Nvidia News

-

@exIM said in Nvidia News:

Numbers are good

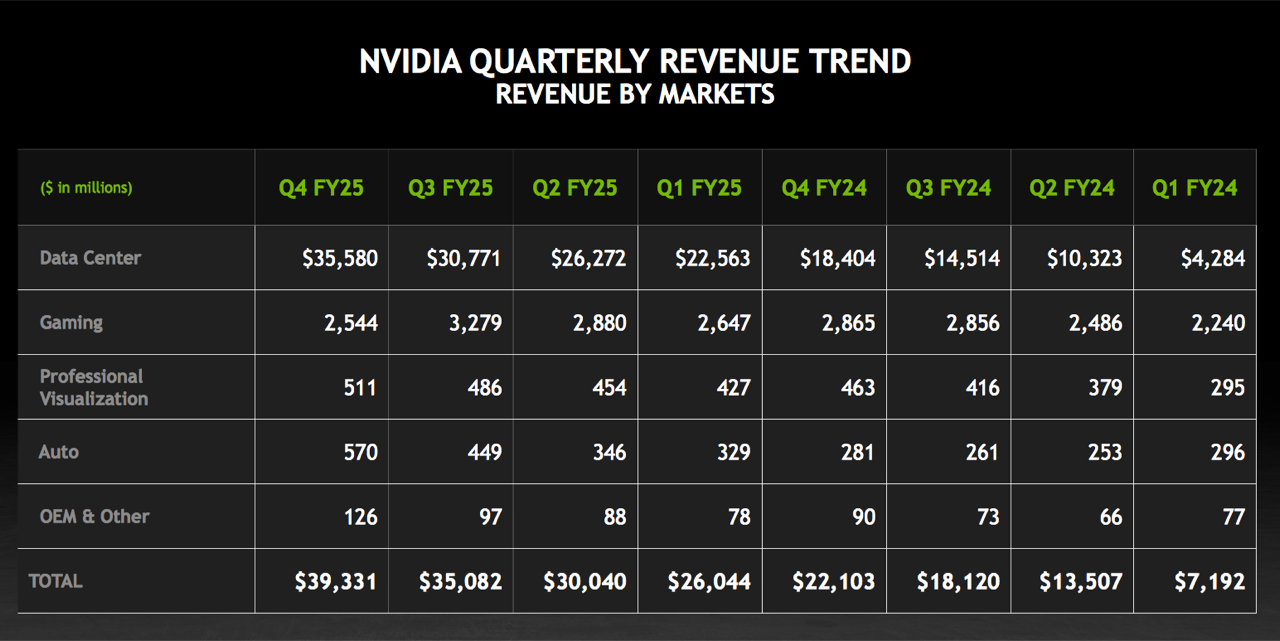

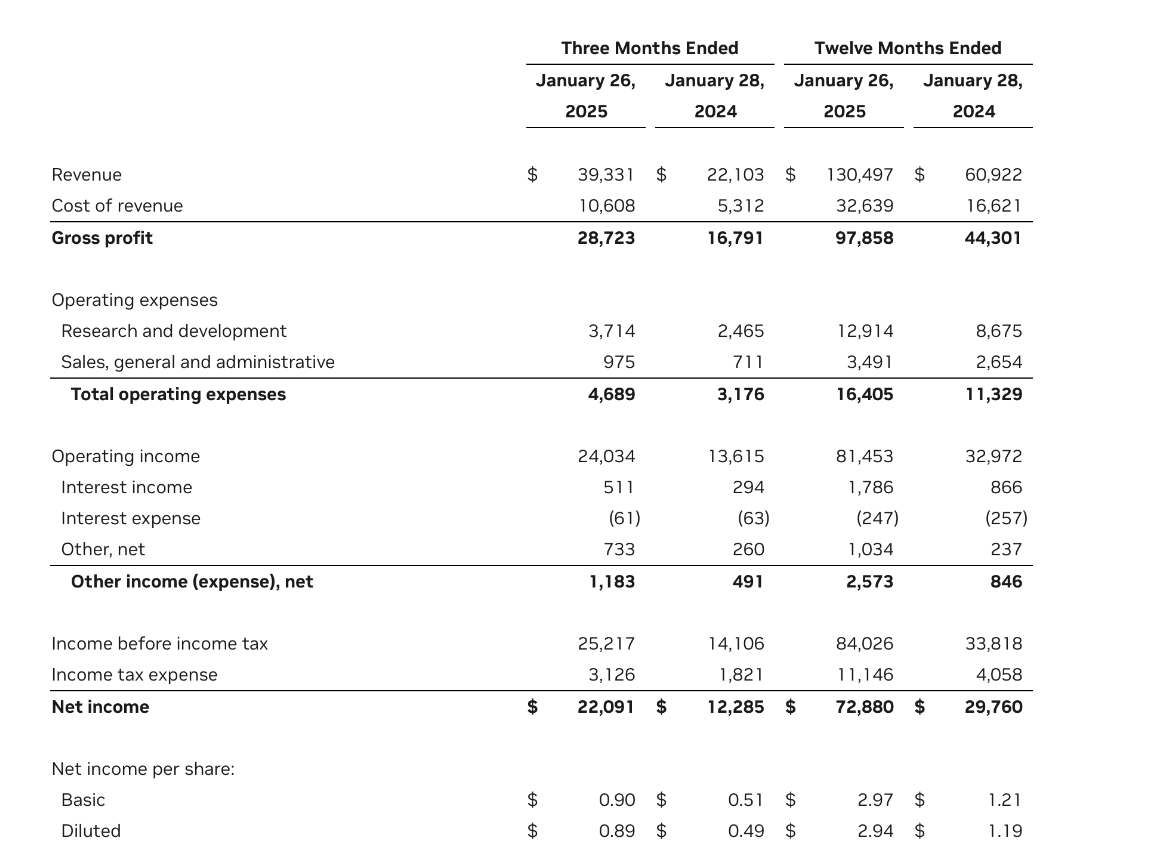

My reading of these things is always wooly but it seems that they delivered $39.3bn in Q4 and guide of $43bn for Q1 next year. This is against a guide of $37.5bn for Q4 just gone (i.e up by $1.8bn) and Q1 next year is in line with Adam's hoped-for Q4+$4Bn.

The detail is more than my IQ can cope with but it looks like exIM's comment is correct!

(Interestingly, the other big NVIDIA piece in the news today concerns faults in their GPU chips, with a small %age of them not being up to snuff. I assume that this is such a tiny detail in the vastness of NVIDIA as to be immaterial).

-

-

$39.3 actual with a $43B guide. It's a solid result. China revenue was relatively unchanged from previous quarters. Well, it's the same on a %age basis which is 'more' but it just goes to show, you can't believe anything you read (Reuters). And gaming was sold out leading me to think they'd ship a record number of cards when in fact they didn't have enough supply.

On 2BT comment above 'big news of faults'- that’s minor fault relating to gaming cards, impacting < 1% of cards. Now fixed. The CEO spoke about previous Blackwell GPU issues last night-they had some issues last year with the mask and yield. That has been resolved and in his words 'it's full steam ahead'. He acknowledged that the previous issues has put them 2 months behind. Does this matter? To some it does but with reporting every 13 weeks does it matter. No it doesn't-you can clearly see the likes of SMCI guide flat due to that delay and many other vendors in this ecosystem has similar stalled guides.

Blackwell shipments in the 4th Q were $11 Billion which is surprising. I had assumed Hopper would stick at its peak for at least another Q or so but clearly, customers want Blackwell. This would account for only +4B Q o Q. The good news is Q1 will see a substantial increase in supply. If accurate the industry expects +500K chips in Q1 which translates to around +$20B so I want to point out, when they guide +$4B yet their potential supply is 5X more than this it becomes difficult to zone in on an accurate result! I do not think Hopper will fall away that quickly so there is material scope for upward revisions.

The company confirmed they are starting to ship Spectrum-X networking with NVL-72 servers, which in their words 'represents a major growth vector'.

