-

Few additional points.

DLC is the future for the simple reason, it saves up to 40% in electricity costs and electricity to run a massive DC costs billions annually. Today 30% of new data centres have chosen DLC. This is up from 1% last year. A massive increase. Demand is massive.

Super micro say they have 70-80% market share.

I would estimate, of known large projects:

Xai Colossus

Meta Louisiana

Stargate

Coreweave

and many many others we must be looking at demand in the 20k+ rack minimum, next 10-12 months. Just DLC and 70% of that is 14,000 racks. North of $50B. SM also have an air cooled rack business which is billions too. -

taken from the call transcript last night-CEO says, in his own words (english not first language)

Yeah, in last few years, our growth have been very strong, except our 10-K interrupt, right? So in that 4 months, 5 months, we suffered a 10-K impact. So, our growth will be slowed down. But we will fix 10-K filed in very soon. And cash flow won't be a problem anymore. So, the product is strong. Capacity here, customer is ready. So, I believe $40 billion forecast is a relatively conservative estimation.

......................................................This backs up the flat growth-they've been churning their working capital-banks won't lend, plenty of orders but can't meet them. The company is paralysed, a cashflow drought. To explain, the cash conversion cycle which is Inventory Oustanding + Sales Outstanding minus Payables Outstanding and to grow you need to either collect your receivables faster than you pay your creditors(not easy) or optimise ones inventory or borrow money. It's a lot easier when you have a big fat margin. Companies like this need ready access to debt and if you're non compliant you don't get much if any and if you do you pay a higher rate/fee.

I would expect all to be filed late next week. They’ll be the banks friend again. Remember even today they are highly profitable

-

Hi Steve,

Good to chat this morning. Really just posting here to reiterate that whilst we disclose our stock holdings in certain portfolios this does not constitute a recommendation or advice.

Regards

Adam

-

On Friday Dell leaked news of their imminent contract to work on Collosus-2. And immediately the rumour mill kicked off, suggesting a win for Dell is a loss to SMCI. False. The two companies co-built Col-1, yet, if you recall, back then, Dell tried to claim credit for it too-Musk publically corrected their statement.

SMCI made material contributions to Col-1 and it's common sense that as the two projects are linked, the same vendors will integrate the next phase-you don't change what works. There is a limited supply of DLC, globally and as we have discussed, Dell DLC is actually Foxconn DLC. By using two vendors, Musk can stand up Col-2 faster. It's that simple.

I would think it won't be long before we hear whether SMCI is working on Meta's new DC expansion-im sure they are. Meta are SMCI's biggest customer. And a reminder, Meta is deploying $65B this year on DC builds

-

Big drop late in the day ….still well up thou..any reason for the drop

-

It’s up 100% in 10 days. That’s not normal and I’m surprised it didn’t happen sooner-it didn’t fall though. It closed up 8% just not 17%. We invested in the company because we consider them a long term winner and the reasons why have been discussed in minute detail. The volatility if anything is a distraction and in time it will calm down.

-

-

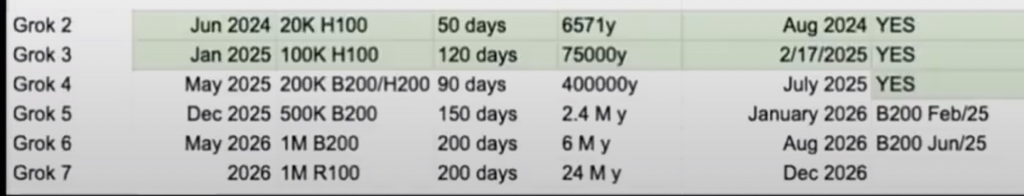

From the above. Grok-3 has just been released(this week), with version 4 due in May 2025 using 200K H/B200. What is interesting is the planned ramp in scale.500K B200, 1 million B200 and 1 Million Rubin. All within the next 18 months. This is just one LLM of many leading scalers. At $50K a piece that's a lot of Blackwell and Rubin will be even more.

SMCI is a core supplier of Xai. Follow the crumbs

-

We will hear from SM today one way or the other- either they file the 10-k/qs or they file an 8-k notifying of a further delay.

-

It's a lot of work, auditing an annual report plus two quarters in 99 days. It would have been nice to see a pre 25th filing. We will see. The facts are there will be no delisting any time soon, regardless. The volatility is driven purely by gamblers (derivatives). The time to file is work load based not 'books and records' issues.

-

And looking at company records, Vanguard own 12% of the entire company(today) so we are in good company with SM.

-

Almost better late than never. SM file their 10-k. The stock is up 15% after hours. I gave it a quick flick-it’s 208 pages-it’s been one of those days. The after hours lunatics seem to like it.

-

The after hours is now 55. Quite clearly they’ve redeemed themselves and ruled out any question of malfeasance. The future looks very bright for the business.

I want to say- they say asset managers don’t have an edge. I agree. The same information is out there for all to see. We worked very hard on this company. Because it is a great business and our 2 years of research told us the naysayers were wrong. I congratulate all the stock holders. And to the contrarians

-

That’s great news …..

I’m sure I speak for quite a few of us ….really appreciate the updates etc

Hope your getting the overtime slip authorised

-

Hi C, honestly, seeing this result is reward enough. As you can imagine the market can be very cruel at times. It makes the often heavy burden worth it.

-

From the ceo…… The Company is now current with its SEC financial reporting obligations. There were no restatements of previously filed financial statements. The Company has received correspondence from the Nasdaq staff that the Company has regained compliance with the filing requirements, and the matter is now closed.

“Today’s filings represent an important milestone,” said Charles Liang, Founder, President, and CEO. “With our financial reporting now current, we can now fully focus on executing our proven winning growth strategy through technology, product and solution innovations, time-to-market advantage, global footprint, and green computing. We are investing extensively in people and processes across our engineering, sales, finance, accounting, compliance, and operations to achieve our great mission in DLC, Data Center Building Block Solution (Supermicro 4.0) as well as our revenue target. Supermicro is accelerating at the forefront of the AI revolution, helping our customers, partners and driving strong returns for investors.”

-

SM announce a major expansion to their San Jose headquarters. Campus 3 will start construction in 2025 and once complete (multiple years) it will add 3M square feet. San Jose Mayor, Matt Mahan is quoted as saying ' We are proud to be the home of SM, the fastest growing and innovative San Jose business, this defines what 'Made in America' looks like. Charles Liang said the new facility is required to fuel the need for DLC.

PG&G, the utilities infrastructure giant is providing the massive power needs. You may read about server rack factories running out of power or hotting the max. This is in relation to testing. SM have a unique testing system where the entire cluster is plugged in and optimised before shipping-it's deployed ready to run and obviously large systems of 100s of racks draw a lot of power. At the Burn-In testing phase the full stack is run hard to ensure it is operating as intended.

.

.