-

Oh yes.

(And for anyone who is following my travails with moving money to Schwab, they have cocked-up repeatedly and hence I've not been able to buy any more SMCI. So perhaps I should be grateful!)

If I were you, which I'm not thank goodness, I would be using an EU or GB based supplier.

But I would also suggest that you sit on your hands for a bit longer, SMCI may drop back to $18 or lower, yet!

-

If I were you, which I'm not thank goodness, I would be using an EU or GB based supplier.

But I would also suggest that you sit on your hands for a bit longer, SMCI may drop back to $18 or lower, yet!

If I were you, which I'm not thank goodness, I would be using an EU or GB based supplier.

But I would also suggest that you sit on your hands for a bit longer, SMCI may drop back to $18 or lower, yet!

Cheeky! I'm pretty happy being me!

Thanks for the advice though. Do you have a EU/GB supplier who would give me access to the NASDAQ without charging silly fees at every turn?

-

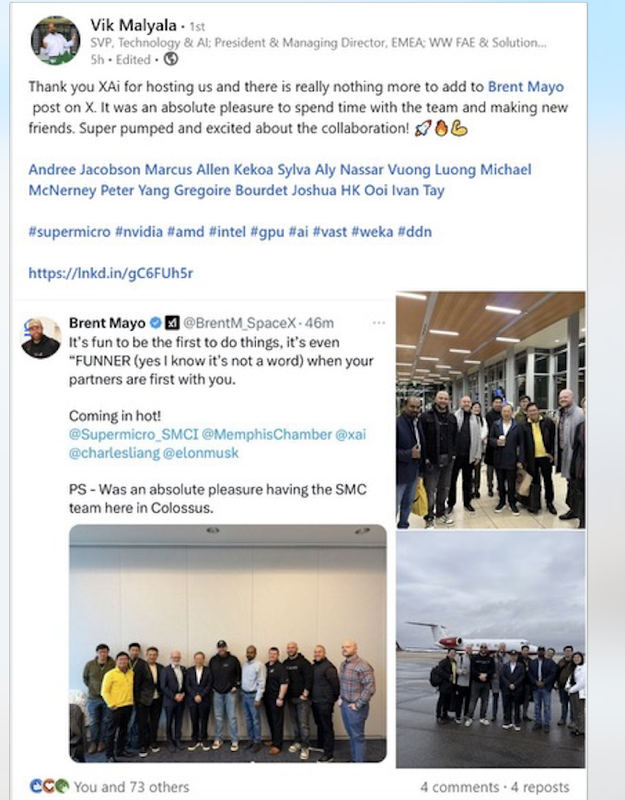

An example of ‘fake news’

-

SMCI built Colossus-1, a 100k H200 DLC super cluster. Circa 1,500 racks. These were mainly 64 chip racks. When short sellers report dropped the rumour mill started swirling that they lost Colossus-2, a 200k GPU addition (B200). perhaps 3,000 expected by April. Dell may be doing some of it but SMCI are 100% doing the DLC. You don't fly private unless the deal is in the bag :). This right here is why we stuck with Super micro-they are the best globally at delivering custom accelerators, and fast.

Thanks Mark for the tweet pic

-

February is the month where we will be presented with a lot of SMCI news. The filing deadline is the 25th.

Just a reminder of time lines. Cooley LLP and Secretariat Advisors conducted the internal review, initiated by concerns raised by former auditors EY. The review(9,000 hours billed) concluded with no evidence of misconduct nor will they require any accounting restatements. Cooley LLP is a top tier global firm (actually Nvidia's external lawyers) specialising is regulatory matters in the tech industry. Secretariat and forensic accountants specialising in complex financial investigations. If they've confirmed 'nothing to see' it's credible. Meanwhile, Hindenburg has closed its business completely and is now under investigation by the Canadian regulator for potential securities fraud. To date the investigation has confirmed 'connections with Anson Funds, suggesting collaboration in preparing targeted reports and coordinated short selling attacks. This would be illegal. Secondly, regulators in India have filed various notices with Hindenburg, accusing the firm of insider dealing and intentionally misleading the public, causing panic. Hindenburg had been hacked and the above 'reports' gleamed from documents obtained.

If we are to weigh the evidence and make judgement it certainly looks like SMCI did nothing wrong and Hindeburg are miscreant fraudsters. The CEO didn't help matters with mixed communications and clearly the company supply chain is a long list of connected parties. This is not illegal and the company has shown that there has not been any favourable terms of trade afforded to these related parties. In fact it is all disclosed in their filings.

