Thoughts on short term market direction

-

@Cappo I very strongly suggest you don't look, probably not for a long time.

Luckily I'm not at that point, but the lower the performance, the longer I'll need to work. Mind you with the way the minimum wage is going up I'll be able to get a job stacking shelves and earn just as much before long. No wage rise for us this year, just my colleagues that are on minimum wage.

-

Re cut backs on AI spending. Currently the demand is maybe 5X higher than the ability to supply. So either way I don't see supply meeting demand for a couple of years at least. The problem with cutting back is you run the real risk of being left behind. AI models will get much smarter and need to be to create the big impact software solutions-this is the goal so in my opinion Mag 7 companies will continue to dig deep and 'invest' in the future.

Don't forget, Oracle have $130B backlog on unmet demand (services) which they can't meet. The 1 trillion of spend we know about doesn't include the 5 GW of AI Factory contracts which Huang mentioned 2 weeks ago. That's another $250B. Musk wants to stand up 2 million GPU, he can't get them other than over the next 24 months. So it comes down to how long this unknown impact, this omnipresence endures. It will give the media something to get their teeth into no doubt. If you tell us all we are heading for recession long enough it's self fulfilling?

Over the past week the media has been shouting about MSFT cancelling leases for data centres. 2 GW which is a lot. But they forgot to mention that Meta and Oracle took them on. MSFT is simply making adjustments to the fact OpenAI are no longer leaning on them for infrastructure.

At the end of the day, bad policy doesn't survive. It's earnings season very soon and i'm sure respective CEOs will focus in on the impact and their thoughts.

Whenever there is a correction it plays tricks on ones mind , 'is this one the worse and will it be permanent'. It always recovers. As I said earlier, it's very annoying and some who rely on those funds will be impacted more of course but that is investing. I remember the crash of 1987, 2000, 2008 and 2020 and we are still here to talk about it, richer unless you were invested in some meme stock or did something stupid. Try not to worry about it.

-

There are definitely two sides to this discussion:

- Markets are haemorrhaging money and unwinding like a broken clock

- Good companies are investing in things to make a better future for themselves and their shareholders

Both can be true at the same time. We (the investors) are looking at some rapidly decreasing numbers (yes, I have looked, as I do every day, and it's not at all pretty). Those numbers being down is more and more of a problem the closer you are to needing to rely on those investments, and if any one of us is thinking about retiring in the next few weeks then they will have some difficult decisions to make.

Markets ALWAYS come back. The question is when will they come back this time? How long will the Trump kybosh last for? Is this a short-term sharp movement downwards, to be closely followed by a short term sharp movement upwards? Or is this to be the start of something longer?

I am reminded of the topic of this thread - 'Thoughts on short term market direction'. It may be helpful if we can keep to that topic. Where do people think the markets are going to go in the short term?

FWIW, my answer to that question is that I think Trump is trying to get a reaction with his fuss about tariffs, and that reaction is extreme. However I think that a lot of negotiation is going to happen in the next month and there will be a sharp upturn in later April/early May. I could be (and very probably am) wrong, and I'd be interested to hear other people's views.

-

I tend to agree.

I firmly agree that much of what trump (& the billionaire sidekick, Musk) are doing is for their good, not the people of America 🫣

Enabling government departments to feel stressed and also to pour money into Musk & other techbro companies pockets

Which comes back to the short term 🧐

Trump is an agent of chases, & likes nothing more than his name on the covers around the globe

He has succeeded this week, very clearly

But when things continue to dive, he will barter & even do several u-turns, naturally without ever admitting as much - it will always be the bigliest deal he has personally done….

I suspect the short term will be more turmoil in coming weeks, followed by some bouncing back in months

But nobody knows

️

️ -

I’ve seen a report ..although on X ..re Vietnam wanting to negotiate on the tariffs and that Japan have requested to do the same …maybe bollox but poss the start of some u turns etc

-

Is trump the bully who has backed himself into a corner?

I cannot for the life of me see China & JinPing backing down in any way.Will the Republicans step in any time soon to stop his self-formed bloodbath?

Interesting article on how he is screwing up Apple - viewable at https://archive.is/X5dnw

-

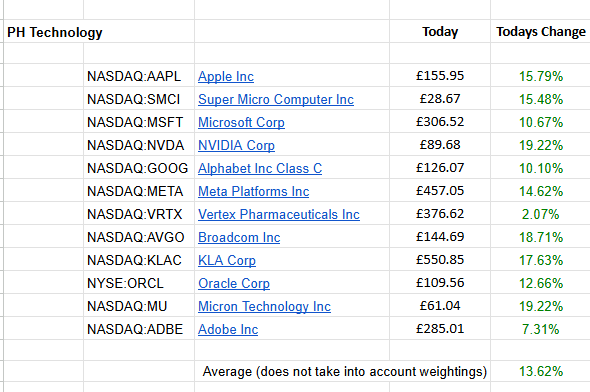

Yes. A rather large tech pop today. showing 10% RTQ at the mo

-

@Ronski said in Thoughts on short term market direction:

This makes a pleasant change, I wonder how long it will last.

And that has to be the biggest question.

It does further my suspicion that Trump does big things for a big reaction and those big reactions are both up as well as down. In the long(ish) term this will be a weird blip. I feel the need to stay invested.

-

You can bet that Trump and his buddies bought this morning

It did give me an opportunity to explain to my daughter why she shouldn't panic sell, as has been explained here before, you invariably sell after that drop, and by the time you've decided to buy you've missed the best rises, locking in a loss.

-

You can bet that Trump and his buddies bought this morning

It did give me an opportunity to explain to my daughter why she shouldn't panic sell, as has been explained here before, you invariably sell after that drop, and by the time you've decided to buy you've missed the best rises, locking in a loss.

@Ronski If only there were folk left at the SEC, they might get investigated

Trump’s actions are clearly manipulating the market in ways only he and people behind him will know.

Odds on that some very wealthy people have become much wealthier over TariffGate…all we mere mortals can do is hold on. -

That is why you 'buy a good business and sit on your ass' (Charlie Munger)

POTUS is mercurial to the extreme. As has been said, don't let the Trump-tail wag the investment Dog.

Love him or loathe him we are stuck with him and good companies will always shine through.

Volatility will prevail but we will get through it in time.

-

Breaking news: Donald Trump is going to "make America's showers great again" by easing rules restricting water flow, the White House says.

The US president is ordering the energy secretary to rescind a change introduced by Barack Obama that restricted multi-nozzle showers from discharging over 2.5 gallons of water per minute overall.

This served "a radical green agenda that made life worse for Americans", the White House said, as Trump criticised the "ridiculous" amount of time he says it takes to wet his hair in the shower.I would have guessed he was a bath kinda guy.

Laser focussed on the issues of the day

Laser focussed on the issues of the day -

Saw that earlier….such a relief….

Let’s hope he moves onto the less important stuff like the Ukrainian war and sorting out the trade wars -

HI Oli,

The last 3 days was a big reversal(gain) followed by a Dip, followed by a modest gain(yesterday).