Busy couple of weeks on results front

-

Thanks Adam, I also have funds in Global growth, how is that comparing to Lifestyle and is it worth switching. What are your thoughts. Thanks Jason.

-

Hi,

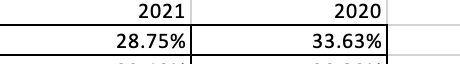

Opt GG has achieved 8.1% YTDLifestyle 1 yr 11.7%

Opt GG 1 y 12.38%Opt GG 3 yr 35.62%

Lifestyle 3 yr 79.8%And in 20/21 Lifestyle returned this:

GG

So looking at a small snap shot is only part of the picture. -

Thanks Adam

-

Hi A,

You're very welcome

-

In an announcement timed with Donald Trump's state visit, leading American tech giants have pledged over $40 billion in investments to bolster the UK's artificial intelligence ecosystem.

Microsoft spearheads the commitment with $30 billion investment from 2025 to 2028, including $15 billion for capital expenditures on AI infrastructure. This will fund the construction of Britain's largest supercomputer, powered Nvidia GPUs in partnership with Nscale, alongside expansions in cloud computing and data centres. Google follows with $6.5 billion, featuring a new Hertfordshire data centre and support for its DeepMind AI research unit in London.

OpenAI, Nvidia, and cloud provider CoreWeave add billions more for data centres and renewable-energy-powered facilities in Scotland and the North East. Salesforce ups its stake to $6 billion while Blackstone eyes $12.8 billion (£10 billion) for an AI Growth Zone in Blyth, promising 5,000 jobs.

Prime Minister Keir Starmer hailed the deals as a "vote of confidence" in Britain's tech prowess, coinciding with a new US-UK "Technology Prosperity Deal" on AI, quantum computing, and nuclear energy (it's not really, it's about being close to your customers and a need for power capacity). Starmer is also quoted as saying 'Labour is securing high paying jobs and putting more money in peoples pockets'.

-

I watched the round of speeches during the State Banquet. The cameras spending a disproportionate amount of time on this attendee

He certainly gets around :). Jensen commented today on the frustrations with China and US relations. He said and quote "I'm disappointed with what I see, but they have larger agendas to work out between China and the United States, and I'm patient about it."

Wise words. The company is thriving in a difficult geopolitical environment as a back drop to fierce competition. I would think he has one of the toughest jobs bar none, and still they excel. Their valuation by any measure is unstretched given their growth and future market opportunities.

-

Expectations are high for a 2 PM UK time call between Donald Trump and Xi Jinping, with hopes of easing US-China tensions.

If all goes well, Trump might visit China soon, the first US president to do so since 2017.

Top of the list: a possible TikTok deal. The app, owned by ByteDance, has dodged bans despite years of claims it’s a security risk due to surveillance or propaganda. Watch for whether it’ll be sold to all-American investors or keep some Chinese ties.

Both sides also agreed to extend their trade truce by 90 days in August after a tariff spat. Issues like fentanyl chemicals, China’s Russia ties, and US farm exports remain on the table. Trump’s optimistic, saying a deal’s close, likely on current terms.

Nvidia’s antitrust probe in China and its chip sales, plus Boeing aircraft orders, are also up for grabs.

My call would be pretty soon the on-again, off-again chip sales and playing nice will be back on-again, at least until it's not-again.

-

I had to laugh-In relation to a news article discussing Musks focus on Xai.........Musk’s focus on xAI raises questions about how much time he giving to his other companies, and comes as Tesla’s board of directors has been pushing to give him a trillion-dollar pay package, which they say will motivate him to improve the company's performance.

And this is why I find Tesla uninvestable. A part time mercurial CEO who needs a trillion dollars to stay motivated. Im not even sure it would.

-

I also find the Tesla package discussion utterly bizarre.

Musk is something of a toxic character this year.

