-

See other thread content

dingg

wrote about 2 hours ago

last edited by dingg

#1

Auditor has resigned.Looking like the rumours were true, damn

A Online

Adam Kay

GLOBAL MODERATOR

wrote 22 minutes ago

last edited by Adam Kay

#2

The auditor, EY has resigned. But this appears to me to be more about a stand off between them and the Board. EY have found nothing after a very long review. As was discussed some time ago I pondered, will they try and re-audit ‘years’ of accounts. The 10-k needs filing. They can’t file if EY want to keep looking back.If you read the 8-k it is clear, nothing has been found which would require the AR to be restated.

In any event I can confirm that the IC materially reduced our Smci holding (many weeks ago)to where is is no longer a significant holding. We did this to protect from such an event.

A Online

Adam Kay

GLOBAL MODERATOR

wrote 18 minutes ago

last edited by

#3

Any further posts please refer to original Smci threadA

Adam Kay

moved this topic from General Chat

about a minute ago

A Online -

Smci announced Q1 ‘business update’ date, Nov 5th.

FYI, they can’t report q1 formal results until the 10-k is filed for y/end hence the terminology. I can imagine that caused some friction with EY. -

I can't comment on that, G.

We hold the stock as you know.

We hold a lot less than we did

The business continues to grow very rapidly. Something like 100% per annum and whilst that is unsustainable it is reasonable to assume 50% CAGR for 5 years.

Accusations have been made regarding aggressive sales tactics and disclosures. The company denies this.

A deep review has been ongoing for 6 weeks now. Both by EY and a 3rd party forensics firm Cooley LLP who are globally, top tier.

As of today, nothing has been found which would require any financial statements to be re-stated'. The company assert this and EY do not dispute this. So why won't EY sign the accounts...... there are several reasons why they won't. One being, they want to keep going back further yet the company wants to move forward, i.e an impasse.There is no getting away from the fact that over the past few months it has become clear that the CEO calls the shots and corporate governance regs put in place a Board and various independent committees to guard against any undue influence. It doesn't have to be toxic just the impression of influence is enough to cause issues with regulators. After all the company is in public hands.

We took the decision to materially limit our exposure to the company, having already realised a significant profit. We make this decision because we have to err on the side of being conservatism.

It is unpleasant seeing the price drop on what is speculation, which is what markets do so no surprises there. However we do not believe that this represents a permanent impairment to the business.

-

And some perspective. In total PHT is down 1.5% today. As of last nights close it was +6.5% MTD Oct and +42.5% YTD.

-

I'll be providing a detailed update on this holding later today after I write it up. The company held it's Q1 'Business Update' last night which went on until past 11pm. The net take away is positive-with the CEO hinting that he may resign, which is great news imo.

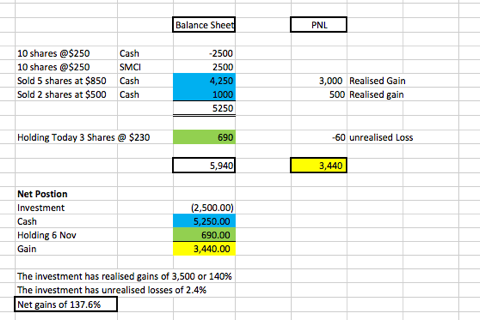

As a starter, I wanted to set out our investment position and illustrate with real numbers just how good an investment SMCI was. Today we are up 137.6%. In fact if you valued our holding at zero the gain would be 110%. To be clear, if the stock got wiped out, we would still be up 110% in cash. By any measure it was a great investment, in less than 11 months.

More to come on last nights update

-

What are the issues facing SMCI and in particular, why are they having problems with their 10-k and EY resigning. We believe this is a governance and independence issue. Not a false reporting issue.

The CEO, Charles Liang has other family business interests, namely Ablecom and Compuware which manufacture power supply and server chassis products. SMCI(SM) have large commercial purchase agreements with these entities. In accounting terms these are called Related Party Transactions.

An audit in the US has a primary objective; to determine whether the financial statements are presented fairly in conformity with GAAP (generally accepted accounting principles), in ‘all material respects. This is equivalent to the UK IFRS standard ‘true and fair view’.

Related party transactions are a significant area where the concept of a "true and fair view" — or fair presentation in U.S. terms — is critically relevant. These transactions can easily misrepresent an entity’s financial position if not disclosed and accounted for accurately. In U.S. audits, the treatment of related party transactions is designed to ensure transparency and fairness, aiming to prevent misleading financial statements. Imagine if a non arms length supplier charged a price which was not a market price or received special treatment. The company could manipulate margin! It is important to note, both the company and the auditor assert that this is not the case. We think this about the optics of the relationship and coupled with loose controls making EY’s position untenable.

Here’s how related party transactions are approached within the U.S. framework to ensure a "fair presentation in all material respects:

Auditors must evaluate whether these transactions might impact the "fair presentation" of the financial statements, as undisclosed or misrepresented related party transactions could mislead users and compromise the financial statements’ credibility.

Materiality and Professional Scepticism

- Materiality is crucial in assessing related party transactions, as even a small, undisclosed transaction can significantly mislead financial statement users, especially if it conceals potential conflicts of interest or transactions that don’t reflect market conditions.

- Auditors are expected to apply professional scepticism and investigate whether these transactions are genuine and necessary for the business or simply to distort financial performance or position.

Audit Procedures Specific to Related Party Transactions

- Auditors perform specific procedures for related party transactions, such as reviewing board minutes, identifying key management and their relationships, and checking for any significant unusual transactions that could indicate misrepresentation.

