Nvidia News

-

We are all happy that he didn’t come and work for IM then …

-

I love how fake/bad news makes stocks plummet, but really huge % increase in turnover/revenue and strong future earnings barely touches the water ! I know stuff is priced in, but the markets tend to do WTF they want

@exIM said in Nvidia News:

I love how fake/bad news makes stocks plummet, but really huge % increase in turnover/revenue and strong future earnings barely touches the water ! I know stuff is priced in, but the markets tend to do WTF they want

I have to say that this is very much my thoughts as well. PHT is down on last week, despite spectacular results from NVIDIA and SMCI (which I think represent more than 20% of the PHT holdings). This is not a grumble at IM or Adam, more a grumble at the world, markets, sentiment and everything else. Thanks to Adam for his answer - it's a long term game, hang on in there for the gains.

(I suppose that a flip side to look at would be that if NVIDIA had returned average or poor results last night then the stock would gave gone down like a lead balloon today, so let's be grateful that that didn't happen.)

-

In relation to those two companies, their outlook has never looked better. The current storm is all about the President potentially starting a trade war. Firstly it's largely talk, so far. Second, SMCI is in the best possible position being an American company with substantial US based manufacturing, serving (90%) US customers.

In spite of the correction over the past week or so, tech is still up YTD and well ahead of all benchmarks and any other tech portfolio.

We've seen these sorts of moves many many times-the ones to be concerned about are structural and micro(company). The opposite is in play.

It wouldn't surprise me at all that the US Govt announce a massive sovereign tech initiative in the coming weeks, perhaps involving the UK (I get that feeling). I was also hoping Jensen would announce a new chip, unique to the US market and call it the DT5000. The most powerful and beautiful chip. The most expensive chip the world has ever seen

-

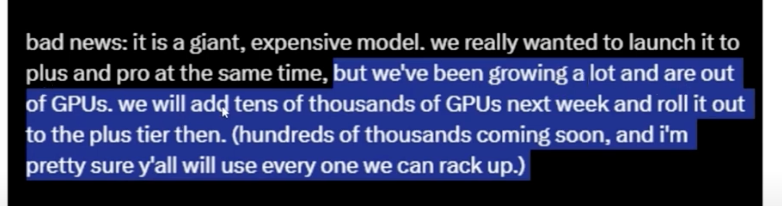

Sam Altman announced GPT 4.5 and also says:

-

In relation to those two companies, their outlook has never looked better. The current storm is all about the President potentially starting a trade war. Firstly it's largely talk, so far. Second, SMCI is in the best possible position being an American company with substantial US based manufacturing, serving (90%) US customers.

In spite of the correction over the past week or so, tech is still up YTD and well ahead of all benchmarks and any other tech portfolio.

We've seen these sorts of moves many many times-the ones to be concerned about are structural and micro(company). The opposite is in play.

It wouldn't surprise me at all that the US Govt announce a massive sovereign tech initiative in the coming weeks, perhaps involving the UK (I get that feeling). I was also hoping Jensen would announce a new chip, unique to the US market and call it the DT5000. The most powerful and beautiful chip. The most expensive chip the world has ever seen

