Q4 2024 Earnings & Guidance

-

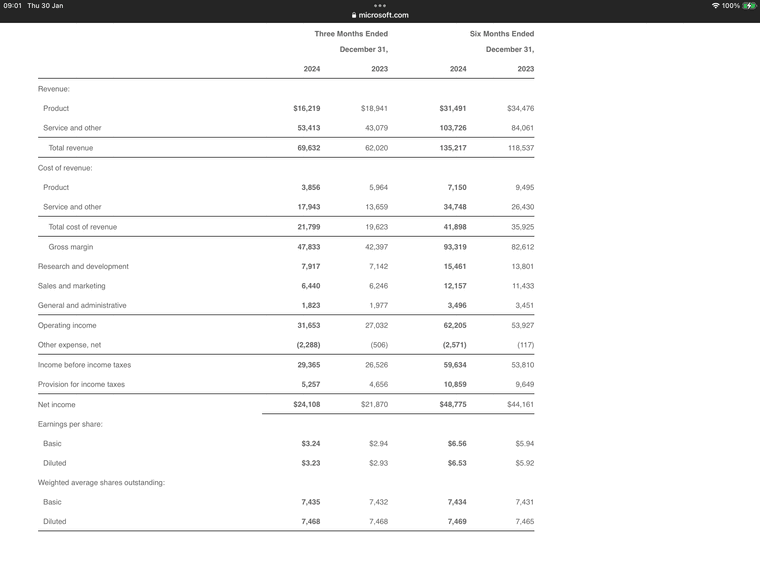

Microsoft turned in a 17% increase in operating profit, handily beating estimates in the top and bottom lines. Azure revenue increased 21% with next quarter guide to be in the range +30-31%. Ai revenue increased 175% yoy. You can see the impact of FX(17% constant ccy to 10% in usd).

Microsoft Corp. today announced the following results for the quarter ended December 31, 2024, as compared to the corresponding period of last fiscal year:

· Revenue was $69.6 billion and increased 12%· Operating income was $31.7 billion and increased 17% (up 16% in constant currency)

· Net income was $24.1 billion and increased 10%

· Diluted earnings per share was $3.23 and increased 10%

“We are innovating across our tech stack and helping customers unlock the full ROI of AI to capture the massive opportunity ahead," said Satya Nadella, chairman and chief executive officer of Microsoft. “Already, our AI business has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year.”

“This quarter Microsoft Cloud revenue was $40.9 billion, up 21% year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft. ”We remain committed to balancing operational discipline with continued investments in our cloud and AI infrastructure.”

-

Meta is up in Pre market to $693, an all time high. The reason is didn't pop more is because it's been on a tear lately, +15% YTD and almost 50% in the last 6 months so Mr market expected a very good result. Either way a very impressive, circa $21 billion quarter. This is 'Apple money'. In fact GOOG,MSFT, META and AAPL all generate similar earnings in the 20-25B per Q range so it's interesting to look at their disparate valuations, and why we may favour (weight)one over the other. Meta clearly has the wind at its back and is growing at a higher rate than both Msft and Apple, for now. I would expect Google to report similarly impressive numbers and on a relative basis it is the 'cheapest' of the Mag 7. But as always we need to balance growth with operation risk (regulatory risk, disruption and competition) and this is where the market will ascribe a valuation not just purely looking at the numbers. Microsoft for example has a much broader income base and I would think, more sticky (like Apple) whereas Meta could face competition from the likes of TikTok (it does). And all of these considerations drive the multiple afforded by investors. No surprise both Apple and MSFT trade at higher multiples. Simply because their earnings are more certain.

-

MSFT is off slightly in pre market by approx 3%-the usual 'we expect more'. In particular, more than 31% Azure growth. When you look under the hood at cashflow they actually did far better than the GAAP(accounting) numbers portray. Depreciation is up 900M (all that capex) and they incurred an unrealised (book and non cash)) loss of $1B on derivative transactions. This will be hedging which swings around quarter to quarter.

-

Adam,

Excellent stuff, as usual. Thanks.

This may have been explained elsewhere in which case then apologies. However if MSFT is reporting a nice fat jump in profits and yet the share price has dropped then where are these extra profits going? I presume that they are being paid out as share dividends and hence to the shareholders, i.e IM.