Stargate will use this configuration and Cisco systems will integrate Spectrum-X into their entire portfolio which is a big deal due to Cisco, previously relying solely on ethernetBlackwell Ultra is on target for deployment in H2/2025 and Vera Rubin thereafter. At GTC in March (17th-21) the CEO will present what architectures come next. Presently the Rubin next chip is internally referred to as 'X'

-

The Blackwell Ultra (B300) is scheduled for H2 production, so Q3 and Q4. Jensen stated 'the GB300' transition will be much smoother than the Hopper to Blackwell-we have learned a lot. It will just slot in. What he is tell us here is the ramp will be much faster. By mid 2025 TSMC will have at least 20k wafers CoWos-L packaging solely for Nvidia which yield 16 chips per waker or 320,000 per month(1 M/Q?). More chips and a higher average selling price.

Q1 CoWoS-L capacity max 15k wafers (168k chips/M)

Q2 20K (224k/M)

Q3 30K (336K/M)

Q4 expected ending 2025 45K wafers

Nvidia have secured 70% of total capacity. This suggest 500K/month or 1.5M/Q

I absolutely expect revenue to accelerate through the year.The bottle neck is with the packaging (CoWoS-L) which is new, (Hopper was 'S'). The net yield per wafer is 16 chips

-

One just needs to be patient. Real time we are back to where we are early Feb. Nothing is plummeting. SMCI will be volatile and is trading on massive short interest currently-all that derivative action needs to unwind. When we added to the holdings we paid $28. It's $47. We bought a great business which is at the very bottom on its cycle. Revenue and margins can only rise materially from here.

I try to avoid making statements of fact when there is doubt. Nvidia delivered a good result. Look above. Q1 2024 $7B quarterly revenue and that was in scope for all prior recent quarters. Look at it today. The new chip needs CWS-L packaging. There isn't enough but it's coming very quickly. Jensen Huang said they have 350 different vendors making all the required parts. He must orchestrate that.

TSMC must build new factories and buy new equipment-you can't magic that up 'hey C.C Wei, ship me another million chips next month, cheers'. It doesn't work like that. TSMC would say give me your plan, give me $2B and i will start building-luckily that process started 2 years ago.

What I can assure you all is that the CWS-L packaging is critical, it started 12 months ago. Today TSMC can process 20k silicon wafers per month. That is it. Demand is at least 100k per month today. 1 wafer yields 16 Blackwell chips (B100/B200/B300-soon). The process is completely different to Hopper hence why there was a lot of noise around the start.

We are at 20k give or take/month today and from what I understand that capacity (new capacity) is increasing by 20% per month with a target of 75k/month by Dec 2025 and 140k by end of 2026-this may change obviously. Therefore it's academic how much product can be supplied. But anyone who bothers to look, can see, that the capacity will grow very quickly. FYI there are two other vendors helping with CWS-L, actually 3. Amkor, ASE, Samsung-they too have been given help by Nvidia to get going!Nvidia isn't slowing, it's not out of first gear. But you will see some real 'financial genius' say look they did 120% last year and now it's 90%-that's bad. Just idiots. You can't grow at 100%+ every year, it's simple maths. Architecture transitions will mean ebbs and flows. It's a very small operating window(every quarter). 350 suppliers. Just one chink and you miss?

The chips, once you factor in the CPU/HBM/DPU/Stectrum X etc etc are not 30k. I look at it differently-one chip is useless without the other parts so i add them (parts) all up. 1 chip is 50-60k so their 11B is something in the order of 220-250k chips which is what various experts thought they could produce. There are a few flavours, right. We don't know exactly what the price points are but 50-60k is about right and when they say '11b blackwell' it's a system of many parts not 1 chip' so this is how i look at it.

Quick math recap. 250k/16 =15,625.

20k wafer capacity and as noted Nvidia get 70% of the output-why? Because they put the moneyup.TSMC always services all comers-good business but Nvidia get the lions share. So 20k @70% x 16 chips = 224,000 chips. pretty close! This is how it works pretty much.And next month they get 20% more. Speculating, in the next 3 months Feb through April, Q1) 20k X (1+r)^n we get 24/28.8/34.56 or 87,360 wafers x 16 chips (@70%) = 978k chips.