Now to the pressing issue, will they file the 10-k by 25 February. BDO was appointed 18 November. And prior to this, BDO would have carried out a thorough risk assessment and discussed everything with EY-legally BDO would not have been able to accept the engagement if it couldn't discharge all of its obligations. This includes completing their audit ON_TIME. Since the assignment has been accepted, BDO must be confident it can meet all filing deadlines without compromise.

We believe SMCI will file their 10-k on time, later this month. At the same time or soon thereafter they will file their 10-Q for Q1 and 2.

Operationally, the company will need additional capital. Probably a combination of debt +equity. This has nothing to do with the filing issues, rather their growth requires it. We think some dilution is a positive as it will confirm growth-if the above images are not evidence enough that new data centre installations are being secured.

We want to remind everyone that there is only so much rack scale capacity available, globally, and SMCI control a very large share of it. The market is pretty much 'big iron' goes to Foxconn, this is reference design generic AI servers you find in cloud DC's such as Azure/AWS and custom/bespoke servers which are built for specific tasks. This is SM's area of expertise. It will be interesting to see how Foxconn manoeuvre around tariffs(coming on Monday apparently) as they ship out of a huge factory in Mexico.

It is very easy to quote rumours and speculate-throw shade on those taking a contrarian view and point to a stock price as evidence that they are right. The stock price proves nothing. If the rumours are untrue, that stock price is clearly very low and does not reflect the company's prospects. The stock price has been driven down hard due to significant and persistent short selling. In our opinion these short sales will need to be closed when and if things turn positive.

Our decisions are based on data, facts and a well-reasoned investment thesis. It's too easy to criticise based on headlines than take the time to dig deeper and try and understand the full context-you just copy and paste old news. Critics who have no understanding of the industry at all-and worse, no experience in stock selection and related research. It's nothing more than lazy and requires no effort at all just to parrot someone else's opinion.

My point is, we may be wrong but they will never be right because there is no original thought, effort or basis for their opinions. It is exactly the same with Nvidia, pointing out its retracement as evidence it's broken (I told you so). We are sure it's not broken but a share price move in isolation is meaningless. There is of course the small matter of buying at $25 and the current price of $120! Hindsight investing and worse suggesting what you would do when you don't have any money invested(and after the fact) should be ridiculed for the vacuous unoriginal opinions they are.

-

SAN JOSE, Calif.--(BUSINESS WIRE)-- Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, today announced that it will provide a second quarter fiscal 2025 business update on Tuesday, February 11, 2025, at 5:00 p.m. ET / 2:00 p.m. PT.

The stock is up 10% AH on the news.

-

More news coming in on SMCI.

Supermicro Ramps Full Production of NVIDIA Blackwell Rack-Scale Solutions with NVIDIA HGX B200

The company has allocated a portion of its total rack production in San Jose to the HGX B200-whatever that capacity is, they are now in full production and utilising all of it.

The stock is up about 10% on the news. We expect plenty of SM news over the next 3 weeks.

-

More information in coming out on SM's new DC system. Offering multiple vendor CPU and unique configurations which the company developed with Nvidia. Offered in Air Cooled, Liquid-to-Liquid(L2L) and Liquid-to-air (L2A).

Clearly SM is still very close with Nvidia which is a significant positive. Big day next tuesday with the Business Update-hoping to receive some positive news on the audit/filing and of course a guide for Q3

-

Looking forward to see what Smci have to say in their scheduled announcement this evening, the stock has been powering along in the run up over the last few days

.

.Well north of $40 now and just below its brief peak in early December. If the news is good and if they can file audited figures successfully by the end of the month they maybe could be back on track?

-

Hi Steve,

I've spent a lot of time on SMCI-in particular, the last 2 months.

Management will speak tonight and no one knows exactly what they will say. However the evidence suggests it's a positive. The stock price in isolation is just moving with sentiment, which, can often be completely wrong. Clearly the 'shorting' that cratered the stock is now being covered-clearly those short position holders fear good news will drive the stock up further and expose even bigger losses(for them). This week is a classic short-squeeze.

I believe the filings will be made on time and without material adjustment.

I believe the company had weak points over some minor governance requirements such as independence re the CEO having too many roles. You often find that when a company, started in a garage with some wires and duck tape from radio shack(I jest) and grows in a 36 month period by 400%.I believe Hindenburg took advantage of the apparent weakness and spread malicious and completely false rumours-the then auditors(EY) got spooked and demanded the accounts be reviewed (for 3 years) thereby delaying filing and sealing its fate. The lawyers arrived and told the company to say nothing. An information vacuum took hold and every miscreant on wall street had a field day.

