Nvidia News

-

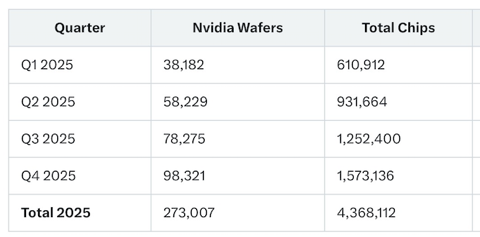

Just wait for the ramp. This cadence is conservative

-

no one knows Oli. All I can say is good businesses will rebound and given nvidia fwd PE is now < 20 it's looking attractive.

-

I'd estimate SMCI Fwd PE is about 6 and its PEG is less than 0.2 imo. Apples PEG is about 2. Generally speaking I like to pay around 1.0. It is however just one ratio to compare different assets.

-

Nvidia will be presenting tomorrow. The big annual even will be GTC in 2 weeks

Morgan Stanley Technology, Media and Telecom Conference 2025

Wednesday, March 5, 12:20 p.m. Pacific time -

Yesterday, TSMC's CC Wei met President DT. The outcome, an increase to the planned $65 billion investment to $165 billion to be spent over the next 4 years.

The technology will produce cutting edge chips beyond the 2 nanometer node and an additional foundry at the A16 node (or 1.6nm). For context an atom is 0.2nm, so 1.6nm is very small.

When completed the entire installed foundries will have a capacity of 600k wafers per year.

The entire capacity when complete would service approx half of Nvidia and Apples needs.

This investment is also insurance against national security and dodging tariffs

-

TSMC Chair C.C Wei said yesterday, that all US production due to be online between 2025 and 2027 is fully sold out already, despite the additional $100B expansion announced earlier this week. They have also committed to building additional(in Taiwan)10 new production lines 'a line is output of 15-20 wafer starts/month. An entire fab is 3m sq feet-collosal so 10 lines is at least two new fabs in Taiwan also. 'This too will still not be enough'(C C Wei).

-

Hi GV,

We don't have to speculate. Facts are

Chips are sold out for all of 2025 and 2026

They are constrained by CoWoS packaging

Every resource available is being thrown at expanding CoWos. Buying suitable factories is easy. Procuring the highly complex machinery takes time. Much of the expansion plans started 18 months ago. Lead times on some equipment is 12-18 months due to its complexity.

In saying that the packaging expansion roadmap looks super quick and they usually find extra efficiencies.What I am reading is they will bring Rubin forward. So today we have B200/GB200 and B300/GB300 is Blackwell Ultra which again looks like it will be a bit early-Jensen will update at GTC on the 17th. I'm hearing Rubin might drop in Q4 rather than early 2026. My theory is, as it's packaged on the same lines at Blackwell (Hopper was not) they could deliver the compute their customers need with fewer chips and a higher ASP of course but clearly, the big customers are chomping at the bit for compute so in my mind it makes sense to release the chip early if possible. We will find out at GTC.

Given the same packaging is used, clearly there won't be the lumpy transition as was experienced when they moved from Hopper to Blackwell.

I also read that the first Stargate DC will be operating by Summer which is no time at all.

On valuation, most analysts think the stock is worth closer to $200.

-

It's widely accepted that in 2024 they sold approx 2.7M chips.

Estimates for 2025 are: approx 2m Hopper and 3.5-5M blackwell depending on supply.

Based on Cowos expansion supply for 2026 should be 8-10M blackwell/RubinYes the company should double revenue this year (2024 $130B) and double again in 2026. Is $500B revenue out of the question-no it is not.

-

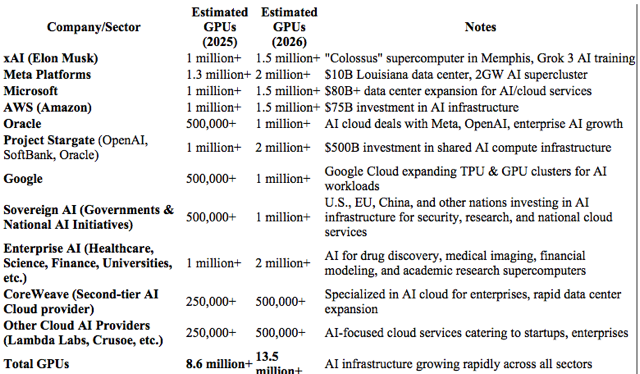

Sense check on supply vs demand. I track all verified projects. Fully funded, publically announced-the data centre is in construction. I.e it’s not speculation. It’s real

-

As you can see with best case scenario 7M chips available in 2025 and 10M in 2026, they will be materially constrained for 'years'. NB: This is GPU demand not compute demand. TPU/Asics is additional. AMD and Intel have about 6% of the market-this won't change simply because CoWoS capacity is the bottleneck and Nvidia own the supply(70%). Second, AMD chips can't be scaled(as discussed), so anyone suggesting they are a threat, simply doesn't understand why Nvidia is so dominant. TPU/Asics are very good at one task(as are AMD/Intel chips) . Nvidia systems are very good for all tasks because they are programable. It's that simply. Nvidia is, and this is not just my opinion, it's industry opinion, 5-10 years ahead of AMD. That may as well be 100 years in this game.

-

It's also a reasonable assumption that the above numbers will get bigger because Stargate won't be allowed to go unchallenged.