Do the share dividends get paid into the accounts of the individual IM account holders? Do they sit as cash or do they get used to buy more shares?

Or am I way off beam somewhere?

Thanks again for the distilled analysis and patient explanations.

-

Hi O,

Dividends get paid in cash where one holds individual shares(the acc yes), 4X per year. The company may or may not increase it. It has nothing to do with the share price changing as the same total Nr of shares are held somewhere. All that changed with the share price is the dividend yield will move Eg: $3 per share at $450 or $3 per share at $400, 0.66% vs 0.75% yield.

-

I’ll update tomorrow. However, KLA didn’t disappoint, exceeding on all metrics. The stick us up 5%.

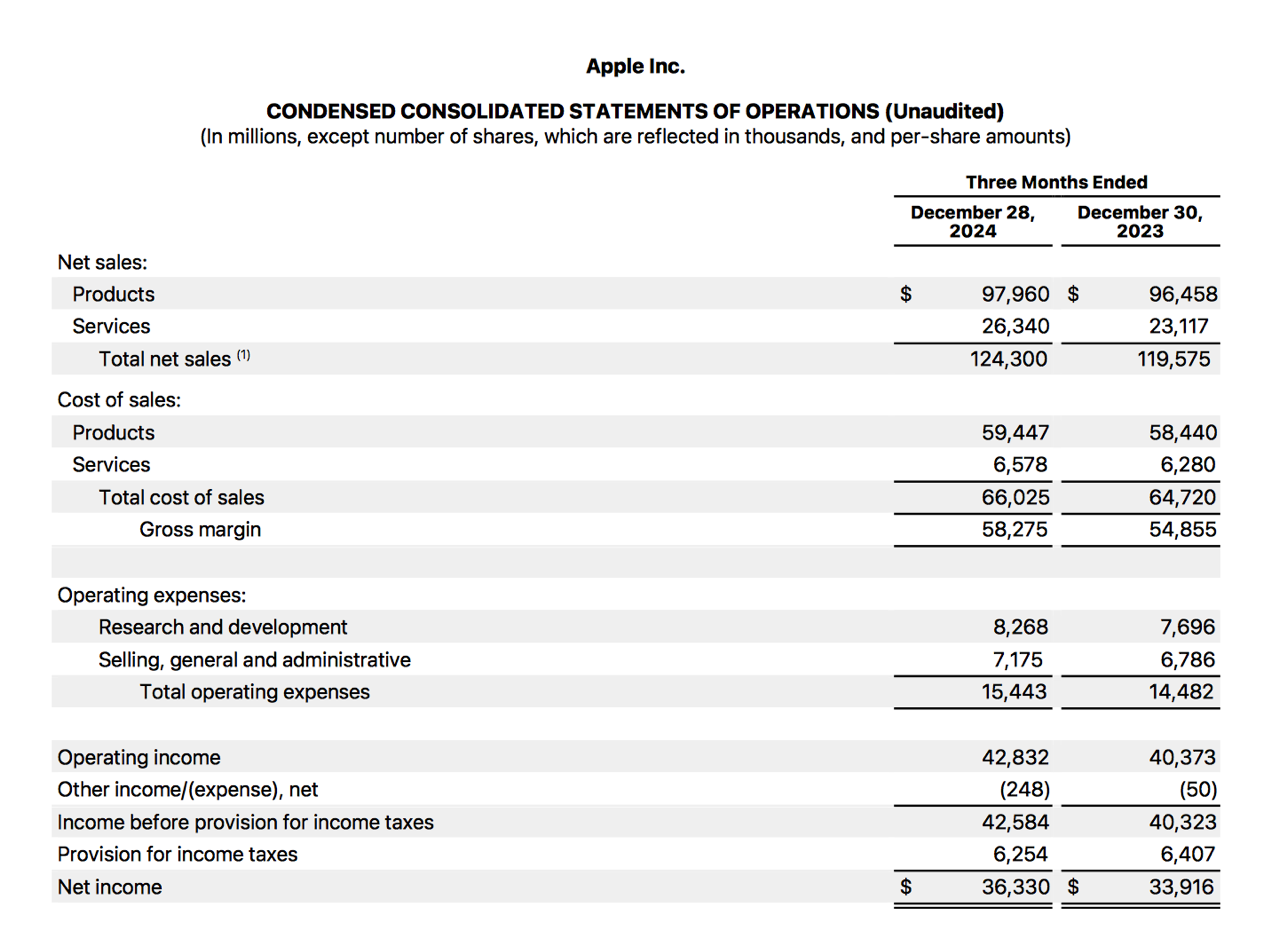

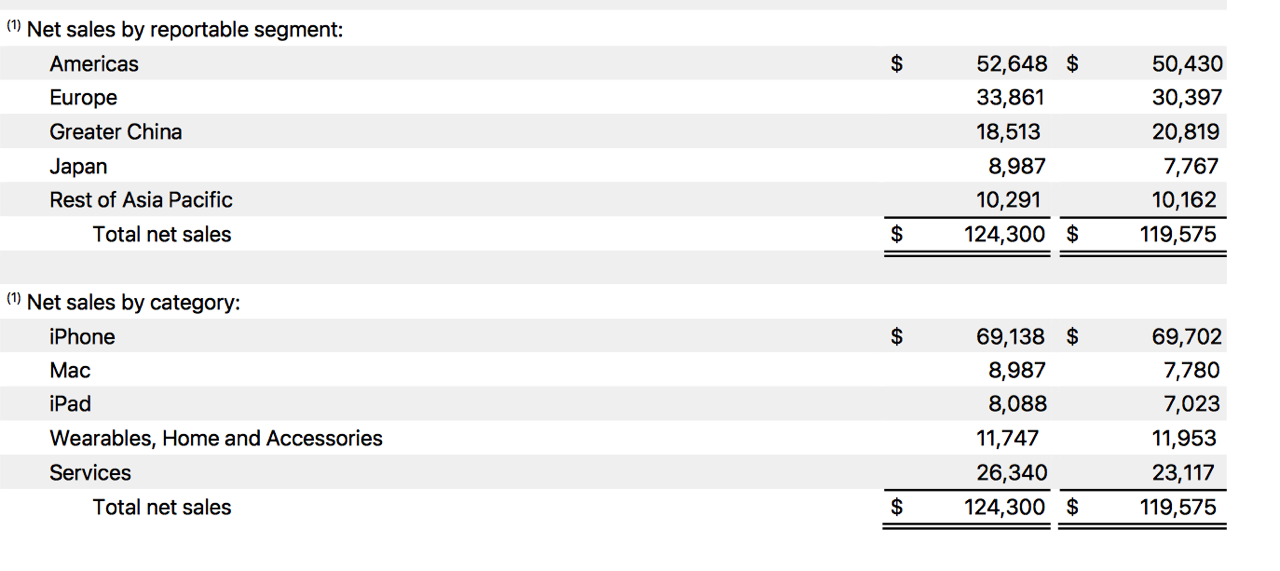

Apple beat despite weakness in China. Those that followed the Apple thesis ‘back in the day’ will remember, we said ‘services’ is their golden goose. The 2 billion users buying apps, iCloud, tv, news, warranty. It was predicted to be a huge cash cow. It is. Services grew 3 billion yoy and had a 90% gross margin.Apples moat is OS/IOS installed base. Whilst I think it will be challenging to launch a needle moving hardware product. I do think when AI matures they will monetise various tools all through their store channels .

Apple is a core, SWAN, sleep well at night, stock. -

Apple GAAP EPS of $2.40 beats by $0.06, revenue of $124.3B beats by $270M

-

-

It's clear to see how Apple 'made up' for poor China sales. Services! Services have a 90% margin. For ever $1 in sales, 90 cents drops to the bottom line-you may recall this was the reason we invested, originally. $36B net income is huge. It is of course their biggest quarter and it is a lot bigger than the other three (Q's).

The company gross profit on all hardware was 38.5B. The gross profit on services was $20B and if we look a bit deeper they made gross profit on phones of about $27.6B. Services is a major contributor-we still think one day it will exceed GP on hardware.

Apples strength is in monetising the 1.3B customers and 2B phones. We firmly believe that when co-pilots/AI agents get better, and they will, Apple is in a prime spot to monetise this new segment.

-

Some thoughts on the Nvidia rumour mill as we get close to hearing the facts from Huang's Team Green.

