-

Mike, re your question.

Senior management receive compensation via stock awards. It's part of their employment contract. They know when these shares will vest and invariably they are sold the day they vest because as said, it's their salary and they are taxed heavily on them on vesting not sale. It makes perfect sense to sell them, otherwise you pay the tax out of your own pocket.

The Liangs hold around 150 million shares and have not sold any shares (these sales are compensation awards), not even when the stock flew to $120. So if he was going to cash-in don't you think he would have back then. it's just dog whistle nonsense repeated by idiots. We will see who is right in the second half of this year

-

Mike,

The Liangs sold their stock via a 10b5-1 plan agreed January 2024 which stipulated a schedule of shares and sale dates. The delayed filings prevented these planned sales.

A- One can not modify any 105b-1 if any sales under said plan have been actioned(they had, October 24).

B-If a sale is not able to be actioned on a prescribed date (the case due to the delayed 10-k), the stock is to be sold at the earliest opportunity. This would be the day following the filing. The 26thThere was absolutely nothing the officers could have done to stop the sale. To do so would break the law and in the very least could be construed to be insider trading. Fyi Liangs 10b5-1 provides for 300k shares total sales to june 2025. It's all disclosed in the 10k. This sale was a mere 46,293 shares.

I hope that clears this up. The ultracrepidarian is again, off the mark.

-

-

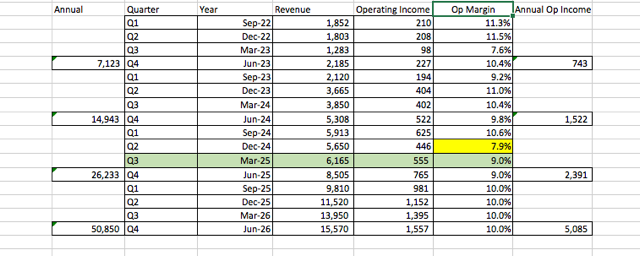

Here is a work in progress (above) detail my forward looking figures. Underlying it is a correlation to Nvidia revenue-it's all about the access to silicon. The dip in operating margin (7.9%) is clear as to the reasons but has historically been around the 10% mark and with scale imo will expand well above 10%

The 10-k late filing cost them around $30M in additional costs

R&D shot up by $60M in the quarter which is all the upfront Blackwell preparation

I suspect a lot of that is also staff hires in Malaysia and the DLC build out-it won't all be capex X

The point being, I would now expect a more normalised margin, at least post Q3(March)Note: The company guided $40B for fiscal 26 and above we are estimating $50.85B, yes a large beat but we have good reason to take this view. We will soon find out whether the quarterly revenue is aligned to this target. -

Late next month they will update for the current quarter. The guide was $5-$6. Above we have 6,165K and I would speculate that the new norm is to guide conservatively. In this example $7-$8B and we expect 8,505K.

This is the sort of trend we would want to see.

Posted for posterity. Today the company trades, based on the above at 4.6X June 26 Operating income. Will it age well -

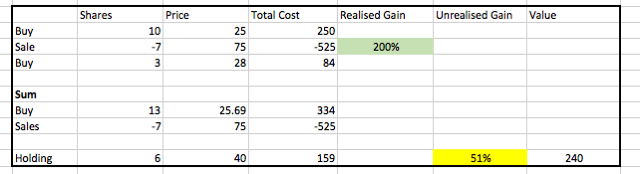

Disclosure of our historical and current position

-

Anyone who followed the investment from inception will know we paid $25 in Dec 2024.

Jan 17th $32

Jan 31 $53

Feb 13 $79

Feb 22 $98

March 15 $115

March 20 $90

To say it was volatile was an understatement. We invested because it was clearly undervalued at $25!($250 in old money) and we identified a business at the beginning of a secular shift in computing, and they held the secret sauce(DLC). Having invested in it years before anyone else and were expanding before the market needed it. The point is research identified the opportunity. Hindsight Harry might point out the subsequent fall from grace however HH doesn’t have any skin in the game because they don’t look for opportunities-they simply sneer after the fact-like an idiot using last weeks lottery numbers.

The unprecedented speed of the assent was driven by short interest betting against the stock. In one day in March 2024 the stock close +$270-one day!The fact is we sold 70% of our position at $75 ($750) and tripled that investment (200%). A fantastic result by any measure. We held the remaining 30% because we did not believe the rumours and frankly, could afford to do so with no risk at all. We sold shares for $525 which cost us $175 (actually 200%) and retained $75(3) + additional buy in Feb 2025 of 3 more for $84. So today, we hold 6 shares at a total cost of $159 or $26.50 per share.