As I have said before, the founders own 25% of the company and had $12B wiped off their net worth. They didn't sell shares at $122, so why would they do anything to hurt their business.

The big picture here, putting all of the above to one side, is very simple. DLC. It's a critical component in the accelerated compute industry. SMCI leads by far. They have the best solution, the most capacity(today), so if big tech want to build the best data centres now, they must do business with SMCI. The market is wrong about Dell and HPE-they produce nothing. All of their servers come from Foxconn and to a lesser degree, Wiwynn, QCT.

I believe SMCI is working on Xai Colossus phase 2. I think there is high probability SMCI are working with Meta and possibly Stargate. I believe they have orders exceeding their current DLC capacity-which is very large btw. I also think it's a sellers market given demand/supply imbalance i.e margins can only improve.

If the company becomes SEC compliant I see no reason why the 'stock' can not revert over time.

A reminder, just 1 year ago they were reporting 2.5B quarters, in September they guided 5-6B and similar in December-whether that was customers being nervous or the known slight Blackwell delay, we don't know. With Blackwell now firing I would like to see a marked increase in guidance. A material step change in their production and am looking for quarters this year exceeding $10B coupled with better margins (14-17%). Id also like to see a net income margin back at 10% and growing. They won't guide 10B tonight but we should see more than 5-6. 8 will do

-

With investing the key consideration is 'Risk vs Reward'. There were risks with SMCI, clearly, however the rewards were potentially much greater, when considering the stock price of $26 just last Monday. Here was a company , if we assume zero growth was still earning $2B net but a mere $15B Mcap. A company, dominant in an industry growing at 50% p.a. We believed we held a material margin of safety (the risk of being wrong and paying too much).

Awaiting tonights update with keen interest and i'll post something tonight to summarise the key points and what next.

-

The CEO had a filmed interview (fire-side chat) with Reuters in early December. I noticed this interview was put on-line by SM only 2 weeks ago. In the interview the CEO spoke of becoming compliant, on time and discussed the significant growth ahead. Now maybe I'm reading too much into that. The timing was interesting. Complete radio silence and impending business update and they release a positive interview(CEO makes big statements again), which if the business update was in anyway negative would only expose them to further risk. In other words I read this as a big positive.

We will soon find out

-

The Smci call is still ongoing. Lots to unpick tomorrow. The stock is ranging 42-43 after hours. Confirmed filing will be on time without material adjustments. Company accept filing delay impacted current quarter but note, once filed they will resume very significant growth. Access to capital being the main reason. Without sec compliant books banks won’t lend. Reconfirmed margin expansion.

Overall happy with what I’m hearing. And please note, the investment committee last Monday approved an increase in Smci holding ‘by’ 20%. We purchased new shares Monday prior week for 26.

The guide for 2025 June y/end is 25 billion(2024 15b) with conservative estimates for the July 2025 year following of 40 billion (emphasise very conservative).

I think the company has redeemed itself and the next 6 months will reveal a lot more. We go into that period with considerable gains supported by low multiples. -

Over this morning i will post excerpts from the call(very long) and a lot of detail. Only when you get under the hood can you see interesting points. Like the special project they are working on but being subject to an NDA can't tell us yet what it's about. hmm either Meta Louisiana or Stargate. It's not Xai as there is no secret what's going in there.

-

I with then discuss margin and why it can only improve.

Why they are guiding 5-6b for this Q not $8 but will be running at 8-10 in the next 6 months.

How the non filing has wounded them temporarily

Why this company has a bright future and i believe the stock is undervalued -

I'm sure those with an agenda will write articles pointing out all the negatives they can think of. The reality is the non filing has hurt them on several fronts but the facts are:

It's done and dusted

They will file on time

Nothing has been found. There are no prior year adjustments incl 2024 year end(June)-Zero

There is a net $40M adjustment to Dec regarding an inventory provision but that is 100% normal. A provision or estimate is subject to assessment right up to filing date(no filing yet for the 10-Q) so clearly, looking at the figures now, management feel a larger impairment provision be applied. It's nothing of any significance and these movements normally roll Q to Q. It's non cash and could reverse in subsequent quartersThe bottom line is, our holdings have an avg cost of around $23 today and given the company's own 3 year target is $100B revenue with margins reverting to historical trends, that would suggest $10B net income. I like that margin of safety!