Now, that is a lot! Morgan Stanley think they'll receive '500k more' than Q1 so 750k but even still, that is $35B+. And clearly TSMC might make some progress or might fall behind in the CWS-L ramp. If anything they will exceed, they are too good to fall behind. And without getting too excited. By year end we are talking over 2M chips in the quarter-that is $100B+. Hopper is still selling but slowing. Plus other segments(auto/vision/gaming).

The year following is 2X again-not wishful thinking the investment ground has been laid and the demand is there.

Every year the experts have been 50% behind what the company has managed to produce. In fact for the year end they delivered(whilst constrained) 131B and estimates 6 months ago were 97B.

What I am suggesting is a guide of $43B in Q1 is nothing compared to the very likely scenario that they are pushing 100B for the same quarter next year(12 months away) and anyone bothering to listen to the CFO will know that margins are rising throughout the year(back to 75+).

Nvidia is a once in a generation business and i'll add that they partner with the best. SMCI are a core partner who we understand will consume somewhere in the order of 25% of total chip output. That is gigantic.

-

And through the year you will see not just more supply but transitions to B300 which is much more powerful and much more expensive. The GB300 'chip' is a 3KW chip. 3000 watts and a large rack holds 72 of them. Anyway, what i want to say is ASP is also going up. This is where the revenue grows even faster. But given q4 was 11b and as per above we are looking at 35b just Blackwell, it’s going to be explosive imo.

-

And the backdrop to all of this is today you are paying less for nvidia stock than you would for apple or msft

-

-

I keep these scraps as time goes on, to look back on and laugh at their folly. One is an analyst in early 2024 when nvidia put in the first big print-their opinion, it's a one off and it's back to 7B quarters-sell the hype. The stock was $30 at the time.

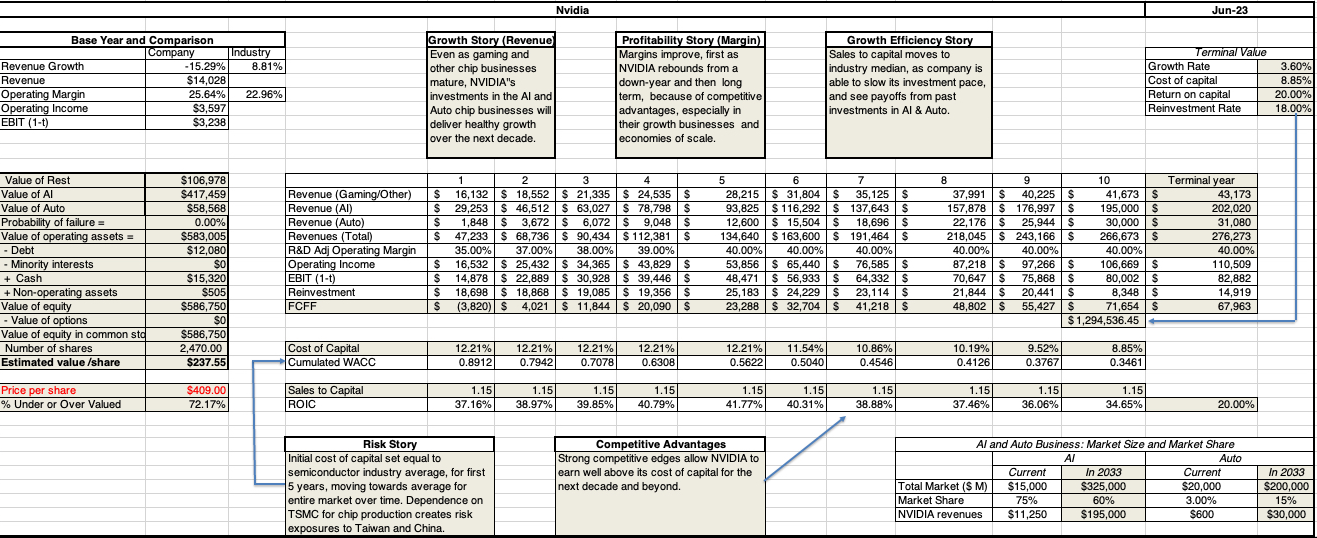

The xls file is from the famous 'Dean of valuation' Aswath Damodaran, professor in business at the Stern school of Business. He's is a celebrity academic. Hard to read but column 1 is 2023 and column 10 2033. The professor in 2023 valued Nvidia at $23.70. It was $43 at the time. Anyone see his flawed logic? Total revenue in 2024 '68B (they just reported 131B) and 90B for 2025, 112B in 2026 all the way up to 266B in 2033! It’s plausible that they deliver 266 this year.

