Thoughts on short term market direction

-

Snag is that while companies may have cracking prospects, it's the markets which make us money. And the fact that semiconductors are exempt from these tariffs isn't that helpful when we're diversely invested with a portfolio that covers other things as well.

I know this thread is 'short term market direction' but I wonder what the medium term looks like and what Trump wants to achieve. He doesn't want higher prices and a trade war any more than we do. I wonder if this is a means of putting pressure on other countries to lower their US tariffs, and he's hoping for leaders to do this very quickly, with the promise that if they do then the reciprocal tariff will be dropped equally quickly.

-

That is very much the goal/intention.

And on markets making money. This is a short term correction which will work its way out through reciprocal compromise and adjustment. We invest in sound businesses and taxes don't factor into it when it's a carpet bomb approach. Some goods and services will be more expensive, some suppliers will absorb the tax, some will share it-it will depend on the product, the margin and their pricing power dynamics. A fungible product with many alternatives-the end user will shop elsewhere, a more monopolistic product with few alternatives, consumers will have to pay. My opinion, if most of the targeted products are China sourced, the biggest loser will be China as they will absorb most of the tax(net).

At the end of the day it is very early days and the impact is not only unknown it is also capped to an extent. We know how this administration can pivot very quickly. The biggest fear was tax on chips even though it was never going to be significant given the margins...A $50K chip costs no more that $8K so 30% is $2,400 (50k vs 52,400) not exactly a big deal yet we now know there are no taxes on chips.

Stating the obvious, investing is a long term strategy. We've seen corrections before (2023), Nvidia was $10, remember, down from $28. It was recently as high as $150. All I can tell you is the company’s prospects, based on objective fact are much better today than when it was at its peak and the quarterly updates, innovation and dominance will prove that as the year progresses-markets won't ignore that.

Nvidia is the tech barometer. It is very important. It is by far the most important company, globally, is the most valuable by far and it is only getting started. In bull markets it’s easy to ‘make money’. When markets get choppy, one must rely on evidence to drive your decision making-the evidence is unequivocal.

-

Every cloud-SMCI has a notable advantage given their manufacturing is materially US centric cf their competitors that mostly manufacture outside the U.S. Some components will still be subject to taxes however HBM memory and GPUs are exempt and whilst this applies to Foxconn, the application of taxes is more nuanced when you look through the cost build up-if materially assembled outside the U.S it will be taxed.

KLA manufactures mainly in the US and Israel-Israel have removed ALL U.S tariffs so again, avoiding punitive taxation. KLA have a monopoly so other countries can tax KLA imports but they will have to pay because their products and services are non fungible.

You may pay more for your iPhone -opinion being that if 100% of the taxes applies and was absorbed by Apple it would cost them $7.5B in 2025. This against a > $100B earnings fig. Apple will likely absorb some, Foxconn will likely absorb some and the consumer will pay a bit more. Net, immaterial impact to Apple, imo.

The majority of our holdings are businesses with strong competitive advantages/moats/brands which are resilient.

I'm not concerned about the long term negative impact from taxes. -

The media will be publishing as much negative rubbish as they possibly can to entice clicks and keep the fear factor high. As I've said before, I put a lot of stock in what trusted CEOs say-CEOs who have an impeccable record of conservatism and honesty. If Huang says they will avoid punitive tariffs I believe him. He meets personally with Trump, he's the CEO of the most important US company. Bill Dally(Nvidia chief scientist) is the advisor to POTAS in Science and Technology-they know exactly what the plan is. Nvidia have a habit of winning. It's annoying seeing the carnage but I stress I'm not worried about it. It's not our first rodeo.

-

Adam, I really do hope you are correct, my fear is that he causes a global recession, and this downturn lasts much longer. It's not just about chips, our portfolio's cover a lot more. If the big players that are buying these AI products cut back, then that will have a knock on effect as well.

