GOOG materially beats

-

That’s the headline. A deeper dive tomorrow

-

Revenue increased 16% YoY to $88.3B, a record reflecting strength business segment wide. Net income increased 35% YoY! Expectations were for earnings of 22.95B. They delivered 26.301. GOOG are clearly on a $100B Net Income TTM (total 12 months) which is very similar to Msft and Apple. Earnings and growth rates-two fundamental metrics which drive valuation. Yet GOOG is 'only' worth $2T vs the $3T+ assigned to the other two mega caps. It is no secret that GOOG is trading at a discount due to its perceived issues with anti trust DOJ investigationsetc. We don't think this is a major issue due to the sum of the parts thesis which would strongly suggest any remedies, such as cessation of payments for default search apps(Apple) would most likely save the company more money than they lose and any potential break up would yield even more shareholder returns. This is why the investment committee reweighted GOOG, higher, a month or so ago. It is a fantastic business 'on sale'.

The company has a very deep portfolio of excellence is a wide range of technology from autonomous vehicles (Waymo) to leading robotics and Quantum compute and cloud services.

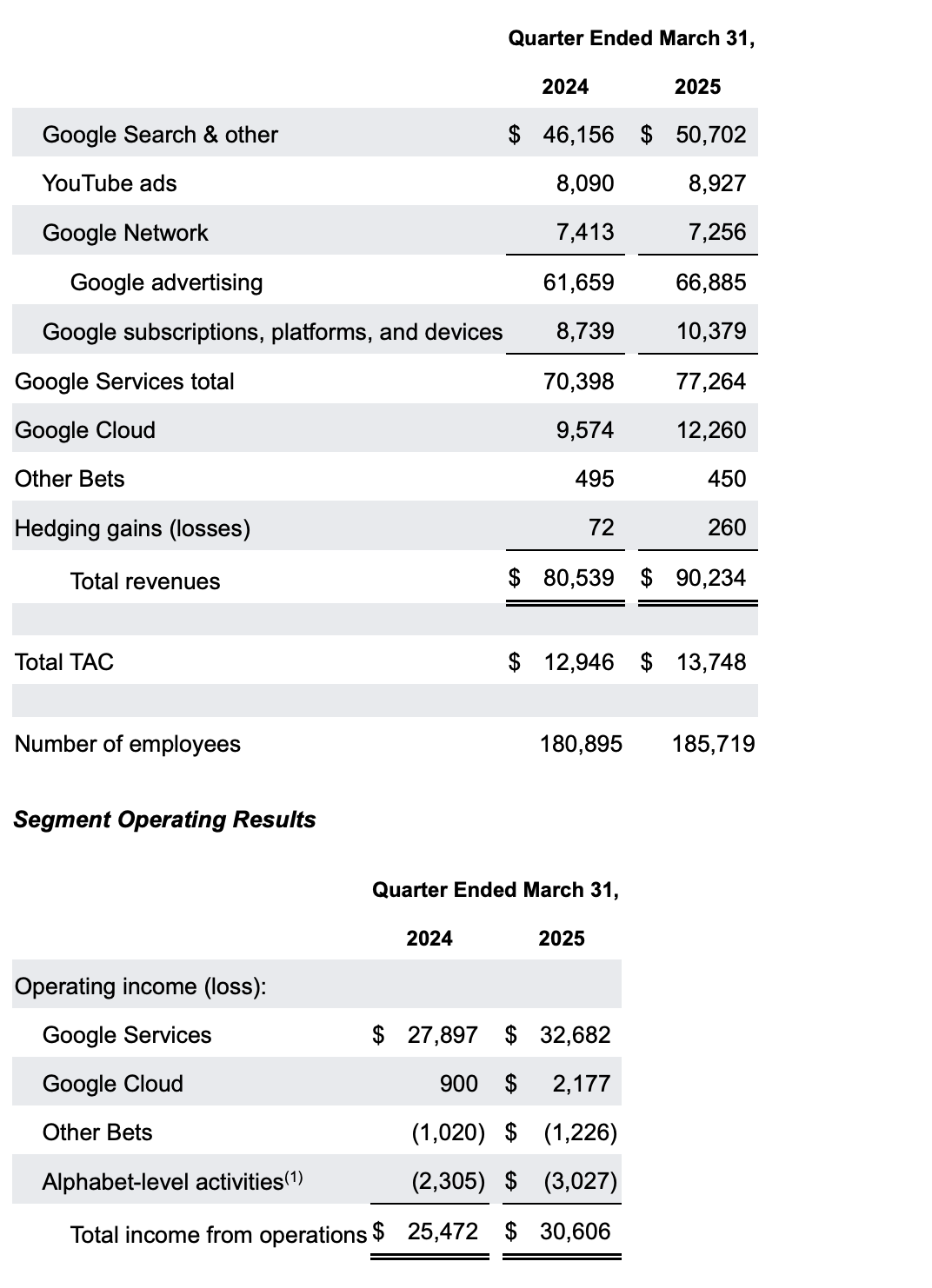

Google Cloud revenue increased 35% due to monetisation of generative AI solutions and core Google Cloud products. CEO Pichai said ' Momentum across the company is extraordinary and our innovation and long term focus on AI investment are paying off.

Youtube, once a nascent medium to watch video's for fun is now generating $50B on a TTM basis

Waymo, the most advanced self drive service in the world has hit a milestone of 150k paid trips per week and is driving 'fully autonomously', > 1M miles per week. A 50% increase since August 2024!The company will continue to aggressively invest in Nvidia GPU's and their own custom TPU solutions

It's a very busy week and an action packed day, with the delivery of the Reeves Budget and earnings for Meta, KLA, MSFT.

Have a good day

-

How time flies. Without checking I’d have guessed 10-12 years! YouTube has been valued by various financiers at circa 450 billion. Not a bad investment

-

Google done good ?

