-

That’s great news …..

I’m sure I speak for quite a few of us ….really appreciate the updates etc

Hope your getting the overtime slip authorised

-

Hi C, honestly, seeing this result is reward enough. As you can imagine the market can be very cruel at times. It makes the often heavy burden worth it.

-

From the ceo…… The Company is now current with its SEC financial reporting obligations. There were no restatements of previously filed financial statements. The Company has received correspondence from the Nasdaq staff that the Company has regained compliance with the filing requirements, and the matter is now closed.

“Today’s filings represent an important milestone,” said Charles Liang, Founder, President, and CEO. “With our financial reporting now current, we can now fully focus on executing our proven winning growth strategy through technology, product and solution innovations, time-to-market advantage, global footprint, and green computing. We are investing extensively in people and processes across our engineering, sales, finance, accounting, compliance, and operations to achieve our great mission in DLC, Data Center Building Block Solution (Supermicro 4.0) as well as our revenue target. Supermicro is accelerating at the forefront of the AI revolution, helping our customers, partners and driving strong returns for investors.”

-

SM announce a major expansion to their San Jose headquarters. Campus 3 will start construction in 2025 and once complete (multiple years) it will add 3M square feet. San Jose Mayor, Matt Mahan is quoted as saying ' We are proud to be the home of SM, the fastest growing and innovative San Jose business, this defines what 'Made in America' looks like. Charles Liang said the new facility is required to fuel the need for DLC.

PG&G, the utilities infrastructure giant is providing the massive power needs. You may read about server rack factories running out of power or hotting the max. This is in relation to testing. SM have a unique testing system where the entire cluster is plugged in and optimised before shipping-it's deployed ready to run and obviously large systems of 100s of racks draw a lot of power. At the Burn-In testing phase the full stack is run hard to ensure it is operating as intended.

-

PG&G?

Did you mean PG&E - Pacific Gas & Energy?

I recall our place being a case study for them with our ‘hot aisle/cold aisle’ cooling config, probably about 10 years ago.

Oooh, the excitement I used to have, roaming around our datacenters and pretending to be all technical! Good times.

Here, some clips from our RTP (North Carolina) state of the art Datacenter from about 8 years ago, surrounded by primeval swamps

-

E yes. Carolina, Louisiana are still hot spots for big DC. It's all to do with access to plenty of water, cheap land and big power.

-

-

Iceland is amongst the cheapest places to run DCs. It's naturally cold and they generate an abundance of renewable energy from hydro and geothermal. The thing is DLC is even cheaper and that is why we are invested in the space.

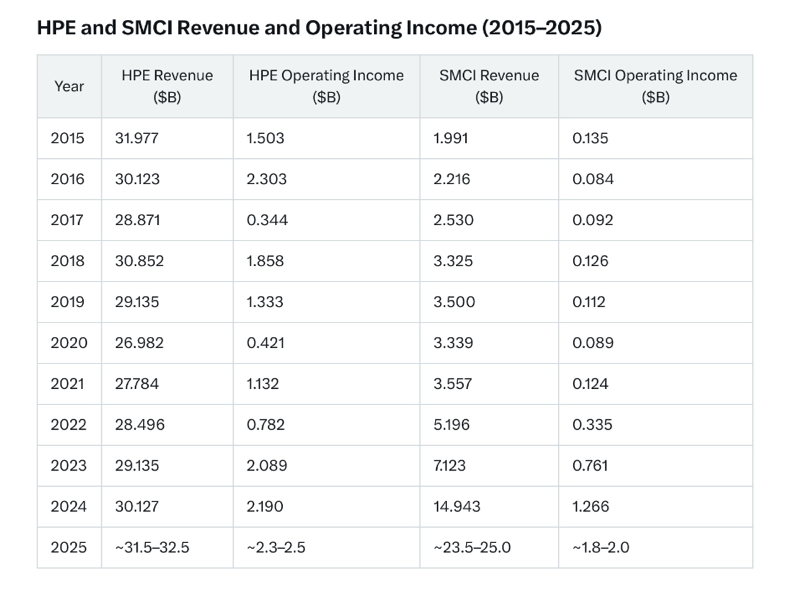

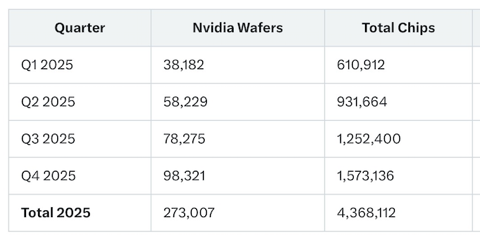

From the above table. Last quarter there was a mere 230k Blackwell chips in circulation. We know Msft/Goog/AWS received the first ones for their 'Big Iron' (Foxconn ref design). It's just a matter of 1 or 2 quarters until supply is much bigger. SMCI has stated many times that they expect to consume 100k blackwell/month on average through 2025. Obviously that will be skewed to the H2 period. This is a supply issue not a demand issue.

