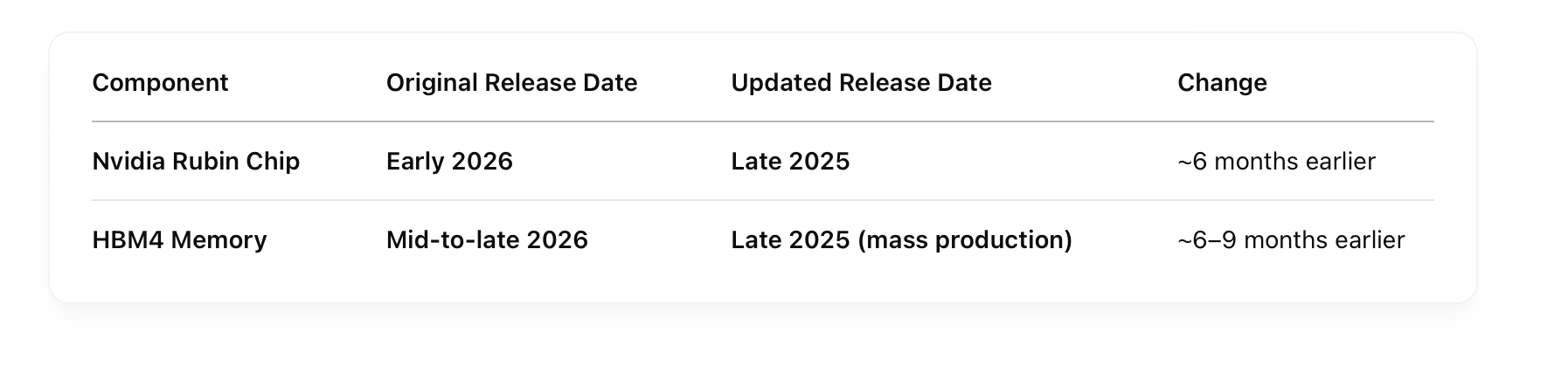

The latest news is Rubin is definitely coming early-6 months early due to high demand. And to crush the competition. Everything is progressing nicely!

-

Hopefully China won't invade Taiwan. Pictures and videos circulating of massive landing barges already built. Apparently Chinese ferries are capable of carry tanks etc. Put them together with the landing barges and you can easily transfer an army across the Taiwan Strait.

IF and that's a big IF they invade, then that would totally change the landscape, all the fab plants there would become chinese, perhaps this is another reason they are building in the US.

If Russia gets away with Ukraine, it might give China idea's, would the US under Trump still help Taiwan???

-

The US will be self reliant(largely) by 2030. Any invasion by China would destroy their own economy because Sanctions would be profound. They would not be able to use any of the most advanced Fabs because there is already a protocol. Destroy them. TSMC has diversified into Japan, Germany and the US. The risk of China causing problems in this regard are very low.

It's one of those scenarios to simply ignore because the impact would be far greater than 'your stock portfolio'.

-

Nvidia’s Claim: The headline about Nvidia making AI servers in the U.S. ties into TSMC’s Arizona plant for Blackwell chips (B100/B200) and plans for data centre infrastructure.

The Chip’s Role: The chip (e.g., Blackwell GPU) is a small physical part of an AI server, albeit the most critical and expensive component. A single B200 can cost $30,000-$40,000, and a server like Nvidia’s DGX B200 will use multiple GPUs, driving costs into the millions. But the server itself—racks, cooling systems, networking, memory, power supplies—comprises thousands of parts.

Most of these—capacitors, resistors, PCBs, etc.—come from Asia (Taiwan, China, South Korea), where companies like Foxconn, Quanta, and TSMC dominate the supply chain.

U.S. Manufacturing Reality: Producing Blackwell chips in TSMC’s Arizona fab is a step toward U.S. involvement, but it’s a tiny piece of the puzzle. These chips need advanced packaging (CoWoS-L) in Taiwan, so they’re not fully “made” in the U.S. Assembly of AI servers could happen stateside—Nvidia has partnered with companies like Dell and Super Micro, who have U.S. facilities—but the components are overwhelmingly sourced from Asia. For example, TSMC’s Arizona plant might churn out 10,000-12,000 Blackwell chips daily at full capacity, but the servers’ other parts aren’t made locally. Today we are looking at max 5,000 chips per day from a total(and growing) 30k per day global supply (15% US/85% Taiwan) Claims of “American-made” servers stretch the truth unless Nvidia redefines what “made” means.

Marketing Fluff?: . Huang’s rhetoric leans into geopolitical tailwinds—U.S. chip self-reliance, CHIPS Act vibes—while glossing over the reality that Asia’s grip on electronics manufacturing is ironclad. The $500 billion figure, if tied to Nvidia’s plans, feels like a headline-grabber, mixing their investments (R&D, factories) with broader AI infrastructure costs. It’s not like Nvidia’s personally cutting a half-trillion-dollar cheque. They’re capitalising on the narrative of bringing tech back to the U.S., but the supply chain math doesn’t lie—Taiwan and Asia are still the backbone.

The Arizona fab’s output is real, even if limited, and Nvidia’s push for U.S. data centres could drive jobs and infrastructure. But fully American-made? No, not happening any time soon.

I only say this because I'm calling the headline out for what it is-waffle. I still do not think any administration is going to damage their most valuable industry-and so far they have not

-

-

Or even the Beeb

Nvidia expects $5.5bn hit as US tightens chip export rules to China https://www.bbc.com/news/articles/cm2xzn6jmzpo

️

️

Still, since federal officials had advised them the licence requirement "will be in effect for the indefinite future", it feels safe to assume it will be reversed by teatime 🫣 -

Hi Mike,

Tying tech restrictions like the H20 license requirement to tariff negotiations fits his pattern of using multiple levers to extract concessions. China’s domestic alternatives (e.g., Huawei’s Ascend 910B) lag in performance for certain workloads, and U.S. restrictions on advanced chipmaking tools (e.g., ASML’s EUV machines) limit China’s ability to close the gap quickly. This dependency gives the U.S. leverage to demand trade concessions.

Trump is betting on China buckling under pressure rather than escalating.

Real impact. Historically $4B/Q, however a rumoured $16B in Q1, 2025 in anticipation of a ban. Is this credible and if so how much did they ship. We won’t know until earnings Q&A.

My view is and always has been, China was an iffy market due to various restrictions. The mentioned $5.5B is a one time reserve to write down any remaining inventory and or compensate for purchase commitments. It amounts to 3 weeks earnings. In some ways it lifts the overhang of future speculation regarding GPUs and China. With this administration, nothing is certain and I would speculate that even this policy is subject to change.

Without China it doesn’t change the investment decision

-

True….although I’m will to bet that Trump betting on China buckling under pressure will prove to be false.

The Chinese would sooner starve themselves than lose face, & trump has already showed signs of weakness in his badly thought out tariff wars…flipyflappy U-turns, the bond market appearing to flex it’s strength against him

️

️ -

Time will tell-in the mean time expect the unexpected.