Thoughts on short term market direction

-

My portfolio is up today, by a whisker. Which is the first day in about a month that it hasn't fallen.

I suspect that when the Trump Tariff storm blows over and there is a ceasefire (and hopefully peace deal) in Ukraine/Russia then things will start to bob up again. Hopefully today is the start of this.

(Putting this comment in the 'Short term market direction' thread as it seems more appropriate here.)

-

Tech +2.5%

IML +1%

PH Equity-down 0.56%Tech/IML have feared better than their benchmarks.

Nvidia is the technology barometer. Anyone interested should watch the GTC keynote March 18th. They will definitely talk about new developments, including I hope, an early Rubin release(6 months early). The Blackwell ultra, Rubin Ultra and probably Rubin-next. Robotics, ADAS, Quantum, health, sovereign ai, Omniverse. Plus HBM-4, Spectrum-X etc.

-

Tech +2.5%

IML +1%

PH Equity-down 0.56%Tech/IML have feared better than their benchmarks.

Nvidia is the technology barometer. Anyone interested should watch the GTC keynote March 18th. They will definitely talk about new developments, including I hope, an early Rubin release(6 months early). The Blackwell ultra, Rubin Ultra and probably Rubin-next. Robotics, ADAS, Quantum, health, sovereign ai, Omniverse. Plus HBM-4, Spectrum-X etc.

@Adam-Kay are these YTD numbers?

-

HI,

No they were in response to 2BToo 'up a whisker on the day(daily)

-

Up a small bit today but numbers for tomorrow are not looking pretty at all.

This rut is taking a while to get out of.

-

My portfolio is up today, by a whisker. Which is the first day in about a month that it hasn't fallen.

I suspect that when the Trump Tariff storm blows over and there is a ceasefire (and hopefully peace deal) in Ukraine/Russia then things will start to bob up again. Hopefully today is the start of this.

(Putting this comment in the 'Short term market direction' thread as it seems more appropriate here.)

@2BToo said in Thoughts on short term market direction:

My portfolio is up today, by a whisker. Which is the first day in about a month that it hasn't fallen.

I suspect that when the Trump Tariff storm blows over and there is a ceasefire (and hopefully peace deal) in Ukraine/Russia then things will start to bob up again. Hopefully today is the start of this.

(Putting this comment in the 'Short term market direction' thread as it seems more appropriate here.)

Quoting myself as it seems I was wrong. More tariffs from Trump. Suits him, I guess, but doesn't suit everyone else.

-

Other than loving wielding power, I’m struggling to see how it even suits Trump for the S&P to slump 2% in a day because of him, or for his joke of a social media company to be at it’s lowest value since he won the election

.

.These things come around in time but this is a president ignoring qualified advice and effectively off the rails. To pull what I am saying back on topic, my hopes are not high for the markets in the short term.

-

Those reacting might want to fact check the tariffs announcements.

'Reciprocal tariffs DO NOT apply to semi conductors'

or pharmaceuticals, lumber, gold, minerals. Confirmed by the White House

-

Nvidia CEO says tariffs will have minimal impact and longer term they are shifting their supply chain to the US.

Meanwhile in China, the H20 chip stock has been depleted due to XOS purchases by Alibaba and tencent(so says local server manufacturers(China) in an email to clients. Last week Alibaba said 'we don't need so many chips-the US is over building, then confirmed they purchased $16B in H20 chips a week later'. The games being played and some swallow it.

You would think the company was on fire yet their prospects, earnings and growth never looked better.

-

Snag is that while companies may have cracking prospects, it's the markets which make us money. And the fact that semiconductors are exempt from these tariffs isn't that helpful when we're diversely invested with a portfolio that covers other things as well.

I know this thread is 'short term market direction' but I wonder what the medium term looks like and what Trump wants to achieve. He doesn't want higher prices and a trade war any more than we do. I wonder if this is a means of putting pressure on other countries to lower their US tariffs, and he's hoping for leaders to do this very quickly, with the promise that if they do then the reciprocal tariff will be dropped equally quickly.

-

That is very much the goal/intention.