I wish all our investments and decisions/timing were this good.And for the record we think the stock today is still significantly undervalued and we intend holding it for a long time subject to its execution at the business level and possible erratic price which might offer an opportunistic early reduction.

-

Just stating the obvious. Ive factored it down to 10 for simplicity.

-

-

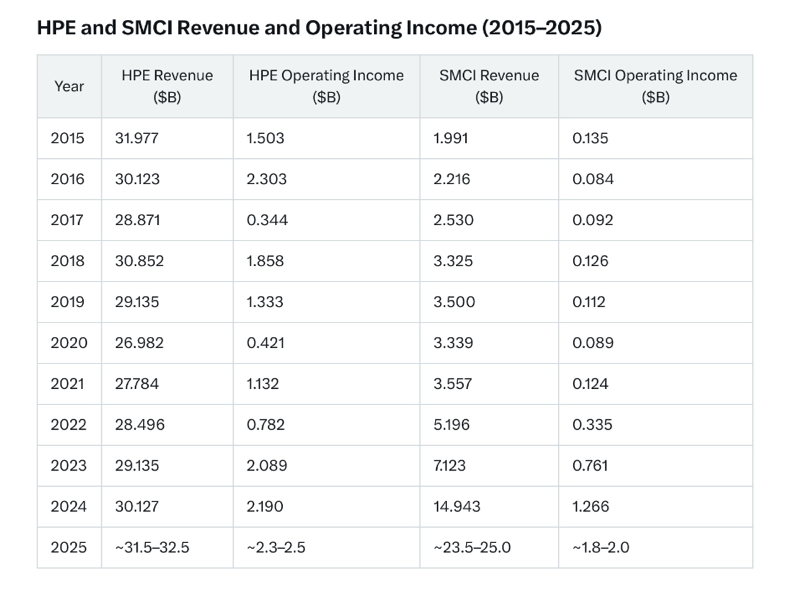

A good example of relative values, growth and investment choices. HPE Hewlitt Packard Enterprises. The number two server company in the world. NB: HPE do not manufacture any servers-like Dell they white label their products, sourced from Wiwynn, Foxconn, Quanta etc.

For 10 years HPE has sat still, yet look at SMCI. Once a mere minnow, they will surpass HPE this year and have Dell in the cross hairs.

The main differences between SMCI and the 'competition' is that SMCI build custom solutions whereas HPE/Dell sell reference designs (a generic box.

You walk into a Bar and buy a Dell/HPE-the bartender hands you a vanilla martini.

You walk into a bar and ask for a supermicro and out comes the 'Savoy Cocktail Book'. Adds in a few extra GPUs, a splash of DLC, a twist of HBM, served in a titanium chassis.There is no money in reference designs because it's generic an a commodity. Hyperscalers use these to run the internet and other general work loads.

Companies like Xai/Tesla/Anthropic/AWS/Meta/Google/Msft if they want to run LLMs or systems designed for specific tasks, such as drug discover, science, robotics, they will need a custom solution. Not a 'Big Iron' quarter horse.

-

A Positive update from SMCI CEO Charles Liang at HumanX https://youtu.be/csPUkLm2xY8?si=5uOuS_g7tWIis8Mf

-

Thanks Bogie . I watched the interview yesterday. There is no question imo, smci existing 2k racks/m capacity(and 3k this year) which is currently utilised at circa 500/m(25%) will not be enough within 12 months.

-

The take aways from the interview is simply 'Growth'. Other companies are laying off staff, SM is hiring. They are expanding their San Jose Campus materially and adding two new campus in the Mid-West and east coast, plus scaling up Malaysia.

We will see the step change in growth start to materialise, latest Q1 July-Sep quarter

-

SMCI is growing rapidly as per the revenue figs earlier in this thread , I was just reading an article on AI and Nvidia potential over next few years here https://www.nextplatform.com/2025/03/14/ai-infrastructure-spending-is-the-boom-chemical-or-nuclear/

So long as the demand for Nvidia compute (and networking) grows then SMCI, as Nvidia's lead manufacturing partner are perfectly positioned to grow with it

-

Hi Bogie,

I now take the view that demand is a given. Posting news of all the new data centres being built seems somewhat redundant. It's all about supply, so my focus is on CoWos-L expansion.

The fact is, AI investment is locked in for the next several years and nothing can derail that. Not even the naysayers questioning 'but what if it hits a limit(in efficiency)'. The 'what if' is simply used to create doubt and is the latest suggestion. I guess when you suggest as Cathy Wood did 'it's all pull fwd and over ordering ' 'it's a blip in demand and will revert to past revenue generation'-wrong and wrong. AMD is coming-wrong-even Intel said they would 'destroy Nvidia'-sure they did.