Maybe he always was, it just came more to the fore with his 'chainsaw for bureaucracy' stunt and DOGE work....I believe I ought to be part of the target demographic for buying a Tesla, but there isn't a barge pole long enough to make me look

️

️ -

Hi A,

It's been a solid week on top of a very strong month(1/9-19/9).

Cobens Tech +12.7% MTD(month), Cobens Lifestyle +7.84%Micron earnings, Tuesday. They will be excellent with a record guide, no doubt about it. The company has recently suspended all contract pricing quotes, what this means is they don't want to lock in further production on long term fixed price deals-they could but prefer to ride the spot market, which is moving up(price) materially (why-Extreme demand). This simply means much much better margins and prices. This of course excludes the significant supply contracts they have locked in with Nvidia and AMD.

To earnings 'What the reaction is', who knows. Micron is growing its revenue at > 40% currently, how long that lasts is up for debate but I think they have blue sky until at least 2030. It's real PE is about 10 or less! There are many listed stocks with multiples in the 60-100+ range which do not have growth rates this high. The market is still valuing Micron on a historical cyclical/commodity basis, however, clearly the move up from the 120s to 160 range is a big vote of confidence. I think the business re HBM is more secular and we will see a material re-rating in Micron multiples over the next several quarters.

The CEO Sanjay Mehrotra is a gifted engineer (Stanford/Berkeley). I have followed him for a very long time, having studied his fine work at Sandisk back in the early 2000s. Sandisk was a brilliant business and pioneer in Solid State memory and he personally holds many patents. He is not just a suit, he's an inventor and innovator. Micron is a case of, investing in the man, not just the business.

-

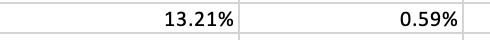

CoWos packaging-discussed here in detail. It is the most critical process in the production of silicon for Data Centres. Having salable GPUs is inextricably linked to Cowos capacity. Without capacity you aren't shipping

The latest figures are based on industry bookings.

-

This imo will pave the way for wider agreement on many resources including high end silicon (GPUs). If the deal gets done and I think it will, China get chips. I think Trump wants the win and Nvidia wants to be able to service all comers-not that China is particularly relevant today! They likely will be in the future. Today Nvidia can't meet demand so excluding certain markets makes no difference(today). In the future, the demand/supply imbalance will converge, and if relations are not restored 'soon', there may not be a future in China, because China will pave its own way and their build out/roadmap will take another course. Feeding their lead to Huawei for even 1-2 years could very well see future market share(China) lost for good.

-

Given the news just put up about Microsoft and Nvidia, we could be on for one of the best weeks I can recall.

-

All eyes on tomorrow. Big earnings coming and Trump/Xi. Volatile either way!

-

Some hefty DB numbers today, particularly Lifestyle and Tech. It's been an exceptional couple of months and earnings are fantastic. After hours reactions are typical of names which run at such pace. New highs attract sellers. The businesses have never been stronger.

Today tech

1 week +8.54%

1 Month +13.46%

3 Months +20.70%

6 Months +68%past performance is no indication of future returns.

-

Some hefty DB numbers today, particularly Lifestyle and Tech. It's been an exceptional couple of months and earnings are fantastic. After hours reactions are typical of names which run at such pace. New highs attract sellers. The businesses have never been stronger.

Today tech

1 week +8.54%

1 Month +13.46%

3 Months +20.70%

6 Months +68%past performance is no indication of future returns.

Much appreciated. In August, I withdrew enough for a holiday, and the funds are nearly back to their original value.

I tell the wife she should be thanking Jeff, Bill and Elon, but really she should be thanking you.

-

Much appreciated. In August, I withdrew enough for a holiday, and the funds are nearly back to their original value.

I tell the wife she should be thanking Jeff, Bill and Elon, but really she should be thanking you.

@SiriAlexaAl said in Busy couple of weeks on results front:

Much appreciated. In August, I withdrew enough for a holiday, and the funds are nearly back to their original value.

I tell the wife she should be thanking Jeff, Bill and Elon, but really she should be thanking you.

100 percent should be thanking Adam!

And a thank you from me!