-

xAI raised $10 billion in , as announced by Morgan Stanley on June 30, 2025, comprising $5 billion in debt (secured notes and term loans) and $5 billion in strategic equity investment. This is the confirmed amount for the quarter, primarily to fund AI infrastructure, including the 110,000 Nvidia GB200 GPUs planned for the Colossus supercomputer in Memphis.....SMCI will be installing these racks 'soon'

Xai isn't finished raising money-I believe they are looking for an additional $20 billion. 800k B200/300 aint cheap

-

Reported in the Daily Memphian last night

The left have tried to shut the project down, and failed.

-

We have now entered a possible reporting window, where SM could pre announce earnings. So it is worth a recap of where we are and what we want to hear/see in the coming days/weeks.

Could SM announce Q4(set) early. Possibly. They guided 5.6-6.4b and a conservative EPS.

The focus more me is Gross Margin. 9.6% in Q3 was poor, but there are reasons why it should almost certainly increase and materially. And why the headline number was swallowed by ignorant observers who don't have any understanding what was driving the number and therefore why it should recover (other things being equal).

H100/H200 inventory write downs totalled 220bps being included in the 9.6%. It is worst case a one time provision, meaning the base line is closer to 11.5% in Q4. Best case scenario they sold the stock at prices above the net book value. I know they are selling meaningful quantities of Hopper systems. We don't know exactly how much or pricing.

There are two other factors which I think will impact margin in a positive way, actually 3.

-

Throughput. The more they produce and ship the lower the cost. This is due to what is a considerable fixed overhead being applied over a larger revenue base. This could easily be 150-200bps. I recall management commenting that Malaysia was only at 1% capacity(Q3). It doesn't take a genius to know that Malaysia, being a large facility is staffed by 100s if not 1000's of staff. 1% means they are doing nothing, costing money.

-

Other things being equal, Blackwell is a more profitable architecture than Hopper. It's newer and more scarce. Simple demand/supply in play here. We know Blackwell systems are now the dominant revenue driver. Added, this enables a better product mix to higher margin sales, with less reliance on other systems. ASP is also much higher.

-

R&D costs. SM have spent significant sums on R&D, preparing for Blackwell. I would estimate 40-50M extra costs in Q2/Q3 developing new products. However the revenue was deferred due to constraints. We all read about the lumpy Blackwell start. So, this cost is absorbed directly to COGS(margin). It's also worth mentioning the costs re the late filing/investigations which were about $20M.

Assuming 1%(100bps) based on Q3 numbers equates to around 45M. It feasible that net SM could improve margins 300-350bps, i.e report 13.1%+. 14% would be brilliant but im not counting on it.

The market expects the same 9.6% or worse! I think they are very much in for a surprise. Just my opinion and I may be wrong.

Currently, the scorecard on Super Micro is a 200% realised gain and a 100% unrealised gain (USD, we paid $26.5). It has been a fantastic investment and we have navigated the issues well, much to the clear annoyance of some :).

-

-

News

SMCI. signed a $1.79 billion Receivables Purchase Agreement on 16 July 2025 with MUFG Bank and others, selling receivables for quick cash at a ~1% discount.

Alongside a $2.3 billion convertible notes deal June 2025), this adds ~$4.09 billion in liquidity. It’s a massive signal of fast growth and big projects.The Q3 FY2025 balance sheet (31 March 2025) shows $2.54 billion cash, $4.31 billion inventory, and $1.43 billion liabilities, with ~60-day supplier payment terms (DPO). With $6.63 billion total liquidity and ~94-day inventory turnover, SMCI can likely support $10–$12 billion quarterly revenue, up from $5.68 billion in Q2 FY2025. This backs their $40 billion FY2026 target, showing they’re gearing up to dominate the AI and data centre boom.Key Metrics:

Receivables Facility

$1.79B, ~1% discount for 60-day terms, funds inventory/production

Convertible Notes

$2.3B, zero-coupon, for manufacturing and growth

Q3 FY2025 Cash/Inventory

$2.54B cash, $4.31B inventory, ~94-day turnover

Liabilities-current

$1.43B liabilities, ~60-day supplier terms

Quarterly Revenue Potential

$10–$12B, up from $5.68B (Q2 FY2025), aligns with $40B FY2026 goal (and I think that is low)

Growth Signal

Rapid expansion, big projects (Colossus/Meta/Coreweave/ME/Europe). And note-the bank would only offer rates like this if the customer(SMCI customer) has excellent credit.Notes: The $4.09 billion in new funds, plus existing cash and supplier terms, boosts SMCI’s ability to scale production and chase AI/data centre demand.