If I was the parent of his pupil i'd demand a refund! The man knows nothing at all about the stock but CBS had him on every week telling people to sell their stock. Competition is coming, margins will fall, it's all front ordering. I can guarantee people like this convinced many investors to get out at $40

Use an evidence based approach. It’s very clear to see

-

We are all happy that he didn’t come and work for IM then …

-

I love how fake/bad news makes stocks plummet, but really huge % increase in turnover/revenue and strong future earnings barely touches the water ! I know stuff is priced in, but the markets tend to do WTF they want

@exIM said in Nvidia News:

I love how fake/bad news makes stocks plummet, but really huge % increase in turnover/revenue and strong future earnings barely touches the water ! I know stuff is priced in, but the markets tend to do WTF they want

I have to say that this is very much my thoughts as well. PHT is down on last week, despite spectacular results from NVIDIA and SMCI (which I think represent more than 20% of the PHT holdings). This is not a grumble at IM or Adam, more a grumble at the world, markets, sentiment and everything else. Thanks to Adam for his answer - it's a long term game, hang on in there for the gains.

(I suppose that a flip side to look at would be that if NVIDIA had returned average or poor results last night then the stock would gave gone down like a lead balloon today, so let's be grateful that that didn't happen.)

-

In relation to those two companies, their outlook has never looked better. The current storm is all about the President potentially starting a trade war. Firstly it's largely talk, so far. Second, SMCI is in the best possible position being an American company with substantial US based manufacturing, serving (90%) US customers.

In spite of the correction over the past week or so, tech is still up YTD and well ahead of all benchmarks and any other tech portfolio.

We've seen these sorts of moves many many times-the ones to be concerned about are structural and micro(company). The opposite is in play.

It wouldn't surprise me at all that the US Govt announce a massive sovereign tech initiative in the coming weeks, perhaps involving the UK (I get that feeling). I was also hoping Jensen would announce a new chip, unique to the US market and call it the DT5000. The most powerful and beautiful chip. The most expensive chip the world has ever seen

-

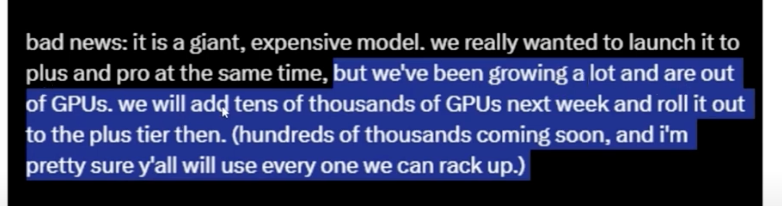

Sam Altman announced GPT 4.5 and also says:

-

In relation to those two companies, their outlook has never looked better. The current storm is all about the President potentially starting a trade war. Firstly it's largely talk, so far. Second, SMCI is in the best possible position being an American company with substantial US based manufacturing, serving (90%) US customers.

In spite of the correction over the past week or so, tech is still up YTD and well ahead of all benchmarks and any other tech portfolio.

We've seen these sorts of moves many many times-the ones to be concerned about are structural and micro(company). The opposite is in play.