-

Alphabet GAAP EPS of $2.81 beats by $0.80, revenue of $90.23B beats by $1.08B

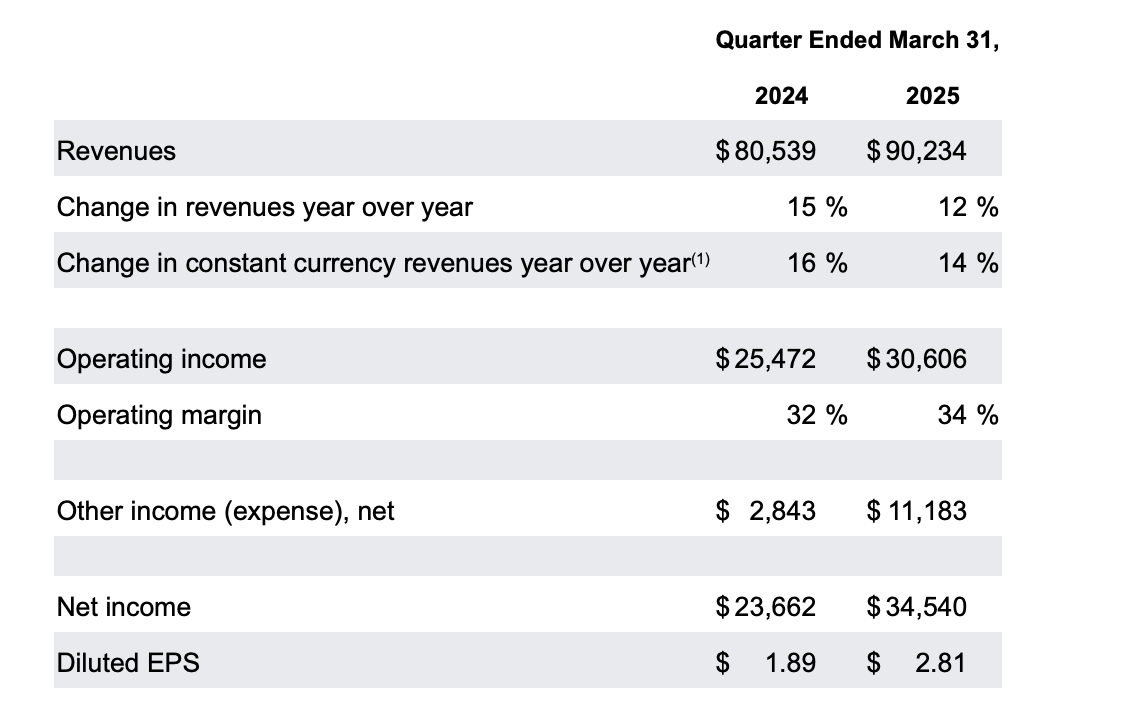

Alphabet Inc., Google’s parent company, delivered a stellar Q1 2025 earnings report, showcasing robust financial performance. Revenue reached $90.23 billion, up 12% from $80.54 billion in Q1 2024, exceeding analyst expectations of $89.1 billion.

Diluted earnings per share soared 49% to $2.81, surpassing forecasts of $2.01, driven by an $8b unrealised gain on non-marketable securities (stocks/investments). Operating income climbed 20% to $30.61 billion, with the operating margin expanding to 33.9% from 31.6%, reflecting disciplined cost management despite a 14% rise in R&D spending to $13.56 billion.Google Cloud was a standout, with revenue up 28% to $12.26 billion and operating margin nearly doubling to 17.8% from 9.4%. Alphabet announced a $70 billion share buyback programme and a $0.21 per share dividend, reinforcing shareholder returns.

Capital expenditure was confirmed at $75 billion for 2025, a 43% increase from $52.5 billion in 2024, primarily for AI-driven infrastructure like servers and data centres, with $16–18 billion earmarked for Q1 alone. CEO Sundar Pichai attributed the strong results to Alphabet’s “unique full stack approach to AI,” highlighting breakthroughs with Gemini 2.5 and AI Overviews, which now serves 1.5 billion monthly users. CFO Anat Ashkenazi emphasised sustained investment in technical infrastructure to bolster cloud and AI capabilities, noting that costs grew slower than revenue, enhancing efficiency

-

Breaking news

On September 2, 2025, U.S. District Judge Amit Mehta’s remedies ruling in the United States v. Google LLC (2020) antitrust case delivered a significant win for Google, lifting the threat of a breakup. The ruling rejected the DOJ’s push to divest Chrome or Android, preserving Google’s ecosystem and ~$175B ad revenue machine. Instead, it imposed lighter measures: ending exclusive default search deals (e.g., $20B/year to Apple), allowing multiple defaults, and sharing limited anonymised data with