- In cases where the transactions are not disclosed or appear non-standard, auditors must obtain sufficient evidence to ensure these are accurately accounted for, either by modifying their audit opinion or requiring further disclosure.

These steps ensure that financial statements reflect "fair presentation," giving users a reliable view of the entity’s financial health.

Mitigation

The above poses significant challenges for an auditor however these can be mitigated if the Board and Audit Committee are clearly independent from both the contract negotiations and payment thereof, including things like competitive tenders. In other words, the Board acts freely, without interference/input or its appearance from the related party. In this case Charles Liang. And it is our opinion that the auditors can not discharge their obligations in this matter. It is our opinion that Liang's influence is pervasive.

What Next?

I think Liang will resign along with the CFO and the Board will be restructured. I think this will be a condition of any new Audit engagement. And whilst regaining compliance is critical, I believe they will do so. The company is highly profitable and growing rapidly. It is critical in the accelerated compute sector and it offers unique solutions which can not be replicated elsewhere within any reasonable time frame (years). The reason for this is simple. SM possess DLC rack scale capacity, built up over the last 3 years. This capacity is absent elsewhere. Further, their specific custom solution is quite unique and they have demonstrated that large US customers demand locally built solutions. Eg Xai Colossus cluster being built in just 122 days.

Q1 Business Update.

- Circa $6B revenue. A record.

- Circa 75c/share based on 640M shares or $480M net income. A record.

- Cash on hand exceeds bank and convertible debt by 600M.

- $5B inventory on hand.

All very positive

Guidance for next quarter is flat. It would have been nice to see some growth however put in context, with the overhang of the non compliance and severe scrutiny, management themselves stated that they are being ultra conservative. We believe this to be the case. Now is not the time to make bold promises-they need to change. They need to start delivering and on that it was very positive to see gross margin increase significantly, from 11.3 to 13.3%. A key metric which derives earnings growth.

Valuation

The company is now valued at $12B. Even assuming zero growth they are on a $2B earnings run rate which corresponds with a PE of 6. It’s this low for a reason but still detached from the business fundamentals. If Liang was ‘cooking the books’ it’s reasonable to assume he would have offloaded a lot of stock when the price was high. He owns 15% of the company. $8B paper net worth would be mighty tempting? He didn’t.

Blackwell is a DLC story and even if the company units shipped was flat, the selling prices being 60% higher would drive further growth.

Rumours of Nvidia reducing GPU supply are just that and in our opinion, false. Jensen Huang is a life long close ally of Liang and as said, SMCI are a critical partner. Liang stated unequivocally that to this day they remain on excellent terms with Nvidia and whilst matters are no doubt strained, we believe good business will prevail.

-

By definition, it's a hold within our portfolios. We have made excellent 'profit' which, being realised will be retained. The remaining holdings are modest. It's a very good business just poorly managed in my opinion. There is no doubt Mr Liang is an excellent engineer and he has built something very special but his management style appears incongruent with Western regulatory framework.

In saying that a manageable problem has ballooned into a critical issue which can be resolved IF he realises what the implications are. In my opinion that will require his exit as CEO.

-

Still going down, under $22 now, when do you think they’ll have some positive news?

-

I was just digging around for some SMCI info and came across this :

https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001375365

To me it looks like a lot of recent disposals by directors/officers ?

-

Insider stock sales have always been a source of debate. They are largely irrelevant. When Huang sold $800M in Nvidia stock 2 months ago it was a clear sell signal for the Bears and they make sure you heard about it. A director sells < 1% of his holding for some spare cash. Zuckerburg sold > $1B worth of Meta stock earlier this year-he did just buy two rather large yachts. Bezos, 3-4B.

The Liangs own 15% of the company. Vested option(stock) sales are pre planned and would have been approved many months ago. Maybe they need the money. It's irrelevant. As has been noted before, they sold very little when the stock was $120.

The facts are RSUs attract high taxation(even when unsold) so directors will often sell them to pay the taxes they are liable for whether they sell them or not. Huang has make many large pledges to various charities in the magnitude of 100's of millions so with taxes Im not surprised he needed to cash in some stock.

-

Still going down, under $22 now, when do you think they’ll have some positive news?

-

I'm waiting for the dip to bottom out and start climbing!

-

It's an interesting case study. We were lucky to realise a material profit and even a theoretical price of 'zero' would net 110%. From failing to file accounts on time to this. It appears a bargain today, right? Well, thinking about the implications.

No access to capital

Customers cancelling contracts

Banks calling in debt(potentially). All debt has covennants requiring a 10-k filing. No filing, you are in breach and the loan becomes callable.

Suppliers withdraw credit

Top quality staff leave-their options are worthless

Shareholder law suites(a big concern)

Real going concern implicationsIt is possible to resolve most of the above. Will they? They have not shown any signs of getting their act together, yet.

The first step is to appoint a new Auditor-a Big 4 Auditor. Most likely PWC. I'm guessing PWC. Before they agree, I would expect their review of the Audit Committee findings (ongoing still), request the CEO/CFO and most of the Board to resign. These imo are red lines. Will they go? Only then will they have a workable plan to convince nasdaq not to delist them. The delisting process is relatively drawn out and the company have two appeals which buys them time. It might take months to appoint new Auditors and get their accounts filed. During this time the rumour mill is driving the stock, more customers leave and banks get nervous.

-

I believe SMCI has taken many institutional investors by surprise, so no one should feel foolish for having invested in them. Around 20% of SMCI is owned by BlackRock and Vanguard !

That said, it's remarkable to see how SMCI is managing these challenges given the potentially serious consequences.

)

)