Revenue Estimate: With $6.63 billion liquidity, $4.31 billion inventory, and extended payables, SMCI can support $10–$12 billion quarterly revenue, leveraging past performance ($5.68 billion in Q2 FY2025) and FY2026 guidance.We have some idea how Q4 went, they are between their wide guide of 5.6b-6.4 and earnings are also in-line, otherwise they would have reported early. They didn't, rather setting an official ER date.

We speculated the Q1 guide(Sept Q) would be very positive (revenue wise), we know they are building Xai colossus-2 which is massive and speculating again, why raise the money now unless they need is 'now'. I have no doubts that revenue will soar. The only thing we need to confirm is margin which we have discussed. For some perspective in Nov 2024 Q1 fiscal 2025 revenue was $2.12B-we are about to hear their guide for this years Q1. Analysts today are expecting $6.18B-I think they are in for a big surprise.

-

Elon Musk post an hour ago.

This is 7,638 racks of NV Link 72 equiv. $25 billion-he's not playing. It would appear a lot of this will be live in the September(end) quarter.

It's worth noting, whilst a rack costs 3.5-4 million each, Musk almost certainly purchased the GPUs direct and upfront some time ago and this deal is a 'BYO-G' 'bring your own GPU', so when a rack builder like SM supplies the finished product they would only recognise the value-add which I would estimate at around 1M-1.2M each-the GPUs are not procured by them on mega deals like this so can not be recognised as revenue. Still half the installation (the min) is $5B and more importantly the gross margins will be higher simply due to the GPU margin being tiny if anything opposed to the rest of the rack(parts) being vendor built. You would be shocked at the price of this kit-power supplies for 150k per rack. The chassis, 250k. The Cooling units 100-150k. SM or their related companies build all of this(unlike Dell/HPE)

Think about the scenario $350K margin on a $3.5M rack is 10%, however $250k margin on a $1.2M rack is 21%. Not only that but the cash burden is far smaller.

-

not to be outdone:

It was probable that once the original Stargate project was made public, that one of the other big players would counter and a DC war ensued. First Xai, then Meta/Msft and Open are all locked in a race for AGI or ASI, artificial super intelligence. We haven't heard what Google are doing but it's quite possible they will just rent capacity from ORCL or someone else.

Altman has also made no secret that he expects to spend multi trillions(just OAI) over the next 5-10 years. I don't doubt it. Well, and here is my point. It doesn't matter if it's 2 or 5T. As I have suggested before, capacity is what matters and that takes time. I don't see much improvement on a 50% annual capacity expansion (geometric average which equate 8X in 5 years)nor do we need it. But it reinforces(is hard proof!) that when someone points out a delay in a. project as bad, it's irrelevant because every single chip TSMC can pump out has 5 or 10 buyers. And this is why companies like Nvidia can be picky when choosing who receives their technology. Using too many AMD chips-back in line, funding uncertain, no thanks. Too many ASICs or developing your own, limited GPUs. Things may change in years but for the next several the facts are 'if Nvidia build it, they will come'-and take it all.

Late next year we will see racks rated at 500KW, certainly by early 27 and in 2028 Feynman drops and we will see 1 Megawatt racks. That's enough juice to run 1,000 houses, in 1 rack. I think power capacity will need radical change. And change it will be and very fast.

-

They produce more powerful efficient systems but when you say 'sorting out'. A good analogy would be an ant on a beach moving the sand. They are a tiny company; $80M annual revenue.

I would think the problem will only be solved via Nuclear in the next decade. After that Fusion has potential and I understand AI is/will play a big role in cracking it, likely at least 10-20 years away

-

I'm old enough to remember when nvda were a similar size hawking graphics cards, remember someone who went by the name of compo on hemscott ranting on about them and taketwo, hopefully he still has a lot, most likely not though.

Anyway their tie up with nvda piqued my interest, they have results on 4th August, dump adobe and stick the proceeds into nvts?

-

Adobe-Ive mentioned here has already been significantly reduced. I can't give an opinion on the other stock because we don't hold it. Suffice to say it could do anything. It's a meme-stock and is being driven by emotion, not fundamentals. It's almost 30% short.

You only need to look at other forums to see the pitfalls playing out in real time.