rivals. This avoids disruption while letting Google redirect funds to AI and cloud growth**. Investors cheered, sending Alphabet’s stock up ~7% after hours**, reflecting relief from the breakup overhang that loomed since the August 2024 liability ruling. The decision’s leniency, Google’s appeal plans, and focus on traditional search (not AI) signal limited immediate impact on its dominance, boosting confidence in its long-term value despite ongoing ad tech scrutiny.

GOOG now sit's at an all time high.

GOOG was the subject of our investment committee meeting last week. We took the decision then and rebalanced on Monday, taking our holding to the highest weight to date, citing the companies superior earnings record, clear pathway to further growth and relatively low PE. Easily the cheapest of the Mag 7. We have held the stock a relatively long time and only recently has it burst forth(the stock). A pleasing piece of news

-

Gleemed from- Goldman Sachs Communacopia + Technology Conference

Google Cloud’s CEO, Thomas Kurian, stated that the company is attracting new customers rapidly due to its unique AI offerings, developed through years of dedicated work. The unit is also strengthening ties with existing clients and expanding its total market opportunity.

Kurian highlighted Google Cloud’s strong differentiation in AI infrastructure, particularly in performance, cost, reliability, and efficiency. The company also stands out with its leading suite of generative AI models. “For years, we’ve been building industry-specific AI applications and agents, and we’re now seeing significant customer interest,” he said.

On AI monetisation, Kurian noted, “We generate revenue from AI in five ways. We’re gaining new customers, deepening relationships with current ones, and broadening our market. This is driving growth in revenue, our remaining performance obligations—or backlog—and operating margins.”He reported a 28% quarter-on-quarter increase in new customer wins in the first half of 2025. “Nine of the top 10 AI labs and nearly all AI unicorns are our customers,” he added.