Anyway, back on track

SMCI needs Chips-that is all they need. They have the customers. More customers more demand than they can fill. If they had the chips today they would not report 5B/Q-a reminder, this is up from 1.5B per quarter only 2 years ago or less. They could report 15B/Q.

SMCI needs Chips-that is all they need. They have the customers. More customers more demand than they can fill. If they had the chips today they would not report 5B/Q-a reminder, this is up from 1.5B per quarter only 2 years ago or less. They could report 15B/Q.

We have Dell sounding desperate-claiming they 'won' all Xai business. Completely false. And then report much lower margins-because they don't manufacture their own servers. Asked last week(Liang) 'are you working on Colossus-2, because Dell say it's their, Charles Liang responded ' well, we are building a new campus nearby to support it. We believe we will be working on Xai expansion'. -

Keep an eye on CoWoS-L expansion. It is pivotal. SM revenue is tied to Nvidia revenue which is tied to CoWoS. Yes, ongoing innovation into robots, ADAS, medicine is all very interesting but over the next 18 months the story is 100% CoWoS. Nvidia is a decade ahead of everyone else because they have the best solution. Not just a chip, it's an entire system.

The moment Blackwell/Blackwell Ultra ramps up to meaningful supply which I believe will next next quarter, 250k Q4, 750k Q1, 1 million? Q2(May through July), SM will receive meaningful supply and its revenue will move up materially to the 8B range and continue on a +2B quarterly cadence from there. Just as I expect Nvidia revenue 'this Q' to be circa $50B and increase every quarter (this year) around +$10B. This compares with +$4B last year. They can not do any more because they are constrained. They are constrained because the equipment needed to make more takes 12-18 months to build.

-

Eviden, a division of the Atos Group, has partnered with Super Micro to distribute SMCI’s AI SuperCluster solutions, powered by NVIDIA’s GB200 NVL72 technology, across Europe, India, the Middle East, and South America. This collaboration leverages Eviden’s core business in digital transformation—spanning advanced computing, digital security, AI, and cloud services—and its 57,000 employees based in Bezons, France, with operations in over 53 countries.

Eviden holds a leading global position in advanced computing, notably as the provider of Europe’s first exascale supercomputer, JUPITER.

Eviden is the market leader in its field with group global revenue of 8b euro

-

Musk’s xAI Bolsters £100 Billion AIP Initiative, Super Micro Computer Likely Involved

20 March 2025 – In a bold move to cement its dominance in the artificial intelligence (AI) race, Elon Musk’s xAI has joined the AI Infrastructure Partnership (AIP), a consortium initially launched with a $30 billion commitment that has now escalated to a staggering $100 billion with debt financing included. The partnership, originally formed by BlackRock, Global Infrastructure Partners (GIP), Microsoft, and MGX in September 2024 under the name Global AI Infrastructure Investment Partnership (GAIIP), welcomed NVIDIA and xAI as key players this month, further solidifying its technological clout.The AIP aims to deploy this colossal investment immediately into AI infrastructure, focusing primarily on state-of-the-art data centres and innovative energy solutions to power them. With a spotlight on the United States and its OECD partner nations, the initiative is set to drive economic growth and technological breakthroughs, positioning the US as a global leader in AI innovation. Partners like GE Vernova and NextEra Energy are also collaborating to enhance supply chain efficiency and deliver high-efficiency energy solutions, amplifying the project’s scope.

Speculation is rife that Super Micro Computer Inc. (SMCI), is likely involved in this ambitious project. Although not officially named as a core AIP member, SMCI’s longstanding partnership with NVIDIA—one of AIP’s newest additions—makes its participation highly plausible. Known for supplying cutting-edge servers crucial for AI data centres, SMCI has already played a pivotal role in Musk’s xAI projects, including the development of advanced AI systems. Analysts suggest that SMCI could serve as a key supplier, capitalising on AIP’s “open architecture” approach to bolster the infrastructure buildout.

Musk, never one to shy away from bold statements, has framed this move as a counter to rival initiatives like Project Stargate, a £385 billion ($500 billion USD) data centre venture. The AIP’s rapid mobilisation of funds and partners underscores the escalating global competition for AI supremacy, with the US aiming to outpace state-driven efforts in places like China.

As the AI Infrastructure Partnership accelerates its plans, all eyes are on how this $100 billion injection will reshape the technological landscape. For now, the synergy of Musk’s xAI, NVIDIA’s expertise, and SMCI’s hardware prowess hints at a formidable alliance in the making.