It wouldn't surprise me at all that the US Govt announce a massive sovereign tech initiative in the coming weeks, perhaps involving the UK (I get that feeling). I was also hoping Jensen would announce a new chip, unique to the US market and call it the DT5000. The most powerful and beautiful chip. The most expensive chip the world has ever seen

-

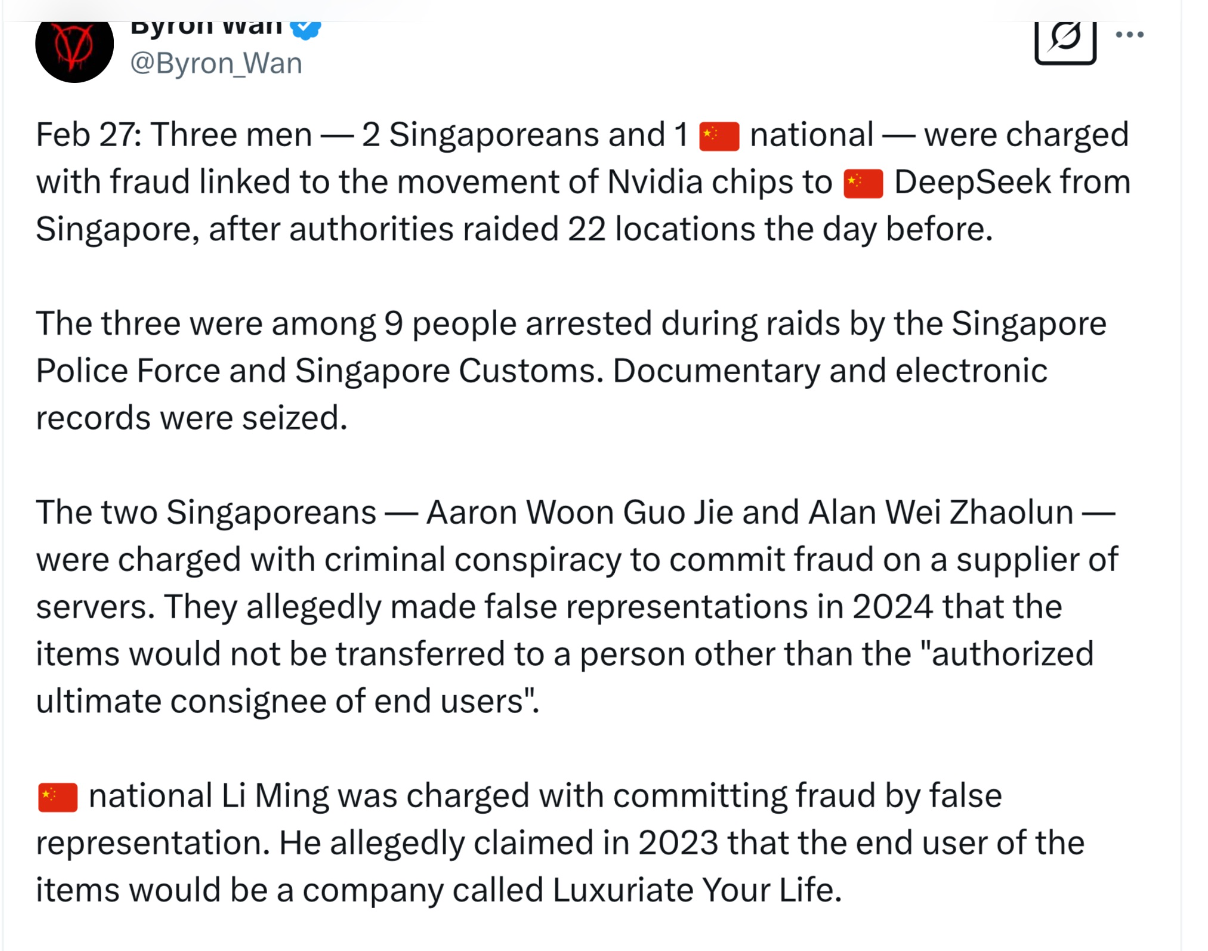

Remember Deep-Seek. They wowed us all , and spent small ££. Not true

-

-

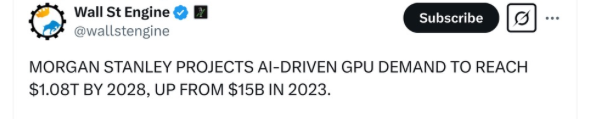

For clarity that trillion is not cumulative. That is spending in the 2028 calendar year. And of that $502B is expected to go directly to Nvidia. This excludes the companies 3 other divisions