Nvidia News

-

@Adam-Kay said in Nvidia News:

The most powerful and beautiful chip. The most expensive chip the world has ever seen

@exIM said in Nvidia News:

@Adam-Kay said in Nvidia News:

The most powerful and beautiful chip. The most expensive chip the world has ever seen

It is the DT5000

-

Hi Oli,

What’s the consensus from the informed investors perspective.

-

My thoughts recently are that the tech industries prospects have never looked better. Remember, China hasn’t participated much at all. Yes they get some supply by hook or by crook but it’s small beer. Breaking down the news promulgated by the sellers. Singapore. The headline why is Singers 20b. Must be illegal. Well. Msft, google, dell et al buy through Singapore due to tax breaks. Nothing material to see here.

I read today TFG (the financial genius),in a blog- Smci is a sell because the ceo ‘is unloading stock’. The ceo owns 150 million shares, draws no salary and the stock award is his salary. The sale was pre announced 9 months ago-so he took the punt back then. 2 million dollars is ‘unloading’ when you’re worth 8-9 billion. TFG screaming at the clouds again

I am confident companies like nvidia and Smci will report greater revenue every quarter for years. Cowos-L is the key. It’s the primary mover. The good news, and not many probably know this. Cowos-L is new, different from ‘S’ which was used for Hopper. The next generation ‘Blackwell-next’ is Rubin. It too will use ‘L’. This means an instant ramp when it’s released because by then, capacity to package will be enormous.

If anyone reads anything in the media I’m happy to discuss it-it might allay some fears.

My biggest concern is how some might get stressed by big daily swings. I want you to know it is based on nothing of a permanent nature. It’s fear and imo misguided. Please do challenge that narrative. -

It seems we bought the dip a little early, which is nothing unusual for me.

It will recover, what I'm more concerned about is what Trump is doing, that could cause far bigger issues. There already seems to be the starting of a backlash as american voters realise they are not getting what they thought they'd get.

-

Agreed, uncertainties caused by the behaviour of Trump and the greater 'influence' which social media echo chambers bring weigh heavy at this moment and this, I am sure, will continue ......... whether fake news, disruptive statements from competitors or folks simply joining 'dots' and wild assumptions making headlines.

The knowledge, effort and logic which Adam has brought and continues to bring about this sector certainly gives me confidence. We live in interesting times! -

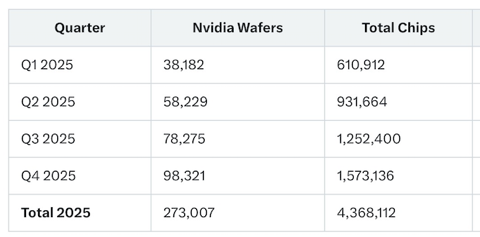

Just wait for the ramp. This cadence is conservative

-

no one knows Oli. All I can say is good businesses will rebound and given nvidia fwd PE is now < 20 it's looking attractive.

-

I'd estimate SMCI Fwd PE is about 6 and its PEG is less than 0.2 imo. Apples PEG is about 2. Generally speaking I like to pay around 1.0. It is however just one ratio to compare different assets.

-

Nvidia will be presenting tomorrow. The big annual even will be GTC in 2 weeks

Morgan Stanley Technology, Media and Telecom Conference 2025

Wednesday, March 5, 12:20 p.m. Pacific time -

Yesterday, TSMC's CC Wei met President DT. The outcome, an increase to the planned $65 billion investment to $165 billion to be spent over the next 4 years.

The technology will produce cutting edge chips beyond the 2 nanometer node and an additional foundry at the A16 node (or 1.6nm). For context an atom is 0.2nm, so 1.6nm is very small.

When completed the entire installed foundries will have a capacity of 600k wafers per year.

The entire capacity when complete would service approx half of Nvidia and Apples needs.

This investment is also insurance against national security and dodging tariffs

-

TSMC Chair C.C Wei said yesterday, that all US production due to be online between 2025 and 2027 is fully sold out already, despite the additional $100B expansion announced earlier this week. They have also committed to building additional(in Taiwan)10 new production lines 'a line is output of 15-20 wafer starts/month. An entire fab is 3m sq feet-collosal so 10 lines is at least two new fabs in Taiwan also. 'This too will still not be enough'(C C Wei).

-

Hi GV,

We don't have to speculate. Facts are

Chips are sold out for all of 2025 and 2026

They are constrained by CoWoS packaging

Every resource available is being thrown at expanding CoWos. Buying suitable factories is easy. Procuring the highly complex machinery takes time. Much of the expansion plans started 18 months ago. Lead times on some equipment is 12-18 months due to its complexity.

In saying that the packaging expansion roadmap looks super quick and they usually find extra efficiencies.What I am reading is they will bring Rubin forward. So today we have B200/GB200 and B300/GB300 is Blackwell Ultra which again looks like it will be a bit early-Jensen will update at GTC on the 17th. I'm hearing Rubin might drop in Q4 rather than early 2026. My theory is, as it's packaged on the same lines at Blackwell (Hopper was not) they could deliver the compute their customers need with fewer chips and a higher ASP of course but clearly, the big customers are chomping at the bit for compute so in my mind it makes sense to release the chip early if possible. We will find out at GTC.

Given the same packaging is used, clearly there won't be the lumpy transition as was experienced when they moved from Hopper to Blackwell.

I also read that the first Stargate DC will be operating by Summer which is no time at all.

On valuation, most analysts think the stock is worth closer to $200.

-

It's widely accepted that in 2024 they sold approx 2.7M chips.

Estimates for 2025 are: approx 2m Hopper and 3.5-5M blackwell depending on supply.

Based on Cowos expansion supply for 2026 should be 8-10M blackwell/RubinYes the company should double revenue this year (2024 $130B) and double again in 2026. Is $500B revenue out of the question-no it is not.

-

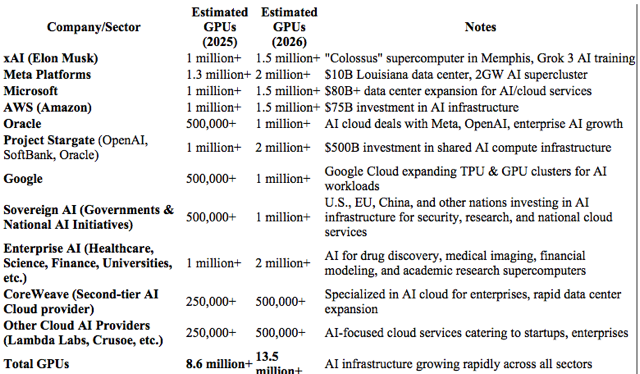

Sense check on supply vs demand. I track all verified projects. Fully funded, publically announced-the data centre is in construction. I.e it’s not speculation. It’s real

-

As you can see with best case scenario 7M chips available in 2025 and 10M in 2026, they will be materially constrained for 'years'. NB: This is GPU demand not compute demand. TPU/Asics is additional. AMD and Intel have about 6% of the market-this won't change simply because CoWoS capacity is the bottleneck and Nvidia own the supply(70%). Second, AMD chips can't be scaled(as discussed), so anyone suggesting they are a threat, simply doesn't understand why Nvidia is so dominant. TPU/Asics are very good at one task(as are AMD/Intel chips) . Nvidia systems are very good for all tasks because they are programable. It's that simply. Nvidia is, and this is not just my opinion, it's industry opinion, 5-10 years ahead of AMD. That may as well be 100 years in this game.