It’s like watching a blindfolded dart thrower aim for a bullseye… in a tornado

-

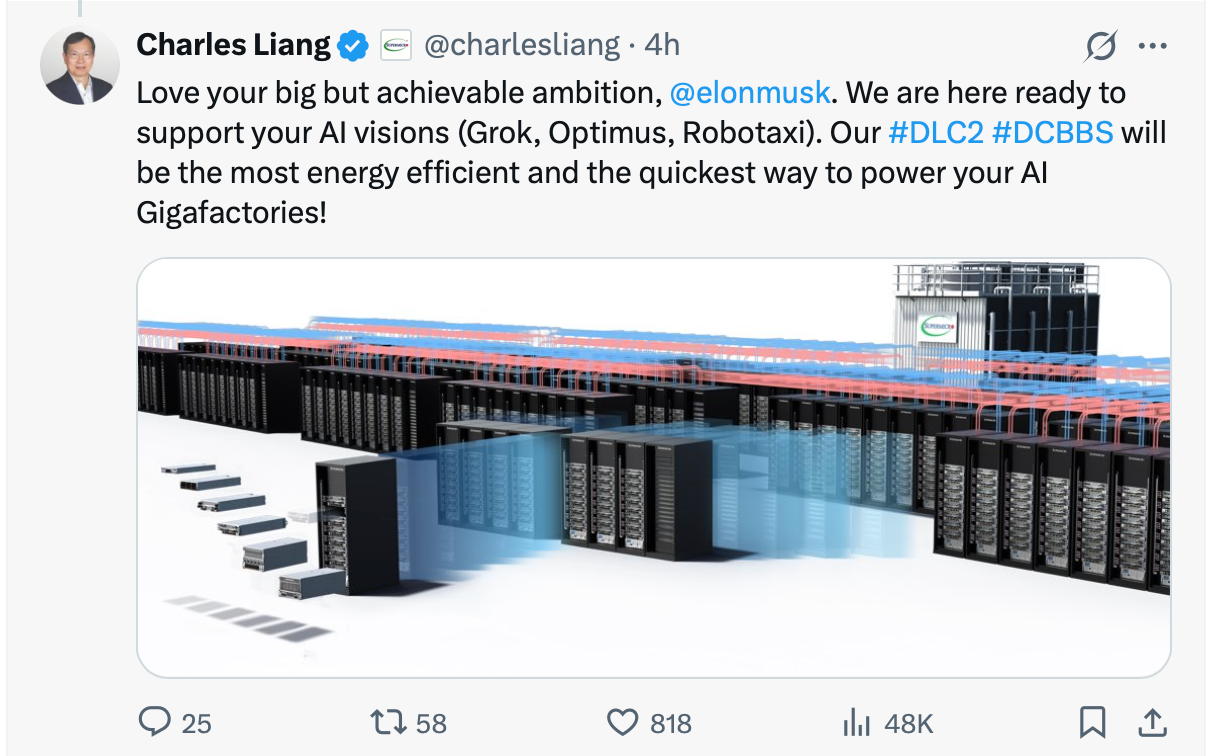

Charles tweets Elon. One criticism is that Charles Liang doesn't shout about their achievements. You literally can't keep Michael Dell quiet and it is a pet peeve of mine. Is this a change in policy? Btw this isn't a hint. This is what is called a BIM. A Building Information Model. And as you can see this is only a part of it. SM manufacture the cooling tower you seee in the background. I believe these racks are being installed as we speak. The total installation is around 20X bigger than this image. We do not know for certain how much of it is SM work but it's at least 50% and likely more because it's 100% DLC.

-

I read that SM installed all the cabling on this project. 15,200 miles of high end fibre and the big metal box in the background, the Cooling Tower-400 of those, in fact 100% of the entire project is SM DLC-2-even Dells racks are cooled by SM. And people are wondering why they need to raise cash-they've been carrying this cost around since the beginning of the year. Next quarter it all drops-in

-

All

5 August

5 August -

a sneak peak at the cabling-interesting, perhaps only because it cost somewhere between 1.2-1.5 billion and it's difficult to comprehend 'thousands of miles of the stuff' Whoever installed it, made some nice margin for sure!

Imagine calling the supplier hi we need some cable-the good stuff. OK how many metres do you want , umm 24 million metres (snigger). Alrighty then that'll be 1.1 billion-how will you be paying?

-

A big move up in the price today ….looking very positive

-

As many know, they report tonight. Generally, I'm bullish, however it's very difficult to arrive at 'a figure' with any degree of accuracy. Suffice to say the factors which impact their business are all looking very positive.

Analyst consensus is for a Q4 revenue figure of around $5.9B and EPS around 40cents. I am far more interested in the Q1 guide and their EPS guide, which should be at least $1B ahead and my wish list is +$1.5B. This would be around $7.5B at the midpoint(analyst consensus is $6.18B and 60c-they will surely blow that away (it's feasible they manage 90c). I also think GM improved during Q4 and should improve further in Q1 and beyond.

Expect management to talk about the market moving rapidly to liquid cooled solutions and in particular their DLC-2 being the market leading solution. Updates on DLC capacity, hoping for 3k racks per month, new DC deployments being 30-35% DLC and SM's market share being 65-70%.

I was away in sunny Spain last week

-

Have you had chance to digest and pick the bones from the figures etc from last night yet Adam …thanking you in advance