-

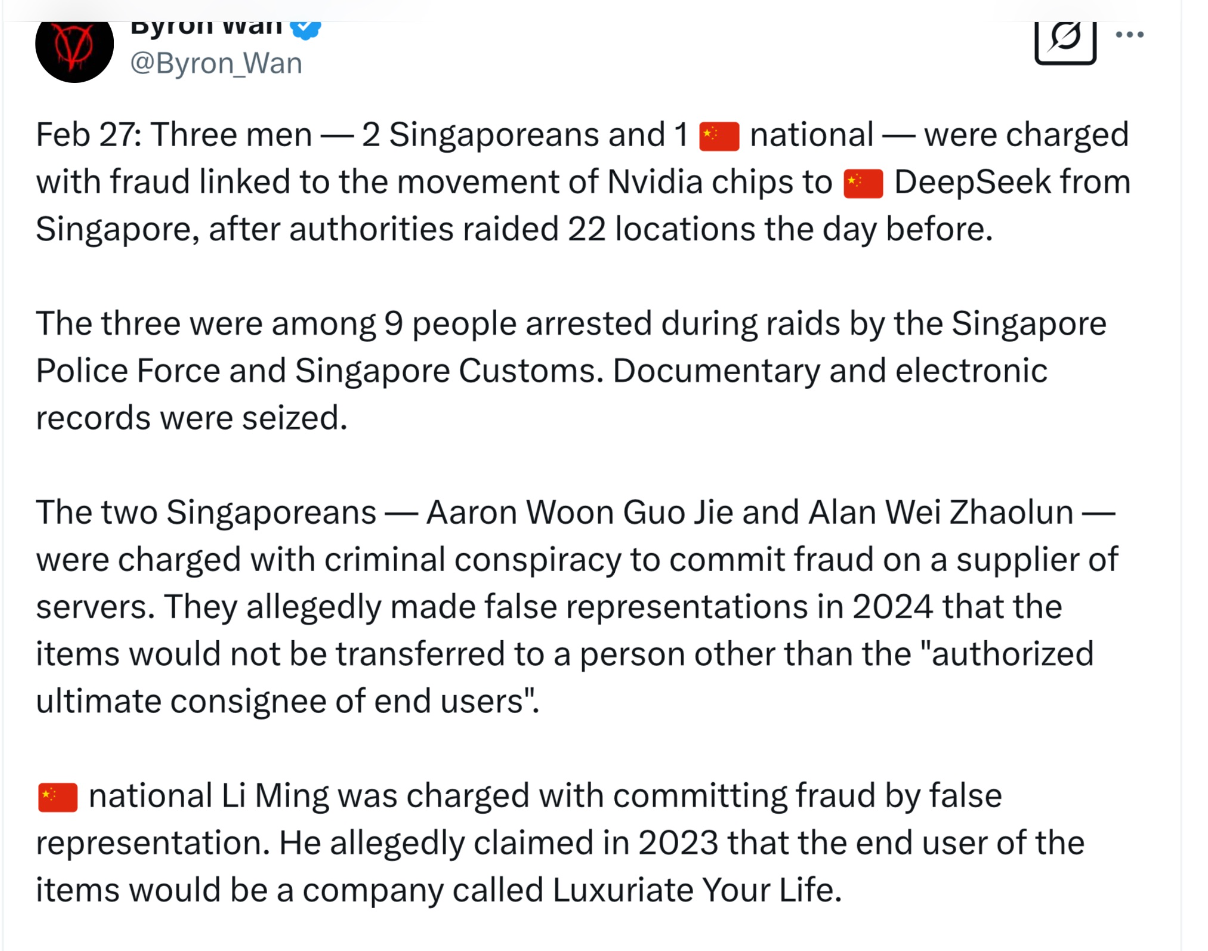

Remember Deep-Seek. They wowed us all , and spent small ££. Not true

-

-

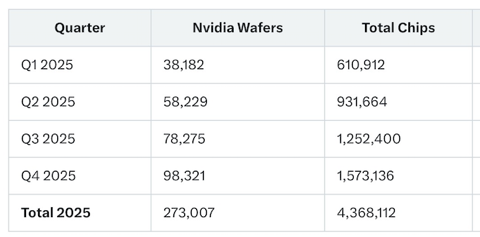

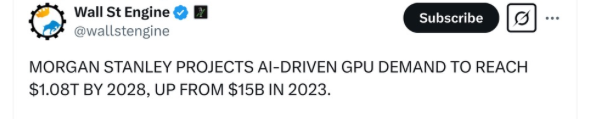

For clarity that trillion is not cumulative. That is spending in the 2028 calendar year. And of that $502B is expected to go directly to Nvidia. This excludes the companies 3 other divisions

-

@Adam-Kay said in Nvidia News:

The most powerful and beautiful chip. The most expensive chip the world has ever seen

@exIM said in Nvidia News:

@Adam-Kay said in Nvidia News:

The most powerful and beautiful chip. The most expensive chip the world has ever seen

It is the DT5000

-

Hi Oli,

What’s the consensus from the informed investors perspective.

-

My thoughts recently are that the tech industries prospects have never looked better. Remember, China hasn’t participated much at all. Yes they get some supply by hook or by crook but it’s small beer. Breaking down the news promulgated by the sellers. Singapore. The headline why is Singers 20b. Must be illegal. Well. Msft, google, dell et al buy through Singapore due to tax breaks. Nothing material to see here.

I read today TFG (the financial genius),in a blog- Smci is a sell because the ceo ‘is unloading stock’. The ceo owns 150 million shares, draws no salary and the stock award is his salary. The sale was pre announced 9 months ago-so he took the punt back then. 2 million dollars is ‘unloading’ when you’re worth 8-9 billion. TFG screaming at the clouds again

I am confident companies like nvidia and Smci will report greater revenue every quarter for years. Cowos-L is the key. It’s the primary mover. The good news, and not many probably know this. Cowos-L is new, different from ‘S’ which was used for Hopper. The next generation ‘Blackwell-next’ is Rubin. It too will use ‘L’. This means an instant ramp when it’s released because by then, capacity to package will be enormous.

If anyone reads anything in the media I’m happy to discuss it-it might allay some fears.

My biggest concern is how some might get stressed by big daily swings. I want you to know it is based on nothing of a permanent nature. It’s fear and imo misguided. Please do challenge that narrative. -

It seems we bought the dip a little early, which is nothing unusual for me.

It will recover, what I'm more concerned about is what Trump is doing, that could cause far bigger issues. There already seems to be the starting of a backlash as american voters realise they are not getting what they thought they'd get.

-

Agreed, uncertainties caused by the behaviour of Trump and the greater 'influence' which social media echo chambers bring weigh heavy at this moment and this, I am sure, will continue ......... whether fake news, disruptive statements from competitors or folks simply joining 'dots' and wild assumptions making headlines.

The knowledge, effort and logic which Adam has brought and continues to bring about this sector certainly gives me confidence. We live in interesting times! -

Just wait for the ramp. This cadence is conservative