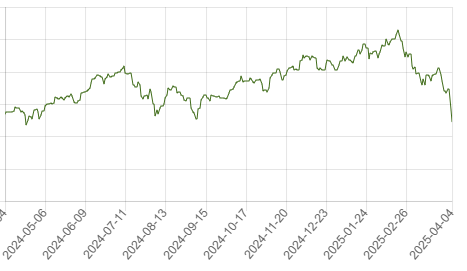

I'm down 6.34% this week, YTD I'm down 12.47%. Today, my portfolio's are worth the same as they were in April 2024 which means I'm now worse off (on paper) than a year ago, as I've been paying in.

Given time I know they will recover, but depending on how bad things get (he's got another four years to go!), it may take substantially longer, especially if this continues, and were all getting older, some us older than others.

Until Trump came in everything was progressing nicely, it seems he's on a mission to destroy things.

Investments may plummet, or fall off a cliff when Trump is left to run things!

At least the sun's shining and my investments in solar means my energy bills are negative.

-

Yes…..totally agree …

I am quite shocked about how he has gone about this ….

Does he think that all the trading nations are now coming knocking on his door for a deal ….

I have read that it’s all to do with re finance of the US debt and these are deliberate actions to force rates down … -

I can see what he's trying to do, that is to get more manufactured in the US, but that does not happen overnight, that takes years, and to build those factories and production lines they are likely going to have to import a large amount, and that means much larger construction costs.

In the meantime US inflation goes up, peoples pensions crash, not only in the US but likely worldwide.

The irony is that its American companies that outsourced a lot of production to cheaper areas, they created the problem in the first place.

Other trading nations are likely to do more deals amongst themselves, perhaps further driving up costs for Americans.

I wouldn't be surprised if he and his buddies sold, shorted or whatever to profit out of the situation.

-

According to the DT only 28% of Brits invest in the stock market compared with 75% of US citizens. So for most of the UK population the falls over the last few days have no direct impact on their finances and are just 'something in the news'. Whereas across the Atlantic the majority will already be feeling actually poorer and blaming their new president.

-

I can see what he's trying to do, that is to get more manufactured in the US, but that does not happen overnight, that takes years, and to build those factories and production lines they are likely going to have to import a large amount, and that means much larger construction costs.

In the meantime US inflation goes up, peoples pensions crash, not only in the US but likely worldwide.

The irony is that its American companies that outsourced a lot of production to cheaper areas, they created the problem in the first place.

Other trading nations are likely to do more deals amongst themselves, perhaps further driving up costs for Americans.

I wouldn't be surprised if he and his buddies sold, shorted or whatever to profit out of the situation.

@Ronski, re:

“I wouldn't be surprised if he and his buddies sold, shorted or whatever to profit out of the situation.”

I’ve seen this posted elsewhere and (if I had any money left) I’d take a sizeable bet that not only is this correct, but that he’s managed it to be so.

I’m trying very hard not to look at my account, not least because I’m already well into pension/drawdown. @Adam-Kay maybe I shouldn’t look until I get another email from you!

-

@Cappo I very strongly suggest you don't look, probably not for a long time.

Luckily I'm not at that point, but the lower the performance, the longer I'll need to work. Mind you with the way the minimum wage is going up I'll be able to get a job stacking shelves and earn just as much before long. No wage rise for us this year, just my colleagues that are on minimum wage.

-

Re cut backs on AI spending. Currently the demand is maybe 5X higher than the ability to supply. So either way I don't see supply meeting demand for a couple of years at least. The problem with cutting back is you run the real risk of being left behind. AI models will get much smarter and need to be to create the big impact software solutions-this is the goal so in my opinion Mag 7 companies will continue to dig deep and 'invest' in the future.

Don't forget, Oracle have $130B backlog on unmet demand (services) which they can't meet. The 1 trillion of spend we know about doesn't include the 5 GW of AI Factory contracts which Huang mentioned 2 weeks ago. That's another $250B. Musk wants to stand up 2 million GPU, he can't get them other than over the next 24 months. So it comes down to how long this unknown impact, this omnipresence endures. It will give the media something to get their teeth into no doubt. If you tell us all we are heading for recession long enough it's self fulfilling?