The rumours circulating over the past month or so:

- Nvidia Blackwell chips are delayed due to over heating and yield issues

- Nvidia customers are reducing their orders

- Nvidia growth has stopped

All of the above articles have been based on 'unnamed individuals with first hand knowledge of the issue'-in other words the author has no credibility from the start. We have mentioned many times why this sort of 'news' is created. Generally it's paid for by short sellers and passes the freedom of speech laws.

If we wanted to disprove the above where could we look. TSM make the chips, the company CEO and CFO sell the chips. Both companies have a long history of 100% integrity and conservatism. If fact legally they can be held personally liable if they say anything which might influence a third party investment decision. They take their commentary and response to questions very seriously. Particularly C C Wei (TSM CEO), if he says things are ok then they are good and if he says things are good then they are fantastic.

There are 4 recent events where analysts asked questions from CC Wei, Colette Kress (NVDA CFO) and Jensen Huang, the CEO. This all relates to the Blackwell architecture.

During last quarter conference call. CFO Kress said ' While demand is greatly exceeding supply, we are on track to exceed our previous Blackwell revenue guidance of several billion USD due to visibility into the supply chain.'- The CFO is saying production yield/supply is better than anticipated.

A follow up question 'So you are shipping more Blackwell than you thought you would 3 months ago?'

CFO Kress, who has a habit of avoiding such direct questions and will deflect(they are conservative) said. Demand is increasing and so is supply. When we look out at what is ahead, it is absolutely growing.

At the UBS Global Tech Conference 6 weeks ago. 'Blackwell which will be here this quarter(Q4-to be reported in 4 weeks/late feb) is experiencing tremendous demand-we will be constrained for many many quarters due to the demand, not the supply per se.'

At CES Vegas 3 weeks ago. Jensen Huang said ' Blackwell is in full scale mass production and every single cloud service (Azure/AWS Google cloud/Meta/ORCL) today has systems up and running.

During TSM earnings call 2 weeks ago. An analyst asked CC Wei 'There appears to be so much rumour around Blackwell and issues with supply/over heating and now cuts in orders '. CC Wei responded 'as you say Rick there is a lot of rumour. We are working very hard to meet the requirement of my customer(it's Nvidia). So cut the orders? That will not happen, actually they continue to increase the orders'

To remind everyone, their guide is $+2B over Q3. If Hopper is close to Q3 and it should be there is hard evidence they have exceeded 'several billion in Blackwell' i.e they will beat(and raise). It is obvious the company is becoming even more bullish. The most recent comments confirming the additional growth in demand and supply.

I think the earnings call will be very exciting. There is nothing to see here other than explosive growth in revenues and demand. Any talk of export controls should be taken with a pinch of salt. Firstly, they don't work and secondly, demand in other countries is so great that any political interference and its perceived impact on growth is immaterial today and for the foreseeable future. They can sell every chip they produce (X 5).

Even though small in comparison to the Data Centre segment, Gaming will be a record-all their new cards are sold out and some are selling for £5k in the secondary market. Automotive will also start ramping(record).

-

Fyi, just a reminder that Tech holding Paypal (and anywhere else it may have been held) was sold yesterday. Paypal reported earnings this morning which were reasonable but showed only 7-8% revenue growth. The stock fell 9% today due to it being up 40% for the past '1 yr' which reflects the market sentiment that their delivery is not good enough. A timely exit!

-

Fyi, just a reminder that Tech holding Paypal (and anywhere else it may have been held) was sold yesterday. Paypal reported earnings this morning which were reasonable but showed only 7-8% revenue growth. The stock fell 9% today due to it being up 40% for the past '1 yr' which reflects the market sentiment that their delivery is not good enough. A timely exit!

@Adam-Kay said in Q4 2024 Earnings & Guidance:

Fyi, just a reminder that Tech holding Paypal (and anywhere else it may have been held) was sold yesterday. Paypal reported earnings this morning which were reasonable but showed only 7-8% revenue growth. The stock fell 9% today due to it being up 40% for the past '1 yr' which reflects the market sentiment that their delivery is not good enough. A timely exit!

Sometimes I wish that this forum had a 'Laughing' emoji, like the one on PH. It would be most appropriate here.

