Vertex beats on top and bottom line-guides higher

-

Vertex Pharmaceuticals Non-GAAP EPS of $4.38 beats by $0.25, revenue of $2.77B beats by $80M

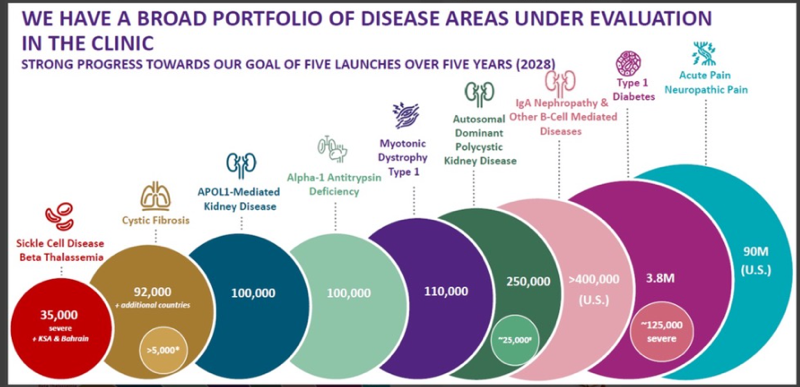

Another strong result from Vertex as is flexes its dominance with their cystic fibrosis franchise, Trikafta and readies the business for entry into the acute pain segment, a massive opportunity, currently served by opioid type therapies. There is a target market of 90M patients making this new medicine, a multi billion dollar opportunity. We are looking for accelerated earnings in 2025 and beyond.

Mid year, Vertex acquired Alpine Immune Sciences for $4.9b in cash,effectively buying their research into autoimmune and inflammatory disease with specific interest in kidney disease.

-

Vertex is currently priced at around $480-we acquired the holdings in April 2022 for $256

-

Vertex report tonight. Expectations are for $2.78B and $4.02. I don't expect any surprises to the negative. I'm more interested in what they have to say about commercialisation of their pain drug Journavx (generic Suzetrigine)

-

The drug is $15.50/capsule so a typical 2 week course costs $420. And with 80 million prescriptions written for moderate-to-severe acute pain in the US along, it has big potential.

-

A solid result from Vertex, meeting expectations and guiding higher for the current year. The main focus being their newly approved pain therapy. Here are some notes taken from the conference call. It's a very big market and this drug will be a 'Blockbuster'-revenue greater than $1B and annually, once it gets known/established.

We have a holding cost of $256. The current price is $470, as such the IC is very pleased with the company performance. Vertex has a bright future ahead of itself-improving patients qualify of life and earning shareholders healthy profits along the way. A win-win as they say.

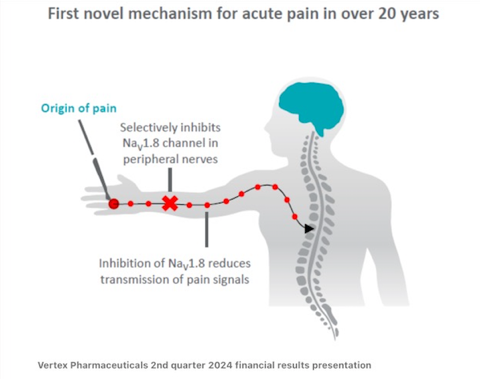

JOURNAVX in acute pain as we are currently 10 days post the milestone approval of this first selective, oral, non-opioid pain signal inhibitor.

The approval is so critical because JOURNAVX represents the first new class of pain medicine in over 20 years. It combines effective pain relief with a favourable safety profile. And based on its MOA(mechanism of action), it does not have addiction potential. It is indicated for use across all types of moderate-to-severe acute pain.

For example, post-surgery, broken bones, sports injuries and has the potential to establish a new standard of care for the 80 million patients, who seek a prescription therapy to treat moderate-to-severe acute pain each year in the U.S. Half of those seeking help for their acute pain or approximately 40 million Americans each year are prescribed opioids, which although effective have significant safety and tolerability concerns and addictive potential.

In fact, tragically, an estimated 85,000 people each year will develop opioid use disorder within the first year of being prescribed an opioid for acute pain. We believe we now have the opportunity to transform how acute pain is treated in the U.S. and to build another multi-billion dollar franchise for Vertex.We are launch ready and have now begun commercialisation of JOURNAVX. Our focus for 2025 is to engage with healthcare professionals, decision-makers and payers to establish the conditions for rapid patient access that will deliver long-term commercial success for our pain franchise.

To that end, while still just a few days into the launch, we believe that the incredibly broad positive media coverage JOURNAVX has received since approval is one measure of the high unmet need and an indication of the societal importance of providing both physicians and patients with a new non-opioid option for the treatment of acute pain. We've already seen tremendous interest and requests for information from both doctors and patients, and we look forward to being able to serve them.