And on markets making money. This is a short term correction which will work its way out through reciprocal compromise and adjustment. We invest in sound businesses and taxes don't factor into it when it's a carpet bomb approach. Some goods and services will be more expensive, some suppliers will absorb the tax, some will share it-it will depend on the product, the margin and their pricing power dynamics. A fungible product with many alternatives-the end user will shop elsewhere, a more monopolistic product with few alternatives, consumers will have to pay. My opinion, if most of the targeted products are China sourced, the biggest loser will be China as they will absorb most of the tax(net).

At the end of the day it is very early days and the impact is not only unknown it is also capped to an extent. We know how this administration can pivot very quickly. The biggest fear was tax on chips even though it was never going to be significant given the margins...A $50K chip costs no more that $8K so 30% is $2,400 (50k vs 52,400) not exactly a big deal yet we now know there are no taxes on chips.

Stating the obvious, investing is a long term strategy. We've seen corrections before (2023), Nvidia was $10, remember, down from $28. It was recently as high as $150. All I can tell you is the company’s prospects, based on objective fact are much better today than when it was at its peak and the quarterly updates, innovation and dominance will prove that as the year progresses-markets won't ignore that.

Nvidia is the tech barometer. It is very important. It is by far the most important company, globally, is the most valuable by far and it is only getting started. In bull markets it’s easy to ‘make money’. When markets get choppy, one must rely on evidence to drive your decision making-the evidence is unequivocal.

-

Every cloud-SMCI has a notable advantage given their manufacturing is materially US centric cf their competitors that mostly manufacture outside the U.S. Some components will still be subject to taxes however HBM memory and GPUs are exempt and whilst this applies to Foxconn, the application of taxes is more nuanced when you look through the cost build up-if materially assembled outside the U.S it will be taxed.

KLA manufactures mainly in the US and Israel-Israel have removed ALL U.S tariffs so again, avoiding punitive taxation. KLA have a monopoly so other countries can tax KLA imports but they will have to pay because their products and services are non fungible.

You may pay more for your iPhone -opinion being that if 100% of the taxes applies and was absorbed by Apple it would cost them $7.5B in 2025. This against a > $100B earnings fig. Apple will likely absorb some, Foxconn will likely absorb some and the consumer will pay a bit more. Net, immaterial impact to Apple, imo.

The majority of our holdings are businesses with strong competitive advantages/moats/brands which are resilient.

I'm not concerned about the long term negative impact from taxes. -

The media will be publishing as much negative rubbish as they possibly can to entice clicks and keep the fear factor high. As I've said before, I put a lot of stock in what trusted CEOs say-CEOs who have an impeccable record of conservatism and honesty. If Huang says they will avoid punitive tariffs I believe him. He meets personally with Trump, he's the CEO of the most important US company. Bill Dally(Nvidia chief scientist) is the advisor to POTAS in Science and Technology-they know exactly what the plan is. Nvidia have a habit of winning. It's annoying seeing the carnage but I stress I'm not worried about it. It's not our first rodeo.

-

Adam, I really do hope you are correct, my fear is that he causes a global recession, and this downturn lasts much longer. It's not just about chips, our portfolio's cover a lot more. If the big players that are buying these AI products cut back, then that will have a knock on effect as well.

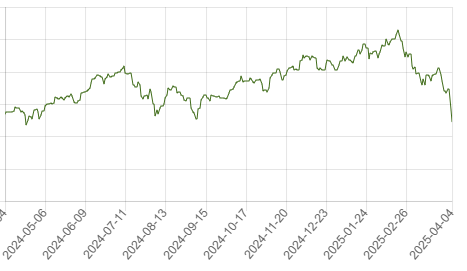

I'm down 6.34% this week, YTD I'm down 12.47%. Today, my portfolio's are worth the same as they were in April 2024 which means I'm now worse off (on paper) than a year ago, as I've been paying in.

Given time I know they will recover, but depending on how bad things get (he's got another four years to go!), it may take substantially longer, especially if this continues, and were all getting older, some us older than others.

Until Trump came in everything was progressing nicely, it seems he's on a mission to destroy things.

Investments may plummet, or fall off a cliff when Trump is left to run things!

At least the sun's shining and my investments in solar means my energy bills are negative.

-

Yes…..totally agree …

I am quite shocked about how he has gone about this ….

Does he think that all the trading nations are now coming knocking on his door for a deal ….

I have read that it’s all to do with re finance of the US debt and these are deliberate actions to force rates down …