-

i'll see what i can do-im not a fan of the plus sized smiley either

-

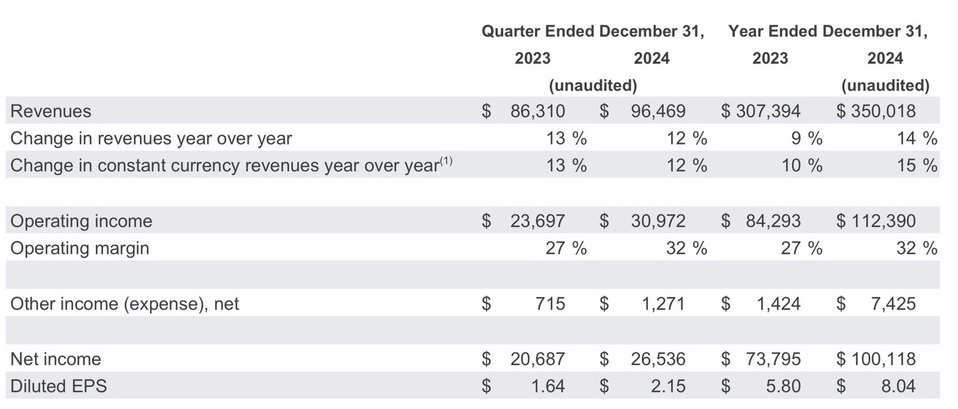

Alphabet Inc-GOOG will report earnings after the closing bell tonight. Expectations are for $2.13 eps and $96.6B revenue. We expect a beat on both top and bottom lines. We will be looking for comments about Waymo progress and robotics, perhaps Quantum Cumpute, all areas where GOOG has a market leading product which is yet to generate profits but surely will in the future.

Much is said of Tesla FSD however Waymo is well ahead in tech and actually monetising driverless cars. 100k paid rides a week and 700 cars.

More later

-

Fyi, just a reminder that Tech holding Paypal (and anywhere else it may have been held) was sold yesterday. Paypal reported earnings this morning which were reasonable but showed only 7-8% revenue growth. The stock fell 9% today due to it being up 40% for the past '1 yr' which reflects the market sentiment that their delivery is not good enough. A timely exit!

-

Hi P, Yes Twilio was sold yesterday. The stock ran hard from September and exceeded our expectations on what is only modest single digit growth, continues stick based comp and negative cash flow, so we booked circa 120% profit.

Google analysis coming shortly. Solid result, exceeding EPS, in line (0.17% miss revenue ). The market seems to dislike the $75B capex on data centres. I wonder who is the winner of all that spending?!

75b GOOG, $80B MSFT, $65B Meta, AMZN? Xai, Stargate.

-

Outlook

Alphabet plans to invest approximately $75 billion in CapEx for 2025, with $16 to $18 billion projected for Q1. Ashkenazi stressed that "the majority of this investment will go towards technical infrastructure, including servers and data centers," to support AI and cloud demand.

Management identified potential revenue headwinds in Q1 2025 due to foreign exchange impacts and one fewer day of revenue compared to Q1 2024.

The company anticipates continued AI-driven growth in Search and Cloud but flagged potential variability in Cloud revenue growth based on the timing of new capacity deployments.