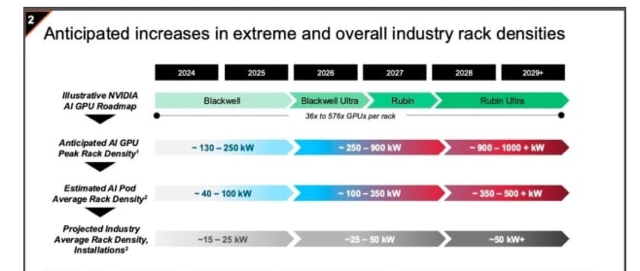

Knowing the above, how does the industry catch up to demand and how are all these racks going to be deployed.Firstly through chip architecture evolution. Rubin and Rubin-next(internally called 'X'.

Now, take a moment to look at this chart. Today, the biggest racks hold 72 GPU +36 CPU and are circa 150KW. Now look at the chip evolution. Blackwell ultra is arriving in 6 months or sooner and Rubin 2 quarters after. 100s of chips per rack and near term 250-300-400 KW. What will be needed to make this work? I wonder. DLC.

If we look at the supply of 5M-7M chips near term that’s (div by 72), 70k-97k racks. The global capacity today at the ai level/DLC is no more than 50k racks with more using air cooled solutions. So when we suggest anyone supplying dlc has a captive market, competition doesn’t matter right now. It’s a vendors market. If one company wins a project it only reduces their ability to meet the needs of the next customer. My point is simple-if you want compute you will have to engage with SMCI. Demand will be met by a combination of expanding rack scale manufacturing capacity plus increased rack density. Liang said during the last update that they are working on a 250KW solution for a ‘special customer’. It’s either Xai or Meta. Follow the crumbs. Ignore the ill informed-who btw will never provide any evidence based support rather continue to repeat statements already debunked.

Right now we sit and wait for silicon supply to ramp, safe in the knowledge it will get there soon enough. So all the nail biting about quarterly results should be put into perspective. 50b or 60b in one quarter-sure I know which is preferred but it will come regardless and the lumpy timing is not in anyway a detraction, more a distraction. We are not looking at ‘lost’ revenue or income years apart-it’s all near term

-

Oracle reported Q3 earnings last night. The interesting parts being their backlog of service contract obligations. Plus $46B this 'year'(q3 to Q3)-a current backlog of $130B. A staggering number. Oracles has gone all-in on AI and has an advantage over its competitors due to its legacy enterprise ties(databases and ERP). Their networks are faster too.

The company also mentioned that 'component delays'(clearly GPU) which slowed cloud expansion, should ease in July. This ties in with everything else we have heard so it's great to get more weight to the thesis that volume supply will be hitting the decks very soon and demand is extreme. It also shuts the door on the shills talking about monetising AI. I can see 130 billion reasons why that is nonsense. It won't stop them repeating it!

-

Nvidia CEO Jensen Huang was interviewed yesterday. Here is what he said.

Tariffs impact will not have a meaningful impact in the medium term and long term we will be sourcing most of our components in tariff free regions.

The market is completely wrong about our growth. Countries are awakening to the need to treat their sovereign data as a national resource. All companies are scrambling for AI factory token generation. Those that don't will become inefficient.

quote:

'All analysts forecasts have it wrong-are you guys listening, are you following along? None of the $1T capex spend(annually by 2028, massive in its own right) takes account of the massive AI Factory and Sovereign AI build out. Do you understand what I am saying? I say that because no one is even close. I see multiple hundred billion Capex projects that are coming online, it's not in any data centre forecast, yet. Are you guys paying attention. We are booking these are we speak. Pretty soon they will wake up. There is no doubt in my mind that out of $120 trillion global industry market that a very large part-many trillions of dollars will be in AI Factories. There is no question in my mind. Industry want to manufacture intelligence and we build those factories. This segment is completely unaccounted for to date. And it is the largest layer, larger than total data centre. The market today is focussed on large CSP (AWS/Azure etc) but I think very soon, starting err now, you will start seeing an AI Factory built out which is completely independent to CSP capex. We are working on some very big AI Factory projects. 100s of billions.And on competition-if your chips are not better than Hopper you may as well just give it away (quality dig there). And for us, every GW of DC is $50B revenue. When we are working on 5GW projects, you can do the math right? So any new DC is a massive investment-you won't be choosing anything but the best systems because the risks are too high otherwise. We are the best in ALL DC areas, not just the chip.

Of course the usual crowd would say, 'CEO pumps his company, shocker' but Huang is ultra conservative.

I've said it many times before. This company is just getting started.

-

Very interesting as always Adam

I did see a couple of reports this morning from so called market experts that there was nothing to excite the market from Nvidia….perhaps they were not listening or thought he was talking crap as per your last comment -

Nothing to get excited about-

ok .Well put them on ignore

ok .Well put them on ignore

-

Nvidia (NASDAQ:NVDA) will open a quantum computing research lab in Boston which is expected to start operations later this year.

The Nvidia Accelerated Quantum Research Center, or NVAQC, will integrate leading quantum hardware with AI supercomputers, enabling what is known as accelerated quantum supercomputing, said the company in a March 18 press release.

Nvidia's CEO Jensen Huang also made this announcement on Thursday at the company's first-ever Quantum Day

-

SK Hynix announce mass production of HBM4 early. Originally scheduled for '2026' the company originally brought forward production to December 2025 but now state a time frame of 'mid-to-late' 2025 (October). Interesting, given there is only one customer and one chip designed to use it. Nvidia Rubin. Huang stated last week that Rubin would be available 'mid 2026' however we did discuss an early launch a couple of weeks ago and this is strong supporting evidence of 'early Rubin'. There is no need for HBM4 otherwise.

The Rubin architecture is a game changer in terms of power and efficiency and sets the industry on a path to 600Kw server racks. Not to mention ASP of said racks going beyond $10 Million each! Remember 'rack capacity ' is key and DLC is a must have for GB300(Blackwell Ultra) and of course Rubin which in future will be named the R100/R200 and VR200. The back end of 2025 is looking interesting.