-

Mike, re your question.

Senior management receive compensation via stock awards. It's part of their employment contract. They know when these shares will vest and invariably they are sold the day they vest because as said, it's their salary and they are taxed heavily on them on vesting not sale. It makes perfect sense to sell them, otherwise you pay the tax out of your own pocket.

The Liangs hold around 150 million shares and have not sold any shares (these sales are compensation awards), not even when the stock flew to $120. So if he was going to cash-in don't you think he would have back then. it's just dog whistle nonsense repeated by idiots. We will see who is right in the second half of this year

-

Mike,

The Liangs sold their stock via a 10b5-1 plan agreed January 2024 which stipulated a schedule of shares and sale dates. The delayed filings prevented these planned sales.

A- One can not modify any 105b-1 if any sales under said plan have been actioned(they had, October 24).

B-If a sale is not able to be actioned on a prescribed date (the case due to the delayed 10-k), the stock is to be sold at the earliest opportunity. This would be the day following the filing. The 26thThere was absolutely nothing the officers could have done to stop the sale. To do so would break the law and in the very least could be construed to be insider trading. Fyi Liangs 10b5-1 provides for 300k shares total sales to june 2025. It's all disclosed in the 10k. This sale was a mere 46,293 shares.

I hope that clears this up. The ultracrepidarian is again, off the mark.

-

-

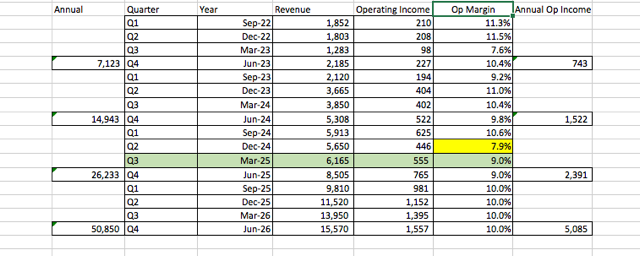

Here is a work in progress (above) detail my forward looking figures. Underlying it is a correlation to Nvidia revenue-it's all about the access to silicon. The dip in operating margin (7.9%) is clear as to the reasons but has historically been around the 10% mark and with scale imo will expand well above 10%

The 10-k late filing cost them around $30M in additional costs

R&D shot up by $60M in the quarter which is all the upfront Blackwell preparation

I suspect a lot of that is also staff hires in Malaysia and the DLC build out-it won't all be capex X

The point being, I would now expect a more normalised margin, at least post Q3(March)Note: The company guided $40B for fiscal 26 and above we are estimating $50.85B, yes a large beat but we have good reason to take this view. We will soon find out whether the quarterly revenue is aligned to this target. -

Late next month they will update for the current quarter. The guide was $5-$6. Above we have 6,165K and I would speculate that the new norm is to guide conservatively. In this example $7-$8B and we expect 8,505K.

This is the sort of trend we would want to see.

Posted for posterity. Today the company trades, based on the above at 4.6X June 26 Operating income. Will it age well -

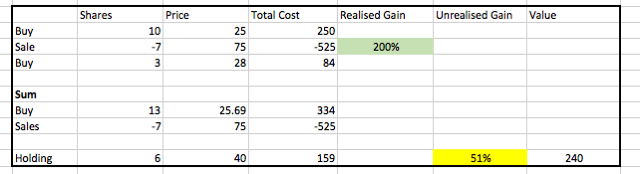

Disclosure of our historical and current position

-

Anyone who followed the investment from inception will know we paid $25 in Dec 2024.

Jan 17th $32

Jan 31 $53

Feb 13 $79

Feb 22 $98

March 15 $115

March 20 $90

To say it was volatile was an understatement. We invested because it was clearly undervalued at $25!($250 in old money) and we identified a business at the beginning of a secular shift in computing, and they held the secret sauce(DLC). Having invested in it years before anyone else and were expanding before the market needed it. The point is research identified the opportunity. Hindsight Harry might point out the subsequent fall from grace however HH doesn’t have any skin in the game because they don’t look for opportunities-they simply sneer after the fact-like an idiot using last weeks lottery numbers.

The unprecedented speed of the assent was driven by short interest betting against the stock. In one day in March 2024 the stock close +$270-one day!The fact is we sold 70% of our position at $75 ($750) and tripled that investment (200%). A fantastic result by any measure. We held the remaining 30% because we did not believe the rumours and frankly, could afford to do so with no risk at all. We sold shares for $525 which cost us $175 (actually 200%) and retained $75(3) + additional buy in Feb 2025 of 3 more for $84. So today, we hold 6 shares at a total cost of $159 or $26.50 per share.

I wish all our investments and decisions/timing were this good.And for the record we think the stock today is still significantly undervalued and we intend holding it for a long time subject to its execution at the business level and possible erratic price which might offer an opportunistic early reduction.

-

Just stating the obvious. Ive factored it down to 10 for simplicity.

-