Our 150 person sales force is actively engaging with healthcare providers and physicians on the compelling efficacy and safety data of JOURNAVX and its role in all types of moderate-to-severe acute pain.

In the institutional setting, we are engaging with roughly 2,000 high-volume hospitals and approximately 150 related health systems. We have line of sight to accelerate the typical P&T (pharmacy & therapeutics) committee processes in many networks to support the use of JOURNAVX in this setting. We are advancing our discussions with national and regional payers and group purchasing organisations to provide access to JOURNAVX, building on our work pre-approval to accelerate formula reviews and limit inappropriate utilization management controls.

And lastly, with retail pharmacies, we are working to secure broad stocking agreements at national retail pharmacies and regional chains to ensure availability of JOURNAVX for patients across the country. We have also now begun our non-personal promotional initiatives to physicians and patients to promote broad awareness of the first, oral, non-opioid pain signal inhibitor for moderate-to-severe acute pain, such as embedded content in relevant websites like Medscape for physicians and WebMD for consumers, along with point-of-care marketing.

-

Hi Ron

Vertex Pharmaceuticals stock took a hit after announcing that its experimental non-opioid painkiller, VX-993, failed to meet the primary endpoint in a Phase 2 trial for acute pain.

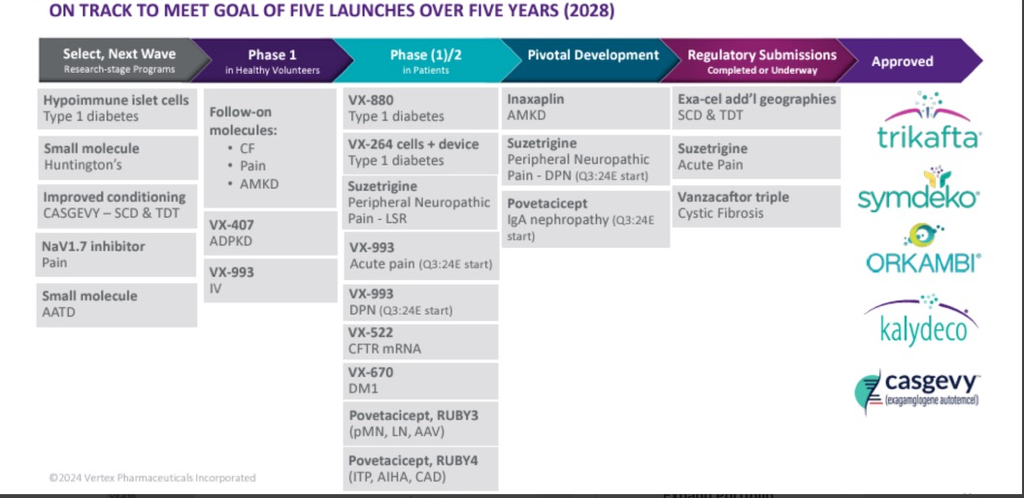

This sharp decline appears to be an exaggerated market response, given several key factors about Vertex’s broader portfolio and financial standing.Firstly, VX-993 is one of three pain therapies in Vertex’s pipeline, with the company’s lead pain drug, JOURNAVX (suzetrigine), already FDA-approved in January 2025 for acute pain.

VX-993, still in early-stage development, was not monetised and thus not factored into the stock’s valuation. Vertex is also pursuing VX-993 for peripheral neuropathic pain (PNP) and developing NaV1.7 inhibitors, maintaining a diversified pain management portfolio.

Secondly, Vertex’s financial performance remains robust. Q2 2025 revenue reached USD 2.96 billion, a 12% year-on-year increase, beating analyst expectations of USD 2.91 billion. Adjusted earnings per share were USD 4.52, exceeding forecasts of USD 4.27. The cystic fibrosis (CF) franchise, led by Trikafta, drove this growth, with U.S. sales up 14% and international revenue rising 8%.

Vertex reaffirmed its full-year revenue guidance of USD 11.85 billion to USD 12 billion, aligning with consensus estimates of USD 11.93 billion. Emerging therapies, such as Casgevy (USD 30.4 million in Q2 revenue), further bolster Vertex’s growth trajectory.The market’s reaction seems disproportionate, as VX-993’s failure was not a significant valuation driver, per analysts from Bernstein SocGen and BMO Capital, who maintained positive ratings with price targets of USD 471 and USD 530, respectively.

The trial’s high placebo effect may have contributed to the statistical miss, and Vertex’s pivot to PNP trials for VX-993 suggests continued potential.

Vertex is a world class Pharma with the very best scientists. It's a set back on one trial(of dozens). When pushing the limits of science it's very common and it changes nothing in regards the 'valuation'.

In any event we were taking profit in the late $400s and early $500s 2-3 quarters ago. Then a relatively large weight and more recently the second smallest.