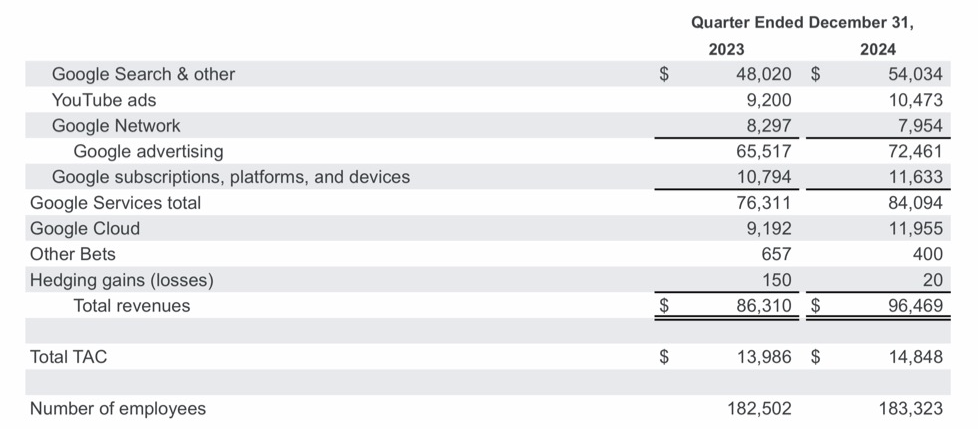

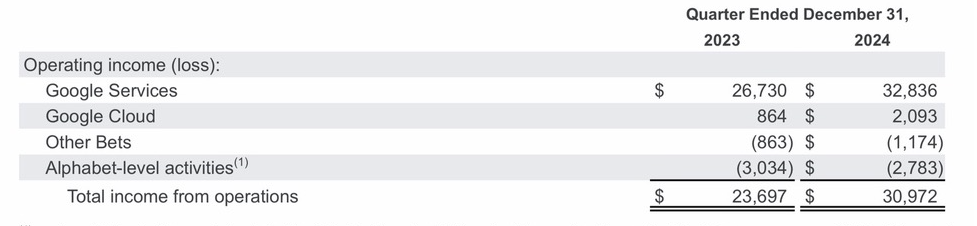

Financial ResultsAlphabet reported Q4 revenue of $96.5 billion, a 12% year-over-year increase, surpassing analysts' revenue estimate of $96.67 billion. Adjusted EPS of $2.15 exceeded analysts' expectations of $2.13.

Google Cloud achieved a 30% revenue growth year-over-year, reaching $12 billion for Q4, with operating margins improving to 17.5%.

YouTube advertising revenue rose 14% to $10.5 billion, benefiting from U.S. election campaigns and retail spending during the holiday season.

Free cash flow increased to $72.8 billion for the full year, with $96 billion in cash and marketable securities by year-end.Sundar Pichai, CEO, said: “Q4 was a strong quarter driven by our leadership in AI and momentum across the business. We are building, testing, and launching products and models faster than ever, and making significant progress in compute and driving efficiencies. In Search, advances like AI Overviews and Circle to Search are increasing user engagement. Our AI-powered Google Cloud portfolio is seeing stronger customer demand, and YouTube continues to be the leader in streaming watchtime and podcasts. Together, Cloud and YouTube exited 2024 at an annual revenue run rate of $110 billion. Our results show the power of our differentiated full-stack approach to AI innovation and the continued strength of our core businesses. We are confident about the opportunities ahead, and to accelerate our progress, we expect to invest approximately $75 billion in capital expenditures in 2025.”

-

From the top table, Google earned > $100B net income for the 2024 year. A staggering amount of money with free cashflow of $72.8B.

Google search grew double digits including Youtube. Google cloud, noted in the third table is now generating a profit and grew 30%. The majority of Google clouds customers are:

eBay, PayPal, Intel, Verizon, Deloitte, Chevron Corporation, Bloomberg plus most startups. Although they are a distant third in cloud behind Azure and AWS.

Other bets continues to make losses, it always has, however it is the incubator of segments like Quantum, robotics and tech used by Waymo which is painting critical mass and is leading self drive. I would expect at some point, Waymo to be spun out as a separate entity, unlocking its true value.

The Capex of $75B is outsized but not unexpected I suppose when you hear MSFT is spending $80B and Meta $65B.

Clearly an AI arms race is underway where the ones who achieve results able to be commercialised will sell and embed themselves in customers businesses and end users. It's also interesting how the market is not rewarding the obvious winners yet ,despite the clear and unequivocal evidence that estimates are way too low! Possibly by as much as 70-80%. We will discuss this more over the next couple of weeks as we get closer to Team Greens earnings. -

Hi Ex, I did bracket the 0.17% miss. It's irrelevant

what's 100m when you generate almost 100B. The slight negative reaction is due to the huge capex spending. I think Google management know a bit more about their industry than the average investor.

what's 100m when you generate almost 100B. The slight negative reaction is due to the huge capex spending. I think Google management know a bit more about their industry than the average investor.What we should be thinking about now is, who will be tasked with building out this data centre infrastructure. Three names we hold will be beneficiaries. And don't forget, however big spending is in 2025, TSMC have committed to producing at least 50% more chips in 2026 and 50% more again in 2027 and today an AI servers cost is circa 10% HBM memory-Micron estimate the TAM to be $100B annually by 2030 which implies $1T total spend. Annual spending! If anyone suggested even 5 years ago that a company could generate $1T in a fiscal year you'd be ridiculed, but it now seems plausible. Exciting times ahead