Over the past week the media has been shouting about MSFT cancelling leases for data centres. 2 GW which is a lot. But they forgot to mention that Meta and Oracle took them on. MSFT is simply making adjustments to the fact OpenAI are no longer leaning on them for infrastructure.

At the end of the day, bad policy doesn't survive. It's earnings season very soon and i'm sure respective CEOs will focus in on the impact and their thoughts.

Whenever there is a correction it plays tricks on ones mind , 'is this one the worse and will it be permanent'. It always recovers. As I said earlier, it's very annoying and some who rely on those funds will be impacted more of course but that is investing. I remember the crash of 1987, 2000, 2008 and 2020 and we are still here to talk about it, richer unless you were invested in some meme stock or did something stupid. Try not to worry about it.

-

There are definitely two sides to this discussion:

- Markets are haemorrhaging money and unwinding like a broken clock

- Good companies are investing in things to make a better future for themselves and their shareholders

Both can be true at the same time. We (the investors) are looking at some rapidly decreasing numbers (yes, I have looked, as I do every day, and it's not at all pretty). Those numbers being down is more and more of a problem the closer you are to needing to rely on those investments, and if any one of us is thinking about retiring in the next few weeks then they will have some difficult decisions to make.

Markets ALWAYS come back. The question is when will they come back this time? How long will the Trump kybosh last for? Is this a short-term sharp movement downwards, to be closely followed by a short term sharp movement upwards? Or is this to be the start of something longer?

I am reminded of the topic of this thread - 'Thoughts on short term market direction'. It may be helpful if we can keep to that topic. Where do people think the markets are going to go in the short term?

FWIW, my answer to that question is that I think Trump is trying to get a reaction with his fuss about tariffs, and that reaction is extreme. However I think that a lot of negotiation is going to happen in the next month and there will be a sharp upturn in later April/early May. I could be (and very probably am) wrong, and I'd be interested to hear other people's views.

-

I tend to agree.

I firmly agree that much of what trump (& the billionaire sidekick, Musk) are doing is for their good, not the people of America 🫣

Enabling government departments to feel stressed and also to pour money into Musk & other techbro companies pockets

Which comes back to the short term 🧐

Trump is an agent of chases, & likes nothing more than his name on the covers around the globe

He has succeeded this week, very clearly

But when things continue to dive, he will barter & even do several u-turns, naturally without ever admitting as much - it will always be the bigliest deal he has personally done….

I suspect the short term will be more turmoil in coming weeks, followed by some bouncing back in months

But nobody knows

️

️ -

I’ve seen a report ..although on X ..re Vietnam wanting to negotiate on the tariffs and that Japan have requested to do the same …maybe bollox but poss the start of some u turns etc

-

Is trump the bully who has backed himself into a corner?

I cannot for the life of me see China & JinPing backing down in any way.Will the Republicans step in any time soon to stop his self-formed bloodbath?

Interesting article on how he is screwing up Apple - viewable at https://archive.is/X5dnw

-

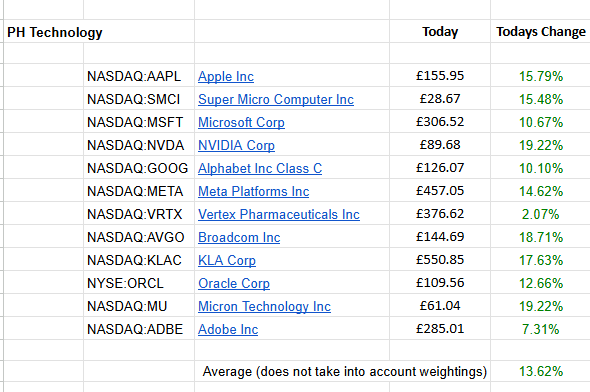

Yes. A rather large tech pop today. showing 10% RTQ at the mo