Kurian also shared, “As Sundar and our CFO Anat have noted, we’ve already earned billions through AI. We’re growing revenue while maintaining operational discipline and efficiency. Our backlog has reached $106 billion and is growing faster than our revenue. Over 50% of it will convert to revenue within the next two years(interesting-> $50B revenue increase alone)

.”Google’s AI systems are optimised for high-performance, reliable, and scalable training and inference (the process of using a trained AI model to make predictions on new data).Discussing the latest AI model, Kurian said Gemini 2.5 reached 1 trillion tokens 20 times faster than Gemini 1.5, launched in January. The developer community is widely adopting Gemini. Google also leads in diffusion models for creating images, videos, audio, and speech.

On cloud adoption, Kurian observed that it’s still in its early stages. “Some government agencies move more slowly due to compliance and regulatory requirements. Europe has been generally slower due to sovereign cloud mandates.”He explained that organisations are leveraging AI in four key areas. Some, like Natura Cosmetics and Snap (SNAP), are developing digital products. Others are transforming customer service, not only in call centres, as with Verizon (VZ), but also at point-of-sale, as with Wendy’s. Companies are also streamlining back-office operations. “Home Depot (HD) uses AI for HR help desks, AES is reducing regulatory and audit times, and Tyson Foods (TSN) is optimising its supply chain,” Kurian said.Google also sees IT departments using AI to enhance code quality, not just to produce it.Kurian outlined three major investment areas: “Our supply chain and capital investments include data centres, power, long-term power contracts, and deploying inference across countries to meet sovereignty requirements.”

He acknowledged power challenges but noted Google is addressing them with innovations like water cooling, which improves system throughput. “We anticipated power constraints and developed solutions early,” he said.Google is also investing in its go-to-market teams to sustain growth.

-

Alphabet climbed to an all time high today, joining the elite club as the fourth US company to hit a massive $3T market cap. The search giant, with Sundar Pichai at the helm, saw its shares shoot up over 4% by late morning trading, pushing its valuation to a tidy $3.05T. That puts Alphabet right up there with the likes of Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT) in the exclusive $3T club.

The buzz around GOOG has been electric lately, especially after some positive news from an antitrust lawsuit earlier this month. The judge handed down a ruling that was basically a big win for Google. He said they’ve got to play a bit nicer by sharing more data with competitors to keep online search fair, but they don’t have to sell their Chrome browser or ditch those lucrative deals that keep Google as the go-to search engine (a deal that’s also a proper bonus for Apple).

Analysts were over the moon, calling it a “massive victory” for both Alphabet and Apple. Meanwhile, Google’s cloud guru, Thomas Kurian, dropped a bombshell recently, revealing that Google Cloud’s sitting on over $106B in remaining performance obligations, with demand for its services still absolutely booming.

And if that wasn’t enough, Google’s Gemini AI chatbot, which they’ve been sprinkling into just about everything lately , pulled off a shocker by overtaking OpenAI’s ChatGPT as the most downloaded free app on the App Store over the weekend.

We acquired the stock initially at $133

-

Today Alphabet announced its quantum-computing team delivered a verifiable quantum advantage via its “Willow” chip and “Quantum Echoes” algorithm running ~13,000× faster than a classical supercomputer. This isn’t just hype — the hardware, software stack and experimental validation all align.

On top of that, Alphabet remains one of the most profitable companies in the world: it reported a net income in excess of US$100 billion in its latest full year.In the battleground of mega-cap tech, alphabets like Nvidia Corporation, Microsoft Corporation and Apple Inc. grab the headlines — but Alphabet quietly leads in profit, while trading at a discount to them.

Why that matters:

It shows Alphabet is not just a search and ads company — it’s positioning for the next frontier of computing (quantum, AI infrastructure, cloud).

It gives it a solid financial base: when profit margins are strong and cash flows healthy, you have the flexibility to experiment and pivot. OTHER BETS

It may mean the market is under-estimating Alphabet’s upside: if these emerging bets pay off, the valuation gap could shrink.

Yes, hurdles remain (commercialising quantum, cloud dominance, regulatory headwinds), but dismissing Alphabet now would overlook its smart strategy and deep pockets.